Your Bank of the west commercial real estate loan rates images are available. Bank of the west commercial real estate loan rates are a topic that is being searched for and liked by netizens today. You can Find and Download the Bank of the west commercial real estate loan rates files here. Find and Download all free photos.

If you’re looking for bank of the west commercial real estate loan rates images information linked to the bank of the west commercial real estate loan rates topic, you have visit the ideal blog. Our site always gives you hints for seeking the highest quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

Bank Of The West Commercial Real Estate Loan Rates. This flexibility results in optimal utilization of your funds. Bank of the Wests Real Estate Finance team is mainly focused on developers and investors who are constructing acquiring or re-positioning real estate projects in the Western United States. In this case a 200000 commercial real estate loan will require a down payment between 30000 and 50000. The most sobering section of the July Federal Open Market Committee Minutes for me was the description and discussion on financial system stability.

Who Were The Top Ten Nbsp Nbsp Mortgage Nbsp Nbsp Lenders Last Year From tr.pinterest.com

Who Were The Top Ten Nbsp Nbsp Mortgage Nbsp Nbsp Lenders Last Year From tr.pinterest.com

Terms are available from 5 to 10 years with up to 30 years amortization. In this case a 200000 commercial real estate loan will require a down payment between 30000 and 50000. Lending professionals with working knowledge of the local real estate market. If you want to purchase land to grow your agribusiness or expand your operations a Farm Real Estate Loan can help you do it. Non-owner occupied property including apartments and mixed-use properties. This flexibility results in optimal utilization of your funds.

Available for a variety of needs including.

And the Fed doesnt stop. What stood out to us was continued broad-based weakness in loan demand. Non-owner occupied property including apartments and mixed-use properties. The most sobering section of the July Federal Open Market Committee Minutes for me was the description and discussion on financial system stability. Financial Stability Concerns On The Rise. Available for a variety of needs including.

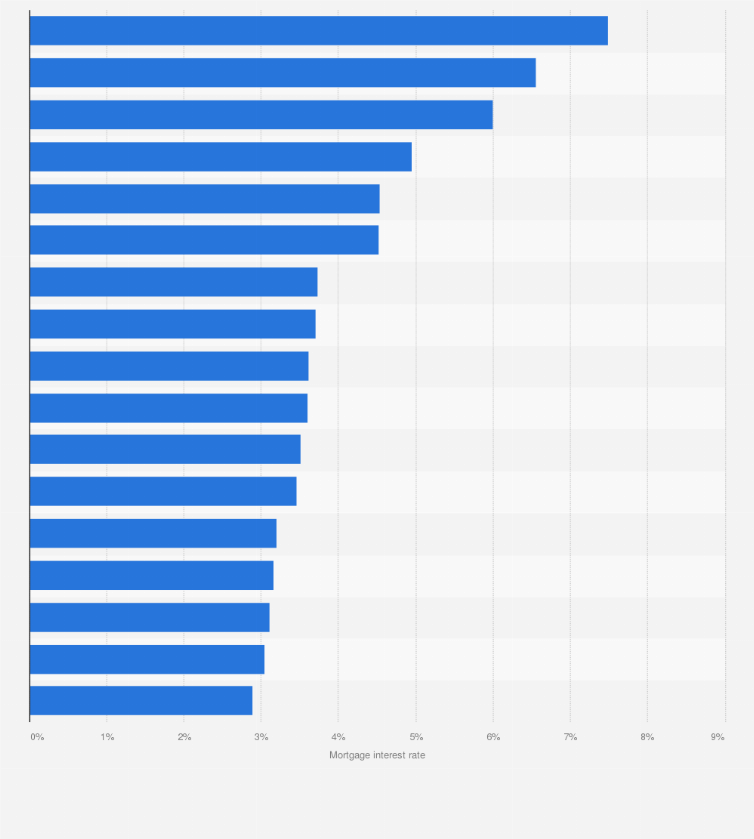

Source: statista.com

Source: statista.com

Lending professionals with working knowledge of the local real estate market. We are passionate about meeting the constantly evolving and complex needs of businesses. Repayment terms customized to fit your businesss unique needs. The most sobering section of the July Federal Open Market Committee Minutes for me was the description and discussion on financial system stability. Commercial real estate Bank of the West.

Source: pinterest.com

Source: pinterest.com

Repayment terms customized to fit your businesss unique needs. Are you ready to upgrade your business office or make an expansion to your existing location. Commercial Real Estate Loans Take the next step in setting up your business. Non-owner occupied property including apartments and mixed-use properties. Competitive rates for the purchase refinance or construction of commercial properties.

Source: pinterest.com

Source: pinterest.com

Fixed or variable interest rate. What stood out to us was continued broad-based weakness in loan demand. Competitive rates for the purchase refinance or construction of commercial properties. Lending professionals with working knowledge of the local real estate market. Balance converts to a fully-amortized loan at maturity.

Source: nl.pinterest.com

Source: nl.pinterest.com

We are passionate about meeting the constantly evolving and complex needs of businesses. And the Fed doesnt stop. This flexible term loan secured by farm land features. Are you ready to upgrade your business office or make an expansion to your existing location. What stood out to us was continued broad-based weakness in loan demand.

Source: pinterest.com

Source: pinterest.com

We understand that obtaining a real estate loan can be complex. This first mortgage secured by commercial real estate offers. Generally conventional commercial loans and SBA 7 a loans will require borrowers to make a down payment of 15 to 25. Amounts from 50000 to 2500000. Our local lenders have extensive experience in the real estate market and are ready to help see you.

