Your Can real estate losses offset capital gains images are ready. Can real estate losses offset capital gains are a topic that is being searched for and liked by netizens today. You can Download the Can real estate losses offset capital gains files here. Get all free images.

If you’re searching for can real estate losses offset capital gains pictures information related to the can real estate losses offset capital gains topic, you have come to the right blog. Our website always gives you hints for viewing the highest quality video and image content, please kindly hunt and locate more informative video articles and graphics that match your interests.

Can Real Estate Losses Offset Capital Gains. Losses on your investments are first used to offset capital gains of the same type. You can use these losses to offset other passive income ie. RBS shares held inside your ISA cannot just as they would not be liable for. Assuming it is owned by the same person.

12 Ways To Beat Capital Gains Tax In The Age Of Trump From forbes.com

12 Ways To Beat Capital Gains Tax In The Age Of Trump From forbes.com

Sell in a Year When Youve Taken Other Losses. See my article on capital gains tax for an explanation of what counts as a taxable asset. You can use an ordinary loss to offset your ordinary income which is generally taxed at a higher rate. Did you rent the property in 2016 prior to selling it. Losses on your investments are first used to offset capital gains of the same type. Generally the tax treatment of the sale is considered capital gain income.

Capital losses on shares can be offset against capital profits on real estate.

The way you manage your portfolio can impact your tax bill and your ultimate bottom line. Yes your capital loss carryover may be deducted against the capital gain on the sale of your house. It seems everyone is buying renovating and flipping these days. See my article on capital gains tax for an explanation of what counts as a taxable asset. So if you get hit with losses one year that year makes a great time to sell your property so your losses offset your gains. Losses on your investments are first used to offset capital gains of the same type.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

Schedule E income perhaps some Partnership income but you cannot use it to offset the capital gain. In such a case you cant use the capital losses to offset capital gains or reduce your income. This prevents investors from seeing tax benefits if they sell at a loss and then turn around and buy the same thing for even less if it goes lower. Keep in mind if your capital losses were to exceed your capital gain the amount of the excess. Capital losses on shares can be offset against capital profits on real estate.

Source: bccpa.ca

Source: bccpa.ca

RBS shares held inside your ISA cannot just as they would not be liable for. RBS shares held inside your ISA cannot just as they would not be liable for. Assuming it is owned by the same person. You can use these losses to offset other passive income ie. While you want to have your real estate qualify if at all possible for capital gains treatment you dont want to have it qualify for capital losses.

Source: myexpattaxes.com

Source: myexpattaxes.com

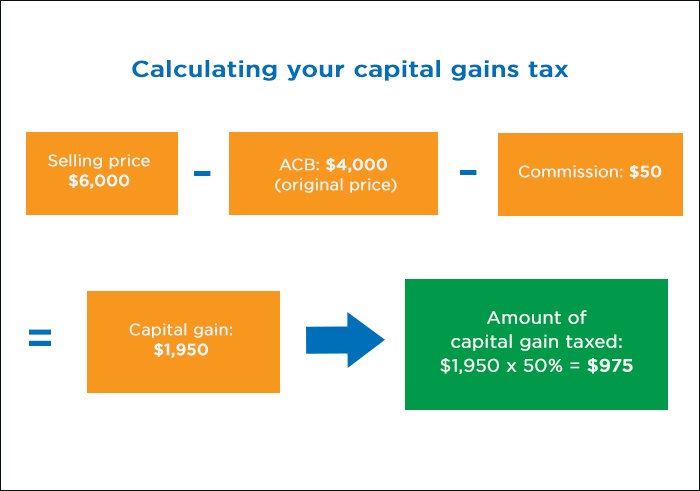

In your case your 200000 in gain can be offset by all of your carryforward of 180000 and you would end up with a net capital gain of 20000. If you sell a long-term rental for a gain you pay less taxes at the long-term capital gains tax rates. You can use an ordinary loss to offset your ordinary income which is generally taxed at a higher rate. Taxpayers can deduct capital losses on the sale of investment property but cant deduct losses on the sale of property they hold for their personal use. Did you rent the property in 2016 prior to selling it.

Source: pinterest.com

Source: pinterest.com

Even if you didnt the best place to. Assuming not in a trust or company so no need to consider anti avoidance provisions. Can real estate losses offset stock gains. While you want to have your real estate qualify if at all possible for capital gains treatment you dont want to have it qualify for capital losses. So if you get hit with losses one year that year makes a great time to sell your property so your losses offset your gains.

Source: hackyourwealth.com

Source: hackyourwealth.com

RBS shares held in your online dealing account that are down 50 since you bought them can be set against gains if you sell them. Assuming not in a trust or company so no need to consider anti avoidance provisions. Yes but there are limits. Yes but there are limits. You also know that before year-end you can cherry-pick investments to sell at losses tax loss harvesting so you can offset your.

Source: nl.pinterest.com

Source: nl.pinterest.com

So if you get hit with losses one year that year makes a great time to sell your property so your losses offset your gains. The way you manage your portfolio can impact your tax bill and your ultimate bottom line. Yes but there are limits. The loss on the real estate will cancel out the 50000 gain on the stock. Can real estate losses offset stock gains.

