Your California capital gains tax real estate 2015 images are ready in this website. California capital gains tax real estate 2015 are a topic that is being searched for and liked by netizens now. You can Find and Download the California capital gains tax real estate 2015 files here. Get all royalty-free photos and vectors.

If you’re looking for california capital gains tax real estate 2015 pictures information linked to the california capital gains tax real estate 2015 interest, you have visit the right blog. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly search and find more informative video content and images that fit your interests.

California Capital Gains Tax Real Estate 2015. MarriedRegistered domestic partner RDP MarriedRDP couples can exclude up to 500000 if all of the following apply. Right off the bat if you are single they will allow you to exclude 250000 of capital gains. So if you bought an Idaho house for 200000 five years ago and then sold it today for 475000 you would make 200000 in capital. Your gain from the sale was less than 500000.

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep From itep.org

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep From itep.org

Capital gains tax is due on 50000 300000 profit - 250000 IRS exclusion. You have not used the exclusion in the last 2 years. Capital gains rates for individual increase to 15 for those individuals in the 25 - 35 marginal tax brackets and increase even further to 20 for those individuals in the 396 marginal tax bracket. It does not recognize the distinction between short-term and long-term capital gains. This tax can apply to several different kinds of investments like stocks and bonds or assets like boats cars and real estate. 100 shares of Z S stock b Sales price c Cost or other basis d Loss.

The Capital Gains Tax in California.

If and when you sell your inherited property youll be liable to pay a tax called capital gains tax. Find out how much you owe and how to determine your tax obligations. The amount you gained between the time you bought the property and the time you sold it. The following Capital Gains Tax. Simply put California taxes all capital gains as regular income. Rates for Capital Gains Tax.

Source: investopedia.com

Source: investopedia.com

It does not recognize the distinction between short-term and long-term capital gains. MarriedRegistered domestic partner RDP MarriedRDP couples can exclude up to 500000 if all of the following apply. If you later sell the home for 350000 you only pay capital gains taxes on the 50000 difference between the sale price and your stepped-up basis. If your income falls between 80000 and 441450 your capital gains tax rate as a single person is 15. If your primary residence is in California add 93 for the state tax rate this could be less for some taxpayers.

Source: itep.org

Source: itep.org

The IRS provides a few ways to avoid paying capital gains tax on real estate sales. D 540 Names as shown on return. This is a brief overview on a subject which is very confusing to many people. This is maximum total of 133 percent in California state tax on your capital gains. If you later sell the home for 350000 you only pay capital gains taxes on the 50000 difference between the sale price and your stepped-up basis.

Source: itep.org

Source: itep.org

Rates for Capital Gains Tax. Inherited properties also usually dont qualify for the home sale tax exclusion which allows single homeowners to make up to 250000 from a house sale tax-free 500000 for married couples. There is no way to protect you from a loss or offset taxes on this type of property unless you offset it with a. Right off the bat if you are single they will allow you to exclude 250000 of capital gains. 100 shares of Z S stock b Sales price c Cost or other basis d Loss.

Source: wikihow.com

Source: wikihow.com

Identify S corporation stock Example. If your primary residence is in California add 93 for the state tax rate this could be less for some taxpayers. If you sell the home for that amount then you dont have to pay capital gains taxes. Calculate Capital Gains Tax on Sale of Property in California. As you can see some tax planning is in order.

Source: investopedia.com

Source: investopedia.com

The amount you gained between the time you bought the property and the time you sold it. The IRS provides a few ways to avoid paying capital gains tax on real estate sales. 6 April 2017 onwards. Inherited properties also usually dont qualify for the home sale tax exclusion which allows single homeowners to make up to 250000 from a house sale tax-free 500000 for married couples. Vacation properties are handled in virtually the same manner as second homes.

Source: diypropertyinvestment.com

Source: diypropertyinvestment.com

This means your capital gains taxes will run. 100 shares of Z S stock b Sales price c Cost or other basis d Loss. When you take into consideration that the IRS can also levy a maximum of 37 percen t in federal taxes on your capital gains it becomes crystal clear how and why capital gains in California are among the highest taxed in the world. It does not recognize the distinction between short-term and long-term capital gains. 6 April 2017 onwards.

Source: taxesforexpats.com

Source: taxesforexpats.com

D 540 Names as shown on return. Capital gains tax is due on 50000 300000 profit - 250000 IRS exclusion. As you can see some tax planning is in order. When you take into consideration that the IRS can also levy a maximum of 37 percen t in federal taxes on your capital gains it becomes crystal clear how and why capital gains in California are among the highest taxed in the world. It is especially important for anyone who has been in their house a long time.

