Your California real estate beneficiary deed images are available. California real estate beneficiary deed are a topic that is being searched for and liked by netizens now. You can Get the California real estate beneficiary deed files here. Find and Download all royalty-free images.

If you’re searching for california real estate beneficiary deed images information connected with to the california real estate beneficiary deed interest, you have visit the right blog. Our site frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that fit your interests.

California Real Estate Beneficiary Deed. Sound like depressing way to transfer property. This deed must be recorded in the county where the real property is located within a certain period of time. The copy of the deed you prepare must meet state requirements and contain the correct language and formatting. In addition many counties add requirements for margins paper size property identification and many other details.

July 2020 Newsletter Law Firm Things To Sell Newsletters From pinterest.com

July 2020 Newsletter Law Firm Things To Sell Newsletters From pinterest.com

3 Sell or give away the property or transfer it to a trust before your death and RECORD the deed. This type of deed can be filed with the recorder so that when the person dies it automatically becomes the property of the person designated. Estates over 150000 require full probate. However this interest or rights in the real property will only go into effect after the owner dies. As of January 1 2016 owners of California real estate can create a revocable Transfer on Death TOD Deed to give their house away at their death without probate. Beneficiary deed forms are set forth in CRS.

The value of property is determined by the.

Simply put a beneficiary deed allows a real property owner to execute a deed that transfers the title to the property to a beneficiary upon the death of the grantor. Property in living trusts can be transferred without going to court. The real estate deed form you use must meet statutory conditions for content and format. As of January 1 2016 owners of California real estate can create a revocable Transfer on Death TOD Deed to give their house away at their death without probate. However this interest or rights in the real property will only go into effect after the owner dies. Real estate sometimes can be transferred without court with a transfer-on-death deed also called a beneficiary deed.

Source: in.pinterest.com

Source: in.pinterest.com

This simple one-page document can be found for free at your county clerks office or website. This deed must be recorded in the county where the real property is located within a certain period of time. Like regular deeds TOD deeds must be signed notarized and filed in the countys land records office. 2 Avoids probate assuming the beneficiary does not predecease the owner. There are also some simplified procedures for estates that are under 166250.

