Your Bonus depreciation 2019 real estate images are available. Bonus depreciation 2019 real estate are a topic that is being searched for and liked by netizens now. You can Get the Bonus depreciation 2019 real estate files here. Get all free images.

If you’re searching for bonus depreciation 2019 real estate pictures information connected with to the bonus depreciation 2019 real estate topic, you have come to the ideal site. Our website frequently gives you suggestions for downloading the highest quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

Bonus Depreciation 2019 Real Estate. Property converted from business use to personal use in the same tax year acquired. This change encourages more real estate investments as well as investments in used equipment according to Tom Wheelwright a CPA and CEO of WealthAbility. The 100 deduction is allowed for both new and used qualified property. By Roger Russell December 19 2019 900 am.

Realty Income Aktie Dividende Im Monatstakt Wie Lange Noch From aktienfinder.net

Realty Income Aktie Dividende Im Monatstakt Wie Lange Noch From aktienfinder.net

Only new property is eligible for bonus depreciation used property is not eligible. Bonus Depreciation is also called the Special Depreciation Allowance. So real estate owners can now claim 100 first-year bonus depreciation for QIP placed in service in 2018 through 2022. Unlike Section 179 expensing landlordstaxpayers do not need net income to take bonus depreciation deductions. Prior to the passage of the TCJA bonus depreciation was set to phase down and generally expire on December 31 2019 with 2018 rates scheduled to be 40 percent of the cost of property with a MACRS recovery period of 20 years or less. The new law provides 50 bonus depreciation for the tax years 2015 thru 2017 then drops to 40 for 2018 and 30.

Property converted from business use to personal use in the same tax year acquired.

Qualified improvements to commercial buildings placed in service after 2015 and before 2018. This change encourages more real estate investments as well as investments in used equipment according to Tom. Houses 8 days ago By Roger Russell December 19 2019 900 am. Residential real estate has a depreciation. Depreciation is one of the biggest and most important tax deductions for rental real estate investors because it reduces taxable income but not cash flow. Historically bonus depreciation has been available for new assets only which excluded the purchase of existing or used assets.