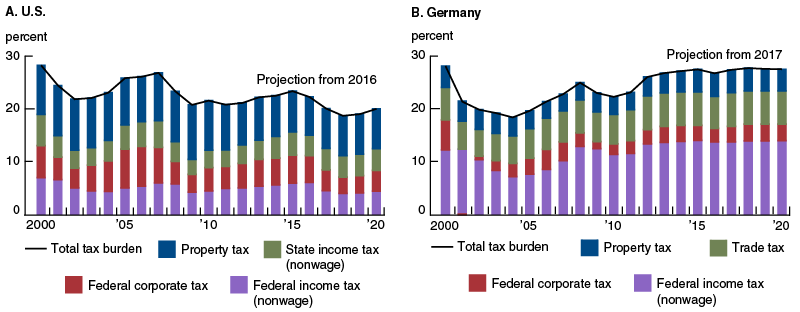

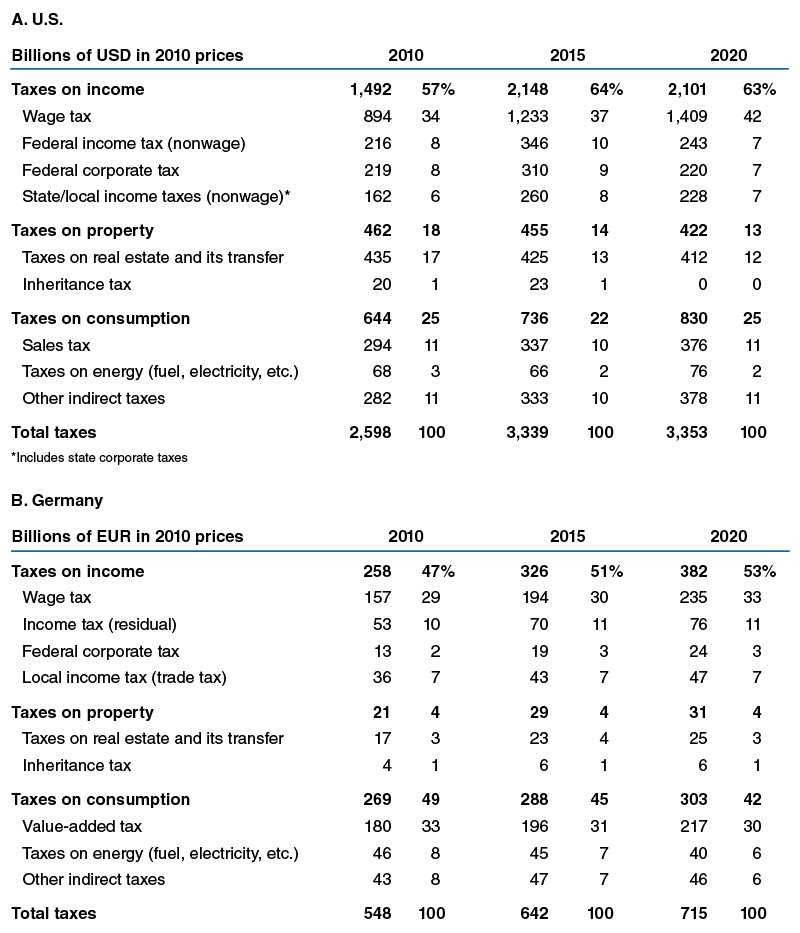

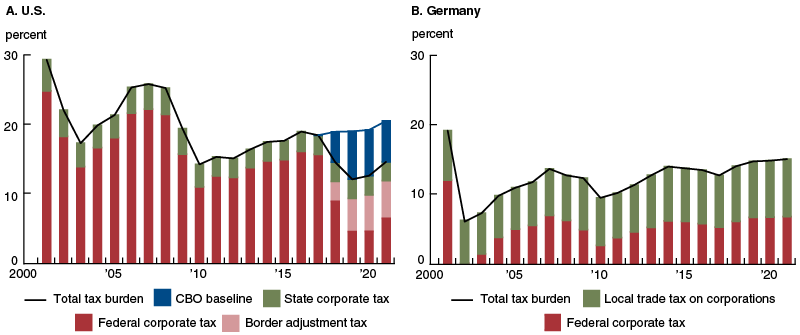

Source: chicagofed.org

Source: chicagofed.org

For high-income taxpayers in California that rate can be 4 higher due to the Mental Health Services Tax and recently enacted Proposition 30. This is a brief overview on a subject which is very confusing to many people. The Capital Gains Tax in California. There is no special California capital gains tax rate for taxable capital gains so California treats taxable gains as ordinary income and they are taxed as such. So if youre a millionaire your total capital gains taxes will be 333.

