Your Blackstone real estate fund performance images are ready. Blackstone real estate fund performance are a topic that is being searched for and liked by netizens today. You can Find and Download the Blackstone real estate fund performance files here. Find and Download all royalty-free photos and vectors.

If you’re searching for blackstone real estate fund performance pictures information related to the blackstone real estate fund performance topic, you have come to the ideal site. Our website always provides you with suggestions for refferencing the maximum quality video and picture content, please kindly surf and find more informative video articles and images that match your interests.

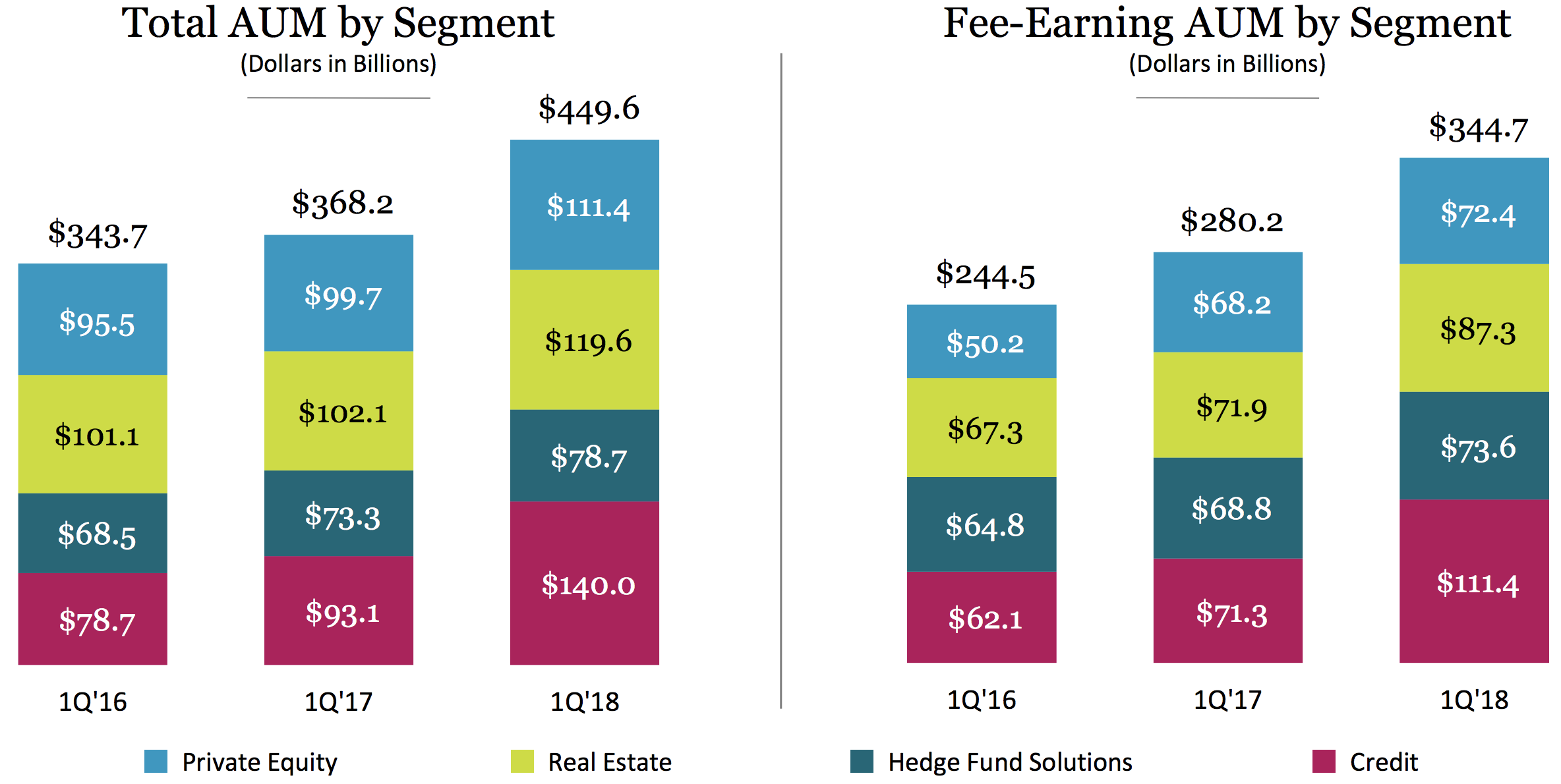

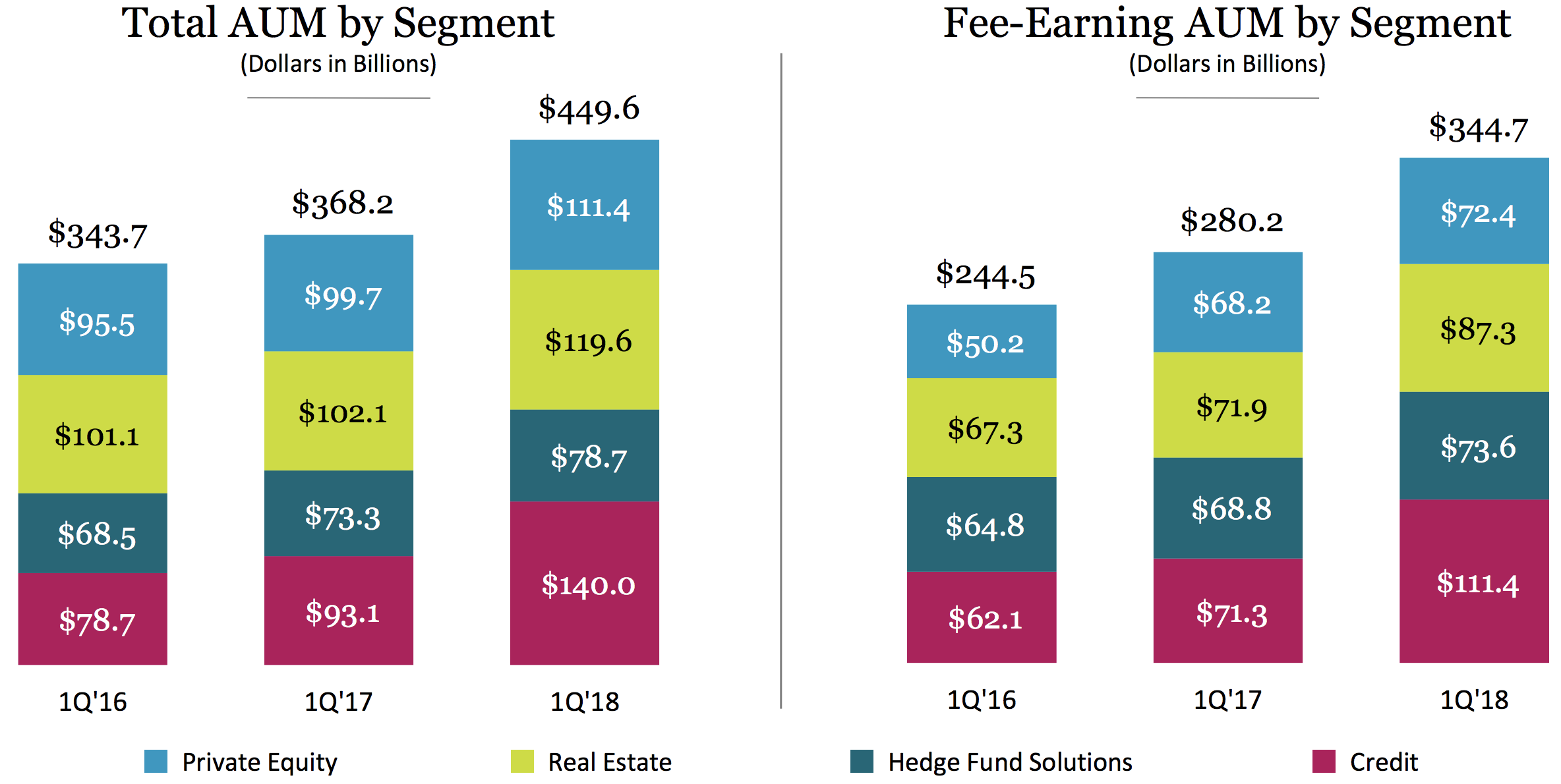

Blackstone Real Estate Fund Performance. Blackstone Group BX -004 LP has finished raising the largest commercial real-estate fund ever with 205 billion of commitments despite an increasingly tough commercial property market. Latest Holdings Performance AUM from 13F 13D Blackstone Real Estate Income Fund has. Private equity firm Blackstone Group Inc said on Wednesday it has raised the largest ever real estate fund amassing 205 billion to be invested in property assets around the world. As of July 8 2019 the Fund has an annualized return before sales charges of 1173 and offers a current distribution rate for all five share classes of 538.