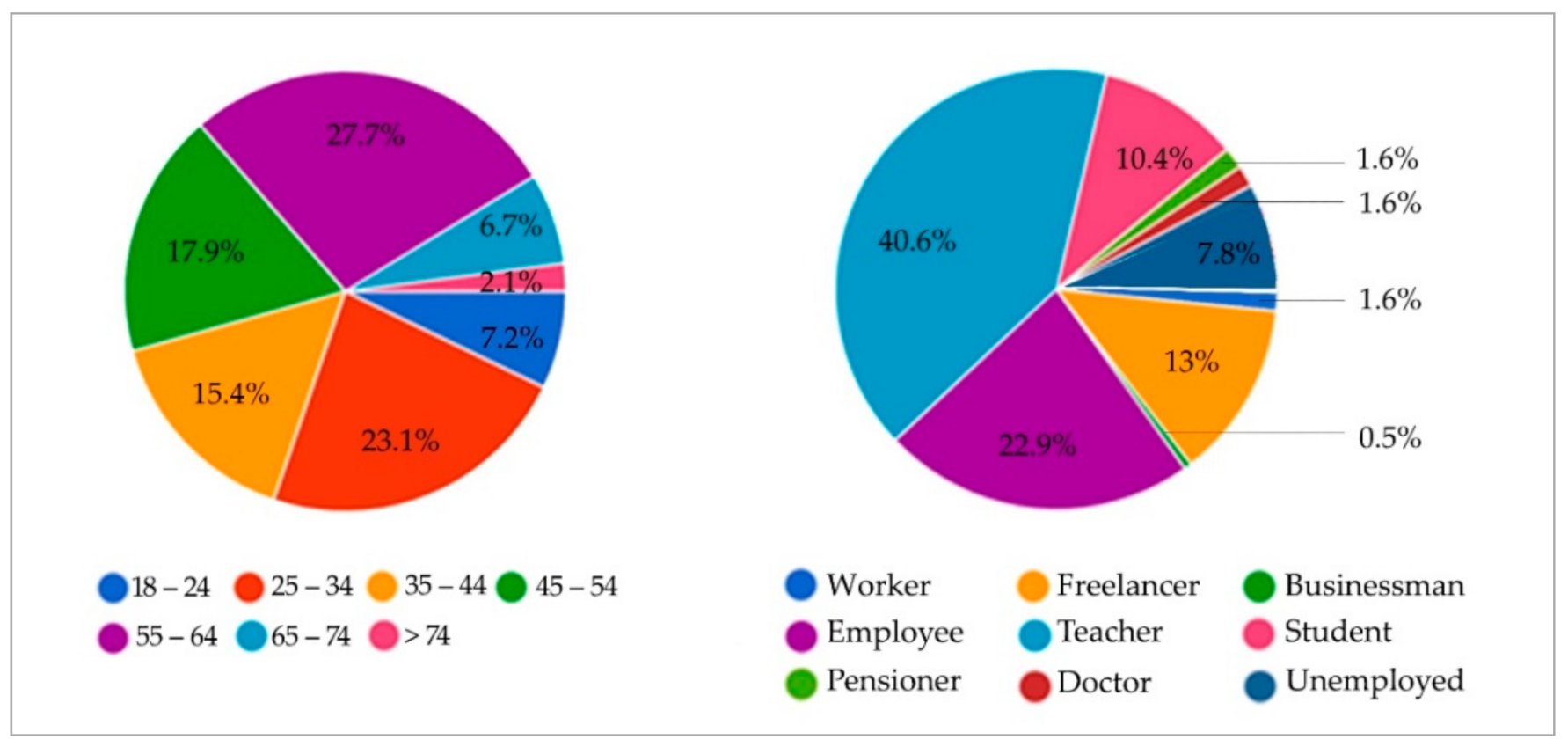

Source: mdpi.com

Source: mdpi.com

To qualify for bonus depreciation the property must be NEW and have a useful life of 20 years or less. Houses 8 days ago By Roger Russell December 19 2019 900 am. Every dollar they spend in tax is a dollar they cant use to secure their financial future. However bonus depreciation has taken it to the next level for the right person. More generous Section 179 deduction rules for real estate For qualifying assets placed in service in tax years beginning in 2018 and beyond the TCJA.

Source: pinterest.com

Source: pinterest.com

The new law provides 50 bonus depreciation for the tax years 2015 thru 2017 then drops to 40 for 2018 and 30. Bonus Depreciation is a Powerful Tax Reducer. This change encourages more real estate investments as well as investments in used equipment according to Tom Wheelwright a CPA and CEO of WealthAbility. The bonus depreciation provision allows a taxpayer to immediately deduct a certain percentage of the cost of qualifying property in the year the property is acquired rather than capitalizing that cost and depreciating it over a period of years. In turn that classification makes QIP eligible for first-year bonus depreciation.

Source: mdpi.com

Source: mdpi.com

100 Bonus Depreciation the Final Regulations On September 13 2019 the IRS issued final regulations on the allowance for the additional first year 100 bonus depreciation deduction under Section 168 k. Before the correction QIP placed in service in those years generally had to be treated as. Other