Your Broward county florida real estate taxes images are available in this site. Broward county florida real estate taxes are a topic that is being searched for and liked by netizens now. You can Download the Broward county florida real estate taxes files here. Find and Download all royalty-free images.

If you’re searching for broward county florida real estate taxes images information connected with to the broward county florida real estate taxes keyword, you have pay a visit to the right site. Our site frequently gives you hints for seeing the highest quality video and image content, please kindly search and find more enlightening video content and graphics that fit your interests.

Broward County Florida Real Estate Taxes. They are maintained by various government offices in Broward County Florida State and at the Federal level. Broward County Property Records are real estate documents that contain information related to real property in Broward County Florida. Taxes on real property ad valorem and non-ad valorem are collected on an annual basis beginning November 1 of the tax year which is January through December. Search all services we offer.

Broward County Tangible Personal Property Tax Fill Online Printable Fillable Blank Pdffiller From property-tax-return.pdffiller.com

Broward County Tangible Personal Property Tax Fill Online Printable Fillable Blank Pdffiller From property-tax-return.pdffiller.com

These records can include Broward County property tax assessments and assessment challenges appraisals and income taxes. Yearly median tax in Broward County The median property tax in Broward County Florida is 2664 per year for a home worth the median value of 247500. It is expressed in numbers of dollars per thousand of value. Real Estate Tax Proration - Based upon the prior years gross real estate taxes - unless otherwise stated in the Real Estate. The Broward County Property Appraiser not an agency of the Broward County Board of County Commissioners establishes the value of property and exemptions. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Broward County Millage Rates To further explain the Broward County Millage MIL rate is the rate of the tax that is charged against the taxable value of the property.

This tax estimator is based on the average millage rate of all Broward municipalities. The median property tax on a 24750000 house is 267300 in Broward County. Delinquent Real Estate bills are charged a 3 interest and advertising costs. The millage rate is a dollar amount per 1000 of a homes taxable property value. Taxes on real property ad valorem and non-ad valorem are collected on an annual basis beginning November 1 of the tax year which is January through December. Having trouble viewing our website.

Source: propertywalls.blogspot.com

Source: propertywalls.blogspot.com

Under Florida law e-mail addresses are public records. The estimated tax amount using this calculator is based upon the average Millage Rate of 199609 mills or 199609 and not the millage rate for a specific property. Broward County Millage Rates To further explain the Broward County Millage MIL rate is the rate of the tax that is charged against the taxable value of the property. If you do not want your e-mail address. These records can include Broward County property tax assessments and assessment challenges appraisals and income taxes.

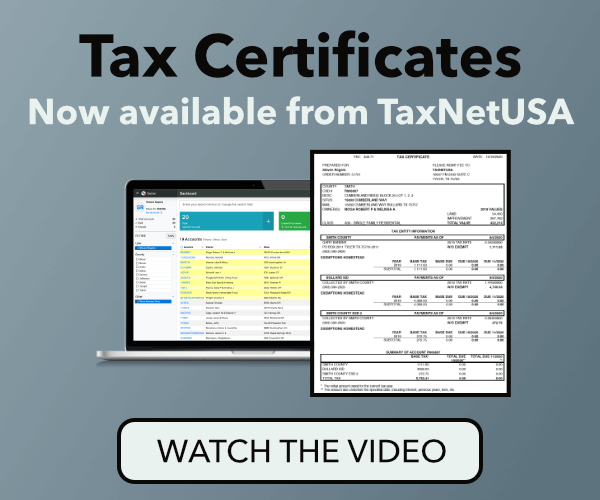

Source: taxnetusa.com

Source: taxnetusa.com

If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Broward County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Broward County Florida. This tax estimator is based on the average millage rate of all Broward municipalities. They are maintained by various government offices in Broward County Florida State and at the Federal level.

