Your California real estate eo insurance per transaction images are available. California real estate eo insurance per transaction are a topic that is being searched for and liked by netizens today. You can Get the California real estate eo insurance per transaction files here. Get all free photos and vectors.

If you’re searching for california real estate eo insurance per transaction images information connected with to the california real estate eo insurance per transaction keyword, you have visit the right blog. Our site frequently provides you with hints for seeing the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that fit your interests.

California Real Estate Eo Insurance Per Transaction. It is 1220 to get coverage bound. To request coverage please complete an application and return to us. Real Estate Individual EO Policy Details. Ideally you would want to have a per claim limit that is at or above the most you could possibly lose in any given transaction and an aggregate limit which totals the maximum amount you could lose per transaction multiplied by the number of transactions which you perform per year.

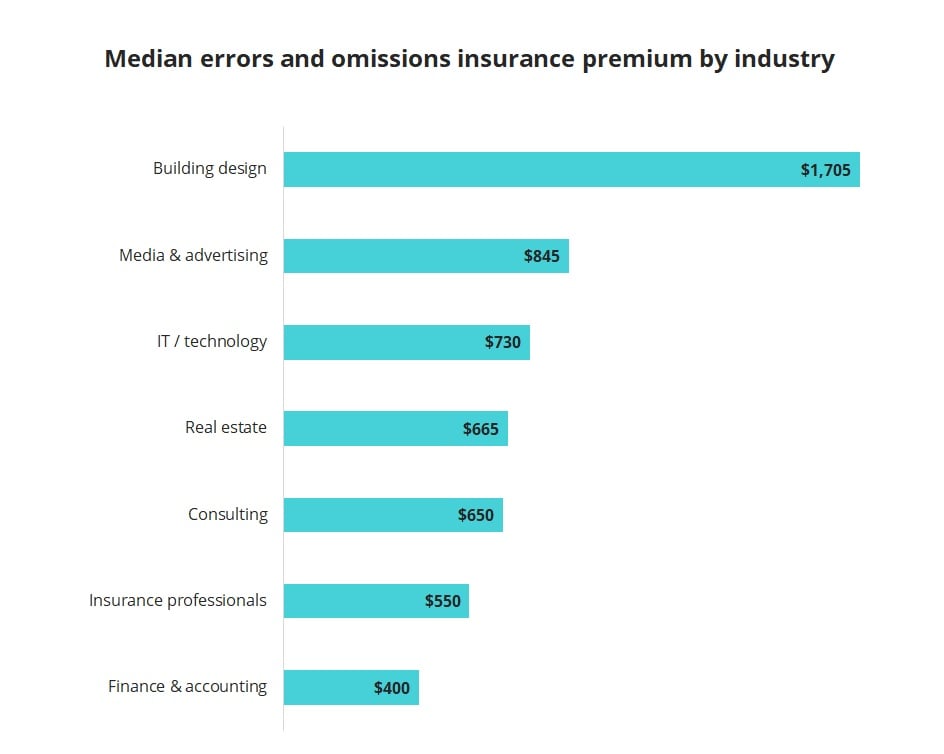

Errors And Omissions E O Insurance Cost Insureon From insureon.com

Errors And Omissions E O Insurance Cost Insureon From insureon.com

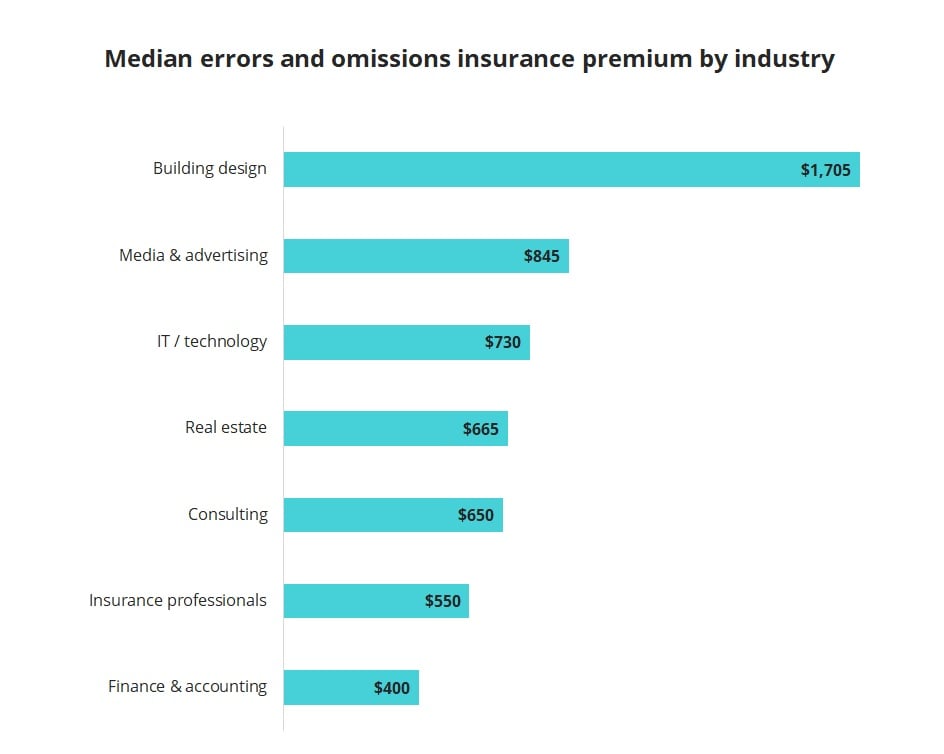

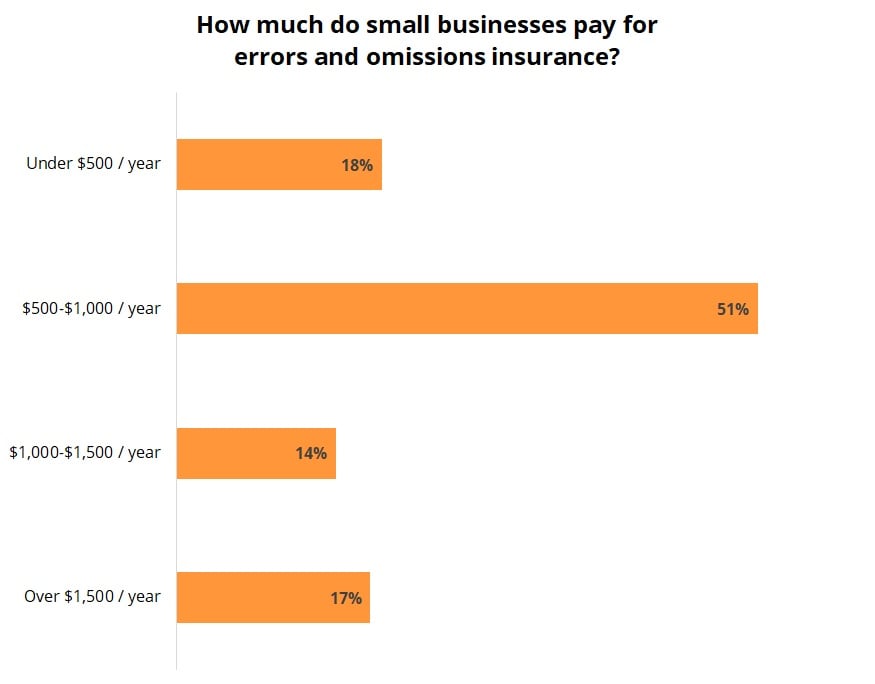

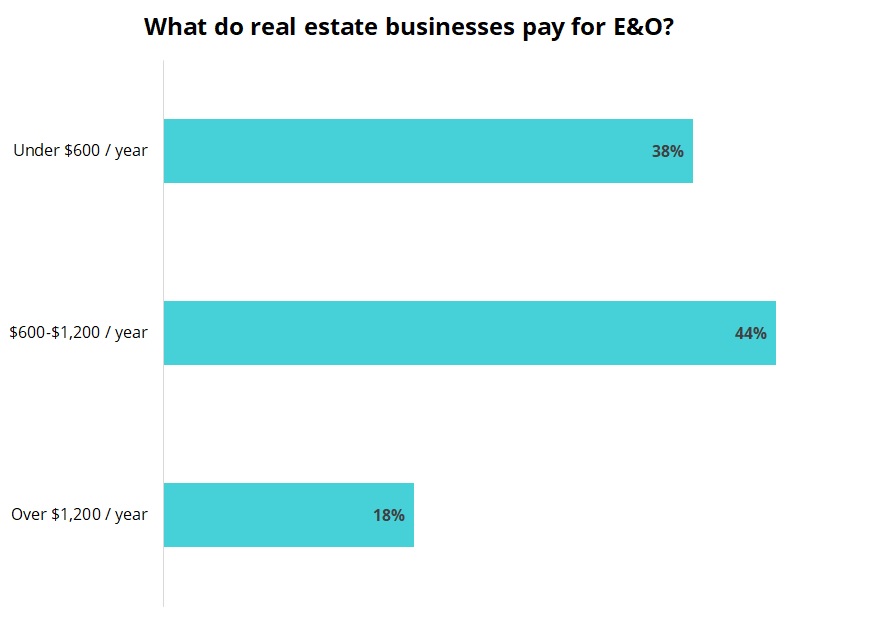

And raw vacant or partially developed land sales. Among real estate businesses that purchase errors and omissions insurance with Insureon 38 pay less than 600 per year and 44 pay between 600 and 1200 per year. I recommend that such referral fee be clearly stated in the closing statement so that all parties. The CRES Per-Transaction Payment Plan. Ideally you would want to have a per claim limit that is at or above the most you could possibly lose in any given transaction and an aggregate limit which totals the maximum amount you could lose per transaction multiplied by the number of transactions which you perform per year. Real Estate Errors and Omissions Quote EO EO insurance for realtors in CA Austin Austin Austin Austin Insurance