Your Australian real estate market 2016 images are available in this site. Australian real estate market 2016 are a topic that is being searched for and liked by netizens today. You can Get the Australian real estate market 2016 files here. Find and Download all free photos.

If you’re looking for australian real estate market 2016 pictures information linked to the australian real estate market 2016 keyword, you have come to the ideal blog. Our website always provides you with hints for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

Australian Real Estate Market 2016. The value of residential real estate investment by foreigners increased more than 18 y-o-y to AU 148 billion US 103 billion but is still far below the record AU 724 billion US 505 billion seen in 2016. Top six Australian real estate deals to watch for 2016 Matthew Cranston and Mercedes Ruehl Updated Jan 13 2016 317pm first published at Jan 11 2016 637pm. Grant Harrod LJ Hooker Harrod predicts the Gold Coast will show the most potential for 2016 mainly due to housing affordability the falling Australian dollar and the Commonwealth Games. Sydney and Melbourne recorded the strongest property performance in 2015 - a trend we expect to continue in 2016 but notably with some improvement in.

Sydney Property Market Analysis Suburb Profiles 20 Expert Insights From propertyupdate.com.au

Sydney Property Market Analysis Suburb Profiles 20 Expert Insights From propertyupdate.com.au

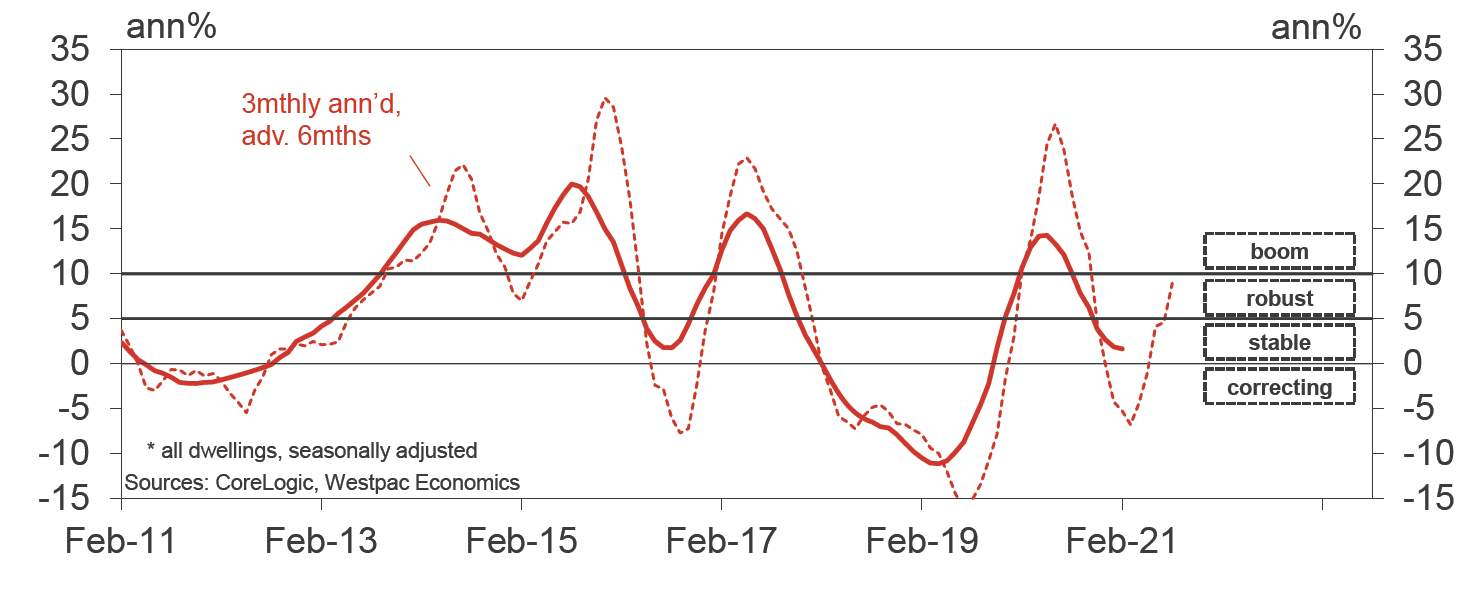

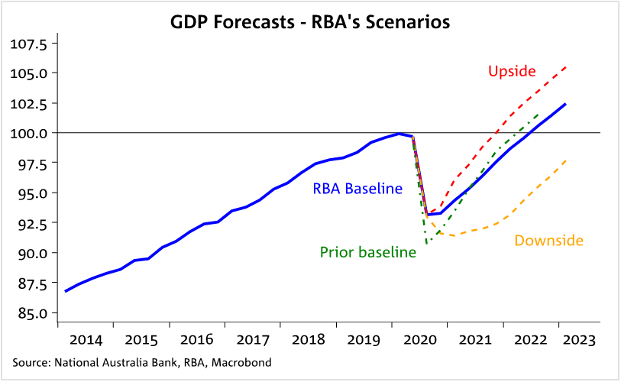

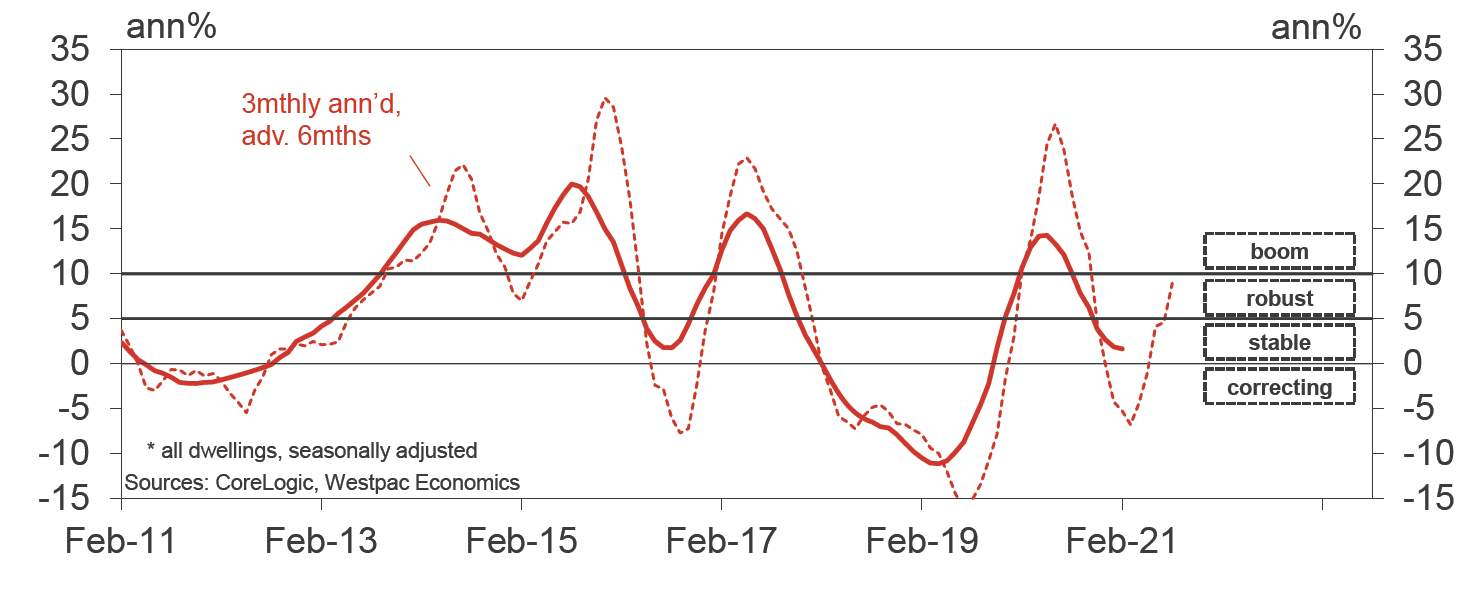

CBs head of Australian economics Gareth Aird expects house prices will rise 9 in 2021 and 7 more in 2022. The boom in real estate sales to foreign investors fell to the lowest proportion in years. The Adelaide and Hobart markets will likely see fairly moderate levels of value growth while we anticipate further value falls for Perth and Darwin. AUSTRALIAS housing market is 40 per cent overvalued based on price to income measures with one expert warning an entire generation is now praying for a property crash. The commercial office markets of Perth and Brisbane remain dire as transactional volumes decline. Another issue concerning the Australian residential property market is the decrease in foreign investors.