Having trouble viewing our website. We are open weekdays from 8 am until 5 pm. Taxes on real property ad valorem and non-ad valorem are collected on an annual basis beginning November 1 of the tax year which is January through December. The median property tax on a 24750000 house is 240075. These records can include Broward County property tax assessments and assessment challenges appraisals and income taxes.

Source: propertyshark.com

Source: propertyshark.com

Cities school districts and county departments in Miami-Dade and Broward Counties may set their own millage all of which are added up to determine the total millage rate. Municipal Lien and Tax Search - 25000 - 45000 - Depends on the City and if the information is needed on a rush basis - This cost can be a buyer cost - However most Broward County Real Estate Contracts have the Seller paying these costs - See Real Estate Contract. See sample report. Broward County Property Appraisers Office - Contact our office at 9543576830Hours. Taxes on real property ad valorem and non-ad valorem are collected on an annual basis beginning November 1 of the tax year which is January through December.

Source: broward.org

They are a valuable tool for the real estate. The Broward County Property Appraiser not an agency of the Broward County Board of County Commissioners establishes the value of property and exemptions. So 23 mills equal 231000 23. Under Florida law e-mail addresses are public records. Broward County Property Records are real estate documents that contain information related to real property in Broward County Florida.

Source: galtmile.com

Source: galtmile.com

If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. The estimated tax amount using this calculator is based upon the average Millage Rate of 199609 mills or 199609 and not the millage rate for a specific property. Broward County Property Records are real estate documents that contain information related to real property in Broward County Florida. Broward County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Broward County Florida. Broward County Property Appraisers Office - Contact our office at 9543576830Hours.

Source: fortlauderdalerealestateonline.com

Source: fortlauderdalerealestateonline.com

Under Florida law e-mail addresses are public records. Broward County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Broward County Florida. So 23 mills equal 231000 23. If you do not want your e-mail address. They are a valuable tool for the real estate.

Source: pdffiller.com

Source: pdffiller.com

Broward County Millage Rates To further explain the Broward County Millage MIL rate is the rate of the tax that is charged against the taxable value of the property. Taxes on real property ad valorem and non-ad valorem are collected on an annual basis beginning November 1 of the tax year which is January through December. It is expressed in numbers of dollars per thousand of value. If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. Broward County Millage Rates To further explain the Broward County Millage MIL rate is the rate of the tax that is charged against the taxable value of the property.

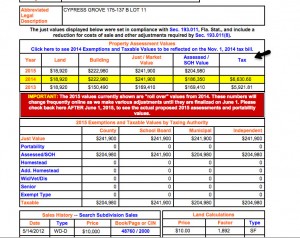

Source: propertyappraisers.us

Source: propertyappraisers.us

Broward County Property Appraisers Office - Contact our office at 9543576830Hours. Information provided on this website is for tax. Having trouble viewing our website. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report.

