Your Automated valuation model for commercial real estate images are available in this site. Automated valuation model for commercial real estate are a topic that is being searched for and liked by netizens today. You can Find and Download the Automated valuation model for commercial real estate files here. Get all free photos and vectors.

If you’re searching for automated valuation model for commercial real estate pictures information connected with to the automated valuation model for commercial real estate interest, you have come to the ideal site. Our website always gives you suggestions for viewing the highest quality video and picture content, please kindly hunt and find more enlightening video articles and images that fit your interests.

Automated Valuation Model For Commercial Real Estate. What is an Automated Valuation Model. Multi-layer neural network fed by a wide variety of. In the simplest terms an Automated Valuation Model also referred to as AVM is a term used to describe a service that leverages a mathematical model to provide a real estate property value. AVMs are more efficient and consistent than a.

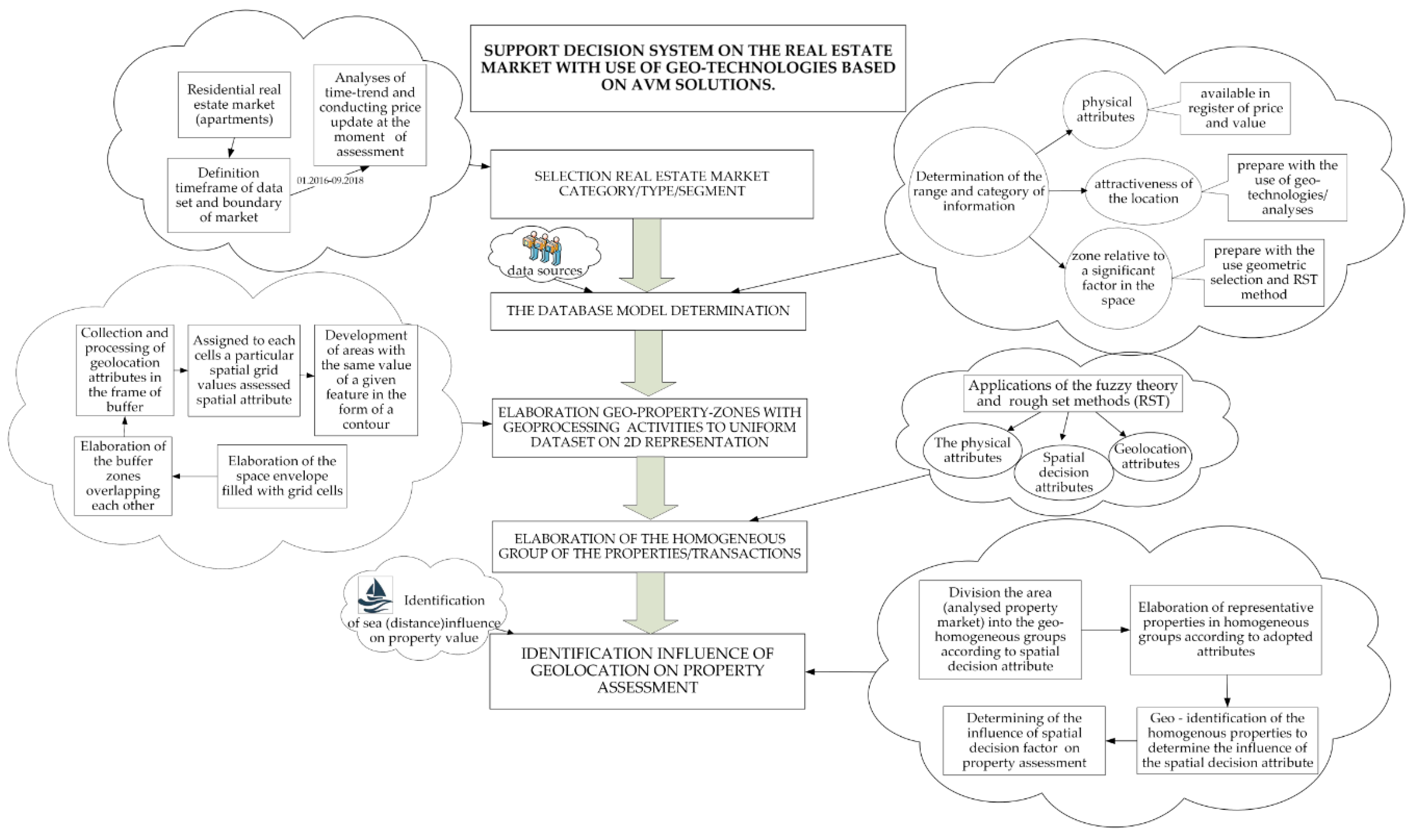

Automated Valuation Model Based On Fuzzy And Rough Set Theory For Real Estate Market With Insufficient Source Data Sciencedirect From sciencedirect.com

