Your Blackstone real estate income trust reviews images are ready in this website. Blackstone real estate income trust reviews are a topic that is being searched for and liked by netizens today. You can Get the Blackstone real estate income trust reviews files here. Download all free photos and vectors.

If you’re looking for blackstone real estate income trust reviews images information linked to the blackstone real estate income trust reviews interest, you have pay a visit to the right blog. Our website always provides you with suggestions for viewing the maximum quality video and image content, please kindly search and locate more informative video content and images that match your interests.

Blackstone Real Estate Income Trust Reviews. Theres one fund that stands head and shoulders above the rest on those 2 things in my opinion. The Blackstone Real Estate Income Trust Inc which will invest primarily in stabilized income-oriented commercial real estate looks to raise 5 billion from investors with 1 billion of that in. Commercial real estate across key property types including multifamily industrial hotel retail and office. Last falls proposed sale of the iconic Bellagio resort in Las Vegas to Blackstone Real Estate Income Trust BREIT is seen by many as a potential harbinger of even more high-stakes deals in the gaming real estate arena and confirmation of the growing institutionalization of this niche REIT segment.

Fundrise Ereit Fees Compared To Blackstone And Starwood Reits From financialsamurai.com

Fundrise Ereit Fees Compared To Blackstone And Starwood Reits From financialsamurai.com

Ordinary Income 2017. Blackstone REIT has raised 55 billion in investor equity as of March 15 2019. Please note that only financial advisors may order kits. Blackstone has built a track record of strong performance across a broad array of asset classes from private equity and real estate to hedge funds and credit. The company oversees a 139 billion portfolio of 474 commercial real estate properties as of December 2018 and its investment portfolio also included 102 positions in real estate-related. We manage Blackstone Mortgage Trust NYSE.

Blackstone Real Estate Income Trust Inc.

The Feeder Fund Is investment objective is to seek long-term total return with an emphasis on current income by primarily investing in a broad range of real estate. BREIT is a perpetual-life institutional quality real estate investment platform that brings private real estate to income-focused investors. The Blackstone Real Estate Income Trust Inc which will invest primarily in stabilized income-oriented commercial real estate looks to raise 5 billion from investors with 1 billion of that in. You should read the prospectus carefully for a. We manage Blackstone Mortgage Trust NYSE. The company oversees a 139 billion portfolio of 474 commercial real estate properties as of December 2018 and its investment portfolio also included 102 positions in real estate-related.

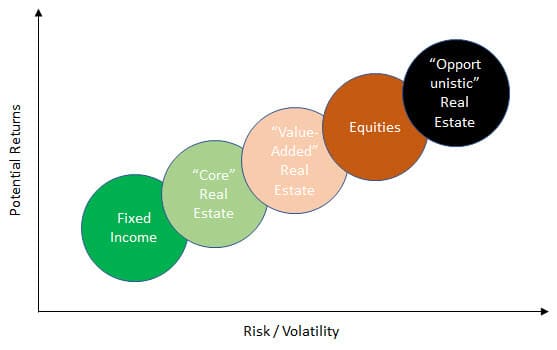

Its one of the few core-plus strategy funds that many institutional investors feel should be part of the bedrock of a real estate portfolio along with core. Corecore plus funds outperform other strategies over the long-term by using conservative techniques and leverage. BREIT invests primarily in stabilized income-generating US. Order now Financial Professional Contact Request Submission. Had raised 7554 million about 41 of all the funds the entire industry raised in 2017 far more than any competitor according to.

Theres one fund that stands head and shoulders above the rest on those 2 things in my opinion. Last falls proposed sale of the iconic Bellagio resort in Las Vegas to Blackstone Real Estate Income Trust BREIT is seen by many as a potential harbinger of even more high-stakes deals in the gaming real estate arena and confirmation of the growing institutionalization of this niche REIT segment. Blackstone Real Estate Income Fund the Feeder Fund I a Delaware statutory trust registered under the Investment Company Act of 1940 as amended the 1940 Act is a continuously offered non-diversified closed-end management investment company. You should purchase these securities only if you can afford the complete loss of your investment. Corecore plus has historically outperformed all other strategies due to better performance in downturns from more conservative leverage and strategy.

