Your Basel iii high volatility commercial real estate images are available in this site. Basel iii high volatility commercial real estate are a topic that is being searched for and liked by netizens today. You can Find and Download the Basel iii high volatility commercial real estate files here. Get all free photos and vectors.

If you’re searching for basel iii high volatility commercial real estate images information related to the basel iii high volatility commercial real estate interest, you have pay a visit to the ideal blog. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly search and locate more enlightening video articles and images that fit your interests.

Basel Iii High Volatility Commercial Real Estate. High Volatility Commercial Real Estate HVCRE Examiner Job Aid Author. Banks is the super-capital charge for so-called High Volatility Commercial Real Estate HVCRE loans. To identify this effect we exploit variation in the loan terms. The concept of High Volatility Commercial Real Estate started gaining traction shortly after the financial crisis of 2007-2008.

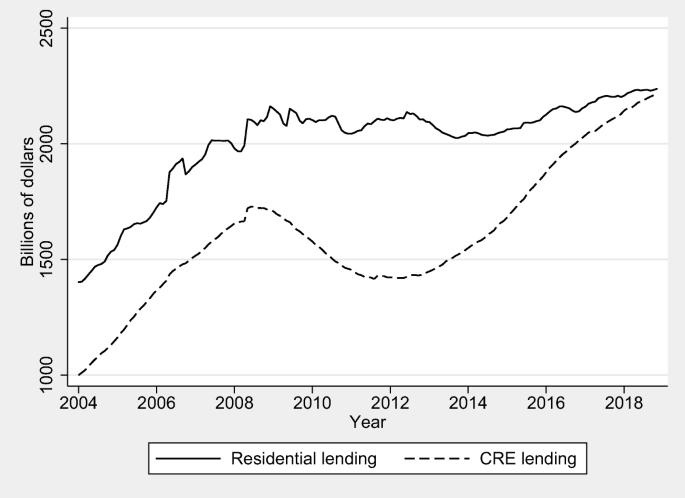

The HVCRE rules may affect the availability and pricing of commercial real estate mortgage capital. Banking regulators issued the Basel III Regulatory Capital and Market Risk Rules. Basel III imposes new rules for high volatility commercial real estate HVCRE which the regulations define as a credit facility that finances the acquisition development or construction ADC of real property. Basel III capital rules. It is expected that President Trump will soon sign the legislation. The concept of High Volatility Commercial Real Estate started gaining traction shortly after the financial crisis of 2007-2008.

Around that same time the.

Around that same time the Basel Committee on Banking Supervision was in the process of updating its bank capital requirements. Around that same time the. We welcome the statement that there are no restrictions on the type of eligible guarantors paragraph 445. In some member countries of the EU like Italy and France mutual guarantee societies play an. In the case of commercial real estate the term multi-purpose excludes many kinds of real estate that is used by businesses eg. The regulations under Basel III require banks to keep 50 percent more cash on hand when commercial real estate investors put less than 15 percent equity into a construction or acquisition deal.

