Your Basic equation for real estate return on investment images are available in this site. Basic equation for real estate return on investment are a topic that is being searched for and liked by netizens now. You can Get the Basic equation for real estate return on investment files here. Download all free photos.

If you’re searching for basic equation for real estate return on investment pictures information linked to the basic equation for real estate return on investment keyword, you have visit the right blog. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly search and find more enlightening video content and images that match your interests.

Basic Equation For Real Estate Return On Investment. Projected Stabilized NOI Total Project Cost. As an example lets say the property you own is worth 350K and your rental income is 2000 per month. If you had no expenses for your property your return on. Lets start with the basics.

Cash On Cash Return Calculate Cash On Cash Return In Real Estate From wallstreetmojo.com

Cash On Cash Return Calculate Cash On Cash Return In Real Estate From wallstreetmojo.com

Return on Investment. Gross income expenses. ROI Gain on Investment Cost of Investment Cost of Investment. Debt Coverage Ratio DCR. Modified Gross Debt Service Ratio Principal Interest Taxes Heat of Maintenance. Return on Investment Annual Returns Cost of Investment.

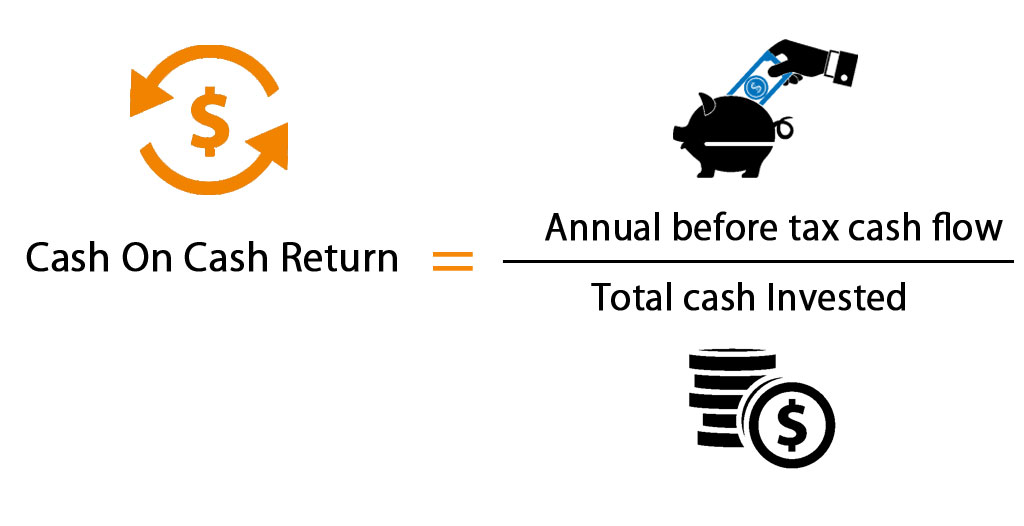

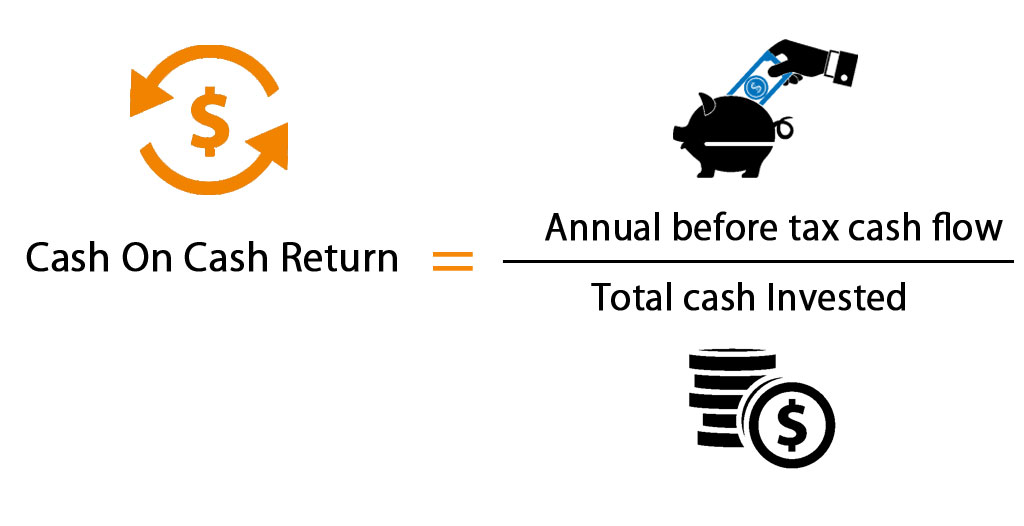

Initial Capital Investment Cash on Cash Return.

