Your Bangalore real estate prices going down images are available. Bangalore real estate prices going down are a topic that is being searched for and liked by netizens now. You can Get the Bangalore real estate prices going down files here. Find and Download all free images.

If you’re looking for bangalore real estate prices going down images information related to the bangalore real estate prices going down topic, you have come to the ideal site. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly surf and locate more enlightening video content and graphics that match your interests.

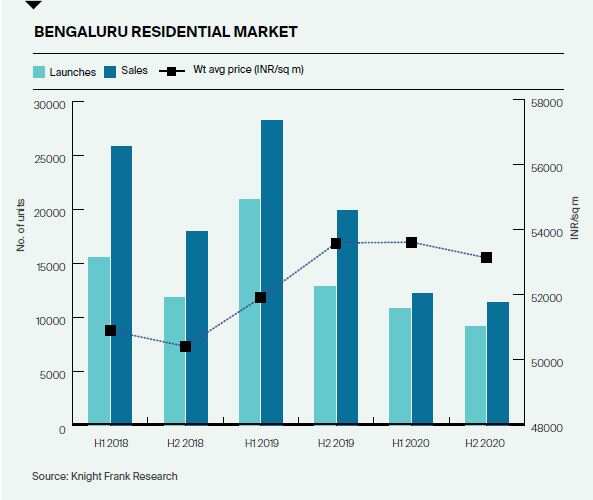

Bangalore Real Estate Prices Going Down. The housing sales recovery is strong as buyers are eager to purchase homes and properties that they had been eyeing during the shutdown. The second wave of COVID-19 would have little effect on the industry because after the first lockdown stage in AprilMay 2020 people realised the value of owning a home for themselves. A buyer can avail units of various configurations - 122534 and 5 BHKs apartments villas and row houses with utopian amenities which will make his life a tad bit easier. The Real Estate sector of this mega city has always been vibrant.

This is almost at a price point of Rs 30000 per sq ft which is comparable to a high-end property in Gurgaons Golf Course Road. A buyer can avail units of various configurations - 122534 and 5 BHKs apartments villas and row houses with utopian amenities which will make his life a tad bit easier. February 19 2018 After the change of government and new measures introduced to. In 2021 interest rates are expected to remain low but would increase gradually. They may come down by 10-20 across geographies while land prices could see an even higher reduction of 30 Pankaj Kapoor chief executive of real estate consultancy firm Liases Foras was quoted as saying. Get latest property rates in Bangalore for residential property plot flat bungalow villa with real estate price trends.

In terms of growth sales in Chennai witnessed maximum on-year growth of 31 followed by Pune at 24 Bangalore 19 Hyderabad 18 and Mumbai Metropolitan Region MMR 7.

The demand is high but the supply is limited also most of the builders have enormous capacity to hoard the properties despite the adverse economic conditions sooner or later the prices will correct. This is almost at a price point of Rs 30000 per sq ft which is comparable to a high-end property in Gurgaons Golf Course Road. A measure of real estate growth from one quarter to the next. As in the stock market crash predictions post the event this. Bengaluru may see residential property prices going up in the coming quarters by 15-20 percent even as demand picks up for both affordable and luxury segments in the city. The Real Estate sector of this mega city has always been vibrant.

Source: globalpropertyguide.com

Source: globalpropertyguide.com

A measure of real estate growth from one quarter to the next. Real estate activity has been going on at an unusual pace. Wages are stagnant high density real estate investors may lose everything first time buyers are disappearing from the market homeowners are holding onto their properties unnaturally and stimulus has to be discontinued. This is almost at a price point of Rs 30000 per sq ft which is comparable to a high-end property in Gurgaons Golf Course Road. The second wave of COVID-19 would have little effect on the industry because after the first lockdown stage in AprilMay 2020 people realised the value of owning a home for themselves.

Source: globalpropertyguide.com

Source: globalpropertyguide.com

Down 21 in real terms In Pune prices rose by 2 y-o-y to INR 4951 US68 per sq. Property prices may come down by 10-20 across geographies while land prices could see an even higher reduction of 30 said Pankaj Kapoor chief executive of real estate consultancy firm. While 2016-2019 period has seen a massive stagnation in property prices owing to the increase in supply during the boom in real estate during 2011-2014 period property investments should be evaluated with a larger time frame of 10-15 years to average out cyclical headwinds. The commercial segment in the city has been impacted as there was no new leasing In the last three months according to CREDAI Bengaluru president Kishore Jain. The Real Estate sector of this mega city has always been vibrant.