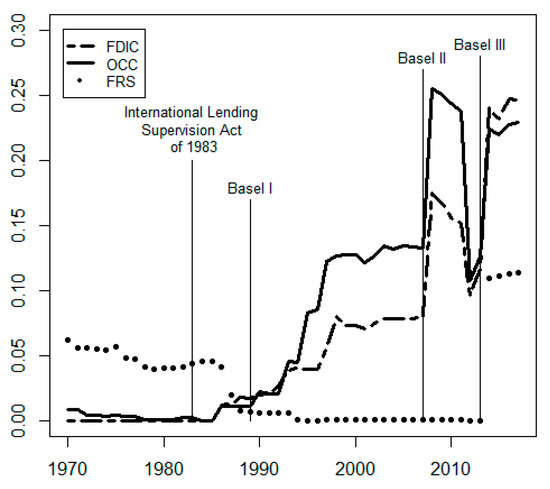

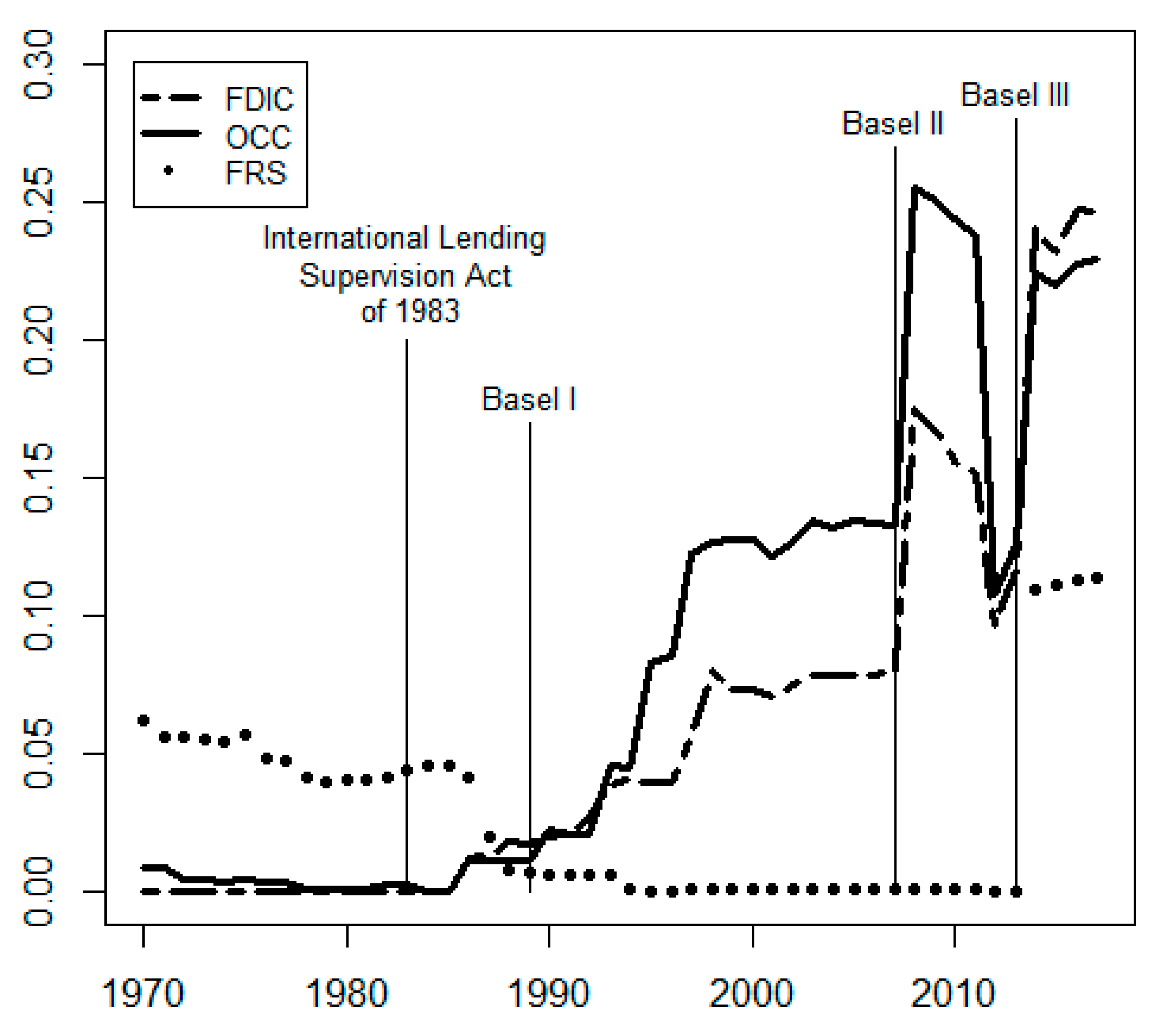

Source: link.springer.com

Source: link.springer.com

Finalising post-crisis reforms December 2017 Minimum capital requirements for market risk January 2016 revised January 2019 Liquidity Coverage Ratio January 2013 Net Stable Funding Ratio October 2014 Basel III. The HVCRE rules may affect the availability and pricing of commercial real estate mortgage capital. Effective January 1 2015 HVCRE loans carry a capital charge that is 50 percent higher than the capital charge for other commercial real estate loans. Basel III imposes new rules for high volatility commercial real estate HVCRE which the regulations define as a credit facility that finances the acquisition development or construction ADC of real property. Finalisation of the Basel III post-crisis regulatory reforms.