Automated Valuation Model Based On Fuzzy And Rough Set Theory For Real Estate Market With Insufficient Source Data Sciencedirect From sciencedirect.com

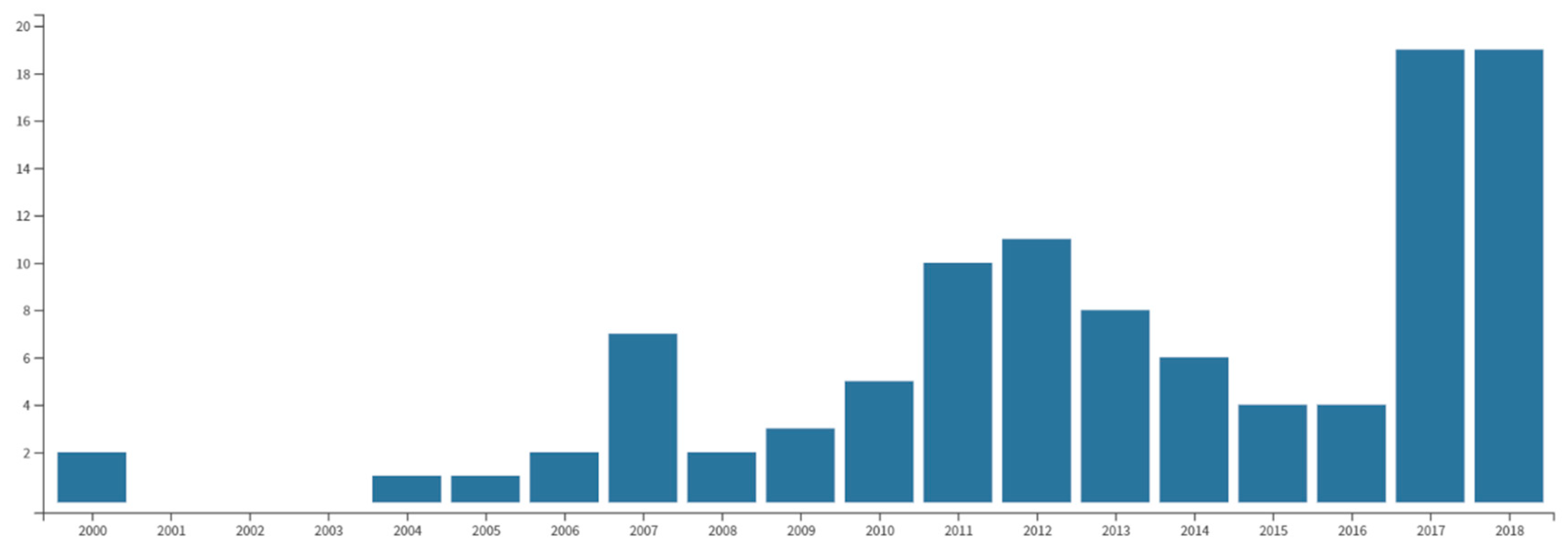

Automated Valuation Models AVM Introduced in the US in the 1980s and the UK in the 1990s AVMs are machine learning platforms that use powerful algorithms to analyse large amounts of comparable property data including historical property prices socio-economic statistics and other commercial indicators that can affect property valuations to value a certain property at a certain. Automated valuation models AVM are clearly beating traditional appraisalsthe absolute error of the automated model is 9 percent which compares favourably against the accuracy of traditional appraisals while the model can produce an instant value at every moment in time at a very low cost. The real estate website uses AVMs to provide additional information to their consumers. That way if we know a space was on the market but we dont have the comp for that. What is an Automated Valuation Model. These templates can be used to find out the value of any commercial property.

As Michael said creating an automatic valuation model requires incredibly complete data.