bonus depreciation property to which section 168k of the Internal Revenue Code applies. For most accredited investors taxes are easily their biggest expense. Property for which you elected not to claim any special depreciation allowance discussed later.

Source: hypofriend.de

Source: hypofriend.de

It allows actually requires the taxpayer to depreciate a certain percentage of qualifying property placed in service during the year. EST 4 Min Read Under the Tax Cuts and Jobs Act bonus depreciation now applies to both new and used property and includes rental real estate. This change encourages more real estate investments as well as investments in used equipment according to Tom Wheelwright a CPA and CEO of WealthAbility. Qualified improvements to commercial buildings placed in service after 2015 and before 2018. Depreciation is one of the biggest and most important tax deductions for rental real estate investors because it reduces taxable income but not cash flow.

Source: slideshare.net

Source: slideshare.net

Houses 8 days ago By Roger Russell December 19 2019 900 am. For this purpose qualified property includes qualified improvement property meaning. Property placed in service and disposed of in the same tax year. Unlike Section 179 expensing landlordstaxpayers do not need net income to take bonus depreciation deductions. Prior to the passage of the TCJA bonus depreciation was set to phase down and generally expire on December 31 2019 with 2018 rates scheduled to be 40 percent of the cost of property with a MACRS recovery period of 20 years or less.