Source: link.springer.com

Source: link.springer.com

The regulatory capital rules BASEL III that went into effect January 1 2015 introduced the concept of High-Volatility Commercial Real Estate HVCRE and requires all loans that meet the definition of HVCRE to be reported separately from other CRE loans and assigned a risk weighting of 150 in. In some member countries of the EU like Italy and France mutual guarantee societies play an. Basel III Regulations. In July 2013 US. One of the lesser noticed changes in the new Basel III capital regime for US.

Source: slideshare.net

Source: slideshare.net

Finalising post-crisis reforms December 2017 Minimum capital requirements for market risk January 2016 revised January 2019 Liquidity Coverage Ratio January 2013 Net Stable Funding Ratio October 2014 Basel III. The regulations under Basel III require banks to keep 50 percent more cash on hand when commercial real estate investors put less than 15 percent equity into a construction or acquisition deal. In July 2013 US. The regulatory capital rules BASEL III that went into effect Jan. This classification is defined as a credit facility that finances or has financed the acquisition development or construction ADC of real property Previously the capital rules applied a risk weighting of 100 to all commercial real estate exposures.

Source: bis.org

Source: bis.org

To identify this effect we exploit variation in the loan terms. High Volatility Commercial Real Estate HVCRE Examiner Job Aid Author. It is expected that President Trump will soon sign the legislation. In July 2013 US. To identify this effect we exploit variation in the loan terms.