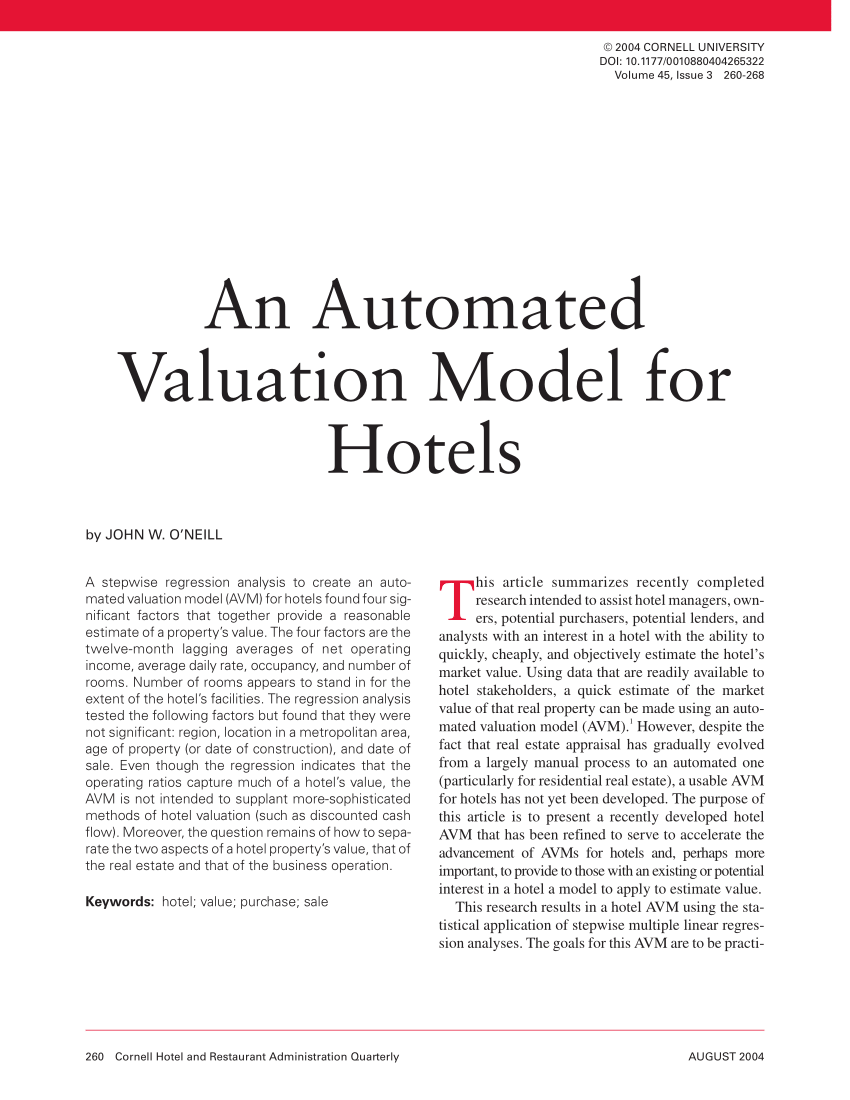

This article is about an automated valuation model for commercial real estate. Automated valuation models have been in use in the residential field for a number of years. This means that they have to do some inference for information that they dont know. A high performance AVM designed to help quickly assess home or portfolio valuation and enhance the quality of risk management decisions. Multi-layer neural network fed by a wide variety of. An AVM is a tool designed to perform the same function that manual appraisals do establish the value of the building.

These templates can be used to find out the value of any commercial property. Automated valuation for. The RVM or Realtors Valuation Model is an automated valuation model developed by the National Association of Realtors for use in its Realtors Property Resource. May 12 2020. Sep 5 2018 3 min read.

Source: asperbrothers.com

Source: asperbrothers.com

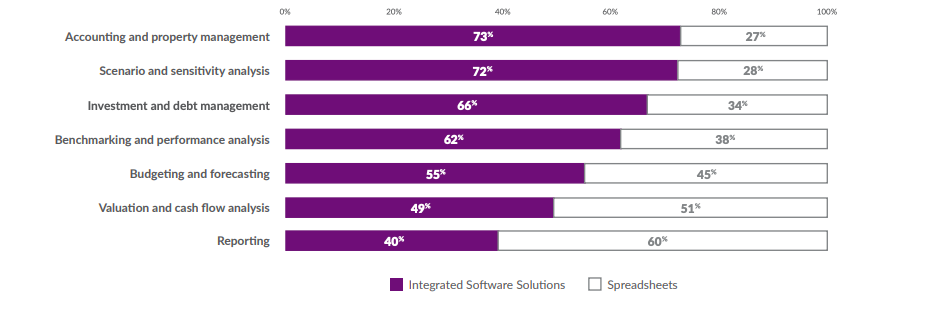

Multi-layer neural network fed by a wide variety of. The commercial real estate industry has yet to see an uptake of machine learning automated valuation models. Automated Valuation Models for Commercial Real Estate - GeoPhy Automated Valuation Models for Commercial Real Estate Automated Valuation Models AVMs typically use advanced analytics such as machine-learning models to predict a given propertys current or future value. What is an Automated Valuation Model. AVMs are more efficient and consistent than a.