Services Inc Errors Omission Insurance EO Errors Omissions Insurance EO EO helps protect professionals against allegations of negligence by a client and seeking to be indemnified.

An independent agent that works in this space can access CRES for you as well.

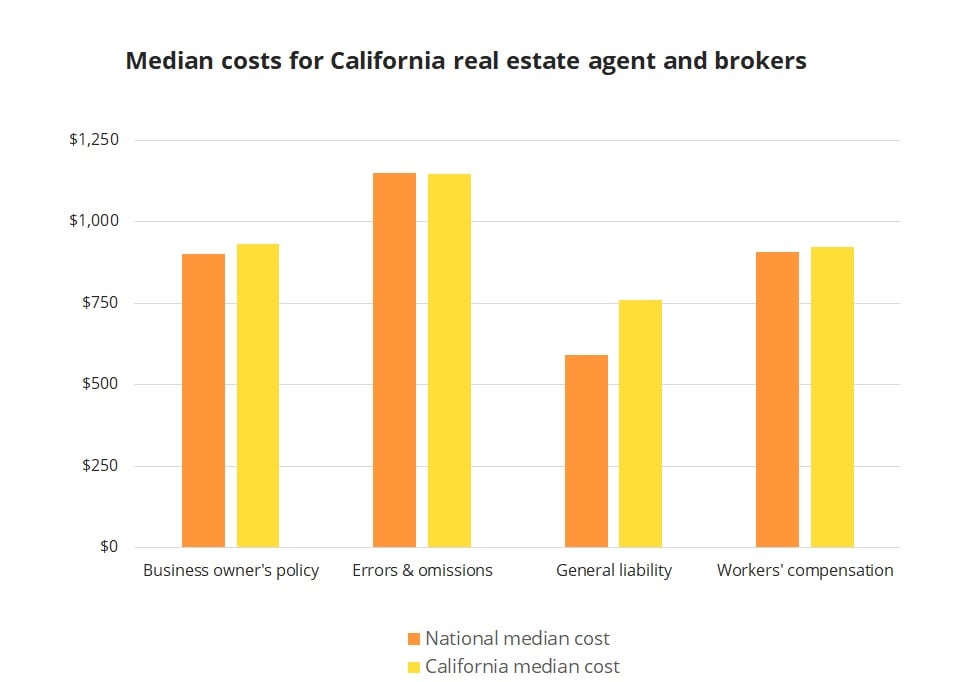

Errors And Omissions Insurance - EO. E O Insurance - CARs Exclusive EO Program with premiums starting at 517 a year Business Insurance - including General Liability Workers Compensation NEW Cyber Security Liability. California EO Insurance for Real Estate Agents and Brokers For states other than California please select from our menu above We offer EO insurance errors and omissions to California real estate agents and brokers. Legal expenses should also be considered as they can be considerable. The professionals we cover include real estate agents and brokers real estate appraisers title insurance agents title abstractors escrow officers home inspectors and mortgage brokers. Typical EO policy limits for real estate appraisers range from 300000 per claim up to 1000000 per claim.