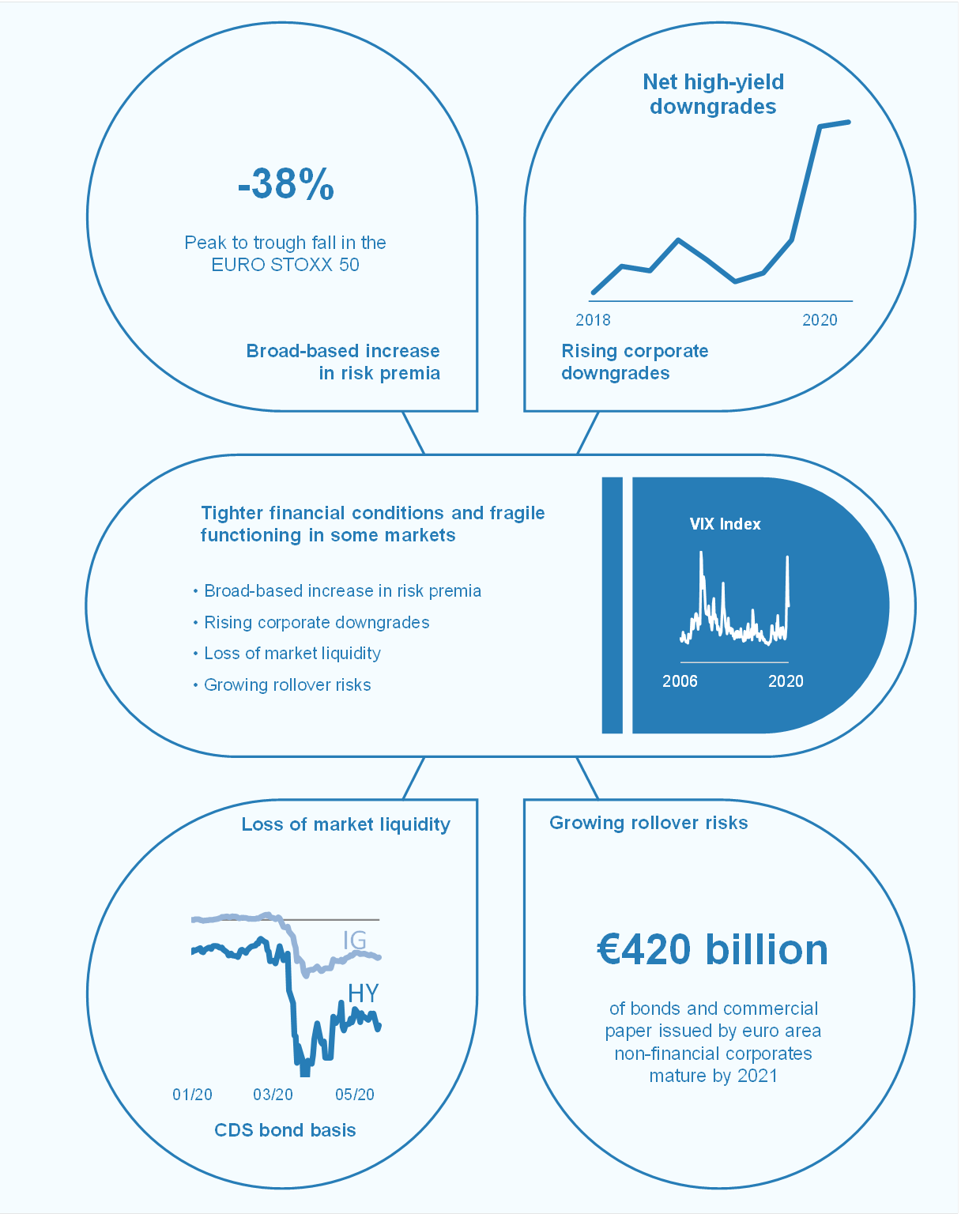

Source: ecb.europa.eu

Source: ecb.europa.eu

In July 2013 US. The concept of High Volatility Commercial Real Estate started gaining traction shortly after the financial crisis of 2007-2008. We welcome the statement that there are no restrictions on the type of eligible guarantors paragraph 445. Basel III capital rules. Recent attention on Basel III has focused on the increased risk weighting of certain High Volatility Commercial Real Estate Loans or HVCRE Loans and the corresponding increase in reserve requirements for banking organizations making such HVCRE Loans.

Source: hogantaylor.com

Source: hogantaylor.com

To identify this effect we exploit variation in the loan terms. Around that same time the. In the case of commercial real estate the term multi-purpose excludes many kinds of real estate that is used by businesses eg. Basel III imposes new rules for high volatility commercial real estate HVCRE which the regulations define as a credit facility that finances the acquisition development or construction ADC of real property. The regulations under Basel III require banks to keep 50 percent more cash on hand when commercial real estate investors put less than 15 percent equity into a construction or acquisition deal.

