Your Australian real estate market 2020 images are available. Australian real estate market 2020 are a topic that is being searched for and liked by netizens now. You can Get the Australian real estate market 2020 files here. Find and Download all free photos.

If you’re searching for australian real estate market 2020 pictures information linked to the australian real estate market 2020 keyword, you have visit the right site. Our site always provides you with hints for seeing the maximum quality video and picture content, please kindly surf and find more enlightening video articles and images that fit your interests.

Australian Real Estate Market 2020. After a solid run over the past five years the ASX200 A-REIT index turned down in March 2020. Experts expect to see modest growth in the Adelaide property market in 2020. After a decade of price boom and busts Australias property market will see big changes in the 2020s. Adelaide property market forecast 2020 The property market in Adelaide saw a very slight decrease in prices in 2019 with a 02 decline.

Sydney Property Market Analysis Suburb Profiles 20 Expert Insights From propertyupdate.com.au

Sydney Property Market Analysis Suburb Profiles 20 Expert Insights From propertyupdate.com.au

Property prices are likely to rise at a slower pace than they have in previous decades mainly because interest rates cannot fall much further. The most impactful restrictions on Australian real estate commenced between the 20th and 25th of March. These included the closure of Australian borders a shut-down of non-essential services a ban on open real estate inspections and on-site auctions and limiting public gatherings to two people. Over the past year buyer demand has increased the most in Victoria and the Australian Capital Territory which have both seen increases of around 45 but all regions have seen strong increases in excess of 25. The residential sector continues to recover logistics will benefit from low vacancy in most markets and in the office sector Perth and Brisbane are forecast to lead the nation in terms of effective rental growth. Major demographic trends will be a driving force.

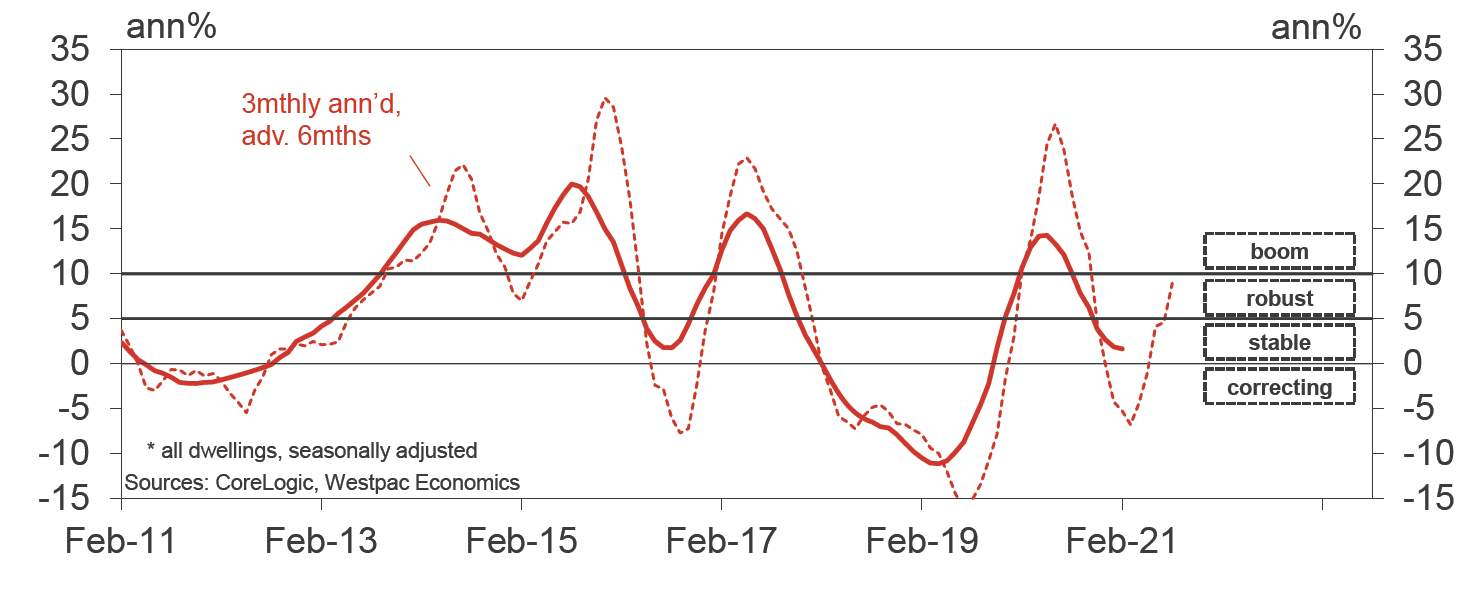

Demand remained high throughout the latter half of 2020 but has increased further in 2021 so far.