Source: onlinelibrary.wiley.com

Source: onlinelibrary.wiley.com

A capital gains tax charges you on the difference between the amount you paid for an asset this is known as the basis and what you sell the asset for. This is maximum total of 133 percent in California state tax on your capital gains. Fortunately there is also an exemption built into the various tax. It does not recognize the distinction between short-term and long-term capital gains. This means your capital gains taxes will run.

Source: in.pinterest.com

Source: in.pinterest.com

So if youre a millionaire your total capital gains taxes will be 333. So if youre a millionaire your total capital gains taxes will be 333. Any gain over 250000 is taxable. When your capital gains can be taxed at 0 versus 20. This means your capital gains taxes will run.

Source: itep.org

Source: itep.org

Your gain from the sale was less than 250000. This is maximum total of 133 percent in California state tax on your capital gains. On top of that California will charge another 1 to 133 when you sell. In the case of real estate this is known as capital gains tax and it applies to the profit made on a real estate property sale. Capital Gains Tax.

Source: chicagofed.org

Source: chicagofed.org

There is no special California capital gains tax rate for taxable capital gains so California treats taxable gains as ordinary income and they are taxed as such. The Capital Gains Tax in California. Capital gains rates for individual increase to 15 for those individuals in the 25 - 35 marginal tax brackets and increase even further to 20 for those individuals in the 396 marginal tax bracket. This tax can apply to several different kinds of investments like stocks and bonds or assets like boats cars and real estate. In the case of real estate this is known as capital gains tax and it applies to the profit made on a real estate property sale.

Source: expattaxes.com.au

Source: expattaxes.com.au

The amount you gained between the time you bought the property and the time you sold it. If your income falls between 80000 and 441450 your capital gains tax rate as a single person is 15. When you take into consideration that the IRS can also levy a maximum of 37 percen t in federal taxes on your capital gains it becomes crystal clear how and why capital gains in California are among the highest taxed in the world. It does not recognize the distinction between short-term and long-term capital gains. Vacation properties are handled in virtually the same manner as second homes.

Source: itep.org

Source: itep.org

The amount you gained between the time you bought the property and the time you sold it. It does not recognize the distinction between short-term and long-term capital gains. As you can see some tax planning is in order. Vacation properties are handled in virtually the same manner as second homes. If you later sell the home for 350000 you only pay capital gains taxes on the 50000 difference between the sale price and your stepped-up basis.

Source: chicagofed.org

Source: chicagofed.org

If your income falls between 80000 and 441450 your capital gains tax rate as a single person is 15. Vacation properties are handled in virtually the same manner as second homes. The Capital Gains Tax in California. Right off the bat if you are single they will allow you to exclude 250000 of capital gains. There is no special California capital gains tax rate for taxable capital gains so California treats taxable gains as ordinary income and they are taxed as such.

Source: japanpropertycentral.com

Source: japanpropertycentral.com

Learn how to calculate capital gains on the sale of property in California. You have not used the exclusion in the last 2 years. 6 April 2017 onwards. When you take into consideration that the IRS can also levy a maximum of 37 percen t in federal taxes on your capital gains it becomes crystal clear how and why capital gains in California are among the highest taxed in the world. If your primary residence is in California add 93 for the state tax rate this could be less for some taxpayers.

Source: businesstoday.in

Source: businesstoday.in

1 a Description of property. Right off the bat if you are single they will allow you to exclude 250000 of capital gains. If you own the investment property for more than a year the long-term federal capital gains tax can be 0 15 or 20 depending on your income bracket. 100 shares of Z S stock b Sales price c Cost or other basis d Loss. You will be responsible for either 15 or 20 in capital gains tax depending on your tax bracket.

Source: itep.org

Source: itep.org

This tax can apply to several different kinds of investments like stocks and bonds or assets like boats cars and real estate. 6 April 2017 onwards. So if youre a millionaire your total capital gains taxes will be 333. For high-income taxpayers in California that rate can be 4 higher due to the Mental Health Services Tax and recently enacted Proposition 30. When you take into consideration that the IRS can also levy a maximum of 37 percen t in federal taxes on your capital gains it becomes crystal clear how and why capital gains in California are among the highest taxed in the world.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title california capital gains tax real estate 2015 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.