Your Baltimore city real estate tax bills images are available in this site. Baltimore city real estate tax bills are a topic that is being searched for and liked by netizens today. You can Download the Baltimore city real estate tax bills files here. Download all free photos.

If you’re searching for baltimore city real estate tax bills pictures information connected with to the baltimore city real estate tax bills topic, you have visit the right blog. Our website always provides you with hints for refferencing the highest quality video and picture content, please kindly surf and find more informative video content and graphics that fit your interests.

Baltimore City Real Estate Tax Bills. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year. Since the Comptrollers Office does not process property tax. If an owners appeal is successful then the City. In Fiscal Year 2020 the tax rate for homeowners in owner-occupied properties has been reduced by an estimated 20 cents per 100 of assessed property value.

Office Of The Register Of Wills Baltimore City From registers.maryland.gov

Office Of The Register Of Wills Baltimore City From registers.maryland.gov

We realize that some people are uncomfortable having. By law Baltimore County must send the property tax bill each year to the registered owner of the property on file and to the billing address on file with SDAT. The Citys real property tax rate for fiscal year 2018 July 1 2017 to June 30 2018 is 2248 per 100 of assessed value the same as the prior fiscal years rate. The Maryland Department of Assessments and Taxation administers and enforces the property assessment and property tax laws of Maryland. The tax levies are based on property assessments determined by the Maryland Department of Assessments and TaxationSDAT. The Munis Self Service Portal for HotelMotel Taxes Parking GarageLot Taxes and Short Term Rental Registration will be temporarily shut down for scheduled system maintenance beginning Friday.

They are due when issued but the City allows a discount of ½ percent if paid on or before July 31.

The current State tax rate is 112 per 100 of assessed value. They are a valuable tool for the real estate. The Citys real property tax rate for fiscal year 2018 July 1 2017 to June 30 2018 is 2248 per 100 of assessed value the same as the prior fiscal years rate. Ambulance Bills Civil Citation Environmental Control Bills and. Does the City offer discounts if I pay my property taxes early. Interest starts to accrue at the rate of one percent per month until the bill.

Source: simple.wikipedia.org

Source: simple.wikipedia.org

Houses 2 days ago The Citys real property tax rate for fiscal year 2018 July 1 2017 to June 30 2018 is 2248 per 100 of assessed value the same as the prior fiscal years rate. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year. Yes there is a 05 discount of the City Tax if the bill is paid by July 31. Call your mortgage company and ask if they need your bill to pay the taxes. If an owners appeal is successful then the City.

Source: bestplaces.net

Source: bestplaces.net

These records can include Baltimore property tax assessments and assessment challenges appraisals and income taxes. Interest starts to accrue at the rate of one percent per month until the bill. Baltimore Property Records are real estate documents that contain information related to real property in Baltimore Maryland. Ambulance Bills Civil Citation Environmental Control Bills and. They are a valuable tool for the real estate.

Source: dhs.maryland.gov

Source: dhs.maryland.gov

An assessment is based on an appraisal of the fair market value of the property. Of gross receipts on taxable activities. Of gross receipts Admissions. Yes there is a 05 discount of the City Tax if the bill is paid by July 31. The State of Maryland charges all property owners 0112 for every 100 of assessed property value.

