Your Can passive real estate losses offset capital gains images are available in this site. Can passive real estate losses offset capital gains are a topic that is being searched for and liked by netizens today. You can Find and Download the Can passive real estate losses offset capital gains files here. Download all free vectors.

If you’re searching for can passive real estate losses offset capital gains images information linked to the can passive real estate losses offset capital gains keyword, you have come to the ideal blog. Our website frequently provides you with hints for downloading the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that fit your interests.

Can Passive Real Estate Losses Offset Capital Gains. To effectively offset your passive losses you dont actually need to sell the real estate thats creating those losses. You can use these losses to offset other passive income ie. Ordinarily business and investment losses are deductible from your other income. Therefore the passive income deduction rules dont apply to you at all.

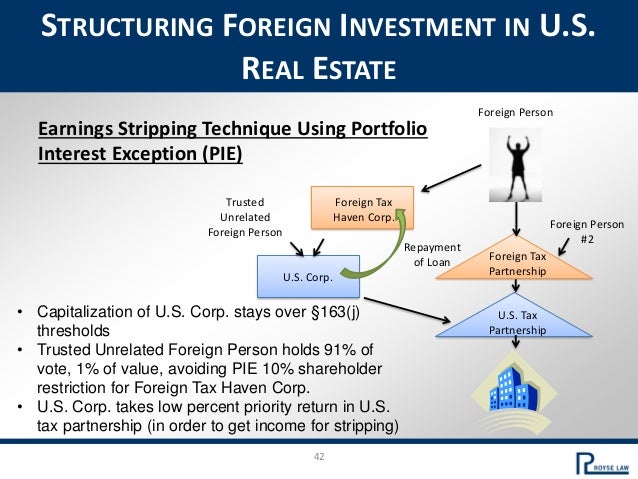

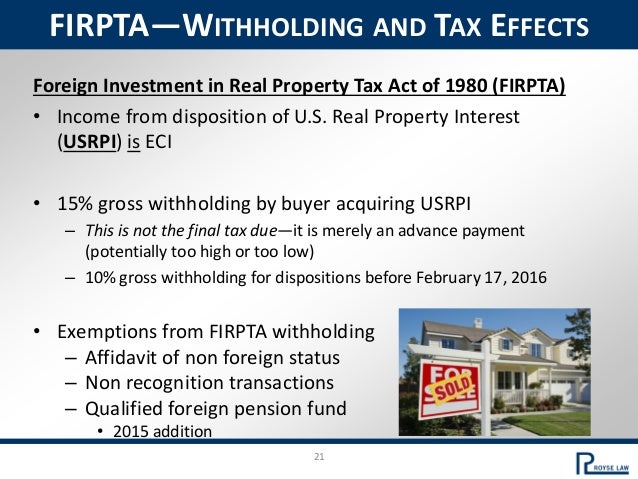

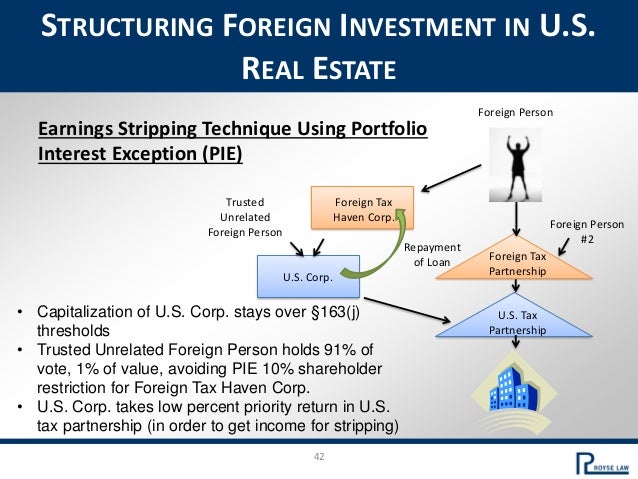

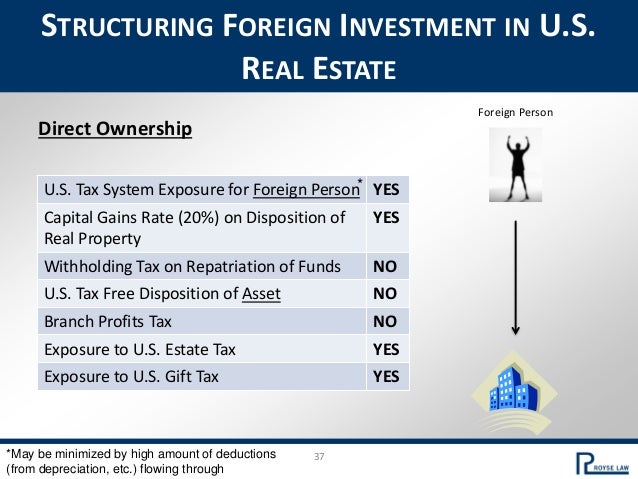

International Foreign Investment In Us Real Estate From slideshare.net

International Foreign Investment In Us Real Estate From slideshare.net

Special passive activity loss rules prevent many landlords from deducting their rental losses from other non-rental income such as salaries or investment income. So short-term losses are first deducted against short-term gains and long-term losses are deducted against long-term gains. The result is that many landlords can. You can offset your passive losses by selling off your rental properties. Your passive losses from any property or activity can go to offset income or gain from any other property or passive activity. Schedule E income perhaps some Partnership income but you cannot use it to offset the capital gain.

Can real estate losses offset stock gains.

Imagine the stock market dips 10 and you sell off some stocks hoping to avoid further losses from market correction or bear market. Its not always a terrible thing to sell at a loss. As a general rule a taxpayer cannot offset passive losses against wage interest or dividend income. Losses on your investments are first used to offset capital gains of the same type. This is true whether or not you dispose of the. For additional information on reducing your tax bill as a larger-scale investor check this out.