Source: link.springer.com

Source: link.springer.com

In the case of commercial real estate the term multi-purpose excludes many kinds of real estate that is used by businesses eg. To identify this effect we exploit variation in the loan terms. Basel III capital rules. One of the lesser noticed changes in the new Basel III capital regime for US. In July 2013 US.

Source: ecb.europa.eu

Source: ecb.europa.eu

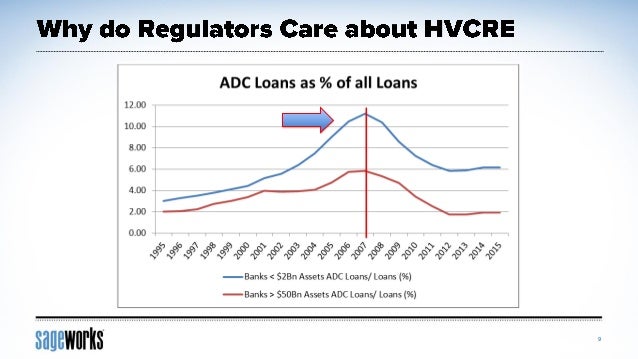

The guidance defines HVCRE as loans that finance the acquisition development or construction ADC of real property. Treatment of acquisition development and construction ADC loans characterized as high volatility commercial real estate HVCRE exposures under the US. In July 2013 US. High Volatility Commercial Real Estate HVCRE ADC Loans Meeting Certain Criteria 1-4 Family Residential Projects Secured by Properties for Agricultural Purposes Community Development Loans Less Total Acquisition Development or Construction ADC Loans HVCRE 150 Risk Weight 2 HVCRE means a credit facility that prior to conversion to permanent financing finances or has. The HVCRE rules may affect the availability and pricing of commercial real estate mortgage capital.

