Your California real estate capital gains tax calculator images are ready. California real estate capital gains tax calculator are a topic that is being searched for and liked by netizens today. You can Download the California real estate capital gains tax calculator files here. Find and Download all royalty-free images.

If you’re searching for california real estate capital gains tax calculator pictures information related to the california real estate capital gains tax calculator keyword, you have pay a visit to the right blog. Our site always provides you with suggestions for seeing the highest quality video and image content, please kindly surf and find more enlightening video articles and images that fit your interests.

California Real Estate Capital Gains Tax Calculator. This tax can apply to several different kinds of investments like stocks and bonds or assets like boats cars and real estate. Learn how to calculate capital gains on the sale of property in California. The tax rate can vary from 0 to 396 depending on two factors - Your income bracket and whether it is considered as a. Real estate withholding FTBcagov.

Capital Gains Tax Calculator Estimate What You Ll Owe From public.com

Capital Gains Tax Calculator Estimate What You Ll Owe From public.com

This handy calculator helps you avoid tedious number-crunching but it should only be used for a back-of-the-envelope approximation. We now have one Form 593 Real Estate Withholding Statement which is filed with FTB after every real estate transaction. The profit you make when you sell your stock and other similar assets like real estate is equal to your capital gain on the sale. Taxes are what we at JRW refer to as guaranteed losses and we attempt to defer or eliminate them wherever it is possible. The California Capital Gains Tax partial exemption would be calculated as follows. Your adjusted cost base was 400000 so your total capital gains is 100000 and your taxable capital gains is 50 of that or 50000.

Review the sites security and confidentiality statements before.

The calculator based on your input calculates both short term capital gains as well as long term capital gains tax. So if one was in the home for 12 months or 50 percent of the minimum then the partial exemption allowed would be 125000 versus 250000 50 percent of the total exemption. California Capital Gain or Loss Schedule D 540 If there are differences between federal and state taxable amounts Visit Instructions for California Schedule D 540 for more information. Capital gains taxes and depreciation. It may not account for specific scenarios that could affect your tax liability. APIs Capital Gain Tax Calculator to calculate taxable gain and avoid paying taxes by taking advantage of IRC Section 1031.

A capital gains tax charges you on the difference between the amount you paid for an asset this is known as the basis and what you sell the asset for. Learn how to calculate capital gains on the sale of property in California. This tax can apply to several different kinds of investments like stocks and bonds or assets like boats cars and real estate. As of January 1 2020 California real estate withholding changed. Contact Modern Wealth Law for a consult now.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

This tax can apply to several different kinds of investments like stocks and bonds or assets like boats cars and real estate. For more information see Form 593 instructions ca state income tax rates Verified 7 days ago. This handy calculator helps you avoid tedious number-crunching but it should only be used for a back-of-the-envelope approximation. APIs Capital Gain Tax Calculator to calculate taxable gain and avoid paying taxes by taking advantage of IRC Section 1031. Review the sites security and confidentiality statements before.

You are leaving ftbcagov. The profit you make when you sell your stock and other similar assets like real estate is equal to your capital gain on the sale. Because California does not give any tax breaks for capital gains you could find yourself taxed at the highest marginal rate of 123 percent plus the 1 percent Mental Health Services tax. At 22 your capital gains tax on this real estate sale would be 3300. We now have one Form 593 Real Estate Withholding Statement which is filed with FTB after every real estate transaction.

Source: relakhs.com

Source: relakhs.com

Investments held long-term more than one year will be taxed at a lower rate. 2020 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. Depending on your income. Real estate withholding FTBcagov. Therefore you would owe 2250.

So if one was in the home for 12 months or 50 percent of the minimum then the partial exemption allowed would be 125000 versus 250000 50 percent of the total exemption. The Capital Gains Tax in California. Capital gains tax might result from selling your home stocks bonds commodities mutual funds a business and other similar capital. We now have one Form 593 Real Estate Withholding Statement which is filed with FTB after every real estate transaction. The amount you gained.

The taxable capital gain for the land would be 12500 and the taxable capital gain for the building would be 37500. No capital gains tax is incurred on inventory assets. With California not giving any tax breaks for capital gains you could find yourself getting hit with a total state tax rate of 133 on your capital gains. This handy calculator helps you avoid tedious number-crunching but it should only be used for a back-of-the-envelope approximation. Find out how much you owe and how to determine your tax obligations.