You should read the prospectus carefully for a. BREIT invests primarily in stabilized income-generating US. BREIT is a perpetual-life institutional quality real estate investment platform that brings private real estate to income-focused investors. Corecore plus funds outperform other strategies over the long-term by using conservative techniques and leverage. Its one of the few core-plus strategy funds that many institutional investors feel should be part of the bedrock of a real estate portfolio along with core.

Commercial real estate across key property types including multifamily industrial hotel retail and office. The company is headquartered in New York City and externally managed by BX REIT Advisors a subsidiary of Blackstone. Blackstone has built a track record of strong performance across a broad array of asset classes from private equity and real estate to hedge funds and credit. The Feeder Fund I commenced investment operations on April 1 2014. Corecore plus has historically outperformed all other strategies due to better performance in downturns from more conservative leverage and strategy.

Source:

Source:

Corecore plus has historically outperformed all other strategies due to better performance in downturns from more conservative leverage and strategy. The company is headquartered in New York City and externally managed by BX REIT Advisors a subsidiary of Blackstone. You should read the prospectus carefully for a. BREIT invests primarily in stabilized income-generating US. This investment involves a high degree of risk.

Source: financialsamurai.com

Source: financialsamurai.com

Had raised 7554 million about 41 of all the funds the entire industry raised in 2017 far more than any competitor according to. The Feeder Fund I commenced investment operations on April 1 2014. Blackstone REIT has raised 55 billion in investor equity as of March 15 2019. The company is headquartered in New York City and externally managed by BX REIT Advisors a subsidiary of Blackstone. With 104 billion of previous real estate experience they dwarf even the most excellent closest competitor with 54 billion at 2.

Source: sciencedirect.com

Source: sciencedirect.com

With 104 billion of previous real estate experience they dwarf even the most excellent closest competitor with 54 billion at 2. Yet as of April Blackstone Real Estate Income Trust Inc. The Blackstone Real Estate Income Trust is a rare bird as well. The firm bought property in low-income neighborhoods refurbished units and exorbitantly increased rent. BREIT is a non-traded REIT that seeks to invest in stabilized commercial real estate properties diversified by sector with a focus on providing current income.

Source: whitesecuritieslaw.com

Source: whitesecuritieslaw.com

Had raised 7554 million about 41 of all the funds the entire industry raised in 2017 far more than any competitor according to. The company oversees a 139 billion portfolio of 474 commercial real estate properties as of December 2018 and its investment portfolio also included 102 positions in real estate-related. 32 Zeilen Ordinary Income 2017. Blackstone offers registered products focused on real estate hedge fund solutions and private credit. Corecore plus funds outperform other strategies over the long-term by using conservative techniques and leverage.

Source: blackstone.com

Source: blackstone.com

Commercial real estate across key property types including multifamily industrial hotel retail and office. With 104 billion of previous real estate experience they dwarf even the most excellent closest competitor with 54 billion at 2. Private Wealth Solutions team of alternative specialists helps advisors better understand how private market investing can complement traditional strategies in client portfolios. Corecore plus funds outperform other strategies over the long-term by using conservative techniques and leverage. Blackstones real estate practice had a disproportionate impact on communities of color in part because the company targeted foreclosures resulting from subprime loans.

Source: sec.gov

Source: sec.gov

The firm bought property in low-income neighborhoods refurbished units and exorbitantly increased rent. Commercial real estate across key property types including multifamily industrial hotel retail and office. Blackstone offers registered products focused on real estate hedge fund solutions and private credit. Blackstone Real Estate Investment Trust the largest non-publicly traded real-estate investment trust faces its biggest challenge since its inception in 2017 amid a. Order now Financial Professional Contact Request Submission.