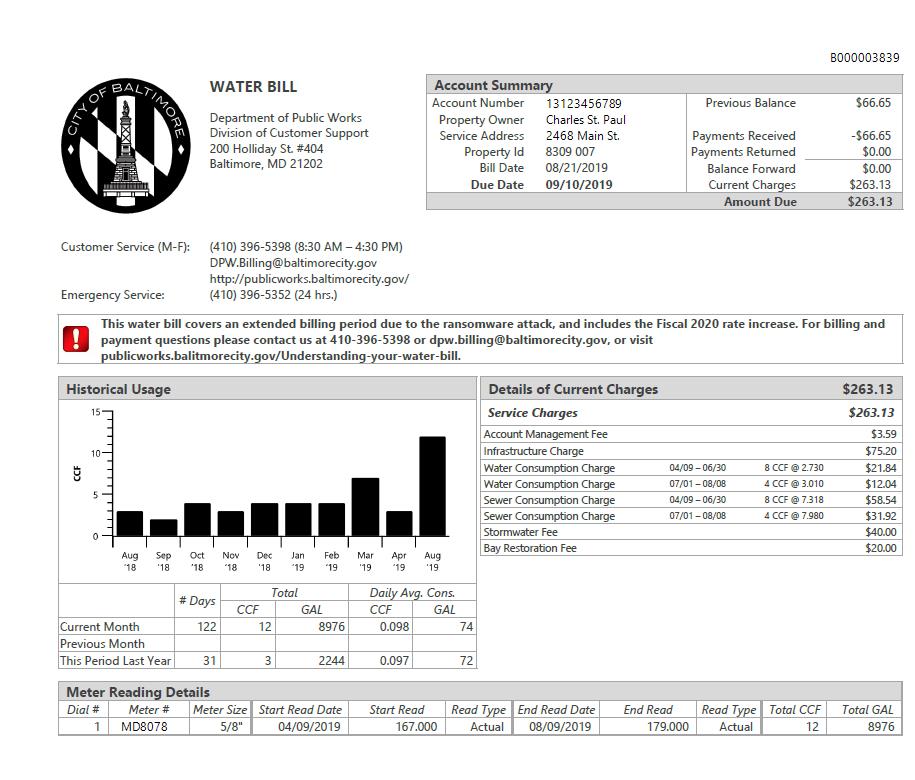

Source: publicworks.baltimorecity.gov

Source: publicworks.baltimorecity.gov

Real property tax bills are due when rendered and are considered delinquent on October 1. Baltimore County law requires that the tax bill be sent directly to the property owner. If you pay your taxes through a mortgage escrow account you should notify your mortgage company any time you receive a bill of the amount due and the due dates. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Since the Comptrollers Office does not process property tax.

Source: baltimoresun.com

Source: baltimoresun.com

The existence of a pending assessment appeal does not excuse non-payment. The Munis Self Service Portal for HotelMotel Taxes Parking GarageLot Taxes and Short Term Rental Registration will be temporarily shut down for scheduled system maintenance beginning Friday. They are a valuable tool for the real estate. This will help to ensure that your bill is paid in the time and manner you agreed to. Does the City offer discounts if I pay my property taxes early.

Source: comptroller.baltimorecity.gov

Source: comptroller.baltimorecity.gov

If you pay your taxes through a mortgage escrow account you should notify your mortgage company any time you receive a bill of the amount due and the due dates. Real property tax bills are due when rendered and are considered delinquent on October 1. Property tax bills are issued in JulyAugust of each year by Marylands 23 counties and Baltimore City as well as the 155 incorporated municipalities in Maryland. They are due when issued but the City allows a discount of ½ percent if paid on or before July 31. Real Property Miscellaneous Bills Part Year Bills Personal Property and Alley Footway and Street Scape Bills City of Baltimore Bureau of Revenue Collections PO.

Source: publicworks.baltimorecity.gov

Source: publicworks.baltimorecity.gov

Interest of 1 percent and penalty of 1 percent per month are imposed if the City taxes are not paid before October 1. Call your mortgage company and ask if they need your bill to pay the taxes. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year. Ambulance Bills Civil Citation Environmental Control Bills and. Interest of 1 percent and penalty of 1 percent per month are imposed if the City taxes are not paid before October 1.

Source: southernmanagement.com

Source: southernmanagement.com

The County sends tax bills to the owners address supplied by the State Department of Assessments and Taxation. Baltimore Property Records are real estate documents that contain information related to real property in Baltimore Maryland. Non-owner-occupied properties are charged 2248 for every 100 of assessed property value by the City of Baltimore. Baltimore Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Baltimore Maryland. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year.