Source: co.pinterest.com

Source: co.pinterest.com

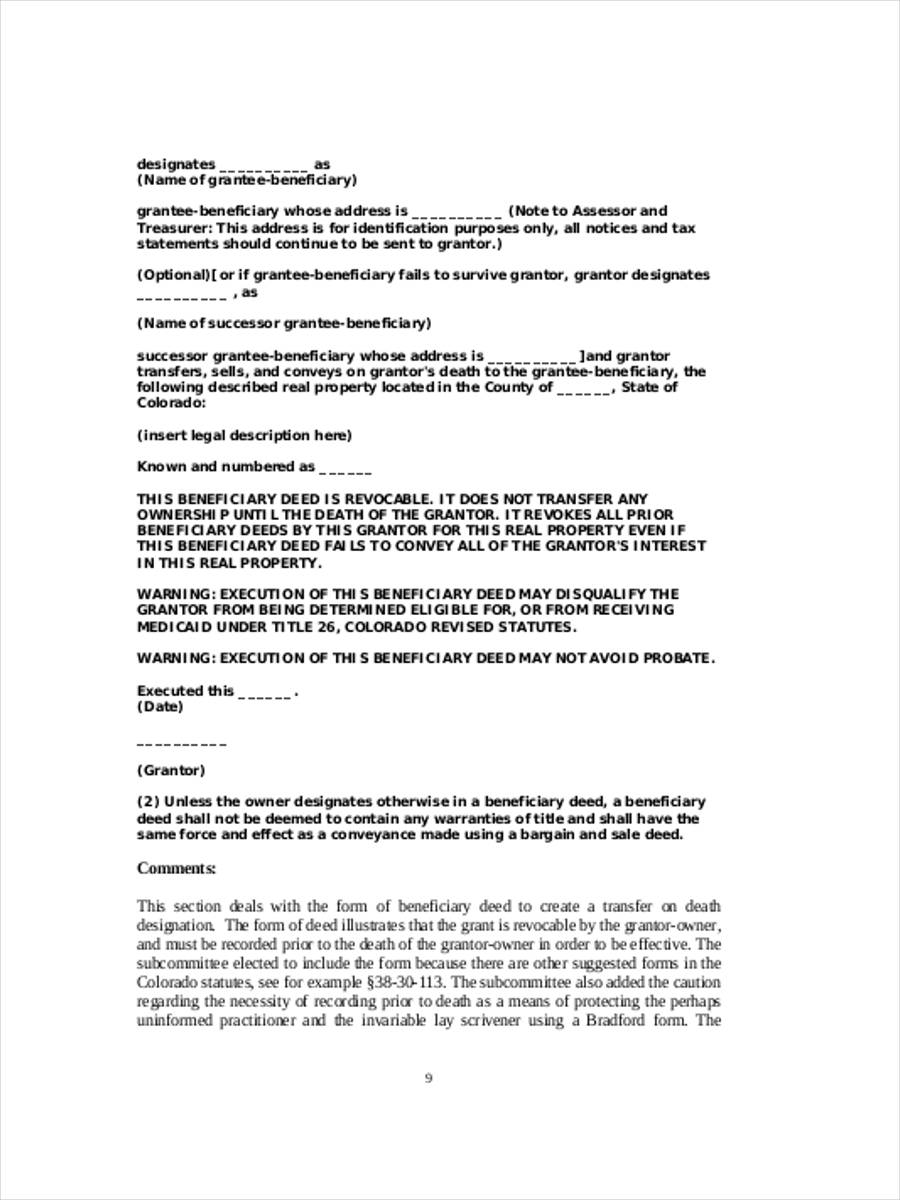

Of the Colorado Revised Statutes authorize the execution and recording of beneficiary deeds in Colorado. This simple one-page document can be found for free at your county clerks office or website. The copy of the deed you prepare must meet state requirements and contain the correct language and formatting. Real estate sometimes can be transferred without court with a transfer-on-death deed also called a beneficiary deed. A beneficiary deed is commonly associated with real estate and property because it is a document used to determine who will receive real estate property when the original owner dies.

Source: sjcbar.org

Source: sjcbar.org

Section 15-15-401 et seq. Simply put a beneficiary deed allows a real property owner to execute a deed that transfers the title to the property to a beneficiary upon the death of the grantor. A beneficiary deed is a conveyance of an interest in real property which is revocable and which becomes effective upon the death of the grantor or if there are multiple grantors upon the death of the last surviving. This deed must be recorded in the county where the real property is located within a certain period of time. Shannon Kietzman Date.

Source: deeds.com

Source: deeds.com

In addition many counties add requirements for margins paper size property identification and many other details. 3 A good temporary solution to avoid probate in a crisis situation where real property owner doesnt have time to create a revocable living trust. A beneficiary deed is commonly associated with real estate and property because it is a document used to determine who will receive real estate property when the original owner dies. Fortunately the process of filing and recording the transfer on death deed to leave real estate for a beneficiary is quite simple. Unfortunately probate is typically required for estates under a million.

Source: sampleforms.com

Source: sampleforms.com

Shannon Kietzman Date. Simply put a beneficiary deed allows a real property owner to execute a deed that transfers the title to the property to a beneficiary upon the death of the grantor. Fortunately the process of filing and recording the transfer on death deed to leave real estate for a beneficiary is quite simple. However this interest or rights in the real property will only go into effect after the owner dies. Sound like depressing way to transfer property.

Source: pinterest.com

Source: pinterest.com

In addition many counties add requirements for margins paper size property identification and many other details. Shannon Kietzman Date. Assets placed in a living trust can avoid probate but its far simpler and less expensive to simply transfer the property by beneficiary deed also called a transfer-on-death deed if you live in a state that. A beneficiary deed or transfer-on-death deed does just what its name implies transfers the property to a beneficiary only upon your death. A beneficiary deed is a conveyance of an interest in real property which is revocable and which becomes effective upon the death of the grantor or if there are multiple grantors upon the death of the last surviving.

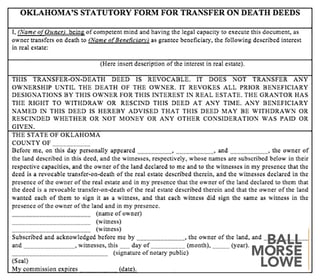

Source: ballmorselowe.com

Source: ballmorselowe.com

A TOD deed can only affect property that you own when you die. A deed of trust sometimes called a trust deed as the terms are interchangeable is a security instrument and functions for all practical purposes just like a mortgage although in California they usually contain a power of sale reposing in the trustee a third party in the event of default. This type of deed can be filed with the recorder so that when the person dies it automatically becomes the property of the person designated. If your beneficiary pisses you off you can always name another one by making a new deed. There are also some simplified procedures for estates that are under 166250.