Source: fool.com

Source: fool.com

Before the correction QIP placed in service in those years generally had to be treated as. From 2018 through 2022 the bonus depreciation percentage rate is 100 unless of course congress changes it before 2022. Depreciation is one of the biggest and most important tax deductions for rental real estate investors because it reduces taxable income but not cash flow. Prior to the passage of the TCJA bonus depreciation was set to phase down and generally expire on December 31 2019 with 2018 rates scheduled to be 40 percent of the cost of property with a MACRS recovery period of 20 years or less. This change encourages more real estate investments as well as investments in used equipment according to Tom.

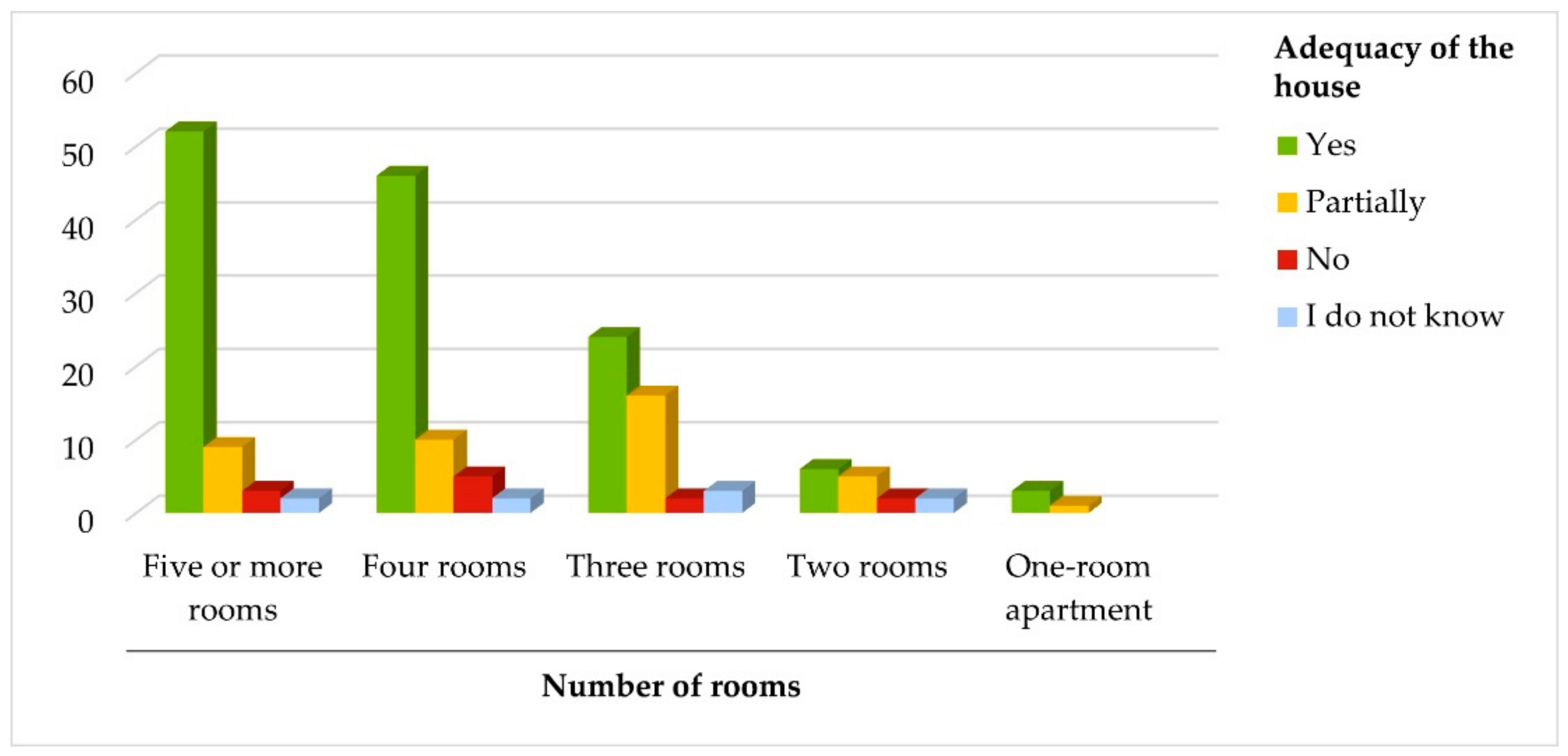

Source: mdpi.com

Source: mdpi.com

New changes to Federal Tax Law will be the driving force behind real estate purchases for 5 years. Bonus Depreciation is a Powerful Tax Reducer. Property for which you elected not to claim any special depreciation allowance discussed later. Bonus Depreciation is also called the Special Depreciation Allowance. New changes to Federal Tax Law will be the driving force behind real estate purchases for 5 years.

Source: blueandco.com

Source: blueandco.com

The highly tax advantaged nature of real estate is one of the reasons they invest in apartments. New changes to Federal Tax Law will be the driving force behind real estate purchases for 5 years. Bonus Depreciation is a Powerful Tax Reducer. More generous Section 179 deduction rules for real estate For qualifying assets placed in service in tax years beginning in 2018 and beyond the TCJA. Before the correction QIP placed in service in those years generally had to be treated as.

Source: pinterest.com

Source: pinterest.com

More generous Section 179 deduction rules for real estate For qualifying assets placed in service in tax years beginning in 2018 and beyond the TCJA. Unlike Section 179 expensing landlordstaxpayers do not need net income to take bonus depreciation deductions. Depreciation is one of the biggest and most important tax deductions for rental real estate investors because it reduces taxable income but not cash flow. Prior to the passage of the TCJA bonus depreciation was set to phase down and generally expire on December 31 2019 with 2018 rates scheduled to be 40 percent of the cost of property with a MACRS recovery period of 20 years or less. Before the correction QIP placed in service in those years generally had to be treated as.

Source: mdpi.com

Source: mdpi.com

Qualified improvements to commercial buildings placed in service after 2015 and before 2018. Unlike Section 179 expensing landlordstaxpayers do not need net income to take bonus depreciation deductions. Every dollar they spend in tax is a dollar they cant use to secure their financial future. To qualify for bonus depreciation the asset has to be used for business at least 50 of the time. One hundred percent bonus depreciation means the taxpayer can expense.

