Your California capital gains tax rate 2015 real estate images are ready. California capital gains tax rate 2015 real estate are a topic that is being searched for and liked by netizens today. You can Download the California capital gains tax rate 2015 real estate files here. Download all free photos and vectors.

If you’re looking for california capital gains tax rate 2015 real estate images information connected with to the california capital gains tax rate 2015 real estate keyword, you have come to the ideal site. Our website frequently gives you suggestions for viewing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

California Capital Gains Tax Rate 2015 Real Estate. Currently the tax rate is 15. California taxes all capital gains as regular income. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. With California not giving any tax breaks for capital gains you could find yourself getting hit with a total state tax rate of 133 on your capital gains.

How To Avoid Capital Gains Tax When Selling Your Home From 24-7pressrelease.com

How To Avoid Capital Gains Tax When Selling Your Home From 24-7pressrelease.com

Theyre taxed at lower rates than short-term capital gains. A capital gains tax charges you on the difference between the amount you paid for an asset this is known as the basis and what you sell the asset for. But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. This is also on the low end compared to the whopper California. Currently the tax rate is 15. The Capital Gains Tax in California.

Theyre taxed at lower rates than short-term capital gains.

The California Capital Gains Tax partial exemption would be calculated as follows. You will be responsible for either 15 or 20 in capital gains tax depending on your tax bracket. A capital gains tax charges you on the difference between the amount you paid for an asset this is known as the basis and what you sell the asset for. Federal Capital Gains Tax. Vacation properties are handled in virtually the same manner as second homes. Find out how much you owe and how to determine your tax obligations.

Source: chicagofed.org

Source: chicagofed.org

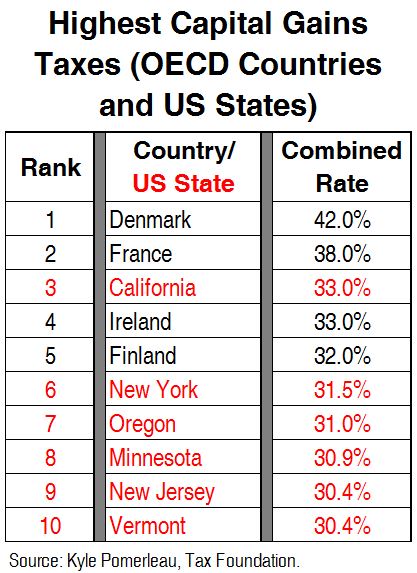

Learn how to calculate capital gains on the sale of property in California. This is the highest marginal capital gains tax rate in the United States. The federal state and local capital gains tax is combined to make one large sum and that sum in Colorado is 2963 percent. Contact Modern Wealth Law for a consult now. This includes the state income tax and the federal capital gains tax.

Source: wikihow.com

Source: wikihow.com

If you want to learn how to sell your house without having to lose all of your. Long-term capital gains are gains on assets you hold for more than one year. Federal Capital Gains Tax. You will be responsible for either 15 or 20 in capital gains tax depending on your tax bracket. The California Capital Gains Tax partial exemption would be calculated as follows.

Source: investopedia.com

Source: investopedia.com

Add the 38 net investment tax under Obamacare and you have 238. Find out how much you owe and how to determine your tax obligations. If the son promptly sells it for 200000 no tax will be owed because he gets a stepped-up basis of 200000. Capital gains that are taxable that is capital gains beyond what is exempted for a principal home sale will be included in your federal AGI which transfers to the California tax return. This is the highest marginal capital gains tax rate in the United States.

Source: hackyourwealth.com

Source: hackyourwealth.com

This tax can apply to several different kinds of investments like stocks and bonds or assets like boats cars and real estate. Find out how much you owe and how to determine your tax obligations. Taxpayers in the highest tax bracket will pay a 20 capital gain rate plus an additional 38 Medicare surtax Patient Protection and Affordable Care Act. This is also on the low end compared to the whopper California. Theyre taxed at lower rates than short-term capital gains.

Source: wikihow.com

Source: wikihow.com

This is the highest marginal capital gains tax rate in the United States. This is also on the low end compared to the whopper California. The California Capital Gains Tax partial exemption would be calculated as follows. However there are continuing differences between California and federal law. So if one was in the home for 12 months or 50 percent of the minimum then the partial exemption allowed would be 125000 versus 250000 50 percent of the total exemption.

Source: chicagofed.org

Source: chicagofed.org

Theyre taxed at lower rates than short-term capital gains. California does not tax long term capital gain at any lower rate so Californians pay up. California taxes all capital gains as regular income. This is the highest marginal capital gains tax rate in the United States. When California conforms to federal tax law changes we do not always adopt all of the changes made at the federal level.

