Your Brevard county real estate tax records images are ready. Brevard county real estate tax records are a topic that is being searched for and liked by netizens now. You can Get the Brevard county real estate tax records files here. Download all royalty-free photos and vectors.

If you’re looking for brevard county real estate tax records pictures information linked to the brevard county real estate tax records interest, you have pay a visit to the right blog. Our website always gives you hints for seeking the maximum quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

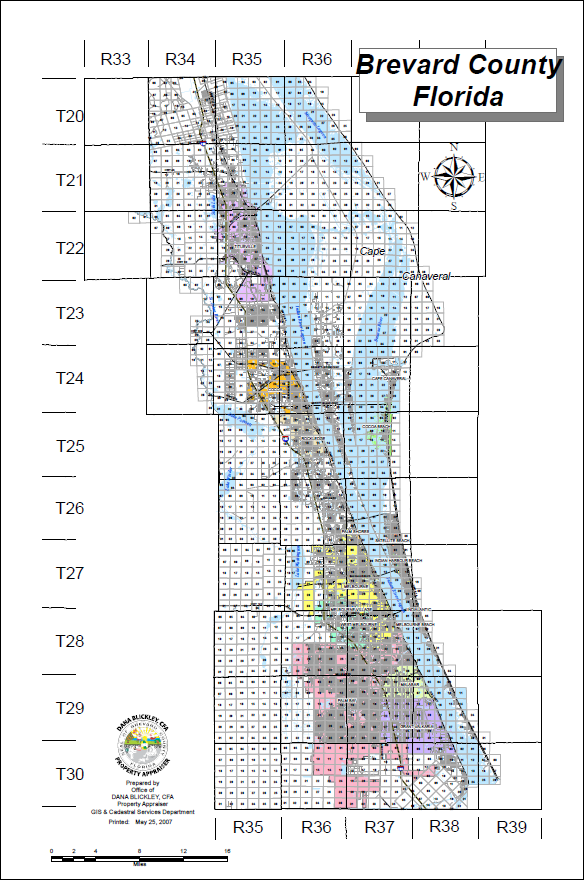

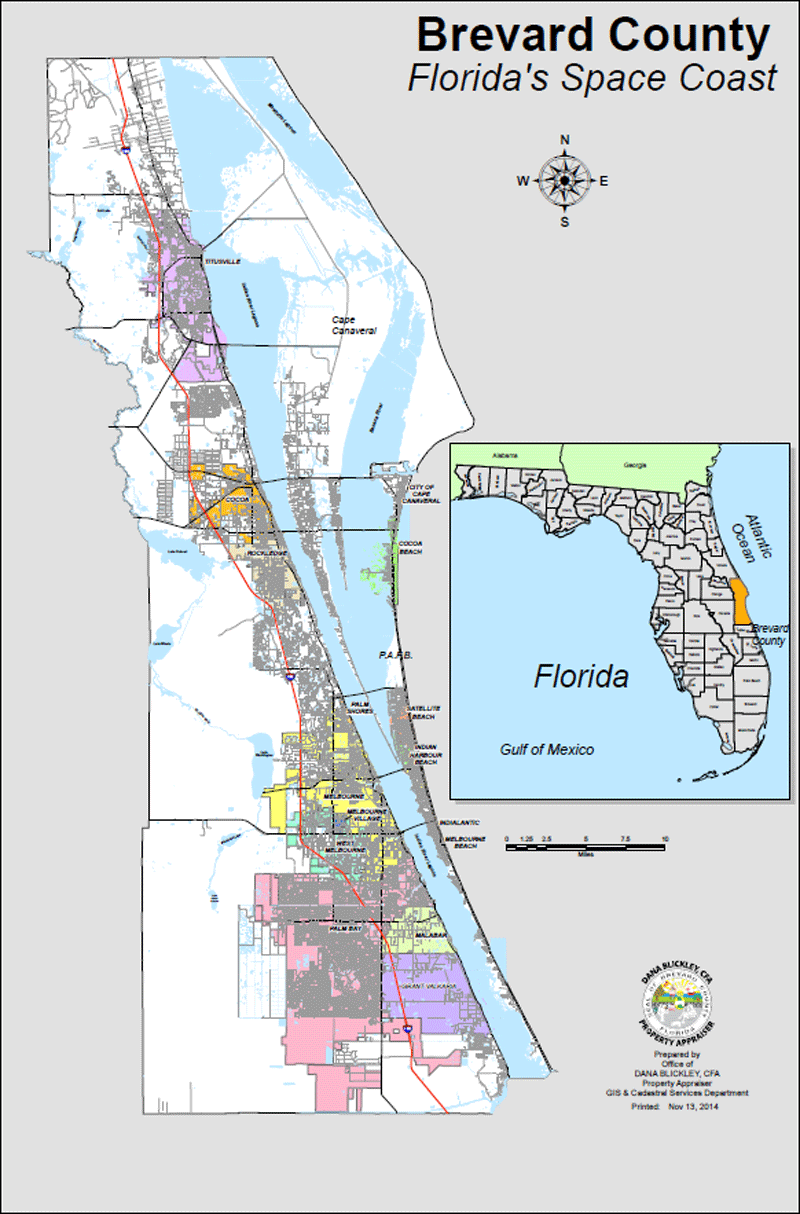

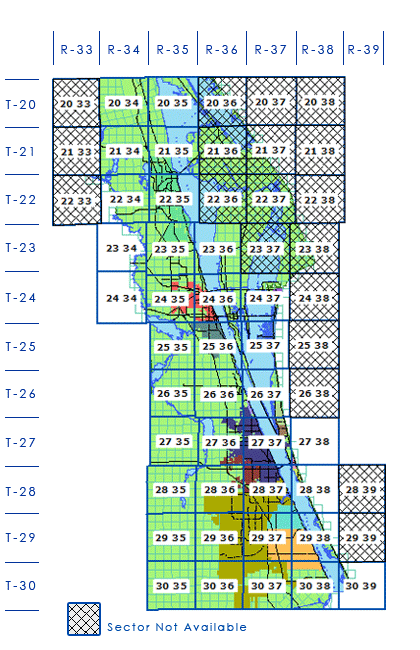

Brevard County Real Estate Tax Records. Upon payment of the statutory fees the Clerk records and indexes a variety of important documents which in most cases are related to real estate. You can turn on the various data layers to view information such as flood data zoning and water and. Data maps or digital files are prepared by employees of Brevard County and may not be resold without prior consent from the Brevard County Board of County Commissioners. Brevard county 2020 property taxes Verified 1 days ago.

Pay Property Taxes Brevard County Tax Collector From brevardtaxcollector.com

Pay Property Taxes Brevard County Tax Collector From brevardtaxcollector.com

You can turn on the various data layers to view information such as flood data zoning and water and. County taxes will continue to be collected by Transylvania County. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Brevard County collects on average 087 of a propertys assessed fair market value as property tax. You may contact Tom Whitlock at 828 885. Data maps or digital files are prepared by employees of Brevard County and may not be resold without prior consent from the Brevard County Board of County Commissioners.

The Official Records are a permanent repository of those documents which primarily relate to real estate transactions.

If your property is located in either of these districts and are paid through a mortgage company escrow we recommend contacting your mortgage company to make them aware of the change in tax billing. You can turn on the various data layers to view information such as flood data zoning and water and. Enter a name or address or account number etc. Brevard County Property Records are real estate documents that contain information related to real property in Brevard County Florida. Zoning and Future Land Use. Brevard County property records for real estate brokers Residential brokers can inform their clients by presenting user-friendly property reports that include property characteristics recent sales property tax records and useful property maps.