Source: landy.com

Source: landy.com

I recommend that such referral fee be clearly stated in the closing statement so that all parties. As of January 1 2020 California requires everyone to have health insurance or pay a penalty. I believe the rating basis is per transaction but you do need to put a deposit down. Additionally it allows you to be efficient with funds as you only pay for insurance when. The cost of EO insurance depends on your risks.

Source: maximumeando.com

Source: maximumeando.com

It is 1220 to get coverage bound. A significant percentage of claims presented to insurance carriers offering errors and omissions coverages involve alleged negligence. CRES Real Estate EO ClaimPrevent includes more coverage and more for your investment. In other words when you purchase E and O insurance you convert a potentially large yet unknown loss into a much smaller outlay for which you can budget an EO insurance premium. The subjects of agency and the fiduciary relationships between real estate brokers and their principals are among the most difficult concepts for real estate licensees to understand and apply when engaged in real property or real property secured transactions.

Source: pinterest.com

Source: pinterest.com

Typical EO policy limits for real estate appraisers range from 300000 per claim up to 1000000 per claim. E O Insurance - CARs Exclusive EO Program with premiums starting at 517 a year Business Insurance - including General Liability Workers Compensation NEW Cyber Security Liability. The CRES Per-Transaction Payment Plan. Errors and omissions insurance EO is a type of professional liability insurance that protects companies and their workers or individuals against claims. EO Insurance for California Real Estate Professionals Policies Starting at 539 Portable EO with Superior Protection Legal Services and Sellers EO to Drive More Listings.

In other words when you purchase E and O insurance you convert a potentially large yet unknown loss into a much smaller outlay for which you can budget an EO insurance premium. Legal expenses should also be considered as they can be considerable. Ideally you would want to have a per claim limit that is at or above the most you could possibly lose in any given transaction and an aggregate limit which totals the maximum amount you could lose per transaction multiplied by the number of transactions which you perform per year. The cost increases depending on the risk of a business being sued over a professional mistake. Errors And Omissions Insurance - EO.

Source: ar.pinterest.com

Source: ar.pinterest.com

Comes with 500000 liability limits and a 2500 Retention out-of-pocket claims expense limit Learn more. This will determine the amount of EO insurance you may need. E O Insurance - CARs Exclusive EO Program with premiums starting at 517 a year Business Insurance - including General Liability Workers Compensation NEW Cyber Security Liability. An independent agent that works in this space can access CRES for you as well. I believe the rating basis is per transaction but you do need to put a deposit down.

Errors And Omissions Insurance - EO. So what is real estate EO insurance. The companies that offer per. Comes with 500000 liability limits and a 2500 Retention out-of-pocket claims expense limit Learn more. The CRES Per-Transaction Payment Plan.

Source: insureon.com

Source: insureon.com

To request coverage please complete an application and return to us. The CRES Per-Transaction Payment Plan. Real Estate Brokers EO Insurance. And raw vacant or partially developed land sales. In applicable states coverage is offered on our unique Per Transaction payment plan.

Source: cresinsurance.com

Source: cresinsurance.com

This will determine the amount of EO insurance you may need. Ideally you would want to have a per claim limit that is at or above the most you could possibly lose in any given transaction and an aggregate limit which totals the maximum amount you could lose per transaction multiplied by the number of transactions which you perform per year. The companies that offer per. In applicable states coverage is offered on our unique Per Transaction payment plan. Typical EO policy limits for real estate appraisers range from 300000 per claim up to 1000000 per claim.

Source: insureon.com

Source: insureon.com

Additionally it allows you to be efficient with funds as you only pay for insurance when. So what is real estate EO insurance. This will determine the amount of EO insurance you may need. One of the main factors that California real estate appraisers should evaluate when selecting an EO insurance policy limit is the typical and the largest value of the properties that have been and will be appraised. By neutralizing the large risk youre.