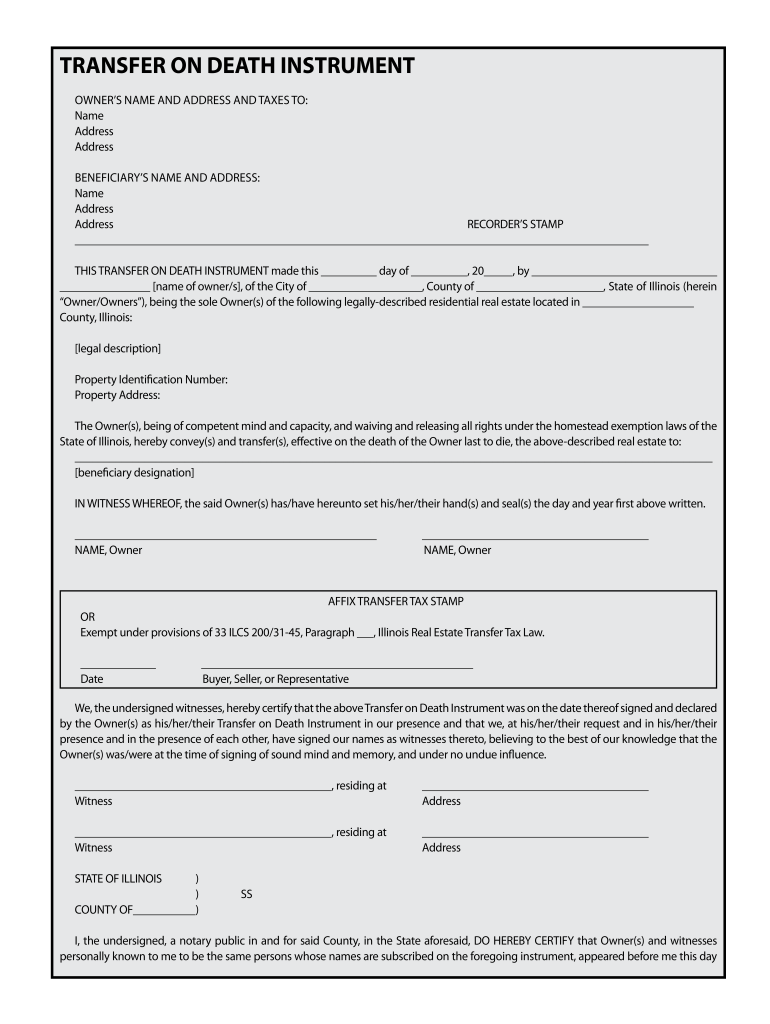

Source: pdffiller.com

Source: pdffiller.com

If your beneficiary pisses you off you can always name another one by making a new deed. Shannon Kietzman Date. The copy of the deed you prepare must meet state requirements and contain the correct language and formatting. The real estate deed form you use must meet statutory conditions for content and format. Beneficiary deed forms are set forth in CRS.

Source: journal.firsttuesday.us

Source: journal.firsttuesday.us

Real estate sometimes can be transferred without court with a transfer-on-death deed also called a beneficiary deed. Benefits of a Transfer on Death Deed 1 Quick easy and inexpensive. Fortunately the process of filing and recording the transfer on death deed to leave real estate for a beneficiary is quite simple. This type of deed can be filed with the recorder so that when the person dies it automatically becomes the property of the person designated. Section 15-15-401 et seq.