Source: brevardtaxcollector.com

Source: brevardtaxcollector.com

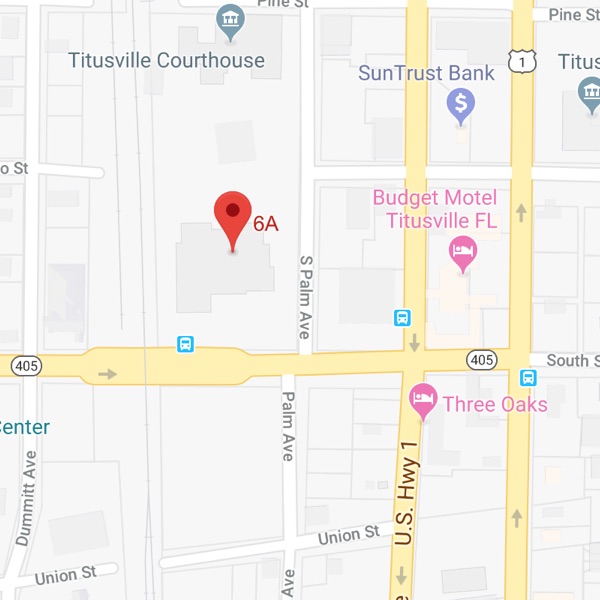

The Brevard County Tax Collectors Office is committed to ensuring website accessibility for people with disabilities. This site specializes in providing access to title and lien searches inluding DEED copies for counties within FL. These records can include Brevard County property tax assessments and assessment challenges appraisals and income taxes. Brevard County Commissioners Districts map and aerial photo. County taxes will continue to be collected by Transylvania County.

Source: brevardtaxcollector.com

Source: brevardtaxcollector.com

Use this service to locate Brevard County property records and deed images for Florida and all counties within the state via US. You may contact Tom Whitlock at 828 885. Use this service to locate Brevard County property records and deed images for Florida and all counties within the state via US. Brevard County collects on average 087 of a propertys assessed fair market value as property tax. This site specializes in providing access to title and lien searches inluding DEED copies for counties within FL.

Source: montecitocdd.org

Source: montecitocdd.org

You can turn on the various data layers to view information such as flood data zoning and water and. 5 days ago Brevard County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Brevard County Florida. The Official Records are a permanent repository of those documents which primarily relate to real estate transactions. Enter a name or address or account number etc. Brevard County Property Records are real estate documents that contain information related to real property in Brevard County Florida.

Source: bcpao.us

Source: bcpao.us

The Brevard County Tax Collectors Office is committed to ensuring website accessibility for people with disabilities. If your property is located in either of these districts and are paid through a mortgage company escrow we recommend contacting your mortgage company to make them aware of the change in tax billing. Data maps or digital files are prepared by employees of Brevard County and may not be resold without prior consent from the Brevard County Board of County Commissioners. Brevard county 2020 property taxes Verified 1 days ago. Use this service to locate Brevard County property records and deed images for Florida and all counties within the state via US.

Source: taxnetusa.com

Source: taxnetusa.com

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The Official Records are a permanent repository of those documents which primarily relate to real estate transactions. To report an ADA accessibility issue request accessibility assistance regarding our website content or to request a specific electronic format please contact the office at 321 264-6930 or visit the Contact Us page to send an electronic message. In-depth Brevard County FL Property Tax Information. These records can include Brevard County property tax assessments and assessment challenges appraisals and income taxes.

Source: brevardtaxcollector.com

Source: brevardtaxcollector.com

Brevard County real estate taxes are due each year on November 1 and are payable through March 31 of the following year with discounts allowed for early payments and a 3 penalty imposed on unpaid taxes beginning on April 1. Brevard County real estate taxes are due each year on November 1 and are payable through March 31 of the following year with discounts allowed for early payments and a 3 penalty imposed on unpaid taxes beginning on April 1. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. Zoning and Future Land Use Map. Florida - Brevard County Recorder Information The Clerk of Court is the official recorder and custodian of all documents placed in the Brevard County Official Records.

Source: brevardtaxcollector.com

Source: brevardtaxcollector.com

The Transylvania County GIS is an interactive web-based Geographic Information System that can be used to locate properties by owner address and PIN. Brevard County collects on average 087 of a propertys assessed fair market value as property tax. Data maps or digital files are prepared by employees of Brevard County and may not be resold without prior consent from the Brevard County Board of County Commissioners. In-depth Brevard County FL Property Tax Information. Please use the following information sources to learn about properties in Brevard and Transylvania County.