Source: itep.org

Source: itep.org

Capital Gains Tax in Real Estate Investing More Changes in tax laws have resulted in more complications and owners of rental properties should invest more time and resources on tax. For married individuals with earnings of 78750 or less the capital gains tax rate is 0. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40000 and 441500 married filing jointly earning between 80001 and 486600 or head of household. If the son promptly sells it for 200000 no tax will be owed because he gets a stepped-up basis of 200000. Calculate Capital Gains Tax on Sale of Property in California.

Source: itep.org

Source: itep.org

So if one was in the home for 12 months or 50 percent of the minimum then the partial exemption allowed would be 125000 versus 250000 50 percent of the total exemption. The Capital Gains Tax in California. California taxes all capital gains as regular income. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. The California Capital Gains Tax partial exemption would be calculated as follows.

Source: itep.org

Source: itep.org

Before diving into individual strategies to avoid real estate capital gains taxes you first need a baseline understanding of short-term versus long-term capital gains. In general for taxable years beginning on or after January 1 2015 California law conforms to the IRC as of January 1 2015. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. Thats why some very rich Americans dont pay as much in taxes. On the federal level the capital gains tax rates are as follows.

Source: japanpropertycentral.com

Source: japanpropertycentral.com

But if his tax basis had been the same as his mothers 75000 then he would have owed capital gains tax on his gain of 125000 on the same transaction. The amount you gained between the time you bought the property and the time you sold it is your capital gain. Long-term capital gains are gains on assets you hold for more than one year. Start with the number of months actually met if the minimum two years is not possible. Taxpayers in the highest tax bracket will pay a 20 capital gain rate plus an additional 38 Medicare surtax Patient Protection and Affordable Care Act.

Source: cato.org

Source: cato.org

You will pay a capital gain rate of 15 on the 50000 gain and a 38 Medicare surtax on 25000 of the gain the amount in excess of 200000 of adjusted gross income. Federal Capital Gains Tax. The amount you gained between the time you bought the property and the time you sold it is your capital gain. Capital gains that are taxable that is capital gains beyond what is exempted for a principal home sale will be included in your federal AGI which transfers to the California tax return. There is no special California capital gains tax rate for taxable capital gains so California treats taxable gains as ordinary income and they are taxed as such.

Source: investopedia.com

Source: investopedia.com

The upper limit is 488850 for married filing jointly or. The California Capital Gains Tax partial exemption would be calculated as follows. Contact Modern Wealth Law for a consult now. In such an instance if the capital gain is less. The federal state and local capital gains tax is combined to make one large sum and that sum in Colorado is 2963 percent.

Source: businesstoday.in

Source: businesstoday.in

Unfortunately that means that HUGE chunks of that cash you make goes to the government. This means you will pay a California income tax rate anywhere from 1 to 133 percent depending on your tax bracket. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. If the son promptly sells it for 200000 no tax will be owed because he gets a stepped-up basis of 200000. Start with the number of months actually met if the minimum two years is not possible.

Source: diypropertyinvestment.com

Source: diypropertyinvestment.com

Calculate Capital Gains Tax on Sale of Property in California. The average marginal capital gains tax rate for all 50 states is 287. In total the marginal capital gains tax rate for California taxpayers is 33. You will pay a capital gain rate of 15 on the 50000 gain and a 38 Medicare surtax on 25000 of the gain the amount in excess of 200000 of adjusted gross income. Calculate Capital Gains Tax on Sale of Property in California.

Source: itep.org

Source: itep.org

Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. The Capital Gains Tax in California. Before diving into individual strategies to avoid real estate capital gains taxes you first need a baseline understanding of short-term versus long-term capital gains. This is the highest marginal capital gains tax rate in the United States. When California conforms to federal tax law changes we do not always adopt all of the changes made at the federal level.

Source: mondaq.com

Source: mondaq.com

The Capital Gains Tax in California. However there are continuing differences between California and federal law. The Capital Gains Tax in California. This tax can apply to several different kinds of investments like stocks and bonds or assets like boats cars and real estate. In total the marginal capital gains tax rate for California taxpayers is 33.

Source: itep.org

Source: itep.org

Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates. This means you will pay a California income tax rate anywhere from 1 to 133 percent depending on your tax bracket. For married individuals with earnings of 78750 or less the capital gains tax rate is 0. Contact Modern Wealth Law for a consult now. Your tax rate is 15 on long-term capital gains if youre a single filer earning between 40000 and 441500 married filing jointly earning between 80001 and 486600 or head of household.

Source: onlinelibrary.wiley.com

Source: onlinelibrary.wiley.com

You will pay a capital gain rate of 15 on the 50000 gain and a 38 Medicare surtax on 25000 of the gain the amount in excess of 200000 of adjusted gross income. In such an instance if the capital gain is less. Calculate Capital Gains Tax on Sale of Property in California. For married individuals with earnings between 78751 and 434549 the capital gains tax rate is 15. You should consider the capital gains tax implications when selling your home to see if selling is even worth it.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title california capital gains tax rate 2015 real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.