Your Australia real estate bubble 2018 images are available. Australia real estate bubble 2018 are a topic that is being searched for and liked by netizens now. You can Get the Australia real estate bubble 2018 files here. Find and Download all royalty-free photos.

If you’re searching for australia real estate bubble 2018 images information connected with to the australia real estate bubble 2018 interest, you have pay a visit to the right blog. Our site always provides you with suggestions for downloading the highest quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

Australia Real Estate Bubble 2018. SourceNews Corp Australia AUSTRALIAN property prices could crash by up to 50 per cent in a looming global crisis tipped to be worse than the. General Manager of Sales and Operations for Australian Finance Group Mark Hewitt says a housing bubble occurs when there is unsustainable growth in property prices. The Bubble Index. This graph shows the median property prices in Australias biggest cities from 2016 to the end of 2018.

Housing In Australia In The 2000s On The Agenda Too Late Conference 2011 Rba From rba.gov.au

Housing In Australia In The 2000s On The Agenda Too Late Conference 2011 Rba From rba.gov.au

And China even within the nation itself. These figures show that the Sydney market peaked in 2017 and has dropped ever since. The UBS Global Real Estate Bubble Index gauges the risk of a property bubble on the basis of such patterns. Michelle Hele network online real estate editor News Corp Australia Network November 3 2016 1201am Louis Christopher warns a housing bubble is. Australias Foreign Investment Review Board FIRB reported this week that foreign residential real estate approvals dropped significantly in the 2016-17 period. It has been that way for decades with the city posting an average real annual price rise of 35 percent since 1980.

Australias housing market cooling sharply.

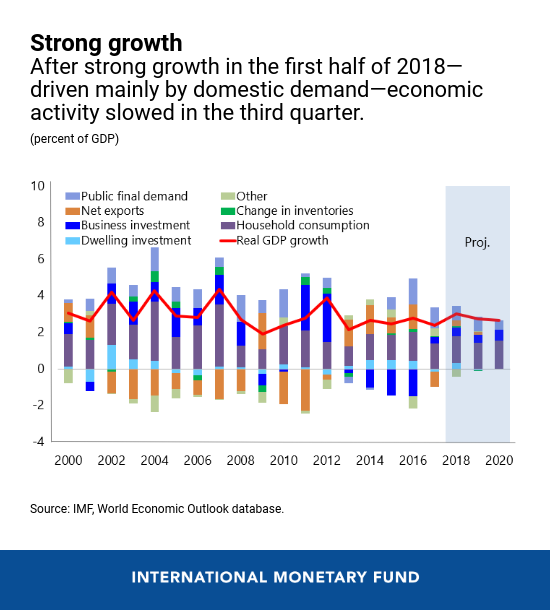

House prices in Australias major cities have been ballooning for over a decade. Michelle Hele network online real estate editor News Corp Australia Network November 3 2016 1201am Louis Christopher warns a housing bubble is. The term bubble refers to a substantial and sustained mispricing of an asset the existence of which cannot be proved unless it bursts. According to the results of the 2018 GRESB Real Estate Assessment 81 of participants monitor diversity indicators for governance bodies. In Sydney Australias largest housing market and one of the worlds biggest housing bubbles prices of homes of all types fell 54 in July compared. Delmendo December 10 2018 After six years of strong house price rises Australias housing market is now slowing sharply mainly due to the introduction of market-cooling measures including stricter lending restrictions and the imposition of higher taxes on foreign investment in the housing market.

Source: propertyology.com.au

Source: propertyology.com.au

The bubble bursts when there is a significant shift downwards normally. Australias Foreign Investment Review Board FIRB reported this week that foreign residential real estate approvals dropped significantly in the 2016-17 period. Australia Real Estate Bubble Will COLLAPSE Videos by David Quintieri Published July 13 2018 Updated July 12 2018. The housing market is hot. Australias housing boombubble could unravel badly.

Source: globalpropertyguide.com

Source: globalpropertyguide.com

Australias housing boombubble could unravel badly. The Australian property bubble is the economic theory that the Australian property market has become or is becoming significantly overpriced and due for a significant downturn also called a correction or collapseSince the early 2010s various commentators including one Treasury official have claimed the Australian property market is in a significant bubble. Australia Real Estate Bubble Will COLLAPSE Videos by David Quintieri Published July 13 2018 Updated July 12 2018. According to the results of the 2018 GRESB Real Estate Assessment 81 of participants monitor diversity indicators for governance bodies. Many people are starting to become cautious of a real estate bubble.

