Your Can real estate commissions be paid to an llc images are available in this site. Can real estate commissions be paid to an llc are a topic that is being searched for and liked by netizens now. You can Get the Can real estate commissions be paid to an llc files here. Find and Download all royalty-free photos.

If you’re searching for can real estate commissions be paid to an llc images information linked to the can real estate commissions be paid to an llc topic, you have visit the ideal site. Our website always gives you hints for refferencing the maximum quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

Can Real Estate Commissions Be Paid To An Llc. The Commission cannot enforce contracts or require real estate agents to fulfill promises reimburse money or perform other acts. Persons who feel that money is owed to them in a real estate transaction or that a sales contract lease etc. Alliance Bay Realty may pay commissions to our agents Corporation or Limited Liability Company when all the requirements below are met. 1 The agents Corporation or Limited Liability Company must be owned solely by our agent.

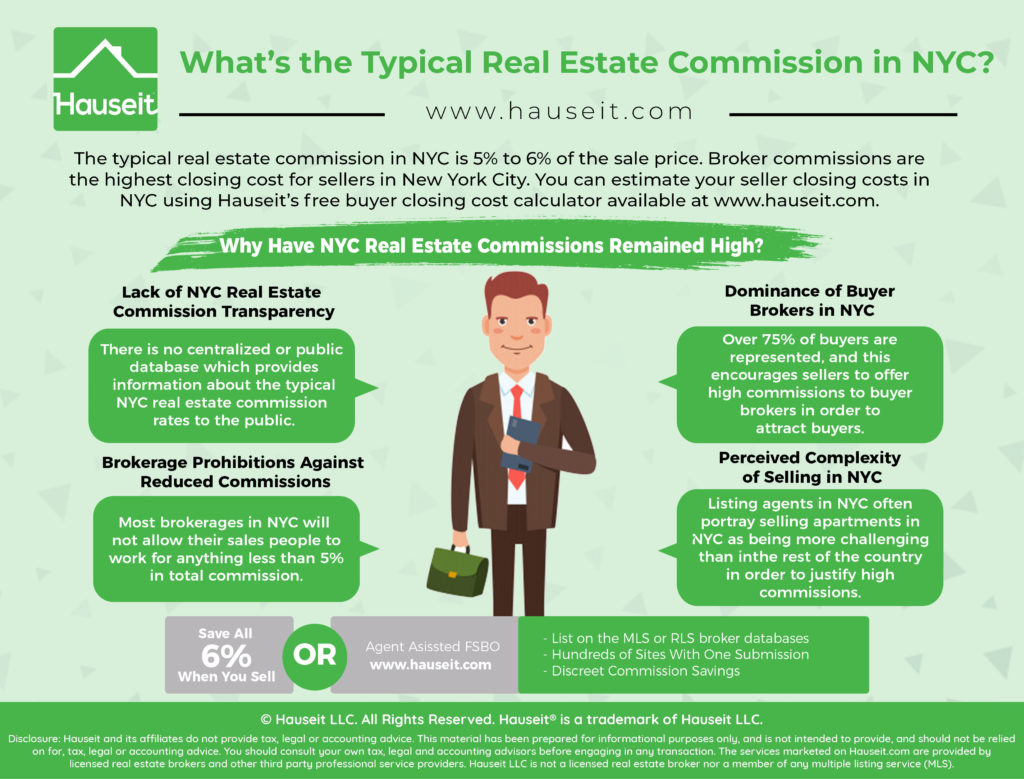

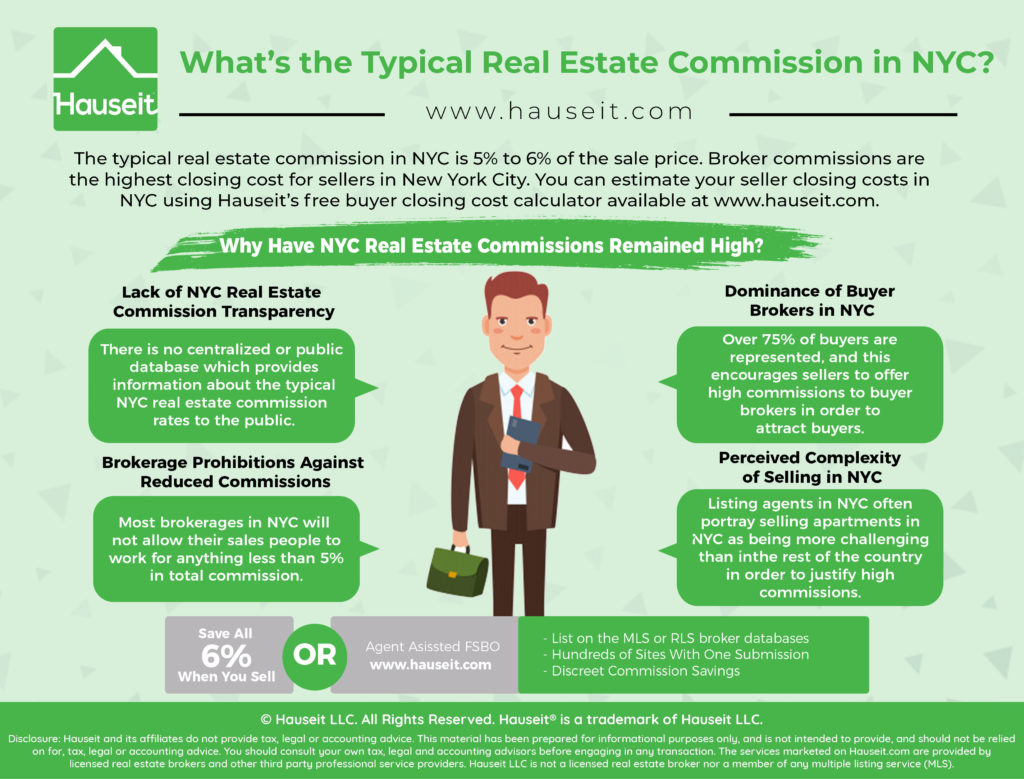

What S The Typical Real Estate Commission In Nyc Hauseit From hauseit.com

What S The Typical Real Estate Commission In Nyc Hauseit From hauseit.com

What Is the Appropriate Remedy for Real Estate Commission Motions. That the agent is duly licensed and affiliated with the broker. How are real estate commissions EARNED. This means that your LLC is taxed exactly the same way a sole proprietorship is taxed. Can the Real Estate Commission give consumers legal advice or help them settle disputes with real estate agents. The right to earn a commission for a sale or lease of commercial real estate is typically set forth in a commission agreement between the property owner and the real estate broker.

Same form will be given to your llc company.

For work requiring a real estate license to perform the broker. Alliance Bay Realty may pay commissions to our agents Corporation or Limited Liability Company when all the requirements below are met. This means that your LLC is taxed exactly the same way a sole proprietorship is taxed. Being aware of any additional fees or filings. Can the Real Estate Commission give consumers legal advice or help them settle disputes with real estate agents. Has been breached should consult their private.

Source: pinterest.com

Source: pinterest.com

How are real estate commissions EARNED. 1 The agents Corporation or Limited Liability Company must be owned solely by our agent. TREC has a good resource for the rules here. Instead a real estate LLC only files an informational tax return because it is eligible for pass-through income taxation. File form 2553 within 60 days to notify the IRS.

Source:

Source:

Then your net business income is taxed two ways. You report your business income on Schedule C of Form 1o40. Yes a realtor can establish a LLC but if it takes commission money or fees associated w real estate it must be licensed and it must have a designated broker. Same form will be given to your llc company. Can an unlicensed person own a real estate company and receive all or a portion of a commission paid to a licensed broker.