Source: pinterest.com

Source: pinterest.com

EO Insurance for California Real Estate Professionals Policies Starting at 539 Portable EO with Superior Protection Legal Services and Sellers EO to Drive More Listings. So what is real estate EO insurance. A flexible menu approach allowing you to. As of January 1 2020 California requires everyone to have health insurance or pay a penalty. Includes Sellers EO Protection Plan to help you get more listings included if Residential Real Estate activity is selected on policy.

Source: investfourmore.com

Source: investfourmore.com

To request coverage please complete an application and return to us. Additionally it allows you to be efficient with funds as you only pay for insurance when. This will determine the amount of EO insurance you may need. The subjects of agency and the fiduciary relationships between real estate brokers and their principals are among the most difficult concepts for real estate licensees to understand and apply when engaged in real property or real property secured transactions. The Per Transaction PT payment plan is a good alternative to the traditional fixed payment plans for some businesses because it allows you to pay for the premium over the term of the policy in installments instead of paying for the entire year when the policy starts.

Source: 360coveragepros.com

Source: 360coveragepros.com

So what is real estate EO insurance. The professionals we cover include real estate agents and brokers real estate appraisers title insurance agents title abstractors escrow officers home inspectors and mortgage brokers. An independent agent that works in this space can access CRES for you as well. This errors and omissions insurance program is designed exclusively for Real Estate Agents and Brokers Brokerage Firms and Real Estate Companies placing transactions through a brokerage firm domiciled in California. Legal expenses should also be considered as they can be considerable.

Source: insureon.com

Source: insureon.com

E O Insurance - CARs Exclusive EO Program with premiums starting at 517 a year Business Insurance - including General Liability Workers Compensation NEW Cyber Security Liability. The cost of EO insurance depends on your risks. Additionally it allows you to be efficient with funds as you only pay for insurance when. To request coverage please complete an application and return to us. The CRES Per-Transaction Payment Plan.

Source: cresinsurance.com

Source: cresinsurance.com

Errors And Omissions Insurance - EO. One of the main factors that California real estate appraisers should evaluate when selecting an EO insurance policy limit is the typical and the largest value of the properties that have been and will be appraised. The Per Transaction PT payment plan is a good alternative to the traditional fixed payment plans for some businesses because it allows you to pay for the premium over the term of the policy in installments instead of paying for the entire year when the policy starts. So what is real estate EO insurance. Includes Sellers EO Protection Plan to help you get more listings included if Residential Real Estate activity is selected on policy.

Source: insureon.com

Source: insureon.com

Additionally it allows you to be efficient with funds as you only pay for insurance when. CRES Real Estate EO ClaimPrevent includes more coverage and more for your investment. An independent agent that works in this space can access CRES for you as well. One of the main factors that California real estate appraisers should evaluate when selecting an EO insurance policy limit is the typical and the largest value of the properties that have been and will be appraised. And raw vacant or partially developed land sales.

Source: 100commissionrealestate.com

Source: 100commissionrealestate.com

Commercial real estate sales includes 5 Units. It is a type of professional liability insurance that turns the uncertainty of doing business today into a known and predictable expense. Commercial real estate sales includes 5 Units. In other words when you purchase E and O insurance you convert a potentially large yet unknown loss into a much smaller outlay for which you can budget an EO insurance premium. So what is real estate EO insurance.

Source: insureon.com

Source: insureon.com

The companies that offer per. Legal expenses should also be considered as they can be considerable. Real Estate Errors and Omissions Quote EO EO insurance for realtors in CA Austin Austin Austin Austin Insurance Services Inc Errors Omission Insurance EO Errors Omissions Insurance EO EO helps protect professionals against allegations of negligence by a client and seeking to be indemnified. A flexible menu approach allowing you to. Errors and omissions insurance EO is a type of professional liability insurance that protects companies and their workers or individuals against claims.

Errors And Omissions Insurance - EO. EO Insurance for California Real Estate Professionals Policies Starting at 539 Portable EO with Superior Protection Legal Services and Sellers EO to Drive More Listings. CRES Real Estate EO ClaimPrevent includes more coverage and more for your investment. The companies that offer per. I believe the rating basis is per transaction but you do need to put a deposit down.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title california real estate eo insurance per transaction by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.