Your Blackstone real estate income fund performance images are ready. Blackstone real estate income fund performance are a topic that is being searched for and liked by netizens today. You can Download the Blackstone real estate income fund performance files here. Get all royalty-free photos.

If you’re looking for blackstone real estate income fund performance pictures information connected with to the blackstone real estate income fund performance topic, you have pay a visit to the ideal site. Our site frequently provides you with hints for refferencing the maximum quality video and image content, please kindly hunt and find more informative video content and graphics that fit your interests.

Blackstone Real Estate Income Fund Performance. Blackstone does not maintain or provide information directly to this service. Blackstone Real Estate Income Trust Inc. The performance information presented below is for certain funds managed by members of the Blackstone Real Estate Debt Strategies BREDS team including Michael Nash and Joshua Mason that have. We are pleased to present this annual shareholder report for Blackstone Real Estate Income Fund BREIF I and Blackstone Real Estate Income Master Fund the Master Fund.

Its one of the few core-plus strategy funds that many institutional investors feel should be part of the bedrock of a real estate portfolio along with core. Income distribution payable 2325368 Payable for shares repurchased 4200080 Payable for distribution fees 772002. The BDCs NAV per share has decreased from its original offering price of 1000 to 940 as of Q1 2019. It had total assets as of March 31 2019 of 189 billion. Commercial real estate across key property types including multifamily industrial hotel retail and office. Blackstone Real Estate Income Trust Inc.

The performance information presented below is for certain funds managed by members of the Blackstone Real Estate Debt Strategies BREDS team including Michael Nash and Joshua Mason that have.

Investment in Master Fund at fair value 628429061 Cash 14666096 Other assets 47778 Total Assets 643142935 Liabilities. Commercial real estate across the. Blackstone Real Estate Income Trust is a public non-listed REIT designed to provide individual investors with access to Blackstones leading institutional real estate investment platform. Blackstone does not maintain or provide information directly to this service. Blackstone offers registered products focused on real estate hedge fund solutions and private credit. Investment in Master Fund at fair value 628429061 Cash 14666096 Other assets 47778 Total Assets 643142935 Liabilities.

Source: sec.gov

Source: sec.gov

Blackstone Real Estate Income Fund Statement of Assets and Liabilities As of December 31 2015 Assets. Ordinary Income 2017. Ordinary Income 2018. Ordinary Income 2017. This nontraded BDC closed its offering in January 2019 after raising 13 billion.

Source:

Source:

We are pleased to present this annual shareholder report for Blackstone Real Estate Income Fund BREIF I and Blackstone Real Estate Income Master Fund the Master Fund. This investment involves a high degree of risk. Its one of the few core-plus strategy funds that many institutional investors feel should be part of the bedrock of a real estate portfolio along with core. You should read the prospectus carefully for a. The Blackstone Real Estate Income Master Fund with about 11 billion of total investments at year-end including those purchased with leverage will sell the assets and distribute the proceeds.