Basel II - EUROCHAMBRES. Finalising post-crisis reforms December 2017 Minimum capital requirements for market risk January 2016 revised January 2019 Liquidity Coverage Ratio January 2013 Net Stable Funding Ratio October 2014 Basel III. In July 2013 US. Around that same time the Basel Committee on Banking Supervision was in the process of updating its bank capital requirements. Recent attention on Basel III has focused on the increased risk weighting of certain High Volatility Commercial Real Estate Loans or HVCRE Loans and the corresponding increase in reserve requirements for banking organizations making such HVCRE Loans.

Source: slideshare.net

Source: slideshare.net

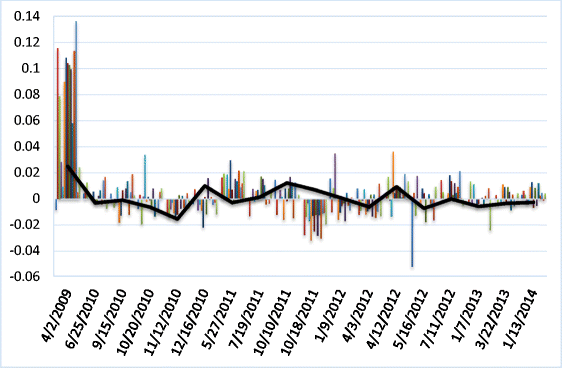

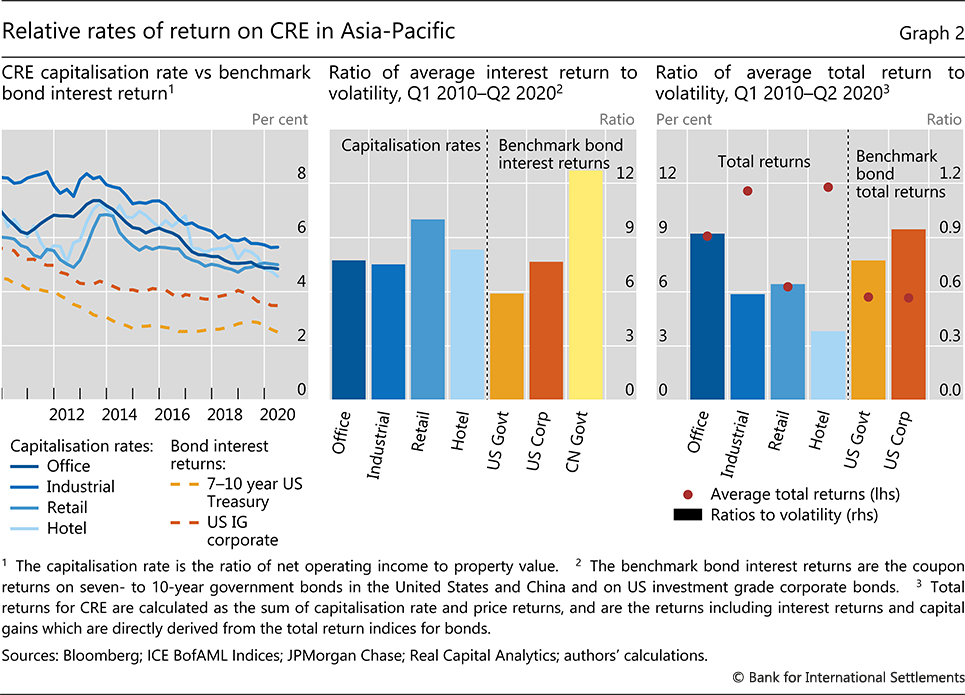

Evidence from High Volatility Commercial Real Estate David Glancy y 1and Robert Kurtzmanz 1Federal Reserve Board of Governors March 27 2018 Abstract We study how bank loan rates responded to a 50 increase in capital require-ments for a subcategory of construction lending High Volatility Commercial Real Es-tate HVCRE. High Volatility Commercial Real Estate HVCRE ADC Loans Meeting Certain Criteria 1-4 Family Residential Projects Secured by Properties for Agricultural Purposes Community Development Loans Less Total Acquisition Development or Construction ADC Loans HVCRE 150 Risk Weight 2 HVCRE means a credit facility that prior to conversion to permanent financing finances or has. On September 27 2017 the Board of Governors of the Federal Reserve System the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation Agencies issued a proposal Proposal that would amend some of the current Basel III capital rules foremost among them the heightened capital charge for so-called high volatility commercial real estate HVCRE. The regulatory capital rules BASEL III that went into effect Jan. Banks is the super-capital charge for so-called High Volatility Commercial Real Estate HVCRE loans.

Basel III imposes new rules for high volatility commercial real estate HVCRE which the regulations define as a credit facility that finances the acquisition development or construction ADC of real property. High Volatility Commercial Real Estate HVCRE ADC Loans Meeting Certain Criteria 1-4 Family Residential Projects Secured by Properties for Agricultural Purposes Community Development Loans Less Total Acquisition Development or Construction ADC Loans HVCRE 150 Risk Weight 2 HVCRE means a credit facility that prior to conversion to permanent financing finances or has. This classification is defined as a credit facility that finances or has financed the acquisition development or construction ADC of real property Previously the capital rules applied a risk weighting of 100 to all commercial real estate exposures. The regulatory capital rules BASEL III that went into effect Jan. Under the standardized approach for risk weighting bank assets the existing capital rules require ADC loans that are deemed to be.