Sydney and Melbourne recorded the strongest property performance in 2015 - a trend we expect to continue in 2016 but notably with some improvement in.

Rebecca Hallas Low wage growth and rising living costs would mean performance coming under pressure if rates rise but this is. 2016 Australia Real Estate Market Outlook Report. Grant Harrod LJ Hooker Harrod predicts the Gold Coast will show the most potential for 2016 mainly due to housing affordability the falling Australian dollar and the Commonwealth Games. Capital Territory 589 and Victoria 437 have been responsible for. Market not slowing down as homes sell at record speeds. Another issue concerning the Australian residential property market is the decrease in foreign investors.

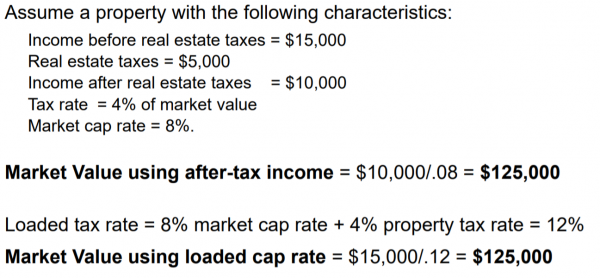

Source: rba.gov.au

Source: rba.gov.au

Market not slowing down as homes sell at record speeds. Whether values in Sydney and Melbourne continue to fall or the rate of value growth just slows will be one of the primary factors determining housing market conditions in 2016 Kusher says. Market not slowing down as homes sell at record speeds. Home prices were the one constant in the 2016 real estate market. CBs head of Australian economics Gareth Aird expects house prices will rise 9 in 2021 and 7 more in 2022.

Source: rba.gov.au

Source: rba.gov.au

CBs head of Australian economics Gareth Aird expects house prices will rise 9 in 2021 and 7 more in 2022. He also believes the Sydney Brisbane and Melbourne markets will flatten out while the Gold Coast market sees a 5-10 per cent growth and Hobart Adelaide Darwin and Perth see a 2-3 per cent fall. Capital Territory 589 and Victoria 437 have been responsible for. Commonwealth Bank has forecasted that Australias house prices will rise 16 over the next two years in what theyre calling a housing market boom. Home prices were the one constant in the 2016 real estate market.

Source: propertyology.com.au

Source: propertyology.com.au

AUSTRALIAS housing market is 40 per cent overvalued based on price to income measures with one expert warning an entire generation is now praying for a property crash. Grant Harrod LJ Hooker Harrod predicts the Gold Coast will show the most potential for 2016 mainly due to housing affordability the falling Australian dollar and the Commonwealth Games. Strong A-REIT sector coming into 2016 the market still has some work to do in order to match the outstanding performance experienced in recent years. THE AUSTRALIAN RESIDENTIAL REAL ESTATE MARKET Residential real estate is the foundation financial asset of all modern economic systems. Capital Territory 589 and Victoria 437 have been responsible for.