Source: brevard.county-taxes.com

Source: brevard.county-taxes.com

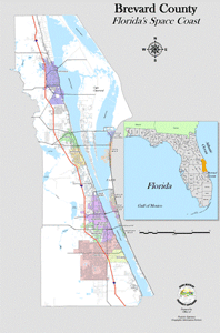

Brevard County Florida Property Taxes. You may contact Tom Whitlock at 828 885. Brevard County Florida Property Taxes. Brevard County Commissioners Districts map and aerial photo. Real Property and Tangible Personal Property Record Search.

Source: bcpao.us

Source: bcpao.us

These records can include Brevard County property tax assessments and assessment challenges appraisals and income taxes. Brevard County Florida Property Taxes. Use this service to locate Brevard County property records and deed images for Florida and all counties within the state via US. To report an ADA accessibility issue request accessibility assistance regarding our website content or to request a specific electronic format please contact the office at 321 264-6930 or visit the Contact Us page to send an electronic message. This site specializes in providing access to title and lien searches inluding DEED copies for counties within FL.

Source: bcpao.us

Source: bcpao.us

The Transylvania County GIS is an interactive web-based Geographic Information System that can be used to locate properties by owner address and PIN. Zoning map and aerial photo of Viera. Real Property and Tangible Personal Property Record Search. The Transylvania County GIS is an interactive web-based Geographic Information System that can be used to locate properties by owner address and PIN. 5 days ago Brevard County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Brevard County Florida.

Source: brevardtaxcollector.com

Source: brevardtaxcollector.com

In-depth Brevard County FL Property Tax Information. These records can include Brevard County property tax assessments and assessment challenges appraisals and income taxes. This site specializes in providing access to title and lien searches inluding DEED copies for counties within FL. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. Zoning map and aerial photo of Viera.

