Your Biggest private equity real estate funds images are available. Biggest private equity real estate funds are a topic that is being searched for and liked by netizens now. You can Get the Biggest private equity real estate funds files here. Get all royalty-free images.

If you’re looking for biggest private equity real estate funds pictures information linked to the biggest private equity real estate funds interest, you have pay a visit to the right site. Our site frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Biggest Private Equity Real Estate Funds. Altan IV has a target size of up to 400 m. Private equity real estate funds allow high-net-worth individuals HWNIs and institutions such as endowments and pension funds to invest in equity and debt holdings related to real estate assets. Real Estate Investment Trust. Listed below are 5 of the largest private equity deals in African real estate over the previous 5 years.

Real Estate Private Equity Complete Guide To Breaking Into The Industry Wall Street Prep From wallstreetprep.com

Real Estate Private Equity Complete Guide To Breaking Into The Industry Wall Street Prep From wallstreetprep.com

IShares Core US REIT ETF. 41 Crow Holdings Capital Real Estate Dallas US 46 09 Mapletree Investments Singapore 46 21 43 Shorenstein Properties San Francisco US 45 05 44 Rialto Capital Management Miami US 44 09 45 Cerberus Real Estate Capital Management New York US 43 13 46 Harrison Street Real Estate Capital Chicago US 42 11. Real Estate Investment Trust. Real estate investment trusts REITs and private equity real estate investing opportunities have their similarities but their differences are much more profound. Roughly 42 of capital raised over the past two years was focused on the US property markets 40 focused on European property markets and 10. It originated as the European.

Private equity is well-capitalised to face the economic and social trauma caused by the covid-19 pandemic.

Real estate investment trusts REITs and private equity real estate investing opportunities have their similarities but their differences are much more profound. It was the largest non-US. Houses 3 days ago A 100000 investment that returns 105000 in one month return of 100000 in principal and 5000 in earnings has an IRR of 80 which seems fantastic but in reality the real estate investor has only made 5 of their initial investment back. Q1 fundraising shows ongoing sector consolidation. Shafiq Bin Laden was also an investor in many Carlyle-managed funds. IShares Global REIT ETF.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

To measure the absolute return the Equity Multiple is. Private equity firm in terms of funds raised over the past five years at 199 billion. Starwood made headlines when. Blackstone is back in the top spot with a five-year fundraising total of 96 billion 16 percent higher than its total last year and almost 35 billion more than second-place Carlyle Group. Both REITs and private equity funds are used to diversify a long-term investment portfolio and both invest in similar types of real estate.

Source: ifswf.org

Source: ifswf.org

Blackstone is back in the top spot with a five-year fundraising total of 96 billion 16 percent higher than its total last year and almost 35 billion more than second-place Carlyle Group. Sub Saharan Capital Cities. Measuring Private Equity Real Estate Returns. However private real estates higher returning strategies value-add and opportunistic have nonetheless attracted record amounts of capital. It primarily focuses on private equity and credit.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

In 2020 they together raised 1963 billion of discretionary equity over the past five years or just shy of 40 percent of the aggregate 4945 billion amassed by all 100 managers. It is mega-funds ahead of the competition. 41 Invesco Real Estate 1662 42 Crow Holdings 1649 43 CIM Group 1632 27 44 Rockwood Capital 1629 45 Berkshire Property Advisors 1619 46 Harrison Street Real Estate Capital 1518 47 GE Capital Real Estate 1514 48 Kayne Anderson Real Estate Advisors 1411 49 Spear Street Capital 1400. Blackstone Group which manages 119B in real estate assets worldwide launched its second Blackstone Real Estate Special Situations Fund targeting US. Private Equity Real Estate is a global asset class and with valued at more than 4 trillion in aggregate.

Source: wallstreetprep.com

Source: wallstreetprep.com

IShares Core US REIT ETF. Sub Saharan Capital Cities. Real Estate Investment Trust. Private equity is well-capitalised to face the economic and social trauma caused by the covid-19 pandemic. It was the largest non-US.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

After all the aggregate fundraising of 4945 billion in this years PERE 100 which ranks. Whether their differences will be pros or cons will depend on the type of investor you are and what youre looking for in a real estate investment opportunity. Both REITs and private equity funds are used to diversify a long-term investment portfolio and both invest in similar types of real estate. The Fund is regulated and supervised by the CNMV. Sub Saharan Capital Cities.

Source: wallstreetprep.com

Source: wallstreetprep.com

Private equity is well-capitalised to face the economic and social trauma caused by the covid-19 pandemic. It is aimed at institutional investors such us insurance companies and pension funds and private investors including family offices and high net worth individuals. Largest LPs in private equity have a combined 791bn invested in the asset class. While it has a more boutique focus it is anything but a boutique firm. After all the aggregate fundraising of 4945 billion in this years PERE 100 which ranks.

Source: wallstreetprep.com

Source: wallstreetprep.com

Real Estate Investment Trust. While Blackstone acquired Bank United in 2009 for 10B and Equity Office Properties for 39B it. CVC Capital manages 69 billion in assets. This is significantly larger than the previous fund which deployed a total of USD 278 million. Actis Africa Real Estate Fund.

Source: wallstreetprep.com

Source: wallstreetprep.com

Real Estate Investment Trust. Real Estate Investment Trust. Real Estate Investment Trust. While Blackstone acquired Bank United in 2009 for 10B and Equity Office Properties for 39B it. 71 Zeilen Real Estate Investment Trust.