Source: propertycashin.com

Source: propertycashin.com

Taxpayers can deduct capital losses on the sale of investment property but cant deduct losses on the sale of property they hold for their personal use. Taxpayers can deduct capital losses on the sale of investment property but cant deduct losses on the sale of property they hold for their personal use. Yes your capital loss carryover may be deducted against the capital gain on the sale of your house. Eventually you reach financial independence with enough cash flow to live on and you never had to pay a cent in real estate capital gains taxes. Thats because capital losses are first used to offset capital gains and then you can take 3000 in addition.

Source: pinterest.com

Source: pinterest.com

Taxpayers can deduct capital losses on the sale of investment property but cant deduct losses on the sale of property they hold for their personal use. RBS shares held inside your ISA cannot just as they would not be liable for. You also know that before year-end you can cherry-pick investments to sell at losses tax loss harvesting so you can offset your. Even if you didnt the best place to. If you have no capital gains to offset your loss the IRS also will let you claim up to 3000 in capital losses against.

Source: forbes.com

Source: forbes.com

Assuming it is owned by the same person. Can real estate losses offset stock gains. Even if you didnt the best place to. If you sell a long-term rental for a gain you pay less taxes at the long-term capital gains tax rates. Losses in ISAs and SIPPs dont count.

Source: relakhs.com

Source: relakhs.com

Generally the tax treatment of the sale is considered capital gain income. – Jeff Rivard Mequon Wisconsin The quick answer is. Thats because capital losses are first used to offset capital gains and then you can take 3000 in addition. You can use these losses to offset other passive income ie. RBS shares held in your online dealing account that are down 50 since you bought them can be set against gains if you sell them.

Source: pinterest.com

Source: pinterest.com

Eventually you reach financial independence with enough cash flow to live on and you never had to pay a cent in real estate capital gains taxes. You know that long-term losses can offset your ordinary income by no more than 3000 once you have no more capital gains to absorb these losses. Losses on your investments are first used to offset capital gains of the same type. Did you rent the property in 2016 prior to selling it. Generally the tax treatment of the sale is considered capital gain income.

Source:

Source:

You can use these losses to offset other passive income ie. The way you manage your portfolio can impact your tax bill and your ultimate bottom line. You also know that before year-end you can cherry-pick investments to sell at losses tax loss harvesting so you can offset your. Can I sell the stocks and take capital losses and use them to offset the gains from the duplex. And contrary to the popular misconception capital gains and dividend income are not considered to be passive activity income so you cant use passive activity losses to offset.

Source: irishtimes.com

Source: irishtimes.com

If you have no capital gains to offset your loss the IRS also will let you claim up to 3000 in capital losses against. Assuming it is owned by the same person. Thats because capital losses are first used to offset capital gains and then you can take 3000 in addition. In your case your 200000 in gain can be offset by all of your carryforward of 180000 and you would end up with a net capital gain of 20000. Taxpayers can deduct capital losses on the sale of investment property but cant deduct losses on the sale of property they hold for their personal use.

Source: pinterest.com

Source: pinterest.com

Can real estate losses offset stock gains. You can use these losses to offset other passive income ie. Capital losses on shares can be offset against capital profits on real estate. So short-term losses are first deducted against short-term gains and long-term losses are deducted against long-term gains. It seems everyone is buying renovating and flipping these days.

Source: wikihow.com

Source: wikihow.com

In such a case you cant use the capital losses to offset capital gains or reduce your income. This prevents investors from seeing tax benefits if they sell at a loss and then turn around and buy the same thing for even less if it goes lower. Its not always a terrible thing to sell at a loss. You should also be aware that capital losses. You can use these losses to offset other passive income ie.

Source: lovemoney.com

Source: lovemoney.com

So short-term losses are first deducted against short-term gains and long-term losses are deducted against long-term gains. Yes but there are limits. So short-term losses are first deducted against short-term gains and long-term losses are deducted against long-term gains. Can real estate losses offset stock gains. Capital losses cancel out capital gains.

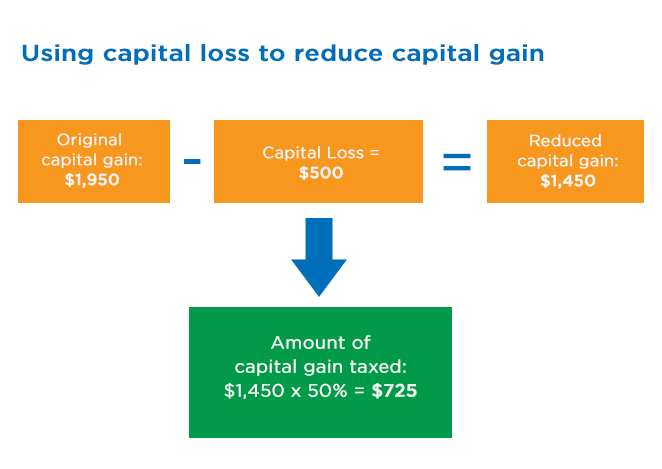

Source: bccpa.ca

Source: bccpa.ca

Yes but there are limits. Losses on your investments are first used to offset capital gains of the same type. You can use these losses to offset other passive income ie. If you have no capital gains to offset your loss the IRS also will let you claim up to 3000 in capital losses against. It seems everyone is buying renovating and flipping these days.

Capital losses on shares can be offset against capital profits on real estate. Keep in mind if your capital losses were to exceed your capital gain the amount of the excess. Its not always a terrible thing to sell at a loss. You should also be aware that capital losses. If you just lost 300000 on a property and have no capital gains it will take you 100 years to take advantage of that loss.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can real estate losses offset capital gains by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.