Source: slideshare.net

Source: slideshare.net

Future passive income and sales of real estate will be offset by your accumulated passive losses. So short-term losses are first deducted against short-term gains and long-term losses are deducted against long-term gains. To effectively offset your passive losses you dont actually need to sell the real estate thats creating those losses. And contrary to the popular misconception capital gains and dividend income are not considered to be passive activity income so you cant use passive activity losses to offset. The way you manage your portfolio can impact your tax bill and your ultimate bottom line.

Source: slideshare.net

Source: slideshare.net

This is true whether or not you dispose of the. One says long term capital gain the other says passive - long term capital gain. So short-term losses are first deducted against short-term gains and long-term losses are deducted against long-term gains. Its not always a terrible thing to sell at a loss. However Congress has promulgated special tax laws for passive losses associated with real estate rental income.

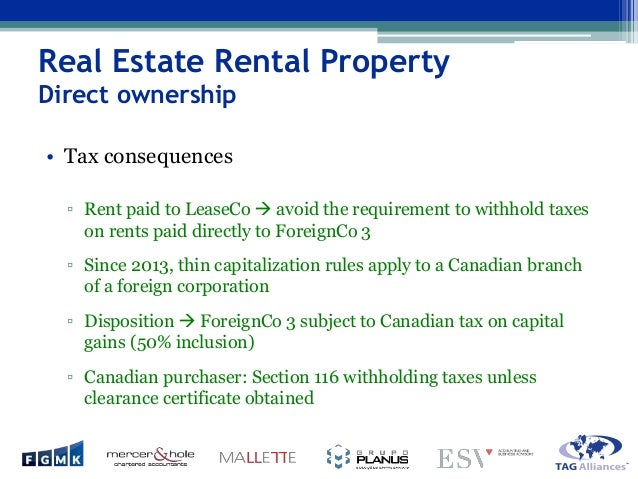

Source: madanca.com

Source: madanca.com

So short-term losses are first deducted against short-term gains and long-term losses are deducted against long-term gains. This is particularly common for higher income landlords. Special passive activity loss rules prevent many landlords from deducting their rental losses from other non-rental income such as salaries or investment income. There is no gray area. Imagine the stock market dips 10 and you sell off some stocks hoping to avoid further losses from market correction or bear market.

Source: stessa.com

Source: stessa.com

Net losses of either type can then be deducted against the other kind. Net losses of either type can then be deducted against the other kind. Its not always a terrible thing to sell at a loss. If you are a real estate professional rental real estate is not considered a passive activity for you. However this is not always the case for losses from real estate rentals.

Source: slideshare.net

Source: slideshare.net

Did you rent the property in 2016 prior to selling it. The bad news is that you cant use your passive losses today. There is no gray area. This is true whether or not you dispose of the. Did you rent the property in 2016 prior to selling it.