Source: breit.com

Source: breit.com

The firm bought property in low-income neighborhoods refurbished units and exorbitantly increased rent. BREIT is a perpetual-life institutional quality real estate investment platform that brings private real estate to income-focused investors. Its one of the few core-plus strategy funds that many institutional investors feel should be part of the bedrock of a real estate portfolio along with core. It declined to comment because it is in the process of fundraising. Blackstone Real Estate Investment Trust the largest non-publicly traded real-estate investment trust faces its biggest challenge since its inception in 2017 amid a.

Source: bsic.it

Source: bsic.it

Theres one fund that stands head and shoulders above the rest on those 2 things in my opinion. The 1000 pound elephant in the room is Blackstone Real Estate Income Trust BREIT. The firm bought property in low-income neighborhoods refurbished units and exorbitantly increased rent. The Blackstone Real Estate Income Trust Inc which will invest primarily in stabilized income-oriented commercial real estate looks to raise 5 billion from investors with 1 billion of that in. Blackstone offers registered products focused on real estate hedge fund solutions and private credit.

Theres one fund that stands head and shoulders above the rest on those 2 things in my opinion. Blackstone also contributed to widespread displacement from gentrification. Blackstone offers registered products focused on real estate hedge fund solutions and private credit. You should purchase these securities only if you can afford the complete loss of your investment. Commercial real estate across key property types including multifamily industrial hotel retail and office.

Theres one fund that stands head and shoulders above the rest on those 2 things in my opinion. The 1000 pound elephant in the room is Blackstone Real Estate Income Trust BREIT. The Blackstone Real Estate Income Trust Inc which will invest primarily in stabilized income-oriented commercial real estate looks to raise 5 billion from investors with 1 billion of that in. Its one of the few core-plus strategy funds that many institutional investors feel should be part of the bedrock of a real estate portfolio along with core. BREIT invests primarily in stabilized income-generating US.

Source: prepona.info

Source: prepona.info

Order Kits Print or digital kits may be ordered by selecting one of the options below. Its one of the few core-plus strategy funds that many institutional investors feel should be part of the bedrock of a real estate portfolio along with core. It declined to comment because it is in the process of fundraising. You should purchase these securities only if you can afford the complete loss of your investment. Blackstone has built a track record of strong performance across a broad array of asset classes from private equity and real estate to hedge funds and credit.

Source: sec.gov

Source: sec.gov

The Blackstone Real Estate Income Trust Inc which will invest primarily in stabilized income-oriented commercial real estate looks to raise 5 billion from investors with 1 billion of that in. Blackstone Real Estate Income Fund the Feeder Fund I a Delaware statutory trust registered under the Investment Company Act of 1940 as amended the 1940 Act is a continuously offered non-diversified closed-end management investment company. Blackstone Real Estate Income Trust Inc. BREIT is a perpetual-life institutional quality real estate investment platform that brings private real estate to income-focused investors. The Blackstone Real Estate Income Trust Inc which will invest primarily in stabilized income-oriented commercial real estate looks to raise 5 billion from investors with 1 billion of that in.

Source: breit.com

Source: breit.com

BXMT a leading real estate finance company that originates senior loans collateralized by commercial real estate. One of the most exciting things about our business is the scope of what were able to do given. Blackstone REIT has raised 55 billion in investor equity as of March 15 2019. Ordinary Income 2017. Please note that only financial advisors may order kits.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Theres one fund that stands head and shoulders above the rest on those 2 things in my opinion. You should read the prospectus carefully for a. The Feeder Fund I commenced investment operations on April 1 2014. Blackstone Real Estate Investment Trust the largest non-publicly traded real-estate investment trust faces its biggest challenge since its inception in 2017 amid a. Yet as of April Blackstone Real Estate Income Trust Inc.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title blackstone real estate income trust reviews by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.