Source: brevardtaxcollector.com

Source: brevardtaxcollector.com

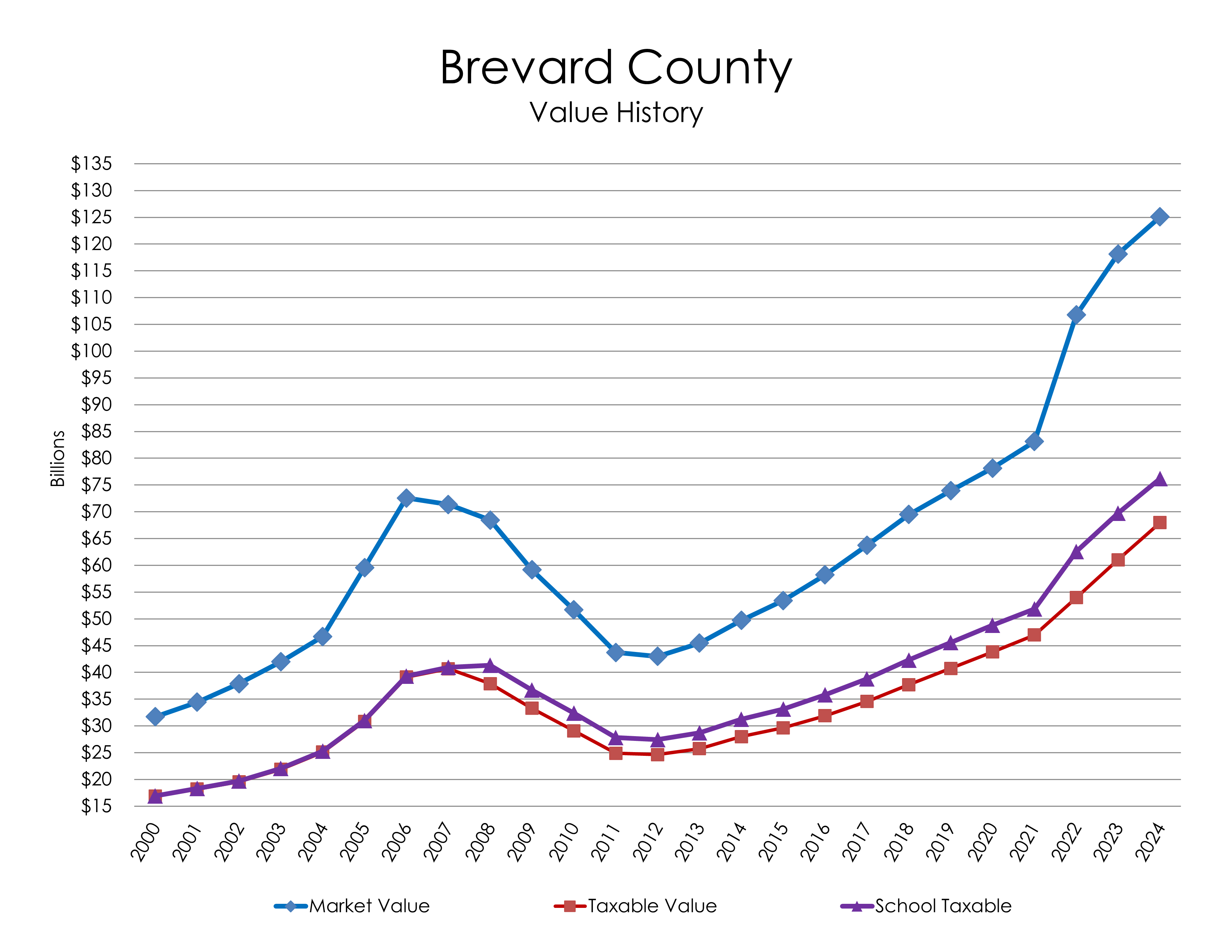

Brevard County Commissioners Districts map and aerial photo. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the. In-depth Brevard County FL Property Tax Information. Brevard County Commissioners Districts map and aerial photo. Brevard County property records for real estate brokers Residential brokers can inform their clients by presenting user-friendly property reports that include property characteristics recent sales property tax records and useful property maps.