Then simply take that number and divide it by the cost of investment to find the ROI. Return on investment is calculated by taking the monthly or annual cashflow of an asset and dividing it by the. To calculate your annual returns as a real estate investor you would take your monthly rental income and multiply it by 12. That is because it factors in amortization and appreciation gained over time. R O I Net Return on Investment Cost of Investment 1 0 0 ROI fractextNet Return on InvestmenttextCost of Investmenttimes 100 R O I Cost of Investment Net. The rate of return formula for ROI is as follows.

Source: pinterest.com

Source: pinterest.com

The rate of return formula for ROI is as follows. Return on investment is calculated by taking the monthly or annual cashflow of an asset and dividing it by the. Initial Capital Investment Cash on Cash Return. The first version of the ROI formula net income divided by the cost of an investment is the most commonly used ratio. There are three main ways to calculate the ROI of real estate investments.

Source: pinterest.com

Source: pinterest.com

Projected Stabilized NOI Total Project Cost. Dividing the annual return by the total cash invested should do the trick. Return on equity takes into account the total gain cash flow appreciation etc as a percentage of the total equity net amount of cash received if property were sold. Return on Investment Annual Returns Cost of Investment. Debt Coverage Ratio DCR.

Source: pinterest.com

Source: pinterest.com

The total return on investment TROI provides a better and more complete measure of a propertys financial performance. The answer is by calculating the ROI of the investment property. Then simply take that number and divide it by the cost of investment to find the ROI. Total ROI BTCF Net Sales Proceeds Initial Cash Investment Initial Cash Investment. The simplest way to think about the ROI formula is taking some type of benefit and dividing it by the cost.

Source: youtube.com

Source: youtube.com

Then simply take that number and divide it by the cost of investment to find the ROI. Your return on investment is basically your total income gross income minus expenses and divide by your total investment represented by the equation below. You need to list the interest you pay each month in your expenses when you buy an investment property with a loan. Total ROI BTCF Net Sales Proceeds Initial Cash Investment Initial Cash Investment. The answer is by calculating the ROI of the investment property.

Source: pinterest.com

Source: pinterest.com

Return on investment is calculated by taking the monthly or annual cashflow of an asset and dividing it by the. Initial Capital Investment Cash on Cash Return. Then simply take that number and divide it by the cost of investment to find the ROI. The cash on cash return is calculated by the out-of-pocket method when calculating ROI in real estate with mortgage-financed transactions. Return on equity in real estate is a measure of the percentage return on a real estate property divided by the total equity.

Source: pinterest.com

Source: pinterest.com

The cash on cash return is calculated by the out-of-pocket method when calculating ROI in real estate with mortgage-financed transactions. Return on investment ROI measures how much money or profit is made on an investment as a percentage of the cost of that investment. R O I Net Return on Investment Cost of Investment 1 0 0 ROI fractextNet Return on InvestmenttextCost of Investmenttimes 100 R O I Cost of Investment Net. The rate of return formula for ROI is as follows. Return on investment is calculated by taking the monthly or annual cashflow of an asset and dividing it by the.

Source: pinterest.com

Source: pinterest.com

Lenders often modify the basic Gross Debt Service Ratio Formula. Gain Investment gain Cost Investment cost beginaligned textROI frac textGain - textCost textCost textbfwhere textGain. There are three main ways to calculate the ROI of real estate investments. As an example lets say the property you own is worth 350K and your rental income is 2000 per month. If you had no expenses for your property your return on.