Queensland Sunshine Coast receives a number 1 on a list of Best Real Estate Markets to Invest in through 2020 presents a combination of community wellbeing development opportunities economic spaces and affordable housing. A new report released from ANZ Bank predicts house prices at the national level will rise to a strong 17 through 2021 before slowing to 6 in 2022. The Melbourne market has been strong and the vacancy rates arent as high but theres no doubt coronavirus will increase caution among many buyers and encourage a lot of sellers to defer. It allows a good living property environment associated with viable financial options and opportunities to live your dream. Published May 7 2020. The outlook for Australias property market is much stronger than just a few weeks ago but conditions are likely to remain subdued over the next six months.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

Prices appear most likely to rebound. Queensland Sunshine Coast receives a number 1 on a list of Best Real Estate Markets to Invest in through 2020 presents a combination of community wellbeing development opportunities economic spaces and affordable housing. In 2020 we expect that rental growth will begin in Sydney and start to strengthen in other parts of Australia. Published May 7 2020. Pricing in all office markets is also expected to rise this year as global investor demand for Australian office product remains very strong.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

A new report released from ANZ Bank predicts house prices at the national level will rise to a strong 17 through 2021 before slowing to 6 in 2022. Under SQMs most likely scenario Adelaide prices will rise by 1-4. Over the past year buyer demand has increased the most in Victoria and the Australian Capital Territory which have both seen increases of around 45 but all regions have seen strong increases in excess of 25. Experts expect to see modest growth in the Adelaide property market in 2020. The residential sector continues to recover logistics will benefit from low vacancy in most markets and in the office sector Perth and Brisbane are forecast to lead the nation in terms of effective rental growth.

Source: prepona.info

Source: prepona.info

Australias property market has been in constant decline in the past years. Adelaide property market forecast 2020 The property market in Adelaide saw a very slight decrease in prices in 2019 with a 02 decline. Yet we saw a rebound in late 2019 and analysts predict that Australias property market will increase by 25 to 5. These included the closure of Australian borders a shut-down of non-essential services a ban on open real estate inspections and on-site auctions and limiting public gatherings to two people. Property prices are likely to rise at a slower pace than they have in previous decades mainly because interest rates cannot fall much further.

Source:

Source:

Last updated on May 7 2020. The strong largely across-the-board rebound in Australian real estate prices from the 2009-10 stimulus is likely to be repeated in 2020. Yet we saw a rebound in late 2019 and analysts predict that Australias property market will increase by 25 to 5. Queensland Sunshine Coast receives a number 1 on a list of Best Real Estate Markets to Invest in through 2020 presents a combination of community wellbeing development opportunities economic spaces and affordable housing. Whats the outlook for the Australian property markets for 2021 and beyond.

Source: crowndistilleries.com

Source: crowndistilleries.com

January 25 2020. But the smart decision-makers of today will be looking beyond 2020 and trying to figure out which Australian property markets have the best potential post-stimulus. Queensland Sunshine Coast receives a number 1 on a list of Best Real Estate Markets to Invest in through 2020 presents a combination of community wellbeing development opportunities economic spaces and affordable housing. The general consensus is that Australias housing market has resumed its upward momentum during the last half of 2019 and is ready for solid growth in 2020. Australia recorded its strongest trade surplus of all time in March.

Source: businessinsider.com.au

Source: businessinsider.com.au

Published May 7 2020. Whats the outlook for the Australian property markets for 2021 and beyond. The Australian real estate market situation At the start of FY20 we saw lending restrictions begin to ease investor confidence rise and the RBA started reducing the official cash rate. Australia recorded its strongest trade surplus of all time in March. It allows a good living property environment associated with viable financial options and opportunities to live your dream.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

Pricing in all office markets is also expected to rise this year as global investor demand for Australian office product remains very strong. After a decade of price boom and busts Australias property market will see big changes in the 2020s. The Melbourne market has been strong and the vacancy rates arent as high but theres no doubt coronavirus will increase caution among many buyers and encourage a lot of sellers to defer. Australia recorded its strongest trade surplus of all time in March. Its down slightly to AUD 88 billion.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

Despite a drop in transactions and lowered consumer confidence positive growth in dwelling values has been recorded in most regions across the country with national house prices up by 03 in April. In 2020 we expect that rental growth will begin in Sydney and start to strengthen in other parts of Australia. The Melbourne market has been strong and the vacancy rates arent as high but theres no doubt coronavirus will increase caution among many buyers and encourage a lot of sellers to defer. A new report released from ANZ Bank predicts house prices at the national level will rise to a strong 17 through 2021 before slowing to 6 in 2022. Australia recorded its strongest trade surplus of all time in March.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

Its down slightly to AUD 88 billion. Whats the outlook for the Australian property markets for 2021 and beyond. The outlook for Australian real estate in 2020 remains positive in most geographies and sectors. While demand from tenants is expected to slow in 2020 rents should remain solid as there are no signs of a supply breakout before 2022. Australian Real Estate Quarterly Review Q2 2020 Page 5 of 12 300 Flight to defensive assets and cash Fixed interest investments unlisted property and cash lead the performance table this quarter as investors adopted a more cautious stance.

