Your Blackstone real estate partners asia images are available in this site. Blackstone real estate partners asia are a topic that is being searched for and liked by netizens now. You can Find and Download the Blackstone real estate partners asia files here. Download all royalty-free photos and vectors.

If you’re looking for blackstone real estate partners asia images information linked to the blackstone real estate partners asia topic, you have pay a visit to the right blog. Our site frequently gives you suggestions for downloading the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

Blackstone Real Estate Partners Asia. We manage Blackstone Mortgage Trust NYSE. Investments are concentrated in the logistics residential and office sectors with a focus on major European markets and key gateway cities. New York September 11 2019 Blackstone NYSE. Core Debt Global Opportunistic.

Blackstone Retakes Lead For Most Opportunistic Dry Powder In Europe Pere From perenews.com

Blackstone Retakes Lead For Most Opportunistic Dry Powder In Europe Pere From perenews.com

We manage Blackstone Mortgage Trust NYSE. US private equity firm Blackstone Group has forged the largest-ever fund dedicated to property investments in Asia by holding a final close on Blackstone Real Estate Partners Asia II BREP II at around 71 billion of capital commitments. Blackstone Property Partners Asia. Blackstone has 10 billion of capital dedicated to its existing Asia-focused opportunistic vehicles Blackstone Real Estate Partners Asia II and private equity vehicle Blackstone Capital Partners Asia. Blackstone Property Partners Europe Holdings Sà rl. Blackstone Real Estate Partners Asia III Lux SCSP.

Blackstone Reports First Quarter.

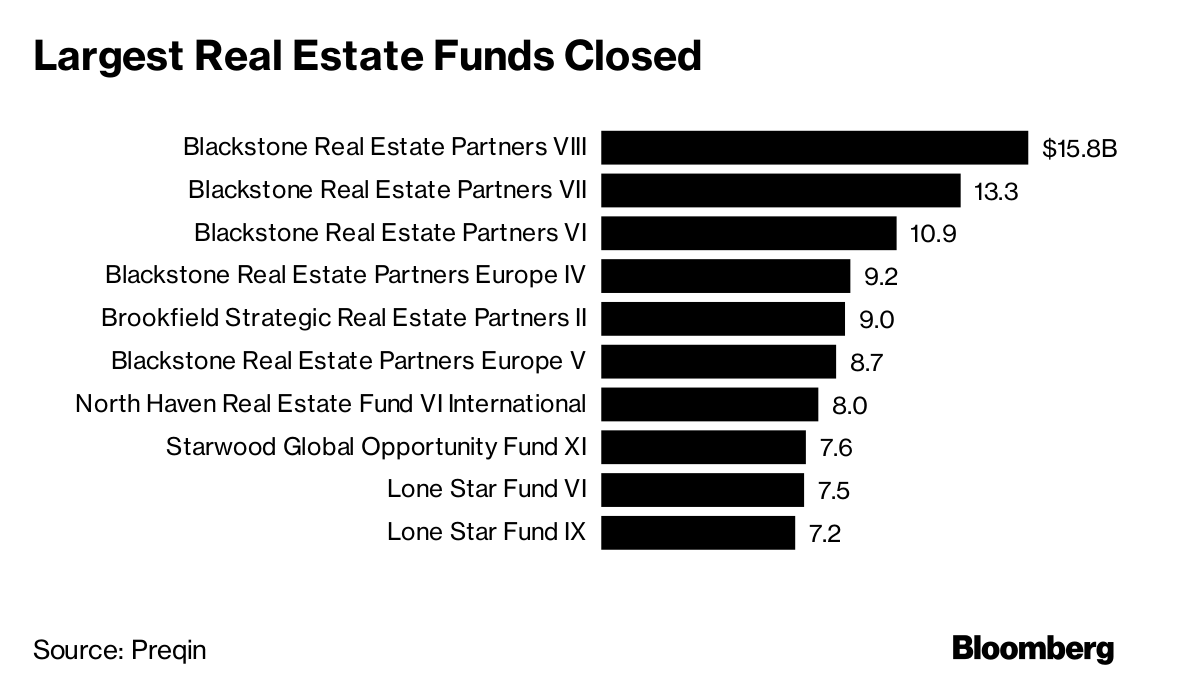

BREP IX has 205 billion of total capital commitments the largest real estate fund ever raised. New York September 11 2019 Blackstone NYSE. BREP IX has 205 billion of total capital commitments the largest real estate fund ever raised. Core Debt Global Opportunistic. Shareholders directors beneficial owners if filed articles of association and full detail of filings. Currently over 50 percent of the funds capital is understood to have been deployed.