Source: rba.gov.au

Source: rba.gov.au

Market not slowing down as homes sell at record speeds. The commercial office markets of Perth and Brisbane remain dire as transactional volumes decline. This year to the relief of many wer. Grant Harrod LJ Hooker Harrod predicts the Gold Coast will show the most potential for 2016 mainly due to housing affordability the falling Australian dollar and the Commonwealth Games. The value of residential real estate investment by foreigners increased more than 18 y-o-y to AU 148 billion US 103 billion but is still far below the record AU 724 billion US 505 billion seen in 2016.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

The boom in real estate sales to foreign investors fell to the lowest proportion in years. THE AUSTRALIAN RESIDENTIAL REAL ESTATE MARKET Residential real estate is the foundation financial asset of all modern economic systems. Another issue concerning the Australian residential property market is the decrease in foreign investors. Sydney and Melbourne recorded the strongest property performance in 2015 - a trend we expect to continue in 2016 but notably with some improvement in. He also believes the Sydney Brisbane and Melbourne markets will flatten out while the Gold Coast market sees a 5-10 per cent growth and Hobart Adelaide Darwin and Perth see a 2-3 per cent fall.

Source: rba.gov.au

Source: rba.gov.au

2016 Australia Real Estate Market Outlook Report. The Australian property market is in for a quiet year. AUSTRALIAS housing market is 40 per cent overvalued based on price to income measures with one expert warning an entire generation is now praying for a property crash. The research report concluded that 437 per cent of all residential dwellings approved in Australia over the 10-years ending 2019 were attached dwellings apartments and townhouses. According to Cameron Kusher compared to 12 months ago when the rental market was only just beginning its recovery following the first wave of COVID-19 restrictions demand is up 241.

Source: propertyology.com.au

Source: propertyology.com.au

Commonwealth Bank has forecasted that Australias house prices will rise 16 over the next two years in what theyre calling a housing market boom. The Australian property market is in for a quiet year. The value of residential real estate investment by foreigners increased more than 18 y-o-y to AU 148 billion US 103 billion but is still far below the record AU 724 billion US 505 billion seen in 2016. Market not slowing down as homes sell at record speeds. The commercial office markets of Perth and Brisbane remain dire as transactional volumes decline.

Source: rba.gov.au

Source: rba.gov.au

The Australian real estate market has seen a lot of ups and downs throughout 2015 but with 2016 in full swing its time to cast our eyes to the year ahead. The boom in real estate sales to foreign investors fell to the lowest proportion in years. Whether values in Sydney and Melbourne continue to fall or the rate of value growth just slows will be one of the primary factors determining housing market conditions in 2016 Kusher says. Another issue concerning the Australian residential property market is the decrease in foreign investors. According to Cameron Kusher compared to 12 months ago when the rental market was only just beginning its recovery following the first wave of COVID-19 restrictions demand is up 241.

Source: propertyology.com.au

Source: propertyology.com.au

2016 Australia Real Estate Market Outlook Report. Capital Territory 589 and Victoria 437 have been responsible for. The Adelaide and Hobart markets will likely see fairly moderate levels of value growth while we anticipate further value falls for Perth and Darwin. This year to the relief of many wer. Top six Australian real estate deals to watch for 2016 Matthew Cranston and Mercedes Ruehl Updated Jan 13 2016 317pm first published at Jan 11 2016 637pm.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

The commercial office markets of Perth and Brisbane remain dire as transactional volumes decline. Prices on average reached 240700 during the second quarter increasing 49 percent from the same time last year with the San Jose real estate market topping the 1 million mark for the first time ever. The Adelaide and Hobart markets will likely see fairly moderate levels of value growth while we anticipate further value falls for Perth and Darwin. One of several big shifts in Australian real estate over the last decade was increased dwelling density. The Australian real estate market has seen a lot of ups and downs throughout 2015 but with 2016 in full swing its time to cast our eyes to the year ahead.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

The Adelaide and Hobart markets will likely see fairly moderate levels of value growth while we anticipate further value falls for Perth and Darwin. 2016 Australia Real Estate Market Outlook Report. Prices on average reached 240700 during the second quarter increasing 49 percent from the same time last year with the San Jose real estate market topping the 1 million mark for the first time ever. Another issue concerning the Australian residential property market is the decrease in foreign investors. Australian housing is valued at 59 trillion1 dwarfing the value of ASX listed companies of 16 trillion2 and the value of all commercial real estate of 07 trillion3.