Source: geophy.com

Source: geophy.com

The RVM produces home appraisal estimates in markets across the United States to help Realtors understand local market dynamics and better price their clients homes. Automated valuation for. Automated valuation models AVM are clearly beating traditional appraisals the absolute error of the automated model is 9 percent which compares favourably against the accuracy of. All that an investor has to do is to enter the corresponding figures in the formulae to find out the fair market value of the property. The real estate website uses AVMs to provide additional information to their consumers.

Source: researchgate.net

Source: researchgate.net

What is an Automated Valuation Model. Automated valuation models AVM are clearly beating traditional appraisalsthe absolute error of the automated model is 9 percent which compares favourably against the accuracy of traditional appraisals while the model can produce an instant value at every moment in time at a very low cost. The commercial real estate industry has yet to see an uptake of machine learning automated valuation models. Automated Valuation Models AVM Introduced in the US in the 1980s and the UK in the 1990s AVMs are machine learning platforms that use powerful algorithms to analyse large amounts of comparable property data including historical property prices socio-economic statistics and other commercial indicators that can affect property valuations to value a certain property at a certain. As regards the assessment of the market values of properties that compose real estate portfolios the purpose of this paper is to propose and test an automated valuation model.

Automated Valuation Models AVM Introduced in the US in the 1980s and the UK in the 1990s AVMs are machine learning platforms that use powerful algorithms to analyse large amounts of comparable property data including historical property prices socio-economic statistics and other commercial indicators that can affect property valuations to value a certain property at a certain. Automated valuation models AVM are clearly beating traditional appraisalsthe absolute error of the automated model is 9 percent which compares favourably against the accuracy of traditional appraisals while the model can produce an instant value at every moment in time at a very low cost. Sep 5 2018 3 min read. Multi-layer neural network fed by a wide variety of. One available product Enodo is a software that uses machine learning and statistical modeling to determine NOI and operating expenses for the multifamily market.

Source: researchgate.net

Source: researchgate.net

An AVM is a tool designed to perform the same function that manual appraisals do establish the value of the building. Michael told the channel that For as far back as 42Floors data goessomething like 7 plus yearswe can see when a space was on the market. Automated valuation models have been in use in the residential field for a number of years. An AVM is a tool designed to perform the same function that manual appraisals do establish the value of the building. Automated valuation models AVMs are algorithms made by companies that value millions of homes simultaneously to provide users with a ballpark figure of a homes value.

Source: mdpi.com

Source: mdpi.com

Sep 5 2018 3 min read. Automated Valuation Models for Commercial Real Estate - GeoPhy Automated Valuation Models for Commercial Real Estate Automated Valuation Models AVMs typically use advanced analytics such as machine-learning models to predict a given propertys current or future value. Much like with residential real estate an automated valuation model in commercial real estate represents a set of algorithms that combine inputs the propertys age the number of. The real estate website uses AVMs to provide additional information to their consumers. The commercial real estate industry has yet to see an uptake of machine learning automated valuation models.

Source: geophy.com

Source: geophy.com

AVMs are more efficient and consistent than a. All that an investor has to do is to enter the corresponding figures in the formulae to find out the fair market value of the property. Automated Valuation Models AVM Introduced in the US in the 1980s and the UK in the 1990s AVMs are machine learning platforms that use powerful algorithms to analyse large amounts of comparable property data including historical property prices socio-economic statistics and other commercial indicators that can affect property valuations to value a certain property at a certain. May 12 2020. To get that kind of valuation they use historical databases that contain similar transactions.

Source: mdpi.com

Source: mdpi.com

Michael told the channel that For as far back as 42Floors data goessomething like 7 plus yearswe can see when a space was on the market. Automated Valuation Models for Commercial Real Estate - GeoPhy Automated Valuation Models for Commercial Real Estate Automated Valuation Models AVMs typically use advanced analytics such as machine-learning models to predict a given propertys current or future value. As Michael said creating an automatic valuation model requires incredibly complete data. Multi-layer neural network fed by a wide variety of. This means that they have to do some inference for information that they dont know.