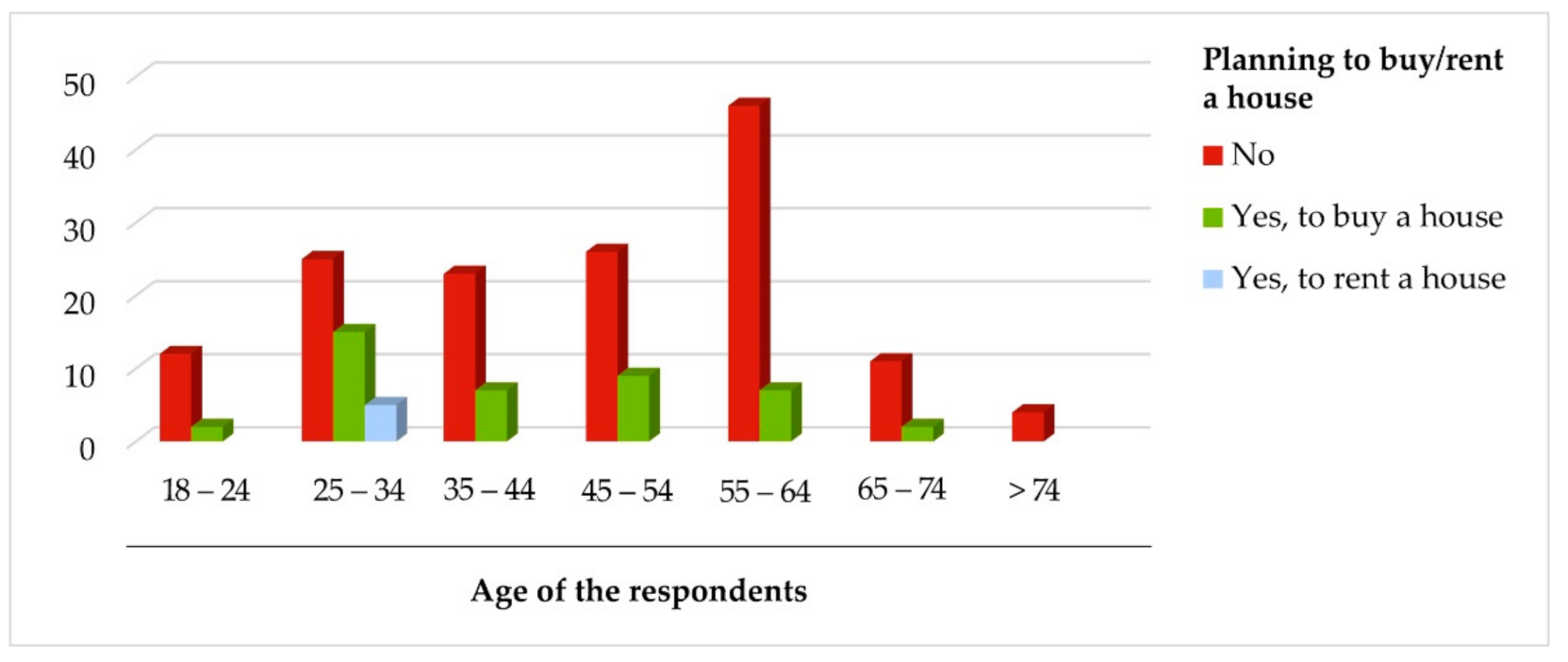

Source: mdpi.com

Source: mdpi.com

Property converted from business use to personal use in the same tax year acquired. EST 4 Min Read Under the Tax Cuts and Jobs Act bonus depreciation now applies to both new and used property and includes rental real estate. So real estate owners can now claim 100 first-year bonus depreciation for QIP placed in service in 2018 through 2022. This change encourages more real estate investments as well as investments in used equipment according to Tom. Unlike Section 179 expensing landlordstaxpayers do not need net income to take bonus depreciation deductions.

Source: aktienfinder.net

Source: aktienfinder.net

For most accredited investors taxes are easily their biggest expense. To qualify for bonus depreciation the property must be NEW and have a useful life of 20 years or less. The technical correction has a retroactive effect for QIP that was placed in service in 2018 and 2019. Only new property is eligible for bonus depreciation used property is not eligible. Property converted from business use to personal use in the same tax year acquired.

Source: stessa.com

Source: stessa.com

Only new property is eligible for bonus depreciation used property is not eligible. Qualified improvements to commercial buildings placed in service after 2015 and before 2018. Specifically the bonus depreciation method isnt allowed on assets with a useful life of 20 years or more. Depreciation is one of the biggest and most important tax deductions for rental real estate investors because it reduces taxable income but not cash flow. Real estate property that qualifies for bonus depreciation is as follows.

Source: pinterest.com

Source: pinterest.com

Depreciation is one of the biggest and most important tax deductions for rental real estate investors because it reduces taxable income but not cash flow. Real estate property that qualifies for bonus depreciation is as follows. This change encourages more real estate investments as well as investments in used equipment according to Tom Wheelwright a CPA and CEO of WealthAbility. Before the correction QIP placed in service in those years generally had to be treated as. Property placed in service and disposed of in the same tax year.