Source: pinterest.com

Source: pinterest.com

Extended Company Report. Our real estate debt business provides creative and comprehensive financing solutions across the capital structure and risk spectrum. Full registry information with list of directors and secretaries. Life Sciences Infrastructure Growth Equity Secondaries Tactical Opportunities. Related commitments from Blackstones global buyout fund bring the total to at least 38 billion of equity to invest in the region.

Source: bvkap.de

Source: bvkap.de

Gray also said the firm had launched a new open-ended core-plus real estate vehicle in Asia. The purchase of US. Investments are concentrated in the logistics residential and office sectors with a focus on major European markets and key gateway cities. Life Sciences Infrastructure Growth Equity Secondaries Tactical Opportunities. Blackstone currently manages two regional opportunistic real estate funds the 82 billion Blackstone Real Estate Partners Europe IV and the 5 billion Blackstone Real Estate Partners Asia.

Source: perenews.com

Source: perenews.com

Full registry information with list of directors and secretaries. Commingled GP Stakes Seeding. Blackstones private equity business has been one of the largest investors in leveraged buyouts in the last three decades while its real estate business has actively acquired commercial real estate. Free and open company data on Luxembourg company Blackstone Real Estate Partners Asia II Lux SCSp company number B213690 11-13 Boulevard de la Foire L - 1528 Luxembourg. Blackstone has also announced the final close of its first Asian private equity fund Blackstone Capital Partners Asia with roughly 23 billion of commitments.

Source: uk.pinterest.com

Source: uk.pinterest.com

New York September 11 2019 Blackstone NYSE. Blackstone Reports First Quarter. The Blackstone Group Inc. Blackstone Real Estate Partners Asia III Lux SCSP. Our real estate debt business provides creative and comprehensive financing solutions across the capital structure and risk spectrum.

Source: blackstone.com

Source: blackstone.com

Industrial warehouse properties from Singapore-based logistics provider GLP for 187 billion. Blackstones private equity business has been one of the largest investors in leveraged buyouts in the last three decades while its real estate business has actively acquired commercial real estate. Shareholders directors beneficial owners if filed articles of association and full detail of filings. Related commitments from Blackstones global buyout fund bring the total to at least 38 billion of equity to invest in the region. Free and open company data on Luxembourg company Blackstone Real Estate Partners Asia II Lux SCSp company number B213690 11-13 Boulevard de la Foire L - 1528 Luxembourg.

Source: analyzemarkets.com

Source: analyzemarkets.com

Shareholders directors beneficial owners if filed articles of association and full detail of filings. Blackstone has 10 billion of capital dedicated to its existing Asia-focused opportunistic vehicles Blackstone Real Estate Partners Asia II and private equity vehicle Blackstone Capital Partners Asia. Blackstone Property Partners Asia. BPPEH invests in high-quality substantially stabilised real estate assets across Europe. Currently over 50 percent of the funds capital is understood to have been deployed.

Source: bloomberg.com

Source: bloomberg.com

Complete list of titles of filed documents. The purchase of US. Free and open company data on Luxembourg company Blackstone Real Estate Partners Asia II Lux SCSp company number B213690 11-13 Boulevard de la Foire L - 1528 Luxembourg. We originate loans and invest in debt securities underpinned by high-quality real estate. Currently over 50 percent of the funds capital is understood to have been deployed.

Source: bloombergquint.com

Source: bloombergquint.com

The portfolio includes hotel office retail and industrial properties in the United. Blackstone Property Partners Asia. BXMT a leading real estate finance company that originates senior loans collateralized by commercial real estate. Investments are concentrated in the logistics residential and office sectors with a focus on major European markets and key gateway cities. Shareholders directors beneficial owners if filed articles of association and full detail of filings.

Source: blackstone.com

Source: blackstone.com

Is an American alternative investment management company based in New York CityIn 2019 Blackstone converted from a publicly traded partnership into a corporation. BPPEH invests in high-quality substantially stabilised real estate assets across Europe. Blackstone Real Estate Partners Asia III Lux SCSP. Related commitments from Blackstones global buyout fund bring the total to at least 38 billion of equity to invest in the region. Full registry information with list of directors and secretaries.