Source: propertyology.com.au

Source: propertyology.com.au

The Australian property market is in for a quiet year. Strong A-REIT sector coming into 2016 the market still has some work to do in order to match the outstanding performance experienced in recent years. Rebecca Hallas Low wage growth and rising living costs would mean performance coming under pressure if rates rise but this is. AUSTRALIAS housing market is 40 per cent overvalued based on price to income measures with one expert warning an entire generation is now praying for a property crash. Another issue concerning the Australian residential property market is the decrease in foreign investors.

Source: propertyology.com.au

Source: propertyology.com.au

Rebecca Hallas Low wage growth and rising living costs would mean performance coming under pressure if rates rise but this is. Top six Australian real estate deals to watch for 2016 Matthew Cranston and Mercedes Ruehl Updated Jan 13 2016 317pm first published at Jan 11 2016 637pm. Grant Harrod LJ Hooker Harrod predicts the Gold Coast will show the most potential for 2016 mainly due to housing affordability the falling Australian dollar and the Commonwealth Games. Rebecca Hallas Low wage growth and rising living costs would mean performance coming under pressure if rates rise but this is. The commercial office markets of Perth and Brisbane remain dire as transactional volumes decline.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

Top six Australian real estate deals to watch for 2016 Matthew Cranston and Mercedes Ruehl Updated Jan 13 2016 317pm first published at Jan 11 2016 637pm. Home prices were the one constant in the 2016 real estate market. Another issue concerning the Australian residential property market is the decrease in foreign investors. CBs head of Australian economics Gareth Aird expects house prices will rise 9 in 2021 and 7 more in 2022. One of several big shifts in Australian real estate over the last decade was increased dwelling density.

Source: propertyology.com.au

Source: propertyology.com.au

Australian housing is valued at 59 trillion1 dwarfing the value of ASX listed companies of 16 trillion2 and the value of all commercial real estate of 07 trillion3. Strong A-REIT sector coming into 2016 the market still has some work to do in order to match the outstanding performance experienced in recent years. Home prices were the one constant in the 2016 real estate market. Capital Territory 589 and Victoria 437 have been responsible for. Prices on average reached 240700 during the second quarter increasing 49 percent from the same time last year with the San Jose real estate market topping the 1 million mark for the first time ever.

Source: rba.gov.au

Source: rba.gov.au

Whether values in Sydney and Melbourne continue to fall or the rate of value growth just slows will be one of the primary factors determining housing market conditions in 2016 Kusher says. While Melbournes high-end real estate market is a little weaker than Sydneys a 1920s mansion in the affluent suburb of Toorak sold for 40 million - well beyond the average persons dreams. The value of residential real estate investment by foreigners increased more than 18 y-o-y to AU 148 billion US 103 billion but is still far below the record AU 724 billion US 505 billion seen in 2016. Another issue concerning the Australian residential property market is the decrease in foreign investors. Sydney and Melbourne recorded the strongest property performance in 2015 - a trend we expect to continue in 2016 but notably with some improvement in.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

Steady economic growth but with divergence in performance across geographies and industries has resonated through to Australian property sectors. The value of residential real estate investment by foreigners increased more than 18 y-o-y to AU 148 billion US 103 billion but is still far below the record AU 724 billion US 505 billion seen in 2016. Another issue concerning the Australian residential property market is the decrease in foreign investors. Strong A-REIT sector coming into 2016 the market still has some work to do in order to match the outstanding performance experienced in recent years. One of several big shifts in Australian real estate over the last decade was increased dwelling density.

Source: dividend.net.au

Source: dividend.net.au

2016 Australia Real Estate Market Outlook Report. Whether values in Sydney and Melbourne continue to fall or the rate of value growth just slows will be one of the primary factors determining housing market conditions in 2016 Kusher says. Capital Territory 589 and Victoria 437 have been responsible for. According to Cameron Kusher compared to 12 months ago when the rental market was only just beginning its recovery following the first wave of COVID-19 restrictions demand is up 241. Sydney and Melbourne recorded the strongest property performance in 2015 - a trend we expect to continue in 2016 but notably with some improvement in.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title australian real estate market 2016 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.