Your Blackstone residential real estate fund images are available in this site. Blackstone residential real estate fund are a topic that is being searched for and liked by netizens today. You can Get the Blackstone residential real estate fund files here. Get all free photos.

If you’re looking for blackstone residential real estate fund pictures information related to the blackstone residential real estate fund topic, you have come to the ideal site. Our website always gives you suggestions for viewing the maximum quality video and image content, please kindly surf and find more enlightening video content and graphics that fit your interests.

Blackstone Residential Real Estate Fund. Blackstone Real Estate Income Trust Inc. Retail residential industrial office and hotel. BPPEH is 100 owned by Blackstone Property Partners Europe which is part of Blackstones Core investment strategy. Blackstone offers registered products focused on real estate hedge fund solutions and private credit.

Real Estate Blackstone From blackstone.com

Real Estate Blackstone From blackstone.com

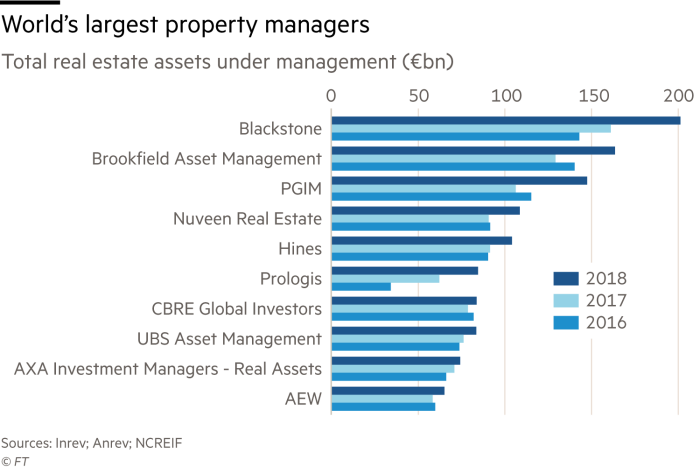

Blackstone is one of the worlds leading real estate investment firms. Similarly the Starwood Capital Group was founded in 1991 and has been a major real estate player for over twenty-five years. BX today announced the final close of its most recent real estate debt fund Blackstone Real Estate Debt Strategies IV BREDS IV. The fund will make new loans and buy real-estate debt securities along with other investments. Starwood has fifteen real estate. Blackstone offers registered products focused on real estate hedge fund solutions and private credit.

Back in the day BREP VIII an opportunistic Real Estate investment fund and co-investors acquired BioMed then a publicly traded REIT for 8 billion in cash in January 2016.

Investments are concentrated in the logistics residential and office sectors with a focus on major European markets and key gateway cities. The Blackstone portfolio includes a wide variety of asset types. Filed pursuant to Rule 497 Registration No. Investments are concentrated in the logistics residential and office sectors with a focus on major European markets and key gateway cities. Starwood has fifteen real estate. IStock PTA parents can look to Blackstone for fundraising inspiration.

Source: perenews.com

Source: perenews.com

Blackstone offers registered products focused on real estate hedge fund solutions and private credit. Blackstone offers registered products focused on real estate hedge fund solutions and private credit. BPPEH is 100 owned by Blackstone Property Partners Europe which is part of Blackstones Core investment strategy. Blackstone Strategic Partners Closes Seventh Real Estate Secondaries Fund at 19 Billion. Blackstone Real Estate Debt Strategies Jonathan Pollack Blackstone.

Source: blackstone.com

Source: blackstone.com

Blackstone Strategic Partners Closes Seventh Real Estate Secondaries Fund at 19 Billion. Blackstone Closes Largest-Ever Real Estate Fund. The fund will make new loans and buy real-estate debt securities along with other investments. New York July 16 2020 Strategic Partners Blackstones NYSEBX secondary and fund solutions business announced today the final close on 19 billion for Strategic Partners Real Estate VII LP. BREIT a non-listed REIT focuses on income-generating assets primarily in the top 50.