Blackstone Group L P Bx Intelligent Income By Simply Safe Dividends From simplysafedividends.com

Blackstone Group L P Bx Intelligent Income By Simply Safe Dividends From simplysafedividends.com

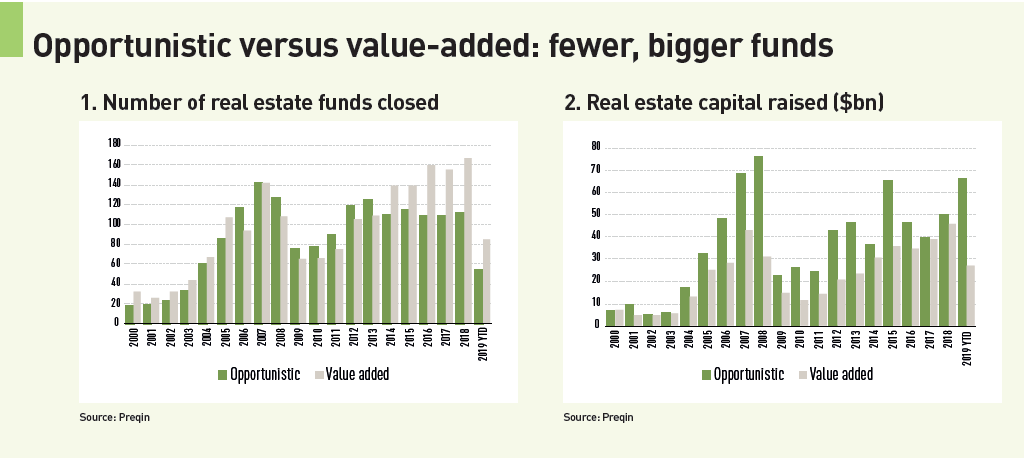

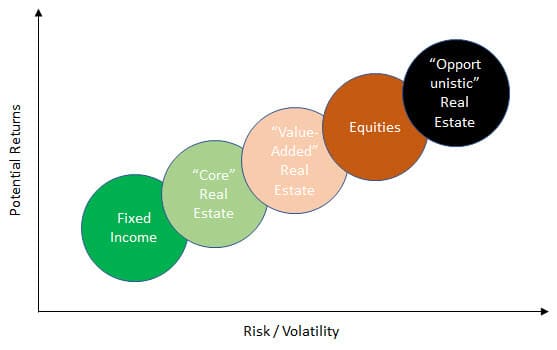

- Opportunistic Real Estate Fund Overview Fund size. Blackstone like its rivals is taking. In June New York-based Blackstone raised 71 billion for an opportunistic real estate fund focused on Asia and Carlyle Group LP this month also raised its largest US. BREIT is a perpetual-life institutional quality real estate investment platform that brings private real estate to income-focused investors. You should read the prospectus carefully for a description. The Funds investments are subject to substantial risks including loss of all or a substantial portion of the investment due to leveraging short-selling or other speculative practices.

Neither this video nor any of the information contained herein constitutes an offer of any Blackstone fund.

Sincerely Blackstone Real Estate Income. Blackstone Group BX -004 LP has finished raising the largest commercial real-estate fund ever with 205 billion of commitments despite an increasingly tough commercial property market. BLACKSTONE REAL ESTATE INCOME FUND COMMON SHARES OF BENEFICIAL INTEREST The Fund. BREIT is a non-traded REIT that seeks to invest in stabilized commercial real estate properties diversified by sector with a focus on providing current income. The private equity industry brought in a record 453 billion last year. BREIT a non-listed REIT focuses on income-generating assets primarily in the top 50.