Source: tflguide.com

Source: tflguide.com

While 2016-2019 period has seen a massive stagnation in property prices owing to the increase in supply during the boom in real estate during 2011-2014 period property investments should be evaluated with a larger time frame of 10-15 years to average out cyclical headwinds. While 2016-2019 period has seen a massive stagnation in property prices owing to the increase in supply during the boom in real estate during 2011-2014 period property investments should be evaluated with a larger time frame of 10-15 years to average out cyclical headwinds. Home prices are bubbling to record highs while unemployment rages and stimulus holds together businesses. A buyer can avail units of various configurations - 122534 and 5 BHKs apartments villas and row houses with utopian amenities which will make his life a tad bit easier. The home prices will continue to appreciate double-digits.

Source: housing.com

Source: housing.com

This is almost at a price point of Rs 30000 per sq ft which is comparable to a high-end property in Gurgaons Golf Course Road. In 2021 interest rates are expected to remain low but would increase gradually. February 19 2018 After the change of government and new measures introduced to. Top localities in Bangalore include Koramangala where the average cost of a property is Rs 5820 per sq ft Rajaji Nagar where average prices are Rs 11100 per sq ft Ashok Nagar where property rates are Rs 22780 per sq ft and Malleshwaram where the average rate of a property is Rs. According to a recent industry report confirmed that India has received US34 billion in real estate as a part.

Source: proptiger.com

Source: proptiger.com

Bangalores flat prices in existing areas is stagnating or not going up as expected because new constructions are coming up every day in new areas. Down 21 in real terms In Pune prices rose by 2 y-o-y to INR 4951 US68 per sq. The demand is high but the supply is limited also most of the builders have enormous capacity to hoard the properties despite the adverse economic conditions sooner or later the prices will correct. Wages are stagnant high density real estate investors may lose everything first time buyers are disappearing from the market homeowners are holding onto their properties unnaturally and stimulus has to be discontinued. In Bangalore prices rose by 3 y-o-y to INR 5299 US72 per sq.

Source: indiatoday.in

Source: indiatoday.in

Property prices may come down by 10-20 across geographies while land prices could see an even higher reduction of 30 said Pankaj Kapoor chief executive of real estate consultancy firm. Property rates are not likely to go down. Home prices are bubbling to record highs while unemployment rages and stimulus holds together businesses. Property Rates in Bangalore - View Compare Property Prices Real Estate Trends for Properties for SaleRent across various localities in Bangalore on MagicBricks. Wages are stagnant high density real estate investors may lose everything first time buyers are disappearing from the market homeowners are holding onto their properties unnaturally and stimulus has to be discontinued.

Source: 99acres.com

Source: 99acres.com

Down 4 in real terms. Bangalores flat prices in existing areas is stagnating or not going up as expected because new constructions are coming up every day in new areas. As in the stock market crash predictions post the event this. The demand is high but the supply is limited also most of the builders have enormous capacity to hoard the properties despite the adverse economic conditions sooner or later the prices will correct. Not directly because of COVID-19 but because of the related constraints imposed on the.

Source: wgbis.ces.iisc.ernet.in

Source: wgbis.ces.iisc.ernet.in

Water scarcity in Bangalore is a seasonal problem and nearly all other suburbs in other big Indian cities have that problem. Top localities in Bangalore include Koramangala where the average cost of a property is Rs 5820 per sq ft Rajaji Nagar where average prices are Rs 11100 per sq ft Ashok Nagar where property rates are Rs 22780 per sq ft and Malleshwaram where the average rate of a property is Rs. Real estate activity has been going on at an unusual pace. If you have postponed buying property in Bangalore just because you think that the rates will come down think again. Recently we reported that India and more specifically Bangalore is going to attract huge investment in real estate sector.