Source: pinterest.com

Source: pinterest.com

You need to list the interest you pay each month in your expenses when you buy an investment property with a loan. Operating Expense Ratio OER OER expresses the ratio as a percentage between a real estate investments total operating expenses dollar amount to its gross operating income dollar amount. Gain Investment gain Cost Investment cost beginaligned textROI frac textGain - textCost textCost textbfwhere textGain. If you had no expenses for your property your return on. Your return on investment is basically your total income gross income minus expenses and divide by your total investment represented by the equation below.

Source: pinterest.com

Source: pinterest.com

As an example lets say the property you own is worth 350K and your rental income is 2000 per month. Return on equity takes into account the total gain cash flow appreciation etc as a percentage of the total equity net amount of cash received if property were sold. The ROI or return on investment is a valuable metric for all real estate investors. The first version of the ROI formula net income divided by the cost of an investment is the most commonly used ratio. The rate of return formula for ROI is as follows.

Source: pinterest.com

Source: pinterest.com

Return on cost is a crucial metric in the real estate development world. Return on equity in real estate is a measure of the percentage return on a real estate property divided by the total equity. ROI Investment Gain Investment Base. ROI Gain Cost Cost where. The total return on investment TROI provides a better and more complete measure of a propertys financial performance.

Source: investopedia.com

Source: investopedia.com

There are three main ways to calculate the ROI of real estate investments. Total ROI BTCF Net Sales Proceeds Initial Cash Investment Initial Cash Investment. Modified Gross Debt Service Ratio Principal Interest Taxes Heat of Maintenance. Gain Investment gain Cost Investment cost beginaligned textROI frac textGain - textCost textCost textbfwhere textGain. Return on cost is a crucial metric in the real estate development world.

Source: pinterest.com

Source: pinterest.com

To calculate your annual returns as a real estate investor you would take your monthly rental income and multiply it by 12. Gross income expenses. All smart investments are made to reap a return making this a fundamental real estate formula. Return on Equity ROE is a measure of the total return of your real estate investment not just cash flow divided by your total equity how much you would put in your pocket if you sold today. Projected Stabilized NOI Total Project Cost.

Source: pinterest.com

Source: pinterest.com

To calculate your annual returns as a real estate investor you would take your monthly rental income and multiply it by 12. Projected Stabilized NOI Total Project Cost. Gross income expenses. If you had no expenses for your property your return on. Return on Investment.

Source: pinterest.com

Source: pinterest.com

The simplest way to think about the ROI formula is taking some type of benefit and dividing it by the cost. Then simply take that number and divide it by the cost of investment to find the ROI. ROI Gain on Investment Cost of Investment Cost of Investment. Return on Investment. ROI Gain Cost Cost where.

Source: wallstreetmojo.com

Source: wallstreetmojo.com

Gross income expenses. R O I Net Return on Investment Cost of Investment 1 0 0 ROI fractextNet Return on InvestmenttextCost of Investmenttimes 100 R O I Cost of Investment Net. The ROI or return on investment is a valuable metric for all real estate investors. Then simply take that number and divide it by the cost of investment to find the ROI. Return on equity takes into account the total gain cash flow appreciation etc as a percentage of the total equity net amount of cash received if property were sold.

Source: airfocus.com

Source: airfocus.com

That is because it factors in amortization and appreciation gained over time. The ROI or return on investment is a valuable metric for all real estate investors. Return on Investment Annual Returns Cost of Investment. To calculate your annual returns as a real estate investor you would take your monthly rental income and multiply it by 12. If you had no expenses for your property your return on.

Source: pinterest.com

Source: pinterest.com

All smart investments are made to reap a return making this a fundamental real estate formula. To calculate your annual returns as a real estate investor you would take your monthly rental income and multiply it by 12. Total Return on Investment. R O I Net Return on Investment Cost of Investment 1 0 0 ROI fractextNet Return on InvestmenttextCost of Investmenttimes 100 R O I Cost of Investment Net. Return on Investment Annual Returns Cost of Investment.

Source: pinterest.com

Source: pinterest.com

The first version of the ROI formula net income divided by the cost of an investment is the most commonly used ratio. The ROI or return on investment is a valuable metric for all real estate investors. Debt Coverage Ratio DCR. Return on Investment ROI or Cash on Cash The ROI or cash on cash return is the most commonly utilized investment measurement in all of real estate. Initial Capital Investment Cash on Cash Return.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title basic equation for real estate return on investment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.