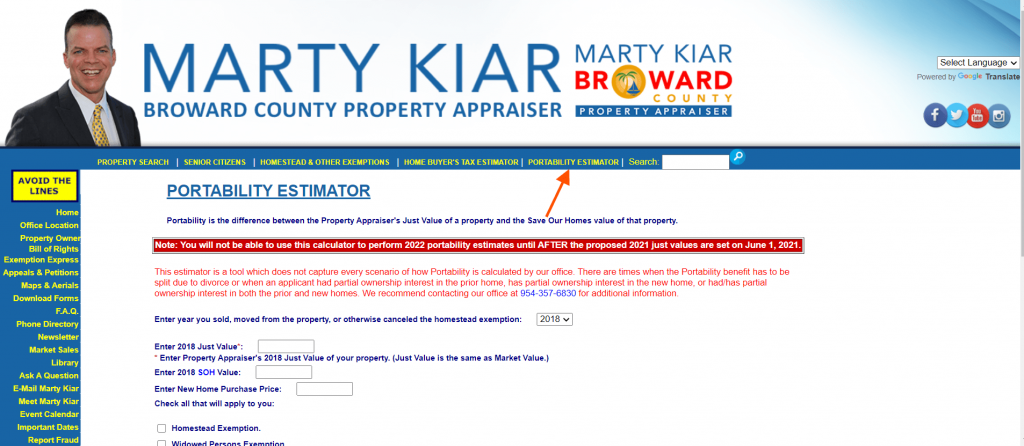

Source: bcpa.net

Source: bcpa.net

Taxes on real property ad valorem and non-ad valorem are collected on an annual basis beginning November 1 of the tax year which is January through December. Under Florida law e-mail addresses are public records. The median property tax also known as real estate tax in Broward County is 266400 per year based on a median home value of 24750000 and a median effective property tax rate of 108 of property value. Delinquent Real Estate bills are charged a 3 interest and advertising costs. If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity.

See sample report. Broward County collects on average 108 of a propertys assessed fair market value as property tax. Taxes on real property ad valorem and non-ad valorem are collected on an annual basis beginning November 1 of the tax year which is January through December. Municipal Lien and Tax Search - 25000 - 45000 - Depends on the City and if the information is needed on a rush basis - This cost can be a buyer cost - However most Broward County Real Estate Contracts have the Seller paying these costs - See Real Estate Contract. Tools for Estimating Your Property Taxes.

Source: floridaforboomers.com

Source: floridaforboomers.com

It is expressed in numbers of dollars per thousand of value. Broward County collects on average 108 of a propertys assessed fair market value as property tax. The median property tax on a 24750000 house is 267300 in Broward County. Discounts for payments made in full are as follows. Delinquent Tangible Personal Property bills are charged a 15 interest per month and advertising costs.

Source: galtmile.com

Source: galtmile.com

Broward County Millage Rates To further explain the Broward County Millage MIL rate is the rate of the tax that is charged against the taxable value of the property. If you do not want your e-mail address. We are open weekdays from 8 am until 5 pm. Broward County Property Records are real estate documents that contain information related to real property in Broward County Florida. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report.

Source: allcitypermits.com

Source: allcitypermits.com

See sample report. Real Estate Tax Proration - Based upon the prior years gross real estate taxes - unless otherwise stated in the Real Estate. It is expressed in numbers of dollars per thousand of value. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The median property tax also known as real estate tax in Broward County is 266400 per year based on a median home value of 24750000 and a median effective property tax rate of 108 of property value.

Source: broward.org

The Florida Property Tax Statute and the Florida State Consitution are the main legal documents regarding taxation in the State of Florida. Broward County FL Property taxes must be paid no later than March 31 of the following year to avoid delinquency interest fees and penalties but may be paid as early as November 1 of the current year to take advantage of early-payment discounts. The estimated tax amount using this calculator is based upon the average Millage Rate of 199609 mills or 199609 and not the millage rate for a specific property. Broward County Property Appraisers Office - Contact our office at 9543576830. If you do not want your e-mail address.

Source: property-tax-return.pdffiller.com

Source: property-tax-return.pdffiller.com

Broward County collects on average 108 of a propertys assessed fair market value as property tax. Under Florida law e-mail addresses are public records. 4 discount if paid in November. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Broward County Tax Appraisers office. Information provided on this website is for tax.

Source: broward.org

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Real Estate report Run a Tangible Property report. Broward County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Broward County Florida. Delinquent Real Estate bills are charged a 3 interest and advertising costs. Under Florida law e-mail addresses are public records. It is expressed in numbers of dollars per thousand of value.

Source: broward.county-taxes.com

Source: broward.county-taxes.com

If you do not want your e-mail address released in response to a public records request do not send electronic mail to this entity. SEE Detailed property tax report for 10924 NW 29 Ct Broward County FL. Under Florida law e-mail addresses are public records. Broward County Property Appraiser. Tools for Estimating Your Property Taxes.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title broward county florida real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.