Source: wsj.com

Source: wsj.com

Blackstone Announces 80 Billion Final Close for Latest Real Estate Debt Strategies Fund 22 September 2020 New York September 222020 Blackstone NYSE. Our Core strategy features stabilized real estate with a long investment horizon and moderate leverage where we can unlock additional value through focused asset management. The new fund breaks Blackstones last record of 158 billion in commitments which closed back in 2015. Blackstone Real Estate Income Fund. The giant firm gathered 8 billion for a property.

Source: globest.com

Source: globest.com

Blackstone Real Estate Income Trust Inc. Blackstone Closes Largest-Ever Real Estate Fund. The Blackstone portfolio includes a wide variety of asset types. Last year Blackstone raised Europes largest ever real estate fund at 78bn off the back of its record-breaking 158bn 117bn 2015 global fund. Blackstone Strategic Partners Closes Seventh Real Estate Secondaries Fund at 19 Billion.

Source: blackstone.com

Source: blackstone.com

The giant firm gathered 8 billion for a property. It has now raised 23bn for its debut core-plus European fund that sees it expand over and above its traditional domain of opportunistic investing. 32 Zeilen An investment in the Fund is appropriate only for investors that are qualified clients as. The giant firm gathered 8 billion for a property. Our Core strategy features stabilized real estate with a long investment horizon and moderate leverage where we can unlock additional value through focused asset management.

Source: bloomberg.com

Source: bloomberg.com

Blackstones real-estate debt business has grown. 32 Zeilen Blackstone Real Estate Income Fund II BREIF II Scroll left. Blackstone Real Estate Income Trust Inc. Blackstones real-estate debt business has grown. BX today announced the final close of its most recent real estate debt fund Blackstone Real Estate Debt Strategies IV BREDS IV.

Source: dealstreetasia.com

Source: dealstreetasia.com

Investments are concentrated in the logistics residential and office sectors with a focus on major European markets and key gateway cities. BREIT a non-listed REIT focuses on income-generating assets primarily in the top 50. Back in the day BREP VIII an opportunistic Real Estate investment fund and co-investors acquired BioMed then a publicly traded REIT for 8 billion in cash in January 2016. BPPEH is 100 owned by Blackstone Property Partners Europe which is part of Blackstones Core investment strategy. Blackstone is one of the worlds leading real estate investment firms.

Source: therealdeal.com

Source: therealdeal.com

Last year Blackstone raised Europes largest ever real estate fund at 78bn off the back of its record-breaking 158bn 117bn 2015 global fund. Blackstone Real Estate Income Fund. In a global real-estate portfolio that Blackstone values at 341 billion retail real-estate holdings make up only 5 of equity value compared with. BPPEH is 100 owned by Blackstone Property Partners Europe which is part of Blackstones Core investment strategy. Deutsche Wohnen AG is to acquire a residential real estate portfolio of approximately 6900 units in Berlin from affiliates of Blackstone Real Estate Partners Europe III Blackstone Funds in a cash and shares transaction that will result in the Blackstone Funds becoming a 5 shareholder in Deutsche Wohnen.

Source: ft.com

Source: ft.com

Blackstones real-estate debt business has grown. Blackstone Closes Largest-Ever Real Estate Fund. Blackstone Announces 80 Billion Final Close for Latest Real Estate Debt Strategies Fund 22 September 2020 New York September 222020 Blackstone NYSE. Global private equity giant Blackstone has closed the largest-ever commercial real estate fund with a whopping 205 billion A30bn of commitments. And its related committed program vehicles.

Source: blackstone.com

Source: blackstone.com

Blackstone raises 75bn for new life science real estate perpetual fund By Jon Peterson30 October 2020 Blackstone has raised 75bn 64bn for its new life science office real estate perpetual fund the manager said in its recent earnings statement. In a global real-estate portfolio that Blackstone values at 341 billion retail real-estate holdings make up only 5 of equity value compared with. Blackstone offers registered products focused on real estate hedge fund solutions and private credit. Blackstone is one of the worlds leading real estate investment firms. Our BPP funds focus on industrial residential office and retail assets in global gateway cities.