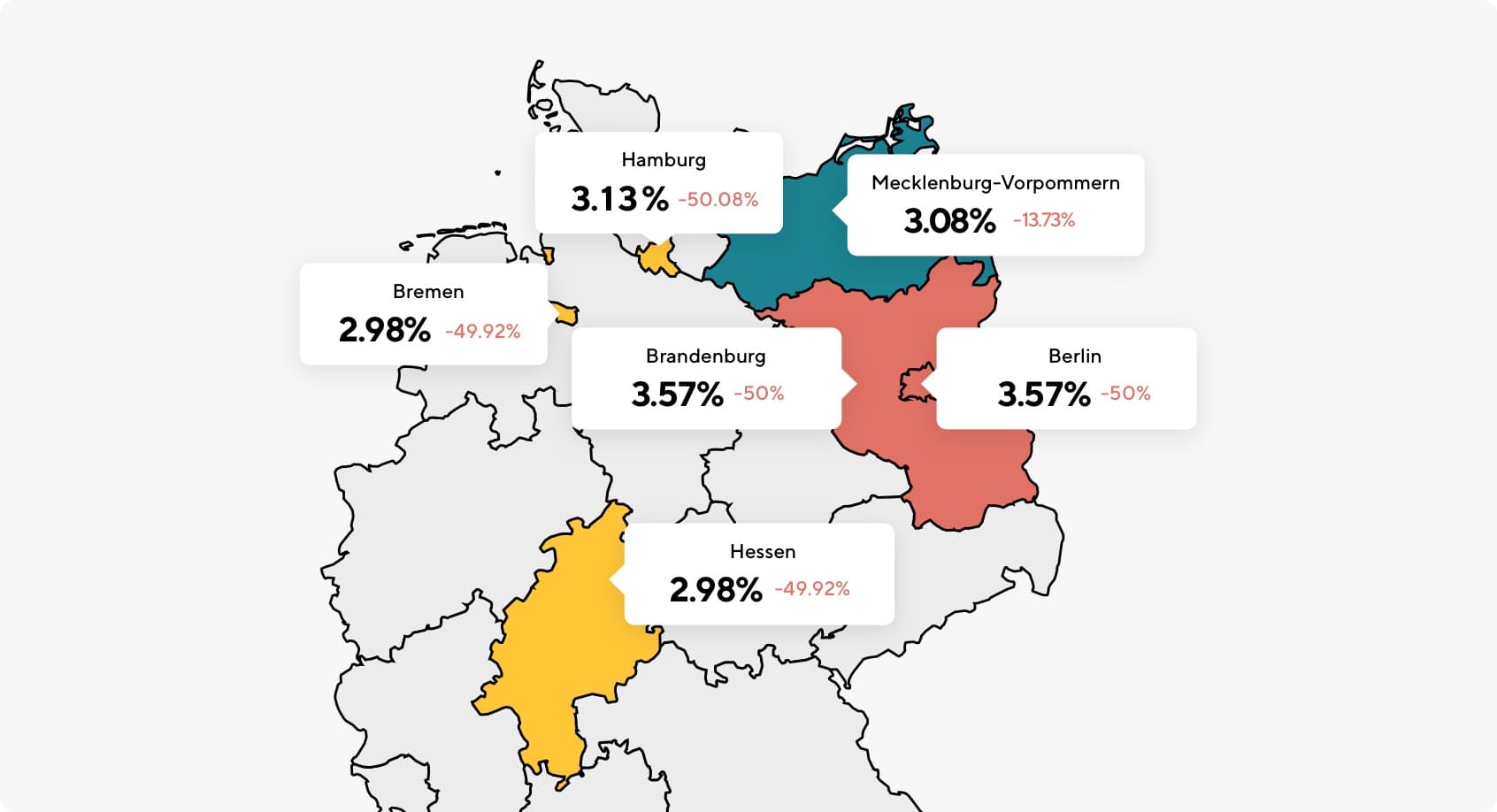

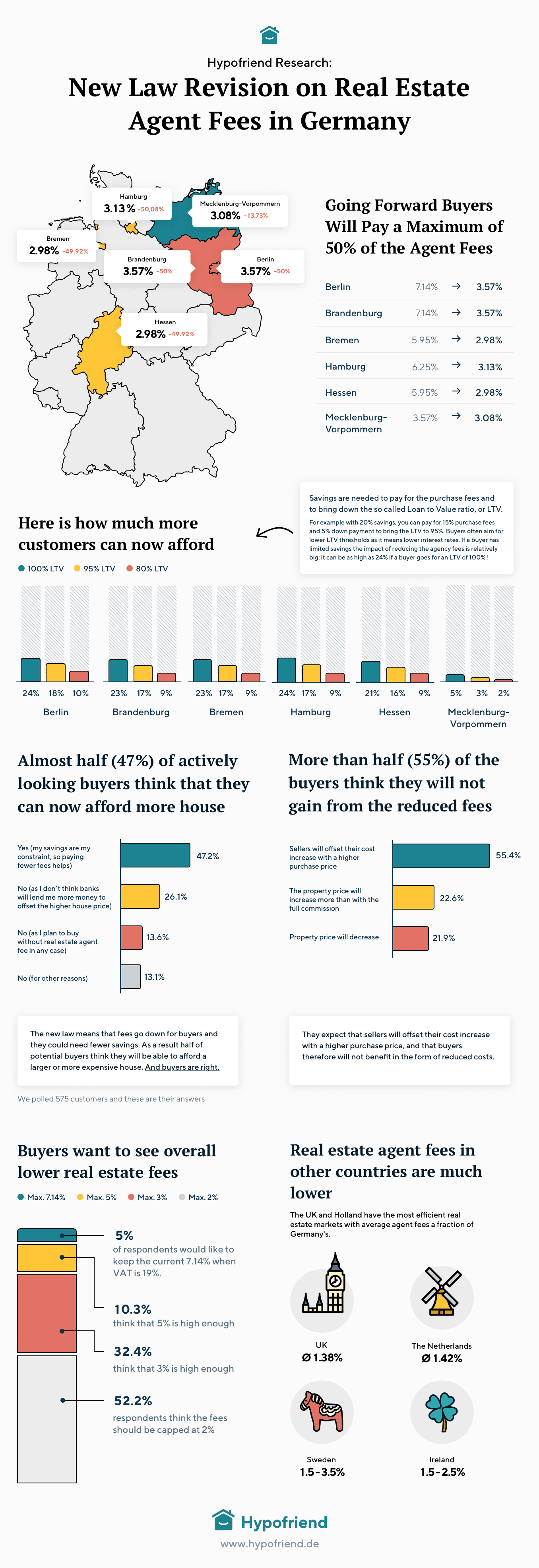

Source: hypofriend.de

Source: hypofriend.de

For this purpose qualified property includes qualified improvement property meaning. For qualified property placed in service between September 28 2017 and December 31 2022 the TCJA increases the first-year bonus depreciation percentage to 100 up from 50. Houses 8 days ago By Roger Russell December 19 2019 900 am. The technical correction has a retroactive effect for QIP that was placed in service in 2018 and 2019. More generous Section 179 deduction rules for real estate For qualifying assets placed in service in tax years beginning in 2018 and beyond the TCJA.

Source: mdpi.com

Source: mdpi.com

Prior to the passage of the TCJA bonus depreciation was set to phase down and generally expire on December 31 2019 with 2018 rates scheduled to be 40 percent of the cost of property with a MACRS recovery period of 20 years or less. Unlike Section 179 expensing landlordstaxpayers do not need net income to take bonus depreciation deductions. 100 Bonus Depreciation the Final Regulations On September 13 2019 the IRS issued final regulations on the allowance for the additional first year 100 bonus depreciation deduction under Section 168 k. Other bonus depreciation property to which section 168k of the Internal Revenue Code applies. For most accredited investors taxes are easily their biggest expense.

Source: aktienfinder.net

Source: aktienfinder.net

Every dollar they spend in tax is a dollar they cant use to secure their financial future. EST 4 Min Read Under the Tax Cuts and Jobs Act bonus depreciation now applies to both new and used property and includes rental real estate. Houses 8 days ago By Roger Russell December 19 2019 900 am. It allows actually requires the taxpayer to depreciate a certain percentage of qualifying property placed in service during the year. Only new property is eligible for bonus depreciation used property is not eligible.

Source: forbes.com

Source: forbes.com

Property converted from business use to personal use in the same tax year acquired. A new appreciation for bonus depreciation Accounting Today. So real estate owners can now claim 100 first-year bonus depreciation for QIP placed in service in 2018 through 2022. Before the correction QIP placed in service in those years generally had to be treated as. EST 4 Min Read Under the Tax Cuts and Jobs Act bonus depreciation now applies to both new and used property and includes rental real estate.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title bonus depreciation 2019 real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.