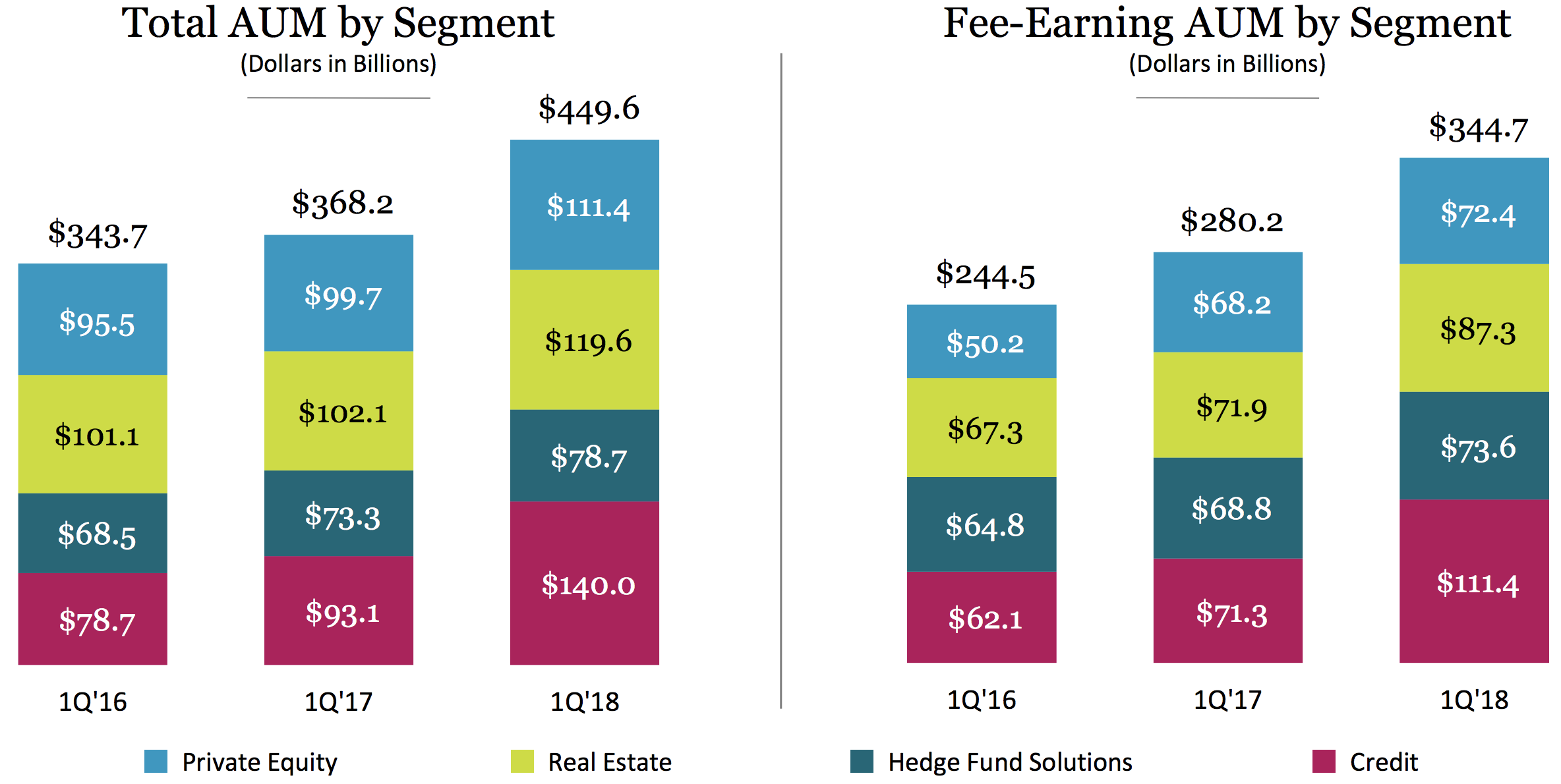

Blackstone Real Estate Advisers its real estate. The company oversees a 139 billion portfolio of 474 commercial real estate properties as of December 2018 and its investment portfolio also included 102 positions in real estate-related securities that totaled 23 billion. Blackstone Real Estate Income Trust Inc. Hear about the Fund from the Blackstone Credit Team View the Funds Latest Performance NAV. In addition to quarterly performance we show annualized performance and the institutions Blackstone Real Estate.

Source: sec.report

Source: sec.report

Blackstone Real Estate Income Trust Inc. Blackstone offers registered products focused on real estate hedge fund solutions and private credit. Investment in Master Fund at fair value 628429061 Cash 14666096 Other assets 47778 Total Assets 643142935 Liabilities. Blackstone Real Estate Income Trust Inc. 1 Dividends since IPO include 059share of value distributed to shareholders upon spin-off of PJT on October 1 2015.

Source: businesswire.com

Source: businesswire.com

We are pleased to present this annual shareholder report for Blackstone Real Estate Income Fund BREIF I and Blackstone Real Estate Income Master Fund the Master Fund. Investment in Master Fund at fair value 628429061 Cash 14666096 Other assets 47778 Total Assets 643142935 Liabilities. 32 Zeilen Ordinary Income 2018. It had total assets as of March 31 2019 of 189 billion. Blackstone Real Estate Income Trust Inc.

BREIF I Blackstone Real Estate Income Fund II BREIF II and the Master Fund are collectively referred to as the Funds or BREIF This report includes market commentary performance commentary for the Funds. It had total assets as of March 31 2019 of 189 billion. Latest Holdings Performance AUM from 13F 13D Blackstone Real Estate Income Fund has. In addition to quarterly performance we show annualized performance and the institutions Blackstone Real Estate. 32 Zeilen Ordinary Income 2018.

Source: breit.com

Source: breit.com

2 March 31 2021 Why Blackstone GSO Floating Rate Enhanced Income Fund. To calculate this we calculate the cost basis of added positions in each quarter and use that to calculate the total profit and returns for each quarter. Ordinary Income 2017. Latest Holdings Performance AUM from 13F 13D Blackstone Real Estate Income Fund has. This nontraded BDC closed its offering in January 2019 after raising 13 billion.

Feeder Fund I Blackstone Real Estate Income Fund II Feeder Fund II and the Consolidated Master Fund are collectively referred to as the Funds or BREIF This report includes market commentary performance commentary for the Funds a listing of the Consolidated Master Funds investments and the unaudited financial statements for Feeder Fund I and the Consolidated Master Fund. The company oversees a 139 billion portfolio of 474 commercial real estate properties as of December 2018 and its investment portfolio also included 102 positions in real estate-related securities that totaled 23 billion. Ordinary Income 2017. Blackstone Real Estate Income Trust Inc. You should purchase these securities only if you can afford the complete loss of your investment.