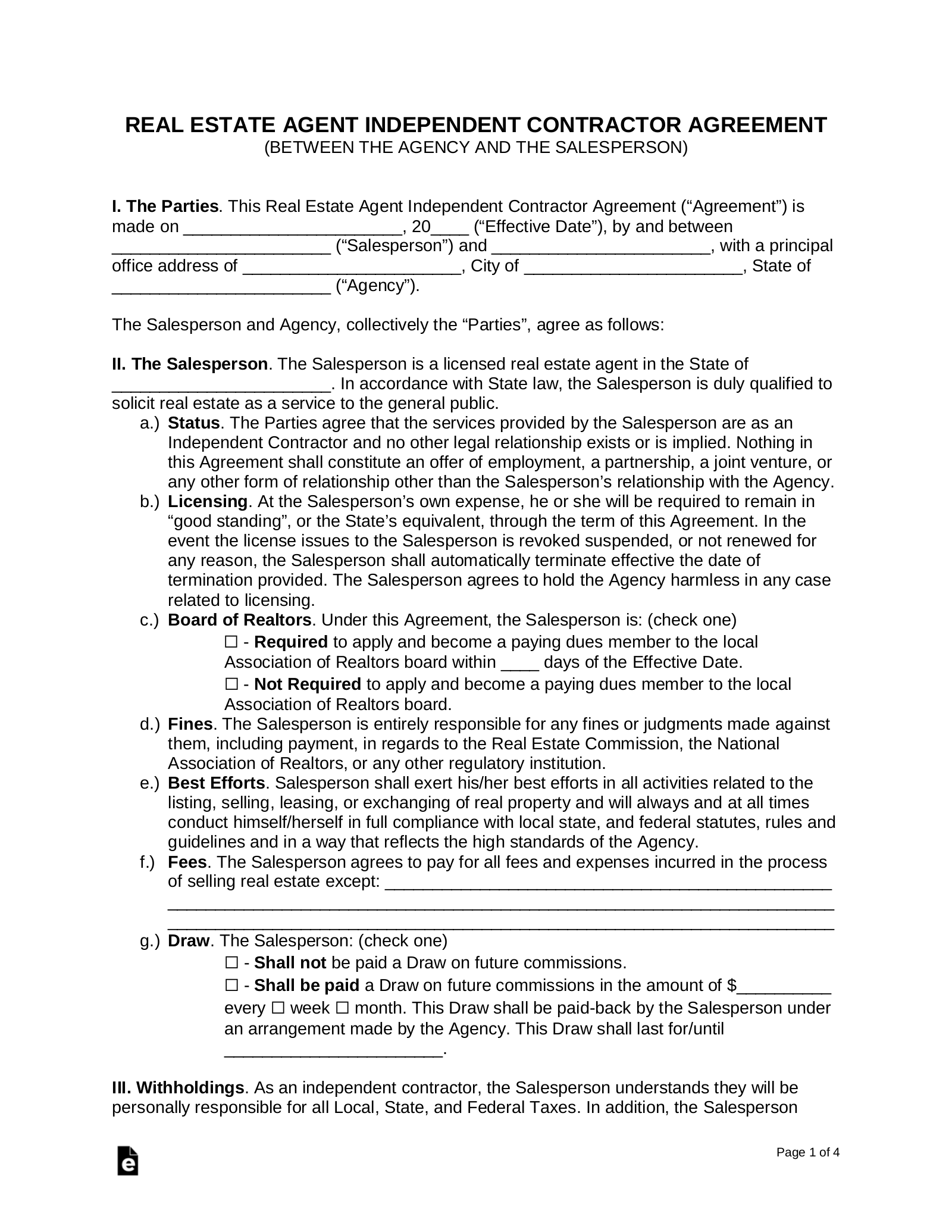

Source: eforms.com

Source: eforms.com

An annual report with a filing fee may also be necessary. Instead a real estate LLC only files an informational tax return because it is eligible for pass-through income taxation. The answer is that sometimes you cannot move your real estate into an LLC or you cannot purchase it directly into an LLC if you are using conventional financing. An annual report with a filing fee may also be necessary. Checking with the regulatory commission or board that awarded your real estate license about any fees qualifications or restrictions pertaining to your LLC.

Source: fr.pinterest.com

Source: fr.pinterest.com

Can an unlicensed person own a real estate company and receive all or a portion of a commission paid to a licensed broker. An IRS W-9 Form is a document to be completed by the recipient of the funds which provides the real estate professional with the necessary identifying information to file Form 1099. Fees and commissions earned from a real estate transaction may only be paid to a licensed salesperson or broker. Yes a realtor can establish a LLC but if it takes commission money or fees associated w real estate it must be licensed and it must have a designated broker. Instead a real estate LLC only files an informational tax return because it is eligible for pass-through income taxation.

Source: vincegray2014.com

Source: vincegray2014.com

A sales agent may not accept compensation for a real estate transaction from anyone other than the broker the sales agent was associated with at the time the commission was earned and may not pay a commission to a person except through the sales agents sponsoring broker. If not your entity will be disregarded and you will still be filing on Schedule C of your 1040. The right to earn a commission for a sale or lease of commercial real estate is typically set forth in a commission agreement between the property owner and the real estate broker. If you wish to take advantage of any potential benefits to corporations under tax reform you must act within the bounds of Massachusetts laws and regulations and should also be aware of. An IRS W-9 Form is a document to be completed by the recipient of the funds which provides the real estate professional with the necessary identifying information to file Form 1099.

Source: hauseit.com

Source: hauseit.com

Inform broker so commission is paid to entity. Then your net business income is taxed two ways. Third the broker must receive a notarized instruction from the agent stating. Except in situations where the real estate broker assigns the real estate agent or salesperson the commission the real estate agent or salesperson is not eligible to claim a real estate commission. TREC has a good resource for the rules here.

Source: pinterest.com

Source: pinterest.com

2 An agent must present the following to the broker. An annual report with a filing fee may also be necessary. Fees and commissions earned from a real estate transaction may only be paid to a licensed salesperson or broker. The answer is that sometimes you cannot move your real estate into an LLC or you cannot purchase it directly into an LLC if you are using conventional financing. Instead a real estate LLC only files an informational tax return because it is eligible for pass-through income taxation.

Source: pinterest.com

Source: pinterest.com

How are real estate commissions EARNED. 1 The agents Corporation or Limited Liability Company must be owned solely by our agent. Yes a realtor can establish a LLC but if it takes commission money or fees associated w real estate it must be licensed and it must have a designated broker. That the agent is duly licensed and affiliated with the broker. LLC taxes are not paid directly by the real estate business.