Source: propertycashin.com

Source: propertycashin.com

Your filing status and the amount of income you earned for the year determine at which rate you will be taxed. Your adjusted cost base was 400000 so your total capital gains is 100000 and your taxable capital gains is 50 of that or 50000. California has no long term capital gains rates and no depreciation recapture. It may not account for specific scenarios that could affect your tax liability. We do not control the destination site and cannot accept any responsibility for its contents links or offers.

Source: propertycashin.com

Source: propertycashin.com

The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as. 2020 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. With California not giving any tax breaks for capital gains you could find yourself getting hit with a total state tax rate of 133 on your capital gains. At 22 your capital gains tax on this real estate sale would be 3300. 15000 x 22 3300 If you owned the home for one year or longer then youd be liable for the long-term capital gains tax rate.

Source: modernwealthlaw.com

Source: modernwealthlaw.com

This is often a surprise to the tech. The California Capital Gains Tax partial exemption would be calculated as follows. Find out how much you owe and how to determine your tax obligations. 2020 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. 10 12 22 24 32 35 and 37.

Source: myexpattaxes.com

Source: myexpattaxes.com

Your income and filing status make your capital gains tax rate on real estate 15. You are leaving ftbcagov. The profit you make when you sell your stock and other similar assets like real estate is equal to your capital gain on the sale. Your adjusted cost base was 400000 so your total capital gains is 100000 and your taxable capital gains is 50 of that or 50000. We do not control the destination site and cannot accept any responsibility for its contents links or offers.

Source: hrblock.com

Source: hrblock.com

This tax can apply to several different kinds of investments like stocks and bonds or assets like boats cars and real estate. At 22 your capital gains tax on this real estate sale would be 3300. Capital gains taxes and depreciation. This handy calculator helps you avoid tedious number-crunching but it should only be used for a back-of-the-envelope approximation. Start with the number of months actually met if the minimum two years is not possible.

Source: pinterest.com

Source: pinterest.com

So if one was in the home for 12 months or 50 percent of the minimum then the partial exemption allowed would be 125000 versus 250000 50 percent of the total exemption. With California not giving any tax breaks for capital gains you could find yourself getting hit with a total state tax rate of 133 on your capital gains. The Capital Gains Tax in California. As of January 1 2020 California real estate withholding changed. For more information see Form 593 instructions ca state income tax rates Verified 7 days ago.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

Read about the primary ways in which an investor can legally avoid capital gain taxesThese include the 1031 721 1033 tax-deferred real estate exchanges Deferred Sales Trust DST and various tax write-offs and credits. California Capital Gain or Loss Schedule D 540 If there are differences between federal and state taxable amounts Visit Instructions for California Schedule D 540 for more information. No capital gains tax is incurred on inventory assets. The IRS taxes capital gains at the federal level and some states also tax capital gains at the state level. Capital gains taxes and depreciation.