Source: pinterest.com

Source: pinterest.com

No matter what type of commercial property you want to purchase develop or construct youll find the financing you need at Bank of the West. The post Financial Stability Concerns On The Rise appeared first on Bank of the West. Amounts from 50000 to 2500000. Commercial Real Estate Loans Take the next step in setting up your business. Our Commercial Real Estate Loan is designed to help business owners purchase or refinance.

Source: pinterest.com

Source: pinterest.com

Repayment terms customized to fit your businesss unique needs. Are you ready to upgrade your business office or make an expansion to your existing location. And the Fed doesnt stop. Our Commercial Real Estate Loan is designed to help business owners purchase or refinance. Local decision-making and processing.

Source: gr.pinterest.com

Source: gr.pinterest.com

We are passionate about meeting the constantly evolving and complex needs of businesses. The post Financial Stability Concerns On The Rise appeared first on Bank of the West. Commercial real estate Bank of the West. We offer a wide variety of interest rate indices for our floating and fixed-rate products. The amount of the discount 025 for Gold tier 035 for Platinum tier and 050 for Platinum Honors tier is based on the business.

Source: pinterest.com

Source: pinterest.com

Repayment terms customized to fit your businesss unique needs. This first mortgage secured by commercial real estate offers. Loan amounts from 10000 to 750000 to help you. This reminds me of the pre-financial crisis period before the Great Recession when investors couldnt get enough of CMBS and MBS in late 2006 and early 2007 and were bidding up prices when housing demand was already on a clear decline. Whether you need expedited turnaround on a loan for the purchase of a multi-family residential property or need an experienced lending partner for a ground-up commercial development project East West Bank can help you.

Source: pinterest.com

Source: pinterest.com

By Erica Gellerman updated February 19 2021. The most sobering section of the July Federal Open Market Committee Minutes for me was the description and discussion on financial system stability. Loan amounts from 10000 to 750000 to help you. Our deep industry expertise innovative treasury and financing solutions and international capabilities and connectivity through our parent company BNP Paribas 1 enable us to proactively support your business worldwide. Discounted interest rate if you choose an automatic payment option.

Source: pinterest.com

Source: pinterest.com

No matter what type of commercial property you want to purchase develop or construct youll find the financing you need at Bank of the West. In this case a 200000 commercial real estate loan will require a down payment between 30000 and 50000. Available for a variety of needs including. This flexible term loan secured by farm land features. This reminds me of the pre-financial crisis period before the Great Recession when investors couldnt get enough of CMBS and MBS in late 2006 and early 2007 and were bidding up prices when housing demand was already on a clear decline.

Source: mymortgageinsider.com

Source: mymortgageinsider.com

Let our knowledgeable bankers with decades of experience help you achieve your goal. This flexibility results in optimal utilization of your funds. Loans from 50000 to 2500000. Banks also reported weaker demand for auto loans credit cards and most categories of residential real estate loans. We are passionate about meeting the constantly evolving and complex needs of businesses.

Source: pinterest.com

Source: pinterest.com

In this case a 200000 commercial real estate loan will require a down payment between 30000 and 50000. Available for owner-occupied or investment properties. Terms are available from 5 to 10 years with up to 30 years amortization. The actual interest rate you secure depends on the type of loan you choose your qualifications as a borrower and the type of building or project youre financing. Non-revolving line with up to 12-month draw period with interest-only payments.

Strengths Choice of interest rate. The actual interest rate you secure depends on the type of loan you choose your qualifications as a borrower and the type of building or project youre financing. We are passionate about meeting the constantly evolving and complex needs of businesses. Loan amounts from 10000 to 750000 to help you. With our emphasis on relationships we provide financing 1 deposit 2 cash management and interest rate protection for midsize private developers to NYSE-traded REITs.

Source: pinterest.com

Source: pinterest.com

Let our knowledgeable bankers with decades of experience help you achieve your goal. No matter what type of commercial property you want to purchase develop or construct youll find the financing you need at Bank of the West. Balance converts to a fully-amortized loan at maturity. Our deep industry expertise innovative treasury and financing solutions and international capabilities and connectivity through our parent company BNP Paribas 1 enable us to proactively support your business worldwide. Prompt and local decisions by your local lender.

Source: pinterest.com

Source: pinterest.com

Competitive rates for purchase refinance or construction of commercial real estate. Whether you need expedited turnaround on a loan for the purchase of a multi-family residential property or need an experienced lending partner for a ground-up commercial development project East West Bank can help you. The average interest rate on a commercial real estate loan is about 22 to 18. The post Financial Stability Concerns On The Rise appeared first on Bank of the West. Available for owner-occupied or investment properties.

Source: statista.com

Source: statista.com

Our local lenders have extensive experience in the real estate market and are ready to help see you. Banks reported that demand for commercial industrial and commercial real estate loans weakened in the first quarter. Terms up to five years with principal and interest payments. Financial Stability Concerns On The Rise. We are passionate about meeting the constantly evolving and complex needs of businesses.

Source: de.pinterest.com

Source: de.pinterest.com

This first mortgage secured by commercial real estate offers. Prompt and local decisions by your local lender. Whether you need expedited turnaround on a loan for the purchase of a multi-family residential property or need an experienced lending partner for a ground-up commercial development project East West Bank can help you. Most loans are available at both variable and fixed rates of interest. We are passionate about meeting the constantly evolving and complex needs of businesses.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bank of the west commercial real estate loan rates by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.