Source: realassets.ipe.com

Source: realassets.ipe.com

The Fund has increased its pace of capital raise from 162 million in Fiscal 2018 to 145 million in just six months in Fiscal 2019. Blackstone reports that its leverage has increased from below-average 41 to above average 60 average for core plus is 50. So this review has been updated with that information. 13 billion target Opportunistic strategy targeting a broad range of real estate and real estate-related investments focused primarily on the US and Canada Founded in 1985 Blackstone Group has total assets under management of. Blackstone Real Estate Income Trust Inc.

Source: sec.gov

Source: sec.gov

Latest Holdings Performance AUM from 13F 13D Blackstone Real Estate Income Fund has. BREIT a non-listed REIT focuses on income-generating assets primarily in the top 50. The private equity giants real estate assets increased 29 per cent to 1536 billion A224bn over the year topping off a decade-long bull-run by the group. Blackstone Real Estate Income Trust Inc. And apparently this is the new target.

Source: bloombergquint.com

Source: bloombergquint.com

Our BPP funds focus on industrial residential office and retail assets in global gateway cities. As of July 8 2019 the Fund has an annualized return before sales charges of 1173 and offers a current distribution rate for all five share classes of 538. Blackstone Real Estate Income Trust Inc. The private equity industry brought in a record 453 billion last year. Blackstone Real Estate Income Trust Inc.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Private equity firm Blackstone Group Inc said on Wednesday it has raised the largest ever real estate fund amassing 205 billion to be invested in property assets around the world. In June New York-based Blackstone raised 71 billion for an opportunistic real estate fund focused on Asia and Carlyle Group LP this month also raised its largest US. The private equity giants real estate assets increased 29 per cent to 1536 billion A224bn over the year topping off a decade-long bull-run by the group. The Funds investments are subject to substantial risks including loss of all or a substantial portion of the investment due to leveraging short-selling or other speculative practices. BLACKSTONE REAL ESTATE INCOME FUND COMMON SHARES OF BENEFICIAL INTEREST The Fund.

Source: simplysafedividends.com

Source: simplysafedividends.com

Blackstones opportunistic real estate funds tend to be reasonably high-risk delivering annual average net returns of 16 per cent according to the groups second quarter earnings results. You should read the prospectus carefully for a description. BREIT is a perpetual-life institutional quality real estate investment platform that brings private real estate to income-focused investors. The Funds focus on low beta high income positions limited allocation to 2015 multi-borrower CMBS transactions and active portfolio management were the main drivers of outperformance during the year. Blackstone offers registered products focused on real estate hedge fund solutions and private credit.

Source: bvkap.de

Source: bvkap.de

Blackstone Real Estate Income Trust Inc. So this review has been updated with that information. Commercial real estate across key property types including multifamily industrial hotel retail and office. As of July 8 2019 the Fund has an annualized return before sales charges of 1173 and offers a current distribution rate for all five share classes of 538. You should purchase these securities only if you can afford the complete loss of your investment.

Source: pensionpulse.blogspot.com

Source: pensionpulse.blogspot.com

Blackstone Real Estate Partners VIII LP. BLACKSTONE REAL ESTATE INCOME FUND COMMON SHARES OF BENEFICIAL INTEREST The Fund. - Opportunistic Real Estate Fund Overview Fund size. BREIT a non-listed REIT focuses on income-generating assets primarily in the top 50. In June New York-based Blackstone raised 71 billion for an opportunistic real estate fund focused on Asia and Carlyle Group LP this month also raised its largest US.

Among the 32 Interval Funds in Blue Vaults reports the Fund ranks third in Sharpe Ratio at 28 over the. Blackstone Real Estate Income Trust Inc. Fundamentals of commercial real estate. You should read the prospectus carefully for a description. And apparently this is the new target.

Source: pitchbook.com

Source: pitchbook.com

Private equity firm Blackstone Group Inc said on Wednesday it has raised the largest ever real estate fund amassing 205 billion to be invested in property assets around the world. This investment involves a high degree of risk. Past performance is not indicative of future resu. - Opportunistic Real Estate Fund Overview Fund size. Sincerely Blackstone Real Estate Income.