Source: cz.pinterest.com

Source: cz.pinterest.com

According to a recent industry report confirmed that India has received US34 billion in real estate as a part. The prices of real estate in Bangalore are overprized. Wages are stagnant high density real estate investors may lose everything first time buyers are disappearing from the market homeowners are holding onto their properties unnaturally and stimulus has to be discontinued. We do not expect a drastic drop in real estate prices as a result of the second wave but there will be some domino effects. Home prices are bubbling to record highs while unemployment rages and stimulus holds together businesses.

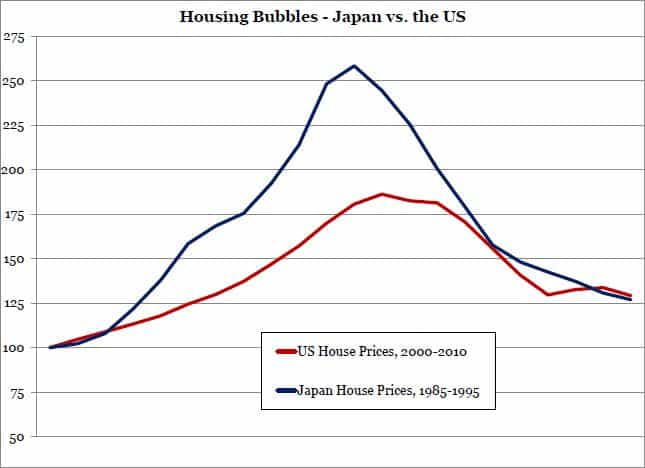

Source: safalniveshak.com

Source: safalniveshak.com

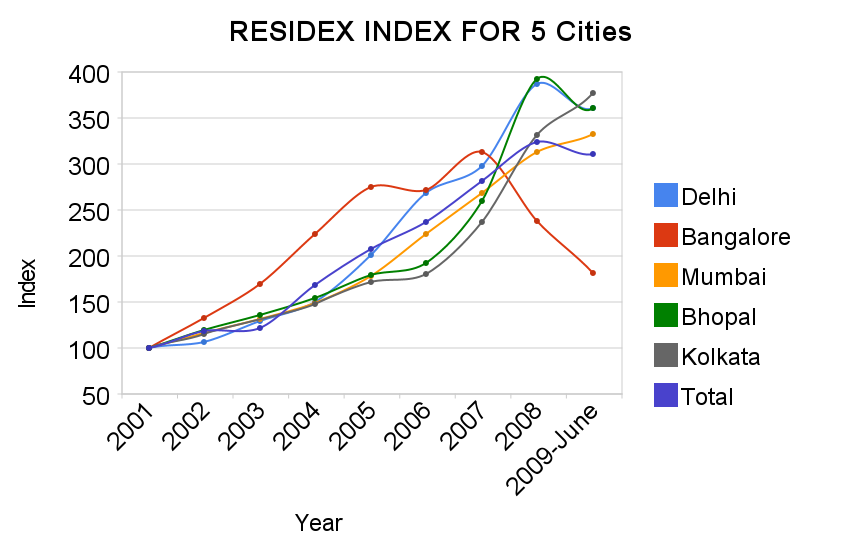

With uncertainty around prices looming large across markets Bangalore 5 and Pune 2 have witnessed the least reduction in prices during the lockdown compared to markets like Hyderabad and Ahmedabad which saw decent price increments in the last one year but now have been majorly impacted during the COVID-19 crisis. A buyer can avail units of various configurations - 122534 and 5 BHKs apartments villas and row houses with utopian amenities which will make his life a tad bit easier. Down 4 in real terms. Real estate activity has been going on at an unusual pace. Prices in most markets have held steady despite the lending and shadow banking crises.

Source: jagoinvestor.com

Source: jagoinvestor.com

The prices of real estate in Bangalore are overprized. In terms of growth sales in Chennai witnessed maximum on-year growth of 31 followed by Pune at 24 Bangalore 19 Hyderabad 18 and Mumbai Metropolitan Region MMR 7. Search This Blog Will prices of Real Estate go down in Bangalore. Recently we reported that India and more specifically Bangalore is going to attract huge investment in real estate sector. Home prices are bubbling to record highs while unemployment rages and stimulus holds together businesses.