Source: propertyology.com.au

Source: propertyology.com.au

It used to be that homes selling in excess of 1 million were solely from the luxury end of the. The Australian property bubble is the economic theory that the Australian property market has become or is becoming significantly overpriced and due for a significant downturn also called a correction or collapseSince the early 2010s various commentators including one Treasury official have claimed the Australian property market is in a significant bubble. In the 2018 edition of the banks Real Estate Bubble Index here are the major cities around the globe that are in or near bubble territory. Price bubbles are a regularly recurring phenomenon in property markets. Will Rates Burst the Real Estate Bubble.

Source: rba.gov.au

Source: rba.gov.au

Australia Real Estate Bubble Will COLLAPSE Videos by David Quintieri Published July 13 2018 Updated July 12 2018. Michelle Hele network online real estate editor News Corp Australia Network November 3 2016 1201am Louis Christopher warns a housing bubble is. Many people are starting to become cautious of a real estate bubble. Identifying a bubble. According to the results of the 2018 GRESB Real Estate Assessment 81 of participants monitor diversity indicators for governance bodies.

Source: theconversation.com

Source: theconversation.com

Delmendo December 10 2018 After six years of strong house price rises Australias housing market is now slowing sharply mainly due to the introduction of market-cooling measures including stricter lending restrictions and the imposition of higher taxes on foreign investment in the housing market. Australias Foreign Investment Review Board FIRB reported this week that foreign residential real estate approvals dropped significantly in the 2016-17 period. Their activities have been overshadowed by countries such as the US. The past has revealed many red. It used to be that homes selling in excess of 1 million were solely from the luxury end of the.

Source: propertyology.com.au

Source: propertyology.com.au

Delmendo December 10 2018 After six years of strong house price rises Australias housing market is now slowing sharply mainly due to the introduction of market-cooling measures including stricter lending restrictions and the imposition of higher taxes on foreign investment in the housing market. General Manager of Sales and Operations for Australian Finance Group Mark Hewitt says a housing bubble occurs when there is unsustainable growth in property prices. This graph shows the median property prices in Australias biggest cities from 2016 to the end of 2018. Any city with a score over 15 is considered at Bubble Risk and right now those include two cities from Canada one from Asia and three from Europe. Many people are starting to become cautious of a real estate bubble.

Source: wolfstreet.com

Source: wolfstreet.com

These figures show that the Sydney market peaked in 2017 and has dropped ever since. Will Rates Burst the Real Estate Bubble. Australias housing market cooling sharply. Australias Foreign Investment Review Board FIRB reported this week that foreign residential real estate approvals dropped significantly in the 2016-17 period. The past has revealed many red.

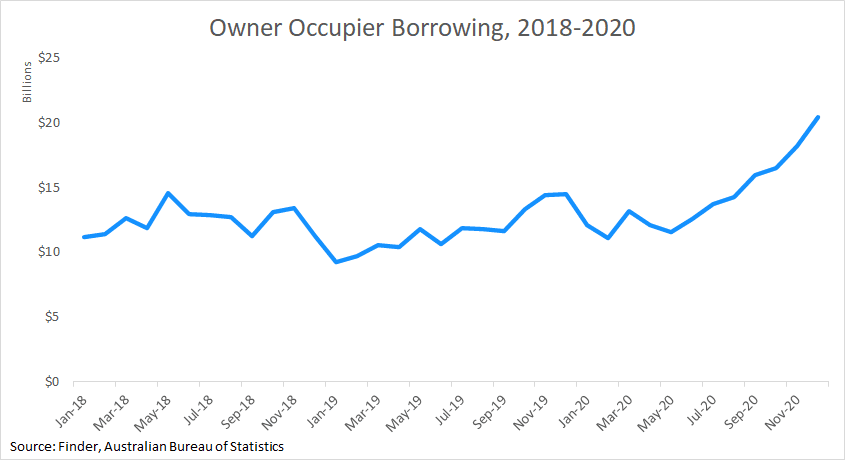

As often happens real estate is involved. The housing market is hot. The most frequently monitored indicator across all regions is gender diversity 78 followed by. Banks in Australia are gearing up for slight increases in interest rates but in an overly inflated market this may well mean disaster for many and a correction in prices across the country. As often happens real estate is involved.