Source: wallstreetprep.com

Source: wallstreetprep.com

1- The Blackstone Group 829 billion. IShares Global REIT ETF. 1- The Blackstone Group 829 billion. Real Estate Investment Trust. The proceeds of the funds will be.

Source: wallstreetprep.com

Source: wallstreetprep.com

While Blackstone acquired Bank United in 2009 for 10B and Equity Office Properties for 39B it. Real estate investment trusts REITs and private equity real estate investing opportunities have their similarities but their differences are much more profound. 1- The Blackstone Group 829 billion. Roughly 42 of capital raised over the past two years was focused on the US property markets 40 focused on European property markets and 10. Real Estate Investment Trust.

Source: thebalance.com

Source: thebalance.com

CVC Capital Partners is headquartered in Luxembourg falling into a unique set of European laws. Real Estate Investment Trust. After all the aggregate fundraising of 4945 billion in this years PERE 100 which ranks. Listed below are 5 of the largest private equity deals in African real estate over the previous 5 years. It is aimed at institutional investors such us insurance companies and pension funds and private investors including family offices and high net worth individuals.

Source: unpri.org

Source: unpri.org

Brookfield targets 17bn for fourth flagship real estate fund North America Kyle Campbell - 13 hours ago DOWNLOAD. The Blackstone Group raised 829 billion between January 2014 and April 2019 earning the title of the worlds largest private equity firm. Real Estate Investment Trust. While it has a more boutique focus it is anything but a boutique firm. Altan IV has a target size of up to 400 m.

Source: investopedia.com

Source: investopedia.com

Houses 3 days ago A 100000 investment that returns 105000 in one month return of 100000 in principal and 5000 in earnings has an IRR of 80 which seems fantastic but in reality the real estate investor has only made 5 of their initial investment back. 41 Crow Holdings Capital Real Estate Dallas US 46 09 Mapletree Investments Singapore 46 21 43 Shorenstein Properties San Francisco US 45 05 44 Rialto Capital Management Miami US 44 09 45 Cerberus Real Estate Capital Management New York US 43 13 46 Harrison Street Real Estate Capital Chicago US 42 11. To measure the absolute return the Equity Multiple is. 41 Invesco Real Estate 1662 42 Crow Holdings 1649 43 CIM Group 1632 27 44 Rockwood Capital 1629 45 Berkshire Property Advisors 1619 46 Harrison Street Real Estate Capital 1518 47 GE Capital Real Estate 1514 48 Kayne Anderson Real Estate Advisors 1411 49 Spear Street Capital 1400. IShares Core US REIT ETF.

Source: wallstreetprep.com

Source: wallstreetprep.com

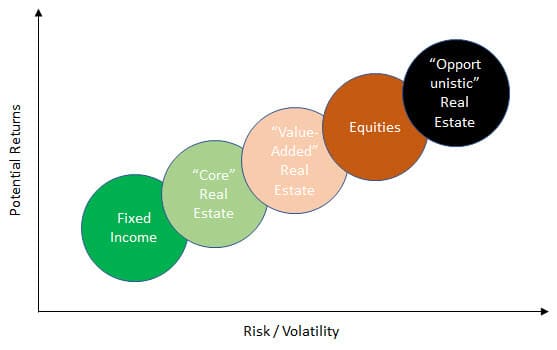

Altan IV has a target size of up to 400 m. To measure the absolute return the Equity Multiple is. 71 Zeilen Real Estate Investment Trust. Fidelity MSCI Real Estate ETF. However private real estates higher returning strategies value-add and opportunistic have nonetheless attracted record amounts of capital.

Source: wallstreetprep.com

Source: wallstreetprep.com

Private equity firm in terms of funds raised over the past five years at 199 billion. Measuring Private Equity Real Estate Returns. Sub Saharan Capital Cities. It originated as the European. While Blackstone acquired Bank United in 2009 for 10B and Equity Office Properties for 39B it.

Source: consultancy.asia

Source: consultancy.asia

However private real estates higher returning strategies value-add and opportunistic have nonetheless attracted record amounts of capital. While Blackstone acquired Bank United in 2009 for 10B and Equity Office Properties for 39B it. It is mega-funds ahead of the competition. It is aimed at institutional investors such us insurance companies and pension funds and private investors including family offices and high net worth individuals. It has 5455 billion of assets under management.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

41 Crow Holdings Capital Real Estate Dallas US 46 09 Mapletree Investments Singapore 46 21 43 Shorenstein Properties San Francisco US 45 05 44 Rialto Capital Management Miami US 44 09 45 Cerberus Real Estate Capital Management New York US 43 13 46 Harrison Street Real Estate Capital Chicago US 42 11. Blackstone Group which manages 119B in real estate assets worldwide launched its second Blackstone Real Estate Special Situations Fund targeting US. Private equity firm in terms of funds raised over the past five years at 199 billion. This is significantly larger than the previous fund which deployed a total of USD 278 million. It primarily focuses on private equity and credit.

Source: unpri.org

Source: unpri.org

Starwood made headlines when. This is significantly larger than the previous fund which deployed a total of USD 278 million. Brookfield targets 17bn for fourth flagship real estate fund North America Kyle Campbell - 13 hours ago DOWNLOAD. IShares Core US REIT ETF. Altan IV has a target size of up to 400 m.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title biggest private equity real estate funds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.