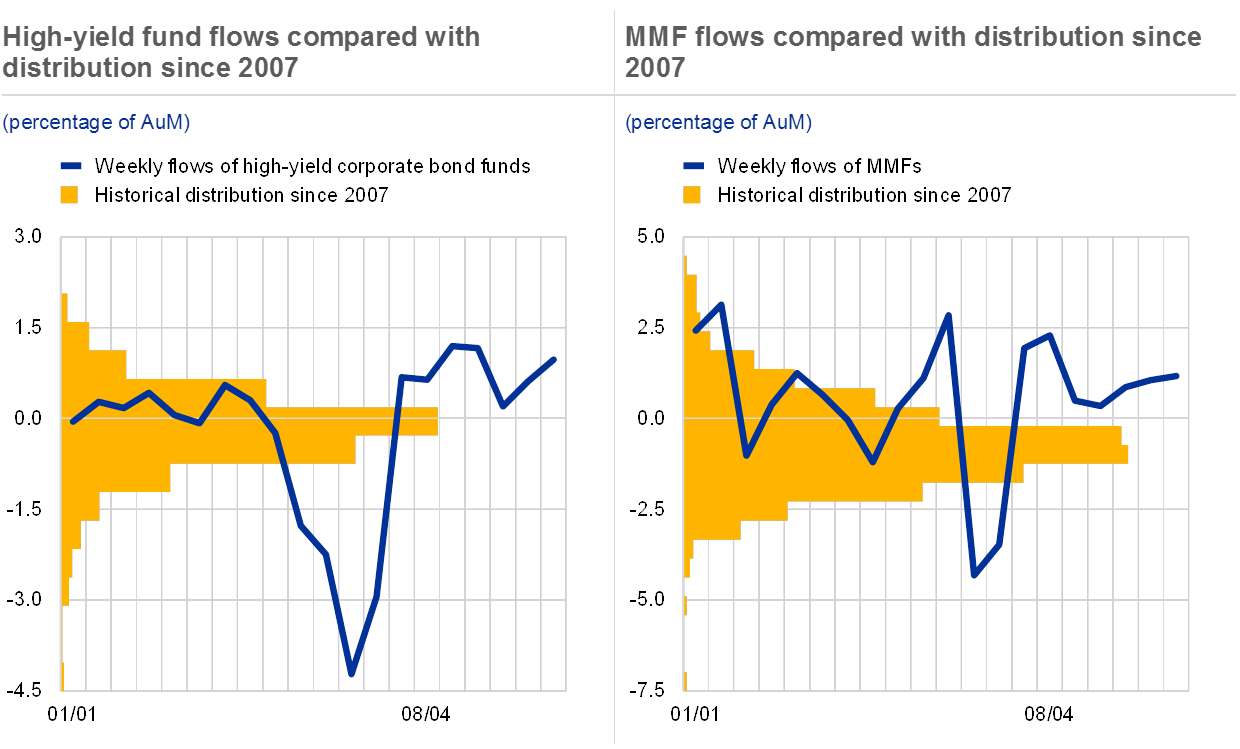

Source: ecb.europa.eu

Source: ecb.europa.eu

The concept of High Volatility Commercial Real Estate started gaining traction shortly after the financial crisis of 2007-2008. High Volatility Commercial Real Estate HVCRE ADC Loans Meeting Certain Criteria 1-4 Family Residential Projects Secured by Properties for Agricultural Purposes Community Development Loans Less Total Acquisition Development or Construction ADC Loans HVCRE 150 Risk Weight 2 HVCRE means a credit facility that prior to conversion to permanent financing finances or has. Recent attention on Basel III has focused on the increased risk weighting of certain High Volatility Commercial Real Estate Loans or HVCRE Loans and the corresponding increase in reserve requirements for banking organizations making such HVCRE Loans. Treatment of acquisition development and construction ADC loans characterized as high volatility commercial real estate HVCRE exposures under the US. One of the lesser noticed changes in the new Basel III capital regime for US.

Source: mdpi.com

Source: mdpi.com

Basel III imposes new rules for high volatility commercial real estate HVCRE which the regulations define as a credit facility that finances the acquisition development or construction ADC of real property. Banking regulators issued the Basel III Regulatory Capital and Market Risk Rules. Treatment of acquisition development and construction ADC loans characterized as high volatility commercial real estate HVCRE exposures under the US. 1 2015 introduced the concept of High-Volatility Commercial Real Estate HVCRE and raised questions among bankers and developers. Basel III imposes new rules for high volatility commercial real estate HVCRE which the regulations define as a credit facility that finances the acquisition development or construction ADC of real property.

Source: mdpi.com

Source: mdpi.com

New Basel III Rules for Loans to High Volatility Commercial Real Estate Projects by James I. On September 27 2017 the Board of Governors of the Federal Reserve System the Office of the Comptroller of the Currency and the Federal Deposit Insurance Corporation Agencies issued a proposal Proposal that would amend some of the current Basel III capital rules foremost among them the heightened capital charge for so-called high volatility commercial real estate HVCRE. Cohen on January 24 2017 The 2016 Winter Business Edition of Best Lawyers includes an article entitled Basel III and New Challenges for Lending to Commercial Development. That issuance included a High Volatility Commercial Real Estate HVCRE rule under which certain acquisition development and construction ADC loans are subject to a 150 percent risk weight. Under the standardized approach for risk weighting bank assets the existing capital rules require ADC loans that are deemed to be.

Source: gibsondunn.com

Source: gibsondunn.com

The concept of High Volatility Commercial Real Estate started gaining traction shortly after the financial crisis of 2007-2008. Banks is the super-capital charge for so-called High Volatility Commercial Real Estate HVCRE loans. The concept of High Volatility Commercial Real Estate started gaining traction shortly after the financial crisis of 2007-2008. Around that same time the. Beth Mattson-Teig Jan 13 2016 Banks are wading through the still murky issue of dealing with new Basel III rules related to high volatility commercial real estate HVCRE loans.