Source: sec.gov

Source: sec.gov

Blackstone Real Estate Income Trust Inc. So this review has been updated with that information. Blackstone Group BX -004 LP has finished raising the largest commercial real-estate fund ever with 205 billion of commitments despite an increasingly tough commercial property market. Blackstone reports that its leverage has increased from below-average 41 to above average 60 average for core plus is 50. The Fund is a feeder fund in a master-feeder structure.

Source: forbes.com

Source: forbes.com

Fundamentals of commercial real estate. The Funds investments are subject to substantial risks including loss of all or a substantial portion of the investment due to leveraging short-selling or other speculative practices. Commercial real estate across key property types including multifamily industrial hotel retail and office. Neither this video nor any of the information contained herein constitutes an offer of any Blackstone fund. Blackstone Real Estate Income Trust Inc.

Source: blackstone.com

Source: blackstone.com

BREIT a non-listed REIT focuses on income-generating assets primarily in the top 50. Beyond real estate investors are piling into alternative assets helping firms raise much larger funds than before. The private equity industry brought in a record 453 billion last year. Sincerely Blackstone Real Estate Income. Private equity firm Blackstone Group Inc said on Wednesday it has raised the largest ever real estate fund amassing 205 billion to be invested in property assets around the world.

Blackstone reports that its leverage has increased from below-average 41 to above average 60 average for core plus is 50. Sincerely Blackstone Real Estate Income. Blackstones opportunistic real estate funds tend to be reasonably high-risk delivering annual average net returns of 16 per cent according to the groups second quarter earnings results. You should purchase these securities only if you can afford the complete loss of your investment. 13 billion target Opportunistic strategy targeting a broad range of real estate and real estate-related investments focused primarily on the US and Canada Founded in 1985 Blackstone Group has total assets under management of.

Source: simplysafedividends.com

Source: simplysafedividends.com

BLACKSTONE REAL ESTATE INCOME FUND COMMON SHARES OF BENEFICIAL INTEREST The Fund. Latest Holdings Performance AUM from 13F 13D Blackstone Real Estate Income Fund has. 32 Zeilen An investment in the Fund is appropriate only for investors that are qualified clients as. So this review has been updated with that information. Blackstone Real Estate Income Trust Inc.

Past performance is not indicative of future resu. The Fund has increased its pace of capital raise from 162 million in Fiscal 2018 to 145 million in just six months in Fiscal 2019. Blackstone Real Estate Income Trust Inc. Latest Holdings Performance AUM from 13F 13D Blackstone Real Estate Income Fund has. The Funds focus on low beta high income positions limited allocation to 2015 multi-borrower CMBS transactions and active portfolio management were the main drivers of outperformance during the year.

32 Zeilen An investment in the Fund is appropriate only for investors that are qualified clients as. Blackstone offers registered products focused on real estate hedge fund solutions and private credit. BREIT a non-listed REIT focuses on income-generating assets primarily in the top 50. The Funds focus on low beta high income positions limited allocation to 2015 multi-borrower CMBS transactions and active portfolio management were the main drivers of outperformance during the year. Blackstones opportunistic real estate funds tend to be reasonably high-risk delivering annual average net returns of 16 per cent according to the groups second quarter earnings results.

Source: blackstone.com

Source: blackstone.com

Blackstone like its rivals is taking. 32 Zeilen An investment in the Fund is appropriate only for investors that are qualified clients as defined in the Investment Advisers Act of 1940 who can tolerate a high degree of risk and do not require a liquid investment. BREIT a non-listed REIT focuses on income-generating assets primarily in the top 50. BREIT is a non-traded REIT that seeks to invest in stabilized commercial real estate properties diversified by sector with a focus on providing current income. And apparently this is the new target.

Source: investingparexc.com

Source: investingparexc.com

And apparently this is the new target. As of July 8 2019 the Fund has an annualized return before sales charges of 1173 and offers a current distribution rate for all five share classes of 538. Our BPP funds focus on industrial residential office and retail assets in global gateway cities. BREIT is a non-traded REIT that seeks to invest in stabilized commercial real estate properties diversified by sector with a focus on providing current income. BLACKSTONE REAL ESTATE INCOME FUND COMMON SHARES OF BENEFICIAL INTEREST The Fund.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title blackstone real estate fund performance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.