Source: sk.pinterest.com

Source: sk.pinterest.com

Blackstone Real Estate Partners BREP Asia closed on its hard cap of 5 billion in end 2014 in what was a record closing for a fund of its kind in the region. As previously reported by IPE Real Assets a number of recent commitments into Blackstone Real Estate Partners Asia II BREP Asia II have come from investors in the US including the New York State Teachers Retirement System and Virginia Retirement System. Blackstones real estate business was founded in 1991 and has about 120 billion in capital under management. BX today announced the final close of its latest global real estate fund Blackstone Real Estate Partners IX BREP IX. Blackstones private equity business has been one of the largest investors in leveraged buyouts in the last three decades while its real estate business has actively acquired commercial real estate.

Earlier this year the US-based private equity firm had floated Blackstone Real Estate Partners Asia II with a target of 5 billion and a hard cap of 7 billion according to a PERE report. US private equity firm Blackstone Group has forged the largest-ever fund dedicated to property investments in Asia by holding a final close on Blackstone Real Estate Partners Asia II BREP II at around 71 billion of capital commitments. Currently over 50 percent of the funds capital is understood to have been deployed. Industrial warehouse properties from Singapore-based logistics provider GLP for 187 billion. Blackstone Real Estate Partners Asia III Lux SCSP.

Source: irei.com

Source: irei.com

BXMT a leading real estate finance company that originates senior loans collateralized by commercial real estate. Performing Insurance Stressed Distressed. Blackstone Real Estate Partners BREP Asia closed on its hard cap of 5 billion in end 2014 in what was a record closing for a fund of its kind in the region. The portfolio includes hotel office retail and industrial properties in the United. Industrial warehouse properties from Singapore-based logistics provider GLP for 187 billion.

Source: perenews.com

Source: perenews.com

Blackstone Real Estate Partners BREP Asia closed on its hard cap of 5 billion in end 2014 in what was a record closing for a fund of its kind in the region. We manage Blackstone Mortgage Trust NYSE. Commingled GP Stakes Seeding. All figures as of March 31 2021 unless otherwise indicated. Our real estate debt business provides creative and comprehensive financing solutions across the capital structure and risk spectrum.

Source: in.pinterest.com

Source: in.pinterest.com

Core Debt Global Opportunistic. BXMT a leading real estate finance company that originates senior loans collateralized by commercial real estate. US private equity firm Blackstone Group has forged the largest-ever fund dedicated to property investments in Asia by holding a final close on Blackstone Real Estate Partners Asia II BREP II at around 71 billion of capital commitments. Blackstone Real Estate Partners Asia III Lux SCSP. Performing Insurance Stressed Distressed.

Source: blackstone.com

Source: blackstone.com

Blackstones second Read More Blackstone Wins 300M Commitment to Latest Fund and More Asia Real Estate Headlines. Blackstones second Read More Blackstone Wins 300M Commitment to Latest Fund and More Asia Real Estate Headlines. Life Sciences Infrastructure Growth Equity Secondaries Tactical Opportunities. Blackstone had already eclipsed the previous Asia fundraising record with this new fund of 508 billion. BPPEH invests in high-quality substantially stabilised real estate assets across Europe.

Source: businesswire.com

Source: businesswire.com

Blackstone Property Partners Asia. BPPEH invests in high-quality substantially stabilised real estate assets across Europe. Commingled GP Stakes Seeding. Blackstone Property Partners Asia. We originate loans and invest in debt securities underpinned by high-quality real estate.

Source: pinterest.com

Source: pinterest.com

Is an American alternative investment management company based in New York CityIn 2019 Blackstone converted from a publicly traded partnership into a corporation. Blackstone had already eclipsed the previous Asia fundraising record with this new fund of 508 billion. BXMT a leading real estate finance company that originates senior loans collateralized by commercial real estate. Blackstones real estate business was founded in 1991 and has about 120 billion in capital under management. Blackstones private equity business has been one of the largest investors in leveraged buyouts in the last three decades while its real estate business has actively acquired commercial real estate.

Source:

Source:

Blackstone Property Partners Asia. We manage Blackstone Mortgage Trust NYSE. Industrial warehouse properties from Singapore-based logistics provider GLP for 187 billion. 1001 FLEET STREET 4TH FLOOR SUITE 420 BALTIMORE MD 21202. Investments are concentrated in the logistics residential and office sectors with a focus on major European markets and key gateway cities.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title blackstone real estate partners asia by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.