Source: slideshare.net

Source: slideshare.net

Net losses of either type can then be deducted against the other kind. Ive also pointed out that 469 clearly states that passive losses can only be offset by passive income so they cant be netted. Yes but there are limits. The rental of real estate is generally a passive activity. However Congress has promulgated special tax laws for passive losses associated with real estate rental income.

Source: forbes.com

Source: forbes.com

You can use these losses to offset other passive income ie. Losses on your investments are first used to offset capital gains of the same type. The bad news is that you cant use your passive losses today. You can offset your passive losses by selling off your rental properties. The way you manage your portfolio can impact your tax bill and your ultimate bottom line.

Source: pughcpas.com

Source: pughcpas.com

However any loss remaining is carried forward as a suspended passive loss. Can real estate losses offset stock gains. You can deduct any. Ordinarily business and investment losses are deductible from your other income. Losses on your investments are first used to offset capital gains of the same type.

Source: tmgnorthwest.com

Source: tmgnorthwest.com

Losses from rental property are considered passive losses and can generally offset passive income only that is income from other rental properties or another small business in which you do not materially participate not including investments. Losses from rental property are considered passive losses and can generally offset passive income only that is income from other rental properties or another small business in which you do not materially participate not including investments. However this is not always the case for losses from real estate rentals. Ive also pointed out that 469 clearly states that passive losses can only be offset by passive income so they cant be netted. Did you rent the property in 2016 prior to selling it.

Source: rsm.de

Source: rsm.de

There is no gray area. For additional information on reducing your tax bill as a larger-scale investor check this out. This prevents investors from seeing tax benefits if they sell at a loss and then turn around and buy the same thing for even less if it goes lower. Net losses of either type can then be deducted against the other kind. The bad news is that you cant use your passive losses today.

Source: forbes.com

Source: forbes.com

So if you get hit with losses one year that year makes a great time to sell your property so your losses offset your gains. Any remaining gain is reported in the normal manner. One says long term capital gain the other says passive - long term capital gain. This is true whether or not you dispose of the. In such a case you cant use the capital losses to offset capital gains or reduce your income.

Source: slideshare.net

Source: slideshare.net

You can offset your passive losses by selling off your rental properties. However Congress has promulgated special tax laws for passive losses associated with real estate rental income. Therefore the passive income deduction rules dont apply to you at all. This is particularly common for higher income landlords. There is no gray area.

Imagine the stock market dips 10 and you sell off some stocks hoping to avoid further losses from market correction or bear market. And contrary to the popular misconception capital gains and dividend income are not considered to be passive activity income so you cant use passive activity losses to offset. We both use lacerte and lacerte has two input boxes for long term capital gains. Any remaining gain is reported in the normal manner. Special passive activity loss rules prevent many landlords from deducting their rental losses from other non-rental income such as salaries or investment income.

Source: fool.com

Source: fool.com

Any remaining gain is reported in the normal manner. Did you rent the property in 2016 prior to selling it. Your passive losses from any property or activity can go to offset income or gain from any other property or passive activity. Therefore the passive income deduction rules dont apply to you at all. Your losses will offset any passive income.

Source: slideshare.net

Source: slideshare.net

The bad news is that you cant use your passive losses today. For additional information on reducing your tax bill as a larger-scale investor check this out. Special passive activity loss rules prevent many landlords from deducting their rental losses from other non-rental income such as salaries or investment income. However Congress has promulgated special tax laws for passive losses associated with real estate rental income. The bad news is that you cant use your passive losses today.

Source: markjkohler.com

Source: markjkohler.com

You can deduct any. If you are a real estate professional rental real estate is not considered a passive activity for you. Net losses of either type can then be deducted against the other kind. So if you get hit with losses one year that year makes a great time to sell your property so your losses offset your gains. The good news is that you dont lose your passive losses generated from your real estate rental.

Source: blueandco.com

Source: blueandco.com

Your passive losses from any property or activity can go to offset income or gain from any other property or passive activity. However any loss remaining is carried forward as a suspended passive loss. Your losses will offset any passive income. Passive losses on the property that you still have are not unsuspended until you dispose of the property. Any remaining gain is reported in the normal manner.

Source: slideshare.net

Source: slideshare.net

However any loss remaining is carried forward as a suspended passive loss. Losses on your investments are first used to offset capital gains of the same type. So if you get hit with losses one year that year makes a great time to sell your property so your losses offset your gains. Your losses will offset any passive income. The rental of real estate is generally a passive activity.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can passive real estate losses offset capital gains by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.