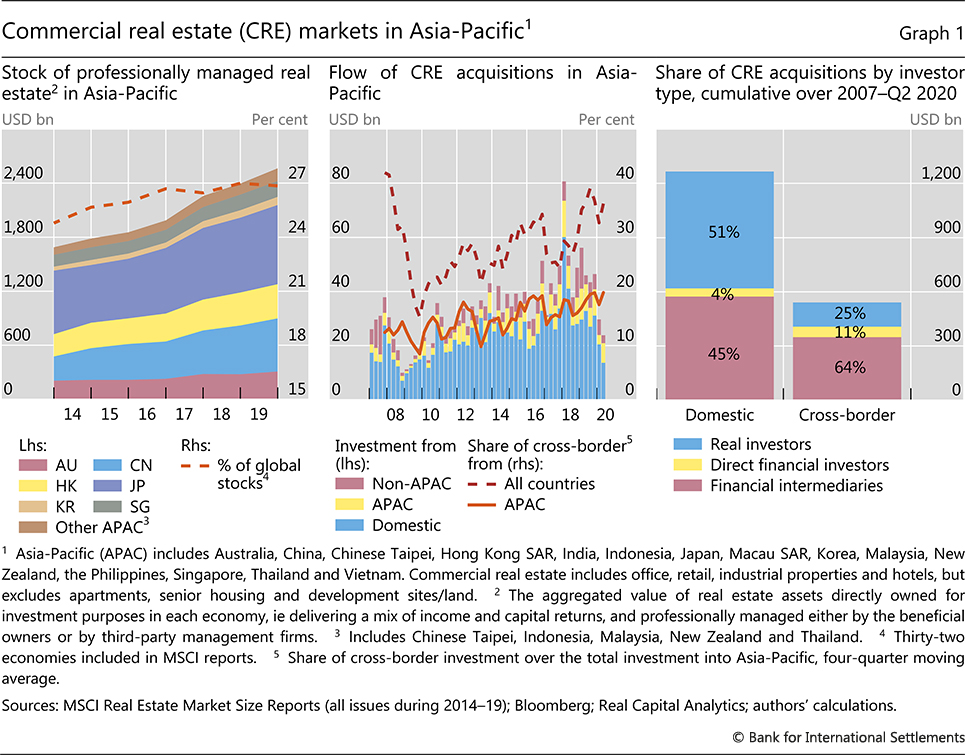

Source: bis.org

Source: bis.org

One of the lesser noticed changes in the new Basel III capital regime for US. One of the lesser noticed changes in the new Basel III capital regime for US. In July 2013 US. In some member countries of the EU like Italy and France mutual guarantee societies play an. Recent attention on Basel III has focused on the increased risk weighting of certain High Volatility Commercial Real Estate Loans or HVCRE Loans and the corresponding increase in reserve requirements for banking organizations making such HVCRE Loans.

Beth Mattson-Teig Jan 13 2016 Banks are wading through the still murky issue of dealing with new Basel III rules related to high volatility commercial real estate HVCRE loans. In some member countries of the EU like Italy and France mutual guarantee societies play an. The regulations under Basel III require banks to keep 50 percent more cash on hand when commercial real estate investors put less than 15 percent equity into a construction or acquisition deal. 1 2015 introduced the concept of High-Volatility Commercial Real Estate HVCRE and raised questions among bankers and developers. Evidence from High Volatility Commercial Real Estate David Glancy y 1and Robert Kurtzmanz 1Federal Reserve Board of Governors March 27 2018 Abstract We study how bank loan rates responded to a 50 increase in capital require-ments for a subcategory of construction lending High Volatility Commercial Real Es-tate HVCRE.

The HVCRE rules may affect the availability and pricing of commercial real estate mortgage capital. Treatment of acquisition development and construction ADC loans characterized as high volatility commercial real estate HVCRE exposures under the US. To identify this effect we exploit variation in the loan terms. The concept of High Volatility Commercial Real Estate started gaining traction shortly after the financial crisis of 2007-2008. Basel III imposes new rules for high volatility commercial real estate HVCRE which the regulations define as a credit facility that finances the acquisition development or construction ADC of real property.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title basel iii high volatility commercial real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.