Source:

Source:

Over the past year buyer demand has increased the most in Victoria and the Australian Capital Territory which have both seen increases of around 45 but all regions have seen strong increases in excess of 25. After a decade of price boom and busts Australias property market will see big changes in the 2020s. The main reason being is that there will be less development this year so the growth in rental housing will slow. Australian property market update - April 2020. It allows a good living property environment associated with viable financial options and opportunities to live your dream.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

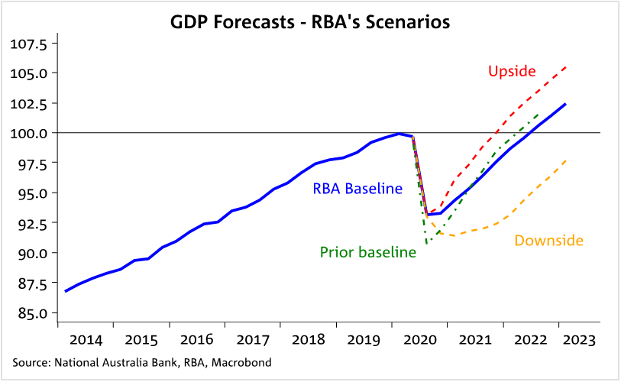

Whats the outlook for the Australian property markets for 2021 and beyond. Yet we saw a rebound in late 2019 and analysts predict that Australias property market will increase by 25 to 5. In 2020 we expect that rental growth will begin in Sydney and start to strengthen in other parts of Australia. The residential sector continues to recover logistics will benefit from low vacancy in most markets and in the office sector Perth and Brisbane are forecast to lead the nation in terms of effective rental growth. Its very interesting looking at the stats and forecasts especially the different scenarios outlined within the Boom Bust Report.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

Pricing in all office markets is also expected to rise this year as global investor demand for Australian office product remains very strong. Over the past year buyer demand has increased the most in Victoria and the Australian Capital Territory which have both seen increases of around 45 but all regions have seen strong increases in excess of 25. In 2020 we expect that rental growth will begin in Sydney and start to strengthen in other parts of Australia. A new report released from ANZ Bank predicts house prices at the national level will rise to a strong 17 through 2021 before slowing to 6 in 2022. These included the closure of Australian borders a shut-down of non-essential services a ban on open real estate inspections and on-site auctions and limiting public gatherings to two people.

Source: aihw.gov.au

Source: aihw.gov.au

Demand remained high throughout the latter half of 2020 but has increased further in 2021 so far. Last updated on May 7 2020. This optimism carried over into 2020 with auction clearance rates in the high 70 percent and vendor confidence returning pushing listings above average for the first time in a long time. While demand from tenants is expected to slow in 2020 rents should remain solid as there are no signs of a supply breakout before 2022. Its very interesting looking at the stats and forecasts especially the different scenarios outlined within the Boom Bust Report.

Source: statista.com

Source: statista.com

Prices appear most likely to rebound. Adelaide property market forecast 2020 The property market in Adelaide saw a very slight decrease in prices in 2019 with a 02 decline. In 2020 we expect that rental growth will begin in Sydney and start to strengthen in other parts of Australia. After a solid run over the past five years the ASX200 A-REIT index turned down in March 2020. The main reason being is that there will be less development this year so the growth in rental housing will slow.

Source: forbes.com

Source: forbes.com

Australias property market has been in constant decline in the past years. January 25 2020. The strong largely across-the-board rebound in Australian real estate prices from the 2009-10 stimulus is likely to be repeated in 2020. Prices appear most likely to rebound. Pricing in all office markets is also expected to rise this year as global investor demand for Australian office product remains very strong.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

Major demographic trends will be a driving force. After a solid run over the past five years the ASX200 A-REIT index turned down in March 2020. The residential sector continues to recover logistics will benefit from low vacancy in most markets and in the office sector Perth and Brisbane are forecast to lead the nation in terms of effective rental growth. Whats the outlook for the Australian property markets for 2021 and beyond. Its down slightly to AUD 88 billion.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

These included the closure of Australian borders a shut-down of non-essential services a ban on open real estate inspections and on-site auctions and limiting public gatherings to two people. The most impactful restrictions on Australian real estate commenced between the 20th and 25th of March. This optimism carried over into 2020 with auction clearance rates in the high 70 percent and vendor confidence returning pushing listings above average for the first time in a long time. Australia recorded its strongest trade surplus of all time in March. Published May 7 2020.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

A new report released from ANZ Bank predicts house prices at the national level will rise to a strong 17 through 2021 before slowing to 6 in 2022. This is a common question people are asking now that our real estate markets are up and running again. While demand from tenants is expected to slow in 2020 rents should remain solid as there are no signs of a supply breakout before 2022. Australias property market has been in constant decline in the past years. The Melbourne market has been strong and the vacancy rates arent as high but theres no doubt coronavirus will increase caution among many buyers and encourage a lot of sellers to defer.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title australian real estate market 2020 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.