Source: simplysafedividends.com

Source: simplysafedividends.com

The BDCs NAV per share has decreased from its original offering price of 1000 to 940 as of Q1 2019. Blackstone does not maintain or provide information directly to this service. Blackstone Real Estate Income Fund the Fund and Blackstone Real Estate Income Master Fund the Master Fund are recently organized and have no performance records of their own. Investment in Master Fund at fair value 628429061 Cash 14666096 Other assets 47778 Total Assets 643142935 Liabilities. Ordinary Income 2018.

Feeder Fund I Blackstone Real Estate Income Fund II Feeder Fund II and the Consolidated Master Fund are collectively referred to as the Funds or BREIF This report includes market commentary performance commentary for the Funds a listing of the Consolidated Master Funds investments and the unaudited financial statements for Feeder Fund I and the Consolidated Master Fund. Ordinary Income 2017. Ordinary Income 2018. Blackstone REIT has raised 55 billion in investor equity as of March 15 2019. BREIT invests primarily in stabilized income-generating US.

Source: pionline.com

Source: pionline.com

Ordinary Income 2016. BREIT is a non-traded REIT that seeks to invest in stabilized commercial real estate properties diversified by sector with a focus on providing current income. Blackstone REIT has raised 55 billion in investor equity as of March 15 2019. Past performance is not indicative of future results. This investment involves a high degree of risk.

Source: simplysafedividends.com

Source: simplysafedividends.com

You should read the prospectus carefully for a. The performance information presented below is for certain funds managed by members of the Blackstone Real Estate Debt Strategies BREDS team including Michael Nash and Joshua Mason that have. Blackstone Real Estate Income Trust Inc. Blackstone Real Estate Income Fund the Fund and Blackstone Real Estate Income Master Fund the Master Fund are recently organized and have no performance records of their own. BREIT is a non-traded REIT that seeks to invest in stabilized commercial real estate properties diversified by sector with a focus on providing current income.

Ordinary Income 2017. This nontraded BDC closed its offering in January 2019 after raising 13 billion. BREIT will seek to directly own stabilized income-generating US. The company oversees a 139 billion portfolio of 474 commercial real estate properties as of December 2018 and its investment portfolio also included 102 positions in real estate-related securities that totaled 23 billion. Blackstone Real Estate Income Master Fund investor performance is calculated on a quarterly basis.

Source: breit.com

Source: breit.com

The Blackstone Real Estate Income Trust is a rare bird as well. Ordinary Income 2017. Latest Holdings Performance AUM from 13F 13D Blackstone Real Estate Income Fund has. The Blackstone Real Estate Income Trust is a rare bird as well. To calculate this we calculate the cost basis of added positions in each quarter and use that to calculate the total profit and returns for each quarter.

Source: prepona.info

Source: prepona.info

Latest Holdings Performance AUM from 13F 13D Blackstone Real Estate Income Fund has. Ordinary Income 2017. The BDCs NAV per share has decreased from its original offering price of 1000 to 940 as of Q1 2019. Ordinary Income 2017. Investment in Master Fund at fair value 628429061 Cash 14666096 Other assets 47778 Total Assets 643142935 Liabilities.

Source: businesswire.com

Source: businesswire.com

Ordinary Income 2018. Blackstone REIT has raised 55 billion in investor equity as of March 15 2019. Ordinary Income 2018. BREIT will seek to directly own stabilized income-generating US. Hear about the Fund from the Blackstone Credit Team View the Funds Latest Performance NAV.

Income distribution payable 2325368 Payable for shares repurchased 4200080 Payable for distribution fees 772002. BREIT is a perpetual-life institutional quality real estate investment platform that brings private real estate to income-focused investors. Blackstone Real Estate Income Trust Inc. Blackstone Real Estate Income Trust is a public non-listed REIT designed to provide individual investors with access to Blackstones leading institutional real estate investment platform. BREIF I Blackstone Real Estate Income Fund II BREIF II and the Master Fund are collectively referred to as the Funds or BREIF This report includes market commentary performance commentary for the Funds.

Source: investingparexc.com

Source: investingparexc.com

BREIT will seek to directly own stabilized income-generating US. Past performance is not indicative of future results. Blackstone REIT has raised 55 billion in investor equity as of March 15 2019. Feeder Fund I Blackstone Real Estate Income Fund II Feeder Fund II and the Consolidated Master Fund are collectively referred to as the Funds or BREIF This report includes market commentary performance commentary for the Funds a listing of the Consolidated Master Funds investments and the unaudited financial statements for Feeder Fund I and the Consolidated Master Fund. Ordinary Income 2018.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title blackstone real estate income fund performance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.