Source: pinterest.com

Source: pinterest.com

Does the City offer discounts if I pay my property taxes early. They are maintained by various government offices in Baltimore Maryland State and at the Federal level. We realize that some people are uncomfortable having. Baltimore County law requires that the tax bill be sent directly to the property owner. Ambulance Bills Civil Citation Environmental Control Bills and.

Source: parking.baltimorecity.gov

Source: parking.baltimorecity.gov

The Munis Self Service Portal for HotelMotel Taxes Parking GarageLot Taxes and Short Term Rental Registration will be temporarily shut down for scheduled system maintenance beginning Friday. In Fiscal Year 2020 the tax rate for homeowners in owner-occupied properties has been reduced by an estimated 20 cents per 100 of assessed property value. Per square foot of billboard. What is the Citys real property tax rate. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year.

Source: transportation.baltimorecity.gov

Source: transportation.baltimorecity.gov

Assessments are certified by the Department to local governments where they are converted into property tax bills by applying the appropriate property tax rates. Real property tax bills are due when rendered and are considered delinquent on October 1. Does the City offer discounts if I pay my property taxes early. If an owners appeal is successful then the City. Per 500 of actual consideration paid.

Source: publicworks.baltimorecity.gov

Source: publicworks.baltimorecity.gov

Assessments are certified by the Department to local governments where they are converted into property tax bills by applying the appropriate property tax rates. The City mails real property tax bills on July 1 each year. What is the Citys real property tax rate. Since the Comptrollers Office does not process property tax. By law Baltimore County must send the property tax bill each year to the registered owner of the property on file and to the billing address on file with SDAT.

Source: publicworks.baltimorecity.gov

Source: publicworks.baltimorecity.gov

Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year. They are a valuable tool for the real estate. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Real Property FAQ Baltimore City Department of Finance. They are due when issued but the City allows a discount of ½ percent if paid on or before July 31.

Source: bestplaces.net

Source: bestplaces.net

With some limited exceptions the County is required by law to provide this data to anyone who requests it. Ambulance Bills Civil Citation Environmental Control Bills and. Real Property Miscellaneous Bills Part Year Bills Personal Property and Alley Footway and Street Scape Bills City of Baltimore Bureau of Revenue Collections PO. This will help to ensure that your bill is paid in the time and manner you agreed to. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Source: baltimoresun.com

Source: baltimoresun.com

The tax levies are based on property assessments determined by the Maryland Department of Assessments and TaxationSDAT. A major part of the Real and Personal Property Tax Payment System involves the dissemination of information regarding real property attributes and ownership. Per square foot of billboard. Does the City offer discounts if I pay my property taxes early. Of gross receipts from lots and garages.

Source: parking.baltimorecity.gov

Source: parking.baltimorecity.gov

Through its real property tax bills the City also collects the States real property tax and remits it to the State. They are maintained by various government offices in Baltimore Maryland State and at the Federal level. Per square foot of billboard. By law Baltimore County must send the property tax bill each year to the registered owner of the property on file and to the billing address on file with SDAT. Does the City offer discounts if I pay my property taxes early.

Source: baltimorecitycouncil.com

Source: baltimorecitycouncil.com

The County sends tax bills to the owners address supplied by the State Department of Assessments and Taxation. They are maintained by various government offices in Baltimore Maryland State and at the Federal level. The Department of Assessments and Taxation must appraise each of these properties once every three years. Call your mortgage company and ask if they need your bill to pay the taxes. Real Property Miscellaneous Bills Part Year Bills Personal Property and Alley Footway and Street Scape Bills City of Baltimore Bureau of Revenue Collections PO.

Source: marylandreporter.com

Source: marylandreporter.com

Baltimore Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Baltimore Maryland. The tax levies are based on property assessments determined by the Maryland Department of Assessments and TaxationSDAT. Certain types of Tax Records are available to the general public while some Tax Records are only available by. Property tax bills are issued in JulyAugust of each year by Marylands 23 counties and Baltimore City as well as the 155 incorporated municipalities in Maryland. Marylands 23 counties Baltimore City and 155 incorporated cities issue property tax bills during July and August each year.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title baltimore city real estate tax bills by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.