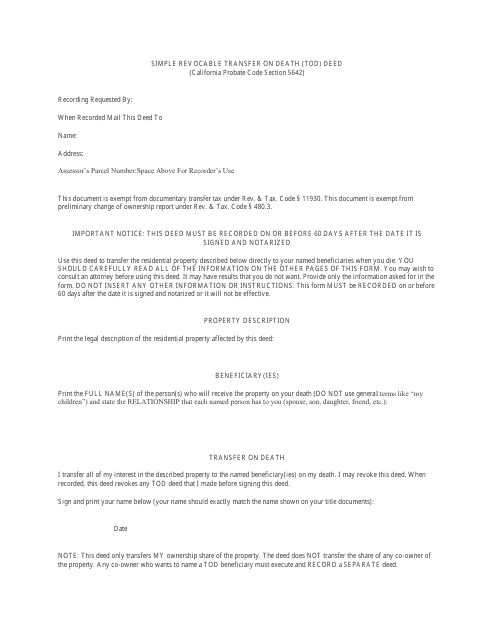

Source: pinterest.com

Source: pinterest.com

The California revocable transfer on death TOD deed is similar to what is called a life estate whereby a person determines that they want to make sure their property passes to a loved one upon their death without it having to pass through the probate process. So far 12 states have passed laws allowing the use of this deed - Arizona AZ Arkansas AR Colorado CO Kansas KS Missouri MO Minnesota MN Montana MT Neveda NV New Mexico NM Ohio OH Oklahama OK and Wisconsin WI. In California unless the decedent has set up a trust or some other vehicle for distribution on death estates valued in excess of 150000 personal or real property or estates with real property are settled through some type of probate. The value of property is determined by the. Beneficiary deed forms are set forth in CRS.

Source: journal.firsttuesday.us

Source: journal.firsttuesday.us

The value of property is determined by the. When the property owner signs and records a beneficiary deed it can cause the owners interest ie rights in the real property to be transferred to certain individuals or entities upon the owners death. Real estate sometimes can be transferred without court with a transfer-on-death deed also called a beneficiary deed. This simple one-page document can be found for free at your county clerks office or website. In California unless the decedent has set up a trust or some other vehicle for distribution on death estates valued in excess of 150000 personal or real property or estates with real property are settled through some type of probate.

Source: templateroller.com

Source: templateroller.com

There are also some simplified procedures for estates that are under 166250. This deed must be recorded in the county where the real property is located within a certain period of time. Shannon Kietzman Date. 1 Complete have notarized and RECORD a revocation form. Like regular deeds TOD deeds must be signed notarized and filed in the countys land records office.

Source: pinterest.com

Source: pinterest.com

This deed must be recorded in the county where the real property is located within a certain period of time. This deed must be recorded in the county where the real property is located within a certain period of time. Estates over 150000 require full probate. Like regular deeds TOD deeds must be signed notarized and filed in the countys land records office. When the property owner signs and records a beneficiary deed it can cause the owners interest ie rights in the real property to be transferred to certain individuals or entities upon the owners death.

Source: sampleforms.com

Source: sampleforms.com

If your beneficiary pisses you off you can always name another one by making a new deed. New Beneficiary Deed for California Property. February 06 2021 A beneficiary deed is used to determine who will get a house after the owner passes away. There are three ways to revoke a recorded TOD deed. Unfortunately probate is typically required for estates under a million.

Source: pinterest.com

Source: pinterest.com

In California home loans are secured by deeds of trusts. This simple one-page document can be found for free at your county clerks office or website. However this interest or rights in the real property will only go into effect after the owner dies. A beneficiary deed or transfer-on-death deed does just what its name implies transfers the property to a beneficiary only upon your death. In addition many counties add requirements for margins paper size property identification and many other details.

Source: sacramentorealestateblog.blogspot.com

Source: sacramentorealestateblog.blogspot.com

Like regular deeds TOD deeds must be signed notarized and filed in the countys land records office. Benefits of a Transfer on Death Deed 1 Quick easy and inexpensive. A deed of trust sometimes called a trust deed as the terms are interchangeable is a security instrument and functions for all practical purposes just like a mortgage although in California they usually contain a power of sale reposing in the trustee a third party in the event of default. Like regular deeds TOD deeds must be signed notarized and filed in the countys land records office. There are three ways to revoke a recorded TOD deed.

Real estate sometimes can be transferred without court with a transfer-on-death deed also called a beneficiary deed. The copy of the deed you prepare must meet state requirements and contain the correct language and formatting. In California home loans are secured by deeds of trusts. This type of deed can be filed with the recorder so that when the person dies it automatically becomes the property of the person designated. 3 Sell or give away the property or transfer it to a trust before your death and RECORD the deed.

Source: pinterest.com

Source: pinterest.com

Simply put a beneficiary deed allows a real property owner to execute a deed that transfers the title to the property to a beneficiary upon the death of the grantor. Simply put a beneficiary deed allows a real property owner to execute a deed that transfers the title to the property to a beneficiary upon the death of the grantor. If your beneficiary pisses you off you can always name another one by making a new deed. Fortunately the process of filing and recording the transfer on death deed to leave real estate for a beneficiary is quite simple. 2 Avoids probate assuming the beneficiary does not predecease the owner.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title california real estate beneficiary deed by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.