Source: pinterest.com

Source: pinterest.com

The Florida Real Estate Commission FREC has a list of informally approved activities an unlicensed assistant can perform. They only possible advantages of having your commissions paid to llc if llc has other assets and actually loosing money this way you will pay less in taxes than on personal income tax. Can a sales agent receive or pay a commission to a party in a real estate transaction. Except in situations where the real estate broker assigns the real estate agent or salesperson the commission the real estate agent or salesperson is not eligible to claim a real estate commission. Pass-through income taxation allows LLC members to tax any business income through their own personal tax rate rather than the corporate rate.

Source: ar.pinterest.com

Source: ar.pinterest.com

Has been breached should consult their private. File form 2553 within 60 days to notify the IRS. Checking with the regulatory commission or board that awarded your real estate license about any fees qualifications or restrictions pertaining to your LLC. Alliance Bay Realty may pay commissions to our agents Corporation or Limited Liability Company when all the requirements below are met. Pass-through income taxation allows LLC members to tax any business income through their own personal tax rate rather than the corporate rate.

Source: pinterest.com

Source: pinterest.com

You take your Gross Commission Income GCI and deduct all your real estate expenses from it which leaves you with your net income. You report your business income on Schedule C of Form 1o40. TREC has a good resource for the rules here. As such any payments to an unlicensed LLC or other unlicensed entity are impermissible. The Commission cannot enforce contracts or require real estate agents to fulfill promises reimburse money or perform other acts.

Source: pinterest.com

Source: pinterest.com

Being aware of any additional fees or filings. Third the broker must receive a notarized instruction from the agent stating. Can a sales agent receive or pay a commission to a party in a real estate transaction. The right to earn a commission for a sale or lease of commercial real estate is typically set forth in a commission agreement between the property owner and the real estate broker. Once commission is received by the broker then it can be paid to the agents corporation or LLC per a separate notarized instruction from the agent to the broker as set forth next-below.

Source: eforms.com

Source: eforms.com

Yes a realtor can establish a LLC but if it takes commission money or fees associated w real estate it must be licensed and it must have a designated broker. This means that your LLC is taxed exactly the same way a sole proprietorship is taxed. If not your entity will be disregarded and you will still be filing on Schedule C of your 1040. Except in situations where the real estate broker assigns the real estate agent or salesperson the commission the real estate agent or salesperson is not eligible to claim a real estate commission. 2 An agent must present the following to the broker.

Source: hauseit.com

Source: hauseit.com

Alliance Bay Realty may pay commissions to our agents Corporation or Limited Liability Company when all the requirements below are met. This means that your LLC is taxed exactly the same way a sole proprietorship is taxed. A sales associate may pay a licensed real estate assistant for activity that doesnt require a real estate license to perform. Pass-through income taxation allows LLC members to tax any business income through their own personal tax rate rather than the corporate rate. TREC has a good resource for the rules here.

Source: easyagentpro.com

Source: easyagentpro.com

Pass-through income taxation allows LLC members to tax any business income through their own personal tax rate rather than the corporate rate. Incorporation fees can run from 40 to 550. They only possible advantages of having your commissions paid to llc if llc has other assets and actually loosing money this way you will pay less in taxes than on personal income tax. What Is the Appropriate Remedy for Real Estate Commission Motions. For work requiring a real estate license to perform the broker.

Source: pinterest.com

Source: pinterest.com

What Is the Appropriate Remedy for Real Estate Commission Motions. You report your business income on Schedule C of Form 1o40. LLC taxes are not paid directly by the real estate business. If you wish to take advantage of any potential benefits to corporations under tax reform you must act within the bounds of Massachusetts laws and regulations and should also be aware of. Being aware of any additional fees or filings.

Source: pinterest.com

Source: pinterest.com

The Commission cannot enforce contracts or require real estate agents to fulfill promises reimburse money or perform other acts. You take your Gross Commission Income GCI and deduct all your real estate expenses from it which leaves you with your net income. Persons who feel that money is owed to them in a real estate transaction or that a sales contract lease etc. LLC taxes are not paid directly by the real estate business. Same form will be given to your llc company.

Source: pinterest.com

Source: pinterest.com

Checking with the regulatory commission or board that awarded your real estate license about any fees qualifications or restrictions pertaining to your LLC. Most conventional real estate mortgage loans require the name of the deed be the same as the borrower. When you get paid a commissions you will be issued a check and given 1099 form at the end of the year. Can an unlicensed person own a real estate company and receive all or a portion of a commission paid to a licensed broker. You take your Gross Commission Income GCI and deduct all your real estate expenses from it which leaves you with your net income.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can real estate commissions be paid to an llc by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.