Source: finder.com.au

Source: finder.com.au

Australia Real Estate Bubble Will Collapse As Housing Price Rise and Unsustainable Debt Levels. Identifying a bubble. Price bubbles are a regularly recurring phenomenon in property markets. The bubble bursts when there is a significant shift downwards normally. As China tightens controls on investment capital outflow and Australia increases restrictions on foreign buyers of property real estate prices in some Australian cities have plummeted.

Source: rba.gov.au

Source: rba.gov.au

As China tightens controls on investment capital outflow and Australia increases restrictions on foreign buyers of property real estate prices in some Australian cities have plummeted. Will Rates Burst the Real Estate Bubble. Australia has been rather quiet since the Global Financial Crisis. The Bubble Index. The UBS Global Real Estate Bubble Index gauges the risk of a property bubble on the basis of such patterns.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

Price bubbles are a regularly recurring phenomenon in property markets. The UBS Global Real Estate Bubble Index gauges the risk of a property bubble on the basis of such patterns. General Manager of Sales and Operations for Australian Finance Group Mark Hewitt says a housing bubble occurs when there is unsustainable growth in property prices. Banks in Australia are gearing up for slight increases in interest rates but in an overly inflated market this may well mean disaster for many and a correction in prices across the country. It has been that way for decades with the city posting an average real annual price rise of 35 percent since 1980.

Delmendo December 10 2018 After six years of strong house price rises Australias housing market is now slowing sharply mainly due to the introduction of market-cooling measures including stricter lending restrictions and the imposition of higher taxes on foreign investment in the housing market. The past has revealed many red. Australias housing boombubble could unravel badly. Will Rates Burst the Real Estate Bubble. And China even within the nation itself.

Source: propertyology.com.au

Source: propertyology.com.au

Australias per-capita GDP has declined in both Q3 and Q4 of 2018. The past has revealed many red. What is a housing bubble. Many people are starting to become cautious of a real estate bubble. The term bubble refers to a substantial and sustained mispricing of an asset the existence of which cannot be proved unless it bursts.

Source: propertyology.com.au

Source: propertyology.com.au

The housing market is hot. At the time of this writing the UBS Global Real Estate Bubble Index has Sydney Australia listed at a 180 risk score which places it among the highest-risk markets in the world. Delmendo December 10 2018 After six years of strong house price rises Australias housing market is now slowing sharply mainly due to the introduction of market-cooling measures including stricter lending restrictions and the imposition of higher taxes on foreign investment in the housing market. Price bubbles are a regularly recurring phenomenon in property markets. Australias housing market cooling sharply.

Source: propertyupdate.com.au

Source: propertyupdate.com.au

What is a housing bubble. These figures show that the Sydney market peaked in 2017 and has dropped ever since. The Bubble Index. House prices in Australias major cities have been ballooning for over a decade. Any city with a score over 15 is considered at Bubble Risk and right now those include two cities from Canada one from Asia and three from Europe.

Source: globalpropertyguide.com

Source: globalpropertyguide.com

At the time of this writing the UBS Global Real Estate Bubble Index has Sydney Australia listed at a 180 risk score which places it among the highest-risk markets in the world. General Manager of Sales and Operations for Australian Finance Group Mark Hewitt says a housing bubble occurs when there is unsustainable growth in property prices. The bubble bursts when there is a significant shift downwards normally. The past has revealed many red. Banks in Australia are gearing up for slight increases in interest rates but in an overly inflated market this may well mean disaster for many and a correction in prices across the country.

At the time of this writing the UBS Global Real Estate Bubble Index has Sydney Australia listed at a 180 risk score which places it among the highest-risk markets in the world. What is a housing bubble. The bubble bursts when there is a significant shift downwards normally. Australias housing market cooling sharply. Any city with a score over 15 is considered at Bubble Risk and right now those include two cities from Canada one from Asia and three from Europe.

Source: propertyology.com.au

Source: propertyology.com.au

General Manager of Sales and Operations for Australian Finance Group Mark Hewitt says a housing bubble occurs when there is unsustainable growth in property prices. Banks in Australia are gearing up for slight increases in interest rates but in an overly inflated market this may well mean disaster for many and a correction in prices across the country. At the time of this writing the UBS Global Real Estate Bubble Index has Sydney Australia listed at a 180 risk score which places it among the highest-risk markets in the world. And China even within the nation itself. Delmendo December 10 2018 After six years of strong house price rises Australias housing market is now slowing sharply mainly due to the introduction of market-cooling measures including stricter lending restrictions and the imposition of higher taxes on foreign investment in the housing market.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title australia real estate bubble 2018 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.