Source: pensionpulse.blogspot.com

Source: pensionpulse.blogspot.com

Blackstone Closes Largest-Ever Real Estate Fund. BREDS IV has 80 billion of total capital commitments making it the largest real estate credit fund. Blackstone raises 75bn for new life science real estate perpetual fund By Jon Peterson30 October 2020 Blackstone has raised 75bn 64bn for its new life science office real estate perpetual fund the manager said in its recent earnings statement. New York July 16 2020 Strategic Partners Blackstones NYSEBX secondary and fund solutions business announced today the final close on 19 billion for Strategic Partners Real Estate VII LP. Blackstones real-estate debt business has grown.

Source: blackstone.com

Source: blackstone.com

333-216456 BLACKSTONE REAL ESTATE INCOME FUND COMMON SHARES OF BENEFICIAL INTEREST The Fund. The giant firm gathered 8 billion for a property. Blackstone Real Estate Debt Strategies Jonathan Pollack Blackstone. In a global real-estate portfolio that Blackstone values at 341 billion retail real-estate holdings make up only 5 of equity value compared with. Investments are concentrated in the logistics residential and office sectors with a focus on major European markets and key gateway cities.

Source: blackstone.com

Source: blackstone.com

32 Zeilen Blackstone Real Estate Income Fund II BREIF II Scroll left. The firm already the private equity industrys largest real estate investor will have a strategy similar to. Retail residential industrial office and hotel. Investments are concentrated in the logistics residential and office sectors with a focus on major European markets and key gateway cities. Back in the day BREP VIII an opportunistic Real Estate investment fund and co-investors acquired BioMed then a publicly traded REIT for 8 billion in cash in January 2016.

Source: lordinvestor.com

Source: lordinvestor.com

Blackstone Strategic Partners Closes Seventh Real Estate Secondaries Fund at 19 Billion. IStock PTA parents can look to Blackstone for fundraising inspiration. Filed pursuant to Rule 497 Registration No. Blackstone Announces 80 Billion Final Close for Latest Real Estate Debt Strategies Fund 22 September 2020 New York September 222020 Blackstone NYSE. Starwood has fifteen real estate.

Source: bppeh.blackstone.com

Source: bppeh.blackstone.com

Global private equity giant Blackstone has closed the largest-ever commercial real estate fund with a whopping 205 billion A30bn of commitments. The fund will make new loans and buy real-estate debt securities along with other investments. Similarly the Starwood Capital Group was founded in 1991 and has been a major real estate player for over twenty-five years. Blackstone Strategic Partners Closes Seventh Real Estate Secondaries Fund at 19 Billion. Retail residential industrial office and hotel.

Source: statista.com

Source: statista.com

Filed pursuant to Rule 497 Registration No. The fund will make new loans and buy real-estate debt securities along with other investments. Investments are concentrated in the logistics residential and office sectors with a focus on major European markets and key gateway cities. The giant firm gathered 8 billion for a property. The Blackstone portfolio includes a wide variety of asset types.

Source: pe-insights.com

Source: pe-insights.com

New York July 16 2020 Strategic Partners Blackstones NYSEBX secondary and fund solutions business announced today the final close on 19 billion for Strategic Partners Real Estate VII LP. BREDS IV has 80 billion of total capital commitments making it the largest real estate credit fund. Blackstones real-estate debt business has grown. BPPEH is 100 owned by Blackstone Property Partners Europe which is part of Blackstones Core investment strategy. 333-216456 BLACKSTONE REAL ESTATE INCOME FUND COMMON SHARES OF BENEFICIAL INTEREST The Fund.

Source: sec.gov

Source: sec.gov

Blackstone Closes Largest-Ever Real Estate Fund. Blackstone Real Estate Income Fund. It has now raised 23bn for its debut core-plus European fund that sees it expand over and above its traditional domain of opportunistic investing. Back in the day BREP VIII an opportunistic Real Estate investment fund and co-investors acquired BioMed then a publicly traded REIT for 8 billion in cash in January 2016. Starwood has fifteen real estate.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title blackstone residential real estate fund by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.