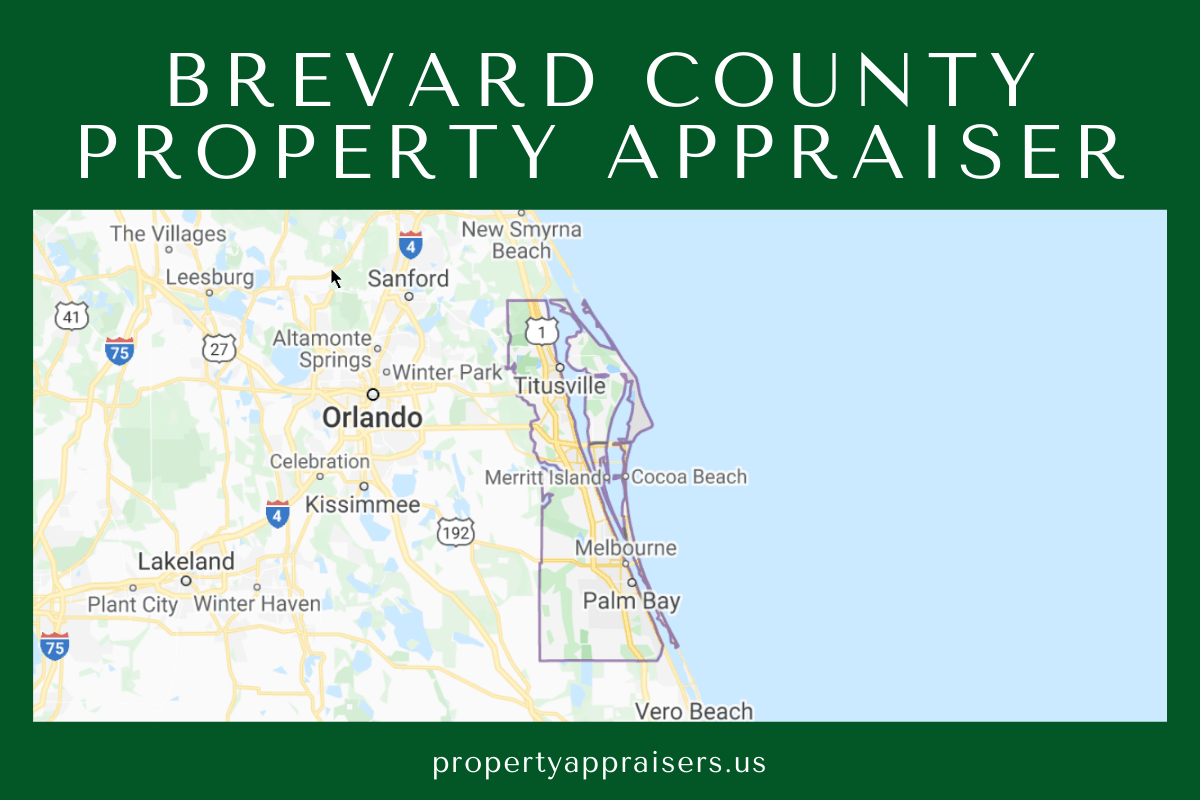

Source: propertyappraisers.us

Source: propertyappraisers.us

The median property tax in Brevard County Florida is 1618 per year for a home worth the median value of 186900. The median property tax in Brevard County Florida is 1618 per year for a home worth the median value of 186900. You may contact Tom Whitlock at 828 885. County taxes will continue to be collected by Transylvania County. The Brevard County Tax Collectors Office is committed to ensuring website accessibility for people with disabilities.

Source: bcpao.us

Source: bcpao.us

If your property is located in either of these districts and are paid through a mortgage company escrow we recommend contacting your mortgage company to make them aware of the change in tax billing. These records can include Brevard County property tax assessments and assessment challenges appraisals and income taxes. You may contact Tom Whitlock at 828 885. Brevard County property records for real estate brokers Residential brokers can inform their clients by presenting user-friendly property reports that include property characteristics recent sales property tax records and useful property maps. Use this service to locate Brevard County property records and deed images for Florida and all counties within the state via US.

Source: propertyappraisers.us

Source: propertyappraisers.us

In-depth Brevard County FL Property Tax Information. To report an ADA accessibility issue request accessibility assistance regarding our website content or to request a specific electronic format please contact the office at 321 264-6930 or visit the Contact Us page to send an electronic message. Florida - Brevard County Recorder Information The Clerk of Court is the official recorder and custodian of all documents placed in the Brevard County Official Records. The Brevard County Tax Collectors Office is committed to ensuring website accessibility for people with disabilities. Upon payment of the statutory fees the Clerk records and indexes a variety of important documents which in most cases are related to real estate.

Source: brevardtaxcollector.com

Source: brevardtaxcollector.com

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. Brevard County real estate taxes are due each year on November 1 and are payable through March 31 of the following year with discounts allowed for early payments and a 3 penalty imposed on unpaid taxes beginning on April 1. Examples of such documents include deeds mortgages liens contracts affidavits subdivision plats surveys declarations of condominium bills of sale judgments certificates of military discharge and declarations of domicile. 5 days ago Brevard County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Brevard County Florida. Brevard County Property Records are real estate documents that contain information related to real property in Brevard County Florida.

Source: bcpao.us

Source: bcpao.us

To report an ADA accessibility issue request accessibility assistance regarding our website content or to request a specific electronic format please contact the office at 321 264-6930 or visit the Contact Us page to send an electronic message. Brevard county 2020 property taxes Verified 1 days ago. The Brevard County Tax Collectors Office is committed to ensuring website accessibility for people with disabilities. Use this service to locate Brevard County property records and deed images for Florida and all counties within the state via US. Florida - Brevard County Recorder Information The Clerk of Court is the official recorder and custodian of all documents placed in the Brevard County Official Records.

Source: brevardtaxcollector.com

Source: brevardtaxcollector.com

County taxes will continue to be collected by Transylvania County. You can turn on the various data layers to view information such as flood data zoning and water and. If your property is located in either of these districts and are paid through a mortgage company escrow we recommend contacting your mortgage company to make them aware of the change in tax billing. Enter a name or address or account number etc. 5 days ago Brevard County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Brevard County Florida.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title brevard county real estate tax records by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.