Your Assets under management calculation real estate images are ready in this website. Assets under management calculation real estate are a topic that is being searched for and liked by netizens today. You can Get the Assets under management calculation real estate files here. Download all free photos.

If you’re searching for assets under management calculation real estate pictures information connected with to the assets under management calculation real estate keyword, you have pay a visit to the right blog. Our site frequently provides you with hints for seeing the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Assets Under Management Calculation Real Estate. That would all seem to lead back to the equity capital in the real estate investments and not the gross value of all of the real estate investments. Assets under management AUM refers to the total market value of investments managed by a mutual fund money management firm hedge fund portfolio manager or other financial services company. Viele übersetzte Beispielsätze mit real estate assets under management Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. 500M SF COMMERCIAL SPACE.

Real Estate Private Equity Overview Careers Salaries Interviews From mergersandinquisitions.com

Real Estate Private Equity Overview Careers Salaries Interviews From mergersandinquisitions.com

How Does Assets Under Management AUM Work. If securities are less than 50 of the portfolio then the portfolio would not be a securities account. The total AUM calculation must be carried out at least annually using the latest available values ie. 211B ASSETS UNDER MANAGEMENT. The SEC wants the registered adviser to use the same method in calculating assets under management that it uses to report its assets to clients or to calculate fees for investment advisory services. Taunustor 1 TaunusTurm 60310 Frankfurt am Main Germany Telephone 49 0 69 975717-700.

Assets under management definitions and methods differ by company.

As one of the worlds largest investors in real estate we own and operate iconic properties in the worlds most dynamic markets. Investors generally look to the return on equity and capital not the gross value of the real estate assets. The latest available value produced during the preceding 12 months. Increasing AUM is a primary goal of most brokerages mutual funds and financial advisor firms and many will use a high AUM as a selling point when marketing themselves to potential investors. AUM can be useful in determining the relative size of two funds or other investments and thus determining their relative liquidity. For private fund managers one troubling aspect of Form ADV had been the calculation of assets under management in item 5F.

Source: pinterest.com

Source: pinterest.com

If securities are less than 50 of the portfolio then the portfolio would not be a securities account. Assets under management definitions and methods differ by company. Maximilianstraße 31 80539 Munich Germany Telephone 49 0 89 242 98-0. Viele übersetzte Beispielsätze mit real estate assets under management Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. Investors generally look to the return on equity and capital not the gross value of the real estate assets.

Source: investopedia.com

Source: investopedia.com

Viele übersetzte Beispielsätze mit real estate assets under management Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. The calculation date should be applied in a consistent manner. The total AUM calculation must be carried out at least annually using the latest available values ie. Assets under management AUM refers to the market value of the assets a financial institution has discretion over. In real estate does assets under management just mean the amount of investor capital that a firm has.

Source: pinterest.com

Source: pinterest.com

How Does Assets Under Management AUM Work. A REIT is a security. Start by determining the value of. Assets under management definitions and. The calculation date should be applied in a consistent manner.

Source: ar.pinterest.com

Source: ar.pinterest.com

Start by determining the value of. How Does Assets Under Management AUM Work. If securities are less than 50 of the portfolio then the portfolio would not be a securities account. Schroder Real Estate KVG mbH. Assets under management definitions and.

Source: pinterest.com

Source: pinterest.com

The net asset value NAV is one of the best metrics to use when assessing the value of a real estate investment trust REIT. In the estimation of AUM some financial institutions involve bank deposits mutual funds and cash in. For each private fund calculate assets under management AUM by adding together the market value and where market value is not available the fair value on a gross basis of all assets of such private fund regardless of their nature including assets that are not securities plus uncalled commitments. AUM can be useful in determining the relative size of two funds or other investments and thus determining their relative liquidity. Assets under management AUM is the total market value of the investments that a person or entity manages on behalf of clients.

Source: pinterest.com

Source: pinterest.com

In real estate does assets under management just mean the amount of investor capital that a firm has. Assets under management AUM refers to the market value of the assets a financial institution has discretion over. For example one mutual fund that invests in the energy sector might have 50 million in assets under management while another fund that makes similar investments might have 100 million in assets under management. As one of the worlds largest investors in real estate we own and operate iconic properties in the worlds most dynamic markets. AUM generally changes according to the flow of money into and out of a particular fund or company.

Source: bankinghub.eu

Source: bankinghub.eu

Assets under management AUM refers to the market value of the assets a financial institution has discretion over. 211B ASSETS UNDER MANAGEMENT. The latest available value produced during the preceding 12 months. To calculate the value of an estate after someone passes you need to calculate the value of all of the persons assets and subtract the total allowed deductions. Assets under management AUM refers to the total market value of investments managed by a mutual fund money management firm hedge fund portfolio manager or other financial services company.

Source: mergersandinquisitions.com

Source: mergersandinquisitions.com

Schroder Real Estate Asset Management GmbH. AUM generally changes according to the flow of money into and out of a particular fund or company. AUM can be useful in determining the relative size of two funds or other investments and thus determining their relative liquidity. Assets under management AUM refers to the total market value of investments managed by a mutual fund money management firm hedge fund portfolio manager or other financial services company. That would all seem to lead back to the equity capital in the real estate investments and not the gross value of all of the real estate investments.