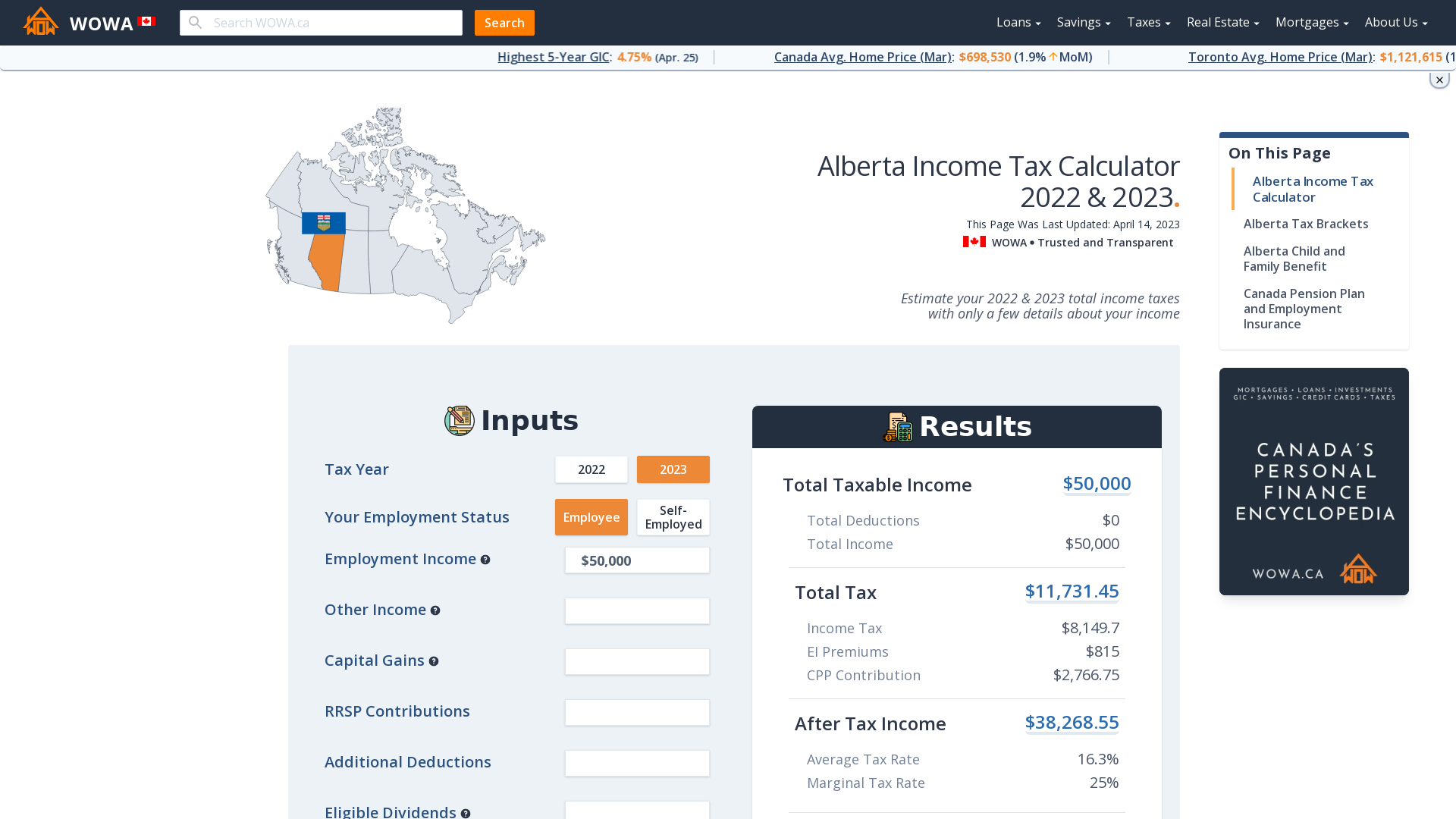

Source: wowa.ca

Source: wowa.ca

This is often a surprise to the tech. The amount you gained. Learn how to calculate capital gains on the sale of property in California. This handy calculator helps you avoid tedious number-crunching but it should only be used for a back-of-the-envelope approximation. Find out how much you owe and how to determine your tax obligations.

Source: bccpa.ca

Source: bccpa.ca

The amount you gained. 2020 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. This handy calculator helps you avoid tedious number-crunching but it should only be used for a back-of-the-envelope approximation. The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as. Review the sites security and confidentiality statements before.

Source: public.com

Source: public.com

So if one was in the home for 12 months or 50 percent of the minimum then the partial exemption allowed would be 125000 versus 250000 50 percent of the total exemption. So if one was in the home for 12 months or 50 percent of the minimum then the partial exemption allowed would be 125000 versus 250000 50 percent of the total exemption. At 22 your capital gains tax on this real estate sale would be 3300. With California not giving any tax breaks for capital gains you could find yourself getting hit with a total state tax rate of 133 on your capital gains. Taxes are what we at JRW refer to as guaranteed losses and we attempt to defer or eliminate them wherever it is possible.

Source: forbes.com

Source: forbes.com

The taxable capital gain for the land would be 12500 and the taxable capital gain for the building would be 37500. For more information see Form 593 instructions ca state income tax rates Verified 7 days ago. The California Capital Gains Tax partial exemption would be calculated as follows. Your income and filing status make your capital gains tax rate on real estate 15. California Capital Gain or Loss Schedule D 540 If there are differences between federal and state taxable amounts Visit Instructions for California Schedule D 540 for more information.

Source: relakhs.com

Source: relakhs.com

So if one was in the home for 12 months or 50 percent of the minimum then the partial exemption allowed would be 125000 versus 250000 50 percent of the total exemption. The California Capital Gains Tax partial exemption would be calculated as follows. For more information see Form 593 instructions ca state income tax rates Verified 7 days ago. Contact Modern Wealth Law for a consult now. Tax rates for short-term gains in 2020 are.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title california real estate capital gains tax calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.