Source: in.pinterest.com

Source: in.pinterest.com

Down 3 in real terms In Mumbai Metropolitan Region MMR the average house price rose by 1 y-o-y to INR 9490 US130 per sq. A measure of real estate growth from one quarter to the next. We do not expect a drastic drop in real estate prices as a result of the second wave but there will be some domino effects. Home prices are bubbling to record highs while unemployment rages and stimulus holds together businesses. In Bangalore prices rose by 3 y-o-y to INR 5299 US72 per sq.

Property rates are not likely to go down. Wages are stagnant high density real estate investors may lose everything first time buyers are disappearing from the market homeowners are holding onto their properties unnaturally and stimulus has to be discontinued. Prices in most markets have held steady despite the lending and shadow banking crises. Bangalores flat prices in existing areas is stagnating or not going up as expected because new constructions are coming up every day in new areas. A measure of real estate growth from one quarter to the next.

While 2016-2019 period has seen a massive stagnation in property prices owing to the increase in supply during the boom in real estate during 2011-2014 period property investments should be evaluated with a larger time frame of 10-15 years to average out cyclical headwinds. 27 Apr 2021 1229 PM IST. A buyer can avail units of various configurations - 122534 and 5 BHKs apartments villas and row houses with utopian amenities which will make his life a tad bit easier. While 2016-2019 period has seen a massive stagnation in property prices owing to the increase in supply during the boom in real estate during 2011-2014 period property investments should be evaluated with a larger time frame of 10-15 years to average out cyclical headwinds. In 2021 interest rates are expected to remain low but would increase gradually.

Source: quora.com

Source: quora.com

In Bangalore prices rose by 3 y-o-y to INR 5299 US72 per sq. The demand is high but the supply is limited also most of the builders have enormous capacity to hoard the properties despite the adverse economic conditions sooner or later the prices will correct. While 2016-2019 period has seen a massive stagnation in property prices owing to the increase in supply during the boom in real estate during 2011-2014 period property investments should be evaluated with a larger time frame of 10-15 years to average out cyclical headwinds. Property rates are not likely to go down. If the conditions in Europe get worse then the real estate bubble will burst.

Source: dsmaxproperties.com

Source: dsmaxproperties.com

The demand is high but the supply is limited also most of the builders have enormous capacity to hoard the properties despite the adverse economic conditions sooner or later the prices will correct. Top localities in Bangalore include Koramangala where the average cost of a property is Rs 5820 per sq ft Rajaji Nagar where average prices are Rs 11100 per sq ft Ashok Nagar where property rates are Rs 22780 per sq ft and Malleshwaram where the average rate of a property is Rs. Down 3 in real terms In Mumbai Metropolitan Region MMR the average house price rose by 1 y-o-y to INR 9490 US130 per sq. Get latest property rates in Bangalore for residential property plot flat bungalow villa with real estate price trends. Bangalores flat prices in existing areas is stagnating or not going up as expected because new constructions are coming up every day in new areas.

Source: housing.com

Source: housing.com

A measure of real estate growth from one quarter to the next. As in the stock market crash predictions post the event this. They may come down by 10-20 across geographies while land prices could see an even higher reduction of 30 Pankaj Kapoor chief executive of real estate consultancy firm Liases Foras was quoted as saying. Prices in most markets have held steady despite the lending and shadow banking crises. Wages are stagnant high density real estate investors may lose everything first time buyers are disappearing from the market homeowners are holding onto their properties unnaturally and stimulus has to be discontinued.

A buyer can avail units of various configurations - 122534 and 5 BHKs apartments villas and row houses with utopian amenities which will make his life a tad bit easier. Real estate activity has been going on at an unusual pace. With uncertainty around prices looming large across markets Bangalore 5 and Pune 2 have witnessed the least reduction in prices during the lockdown compared to markets like Hyderabad and Ahmedabad which saw decent price increments in the last one year but now have been majorly impacted during the COVID-19 crisis. Wages are stagnant high density real estate investors may lose everything first time buyers are disappearing from the market homeowners are holding onto their properties unnaturally and stimulus has to be discontinued. The commercial segment in the city has been impacted as there was no new leasing In the last three months according to CREDAI Bengaluru president Kishore Jain.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title bangalore real estate prices going down by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.