Source: businesswire.com

Source: businesswire.com

To get that kind of valuation they use historical databases that contain similar transactions. It minimizes the need to personally inspect and scrutinize each and every property on the market the way it was in the not so distant olden days. Sep 5 2018 3 min read. As regards the assessment of the market values of properties that compose real estate portfolios the purpose of this paper is to propose and test an automated valuation model. Automated Valuation Models for Commercial Real Estate - GeoPhy Automated Valuation Models for Commercial Real Estate Automated Valuation Models AVMs typically use advanced analytics such as machine-learning models to predict a given propertys current or future value.

Source: kapre.com

Source: kapre.com

The real estate website uses AVMs to provide additional information to their consumers. As regards the assessment of the market values of properties that compose real estate portfolios the purpose of this paper is to propose and test an automated valuation model. Automated valuation models AVM are clearly beating traditional appraisals the absolute error of the automated model is 9 percent which compares favourably against the accuracy of. This means that they have to do some inference for information that they dont know. What is an Automated Valuation Model.

Source: researchgate.net

Source: researchgate.net

Automated valuation models have been in use in the residential field for a number of years. AVMs are more efficient and consistent than a. That way if we know a space was on the market but we dont have the comp for that. In the simplest terms an Automated Valuation Model also referred to as AVM is a term used to describe a service that leverages a mathematical model to provide a real estate property value. This means that they have to do some inference for information that they dont know.

Source: researchgate.net

Source: researchgate.net

AVMs are more efficient and consistent than a. As regards the assessment of the market values of properties that compose real estate portfolios the purpose of this paper is to propose and test an automated valuation model. To get that kind of valuation they use historical databases that contain similar transactions. The real estate website uses AVMs to provide additional information to their consumers. The commercial real estate industry has yet to see an uptake of machine learning automated valuation models.

Source: researchgate.net

Source: researchgate.net

This article is about an automated valuation model for commercial real estate. It minimizes the need to personally inspect and scrutinize each and every property on the market the way it was in the not so distant olden days. Automated valuation models have been in use in the residential field for a number of years. The RVM or Realtors Valuation Model is an automated valuation model developed by the National Association of Realtors for use in its Realtors Property Resource. Gives mortgage lenders insurers servicers and investors the ability to evaluate and manage the collateral value of mortgage portfolios.

Source: sciencedirect.com

Source: sciencedirect.com

AVMs are more efficient and consistent than a. The RVM produces home appraisal estimates in markets across the United States to help Realtors understand local market dynamics and better price their clients homes. Much like with residential real estate an automated valuation model in commercial real estate represents a set of algorithms that combine inputs the propertys age the number of. What is an Automated Valuation Model. Gives mortgage lenders insurers servicers and investors the ability to evaluate and manage the collateral value of mortgage portfolios.

Source: sciencedirect.com

Source: sciencedirect.com

Automated valuation models AVMs are algorithms made by companies that value millions of homes simultaneously to provide users with a ballpark figure of a homes value. A high performance AVM designed to help quickly assess home or portfolio valuation and enhance the quality of risk management decisions. To get that kind of valuation they use historical databases that contain similar transactions. Automated valuation models AVMs are algorithms made by companies that value millions of homes simultaneously to provide users with a ballpark figure of a homes value. The RVM produces home appraisal estimates in markets across the United States to help Realtors understand local market dynamics and better price their clients homes.

Source: asperbrothers.com

Source: asperbrothers.com

This means that they have to do some inference for information that they dont know. Automated valuation models have been in use in the residential field for a number of years. A high performance AVM designed to help quickly assess home or portfolio valuation and enhance the quality of risk management decisions. Our Automated Valuation Model AVM prototype for South Korean Commercial Real Estate CRE Raymond Chetti. May 12 2020.

Source: asperbrothers.com

Source: asperbrothers.com

To get that kind of valuation they use historical databases that contain similar transactions. Automated Valuation Models AVM Introduced in the US in the 1980s and the UK in the 1990s AVMs are machine learning platforms that use powerful algorithms to analyse large amounts of comparable property data including historical property prices socio-economic statistics and other commercial indicators that can affect property valuations to value a certain property at a certain. AVMs are more efficient and consistent than a. Gives mortgage lenders insurers servicers and investors the ability to evaluate and manage the collateral value of mortgage portfolios. All that an investor has to do is to enter the corresponding figures in the formulae to find out the fair market value of the property.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title automated valuation model for commercial real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.