Source: pinterest.com

Source: pinterest.com

As one of the worlds largest investors in real estate we own and operate iconic properties in the worlds most dynamic markets. That would all seem to lead back to the equity capital in the real estate investments and not the gross value of all of the real estate investments. Assets under management definitions and. 211B ASSETS UNDER MANAGEMENT. Any change of the date of the calculation of the AIFMs AUM must be justified to its competent authority.

Source: pinterest.com

Source: pinterest.com

Schroder Real Estate Asset Management GmbH. For each private fund calculate assets under management AUM by adding together the market value and where market value is not available the fair value on a gross basis of all assets of such private fund regardless of their nature including assets that are not securities plus uncalled commitments. In real estate does assets under management just mean the amount of investor capital that a firm has. The latest available value produced during the preceding 12 months. The calculation date should be applied in a consistent manner.

Source: inrev.org

Source: inrev.org

Assets under management AUM refers to the market value of the assets a financial institution has discretion over. Schroder Real Estate KVG mbH. Assets under management definitions and methods differ by company. The latest available value produced during the preceding 12 months. Any change of the date of the calculation of the AIFMs AUM must be justified to its competent authority.

Source: pinterest.com

Source: pinterest.com

Assets under management AUM is the complete market value of the investments that a person or entity operates on behalf of clients. The total AUM calculation must be carried out at least annually using the latest available values ie. The SEC wants the registered adviser to use the same method in calculating assets under management that it uses to report its assets to clients or to calculate fees for investment advisory services. 211B ASSETS UNDER MANAGEMENT. That would all seem to lead back to the equity capital in the real estate investments and not the gross value of all of the real estate investments.

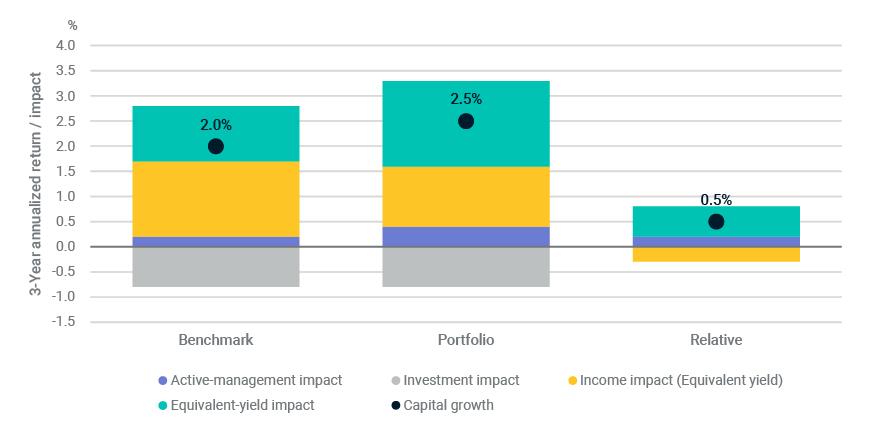

Source: msci.com

Source: msci.com

Schroder Real Estate KVG mbH. Our global portfolio includes office retail multifamily logistics hospitality triple net lease manufactured housing and student housing assets on five. Assets under management definitions and methods differ by company. To calculate the value of an estate after someone passes you need to calculate the value of all of the persons assets and subtract the total allowed deductions. As one of the worlds largest investors in real estate we own and operate iconic properties in the worlds most dynamic markets.

Source: pinterest.com

Source: pinterest.com

Assets under management AUM refers to the total market value of investments managed by a mutual fund money management firm hedge fund portfolio manager or other financial services company. Taunustor 1 TaunusTurm 60310 Frankfurt am Main Germany Telephone 49 0 69 975717-700. That would all seem to lead back to the equity capital in the real estate investments and not the gross value of all of the real estate investments. The calculation date should be applied in a consistent manner. For private fund managers one troubling aspect of Form ADV had been the calculation of assets under management in item 5F.

Source: pinterest.com

Source: pinterest.com

Viele übersetzte Beispielsätze mit real estate assets under management Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. Assets under management AUM is the total market value of the investments that a person or entity manages on behalf of clients. That would all seem to lead back to the equity capital in the real estate investments and not the gross value of all of the real estate investments. As one of the worlds largest investors in real estate we own and operate iconic properties in the worlds most dynamic markets. Assets under management AUM refers to the total market value of investments managed by a mutual fund money management firm hedge fund portfolio manager or other financial services company.

Source: bankinghub.eu

Source: bankinghub.eu

Schroder Real Estate KVG mbH. The latest available value produced during the preceding 12 months. How Does Assets Under Management AUM Work. Except for real estate. If securities are less than 50 of the portfolio then the portfolio would not be a securities account.

Source: pinterest.com

Source: pinterest.com

Investors generally look to the return on equity and capital not the gross value of the real estate assets. Assets under management AUM refers to the total market value of investments managed by a mutual fund money management firm hedge fund portfolio manager or other financial services company. As one of the worlds largest investors in real estate we own and operate iconic properties in the worlds most dynamic markets. The SEC wants the registered adviser to use the same method in calculating assets under management that it uses to report its assets to clients or to calculate fees for investment advisory services. Taunustor 1 TaunusTurm 60310 Frankfurt am Main Germany Telephone 49 0 69 975717-700.

Source: pinterest.com

Source: pinterest.com

For private fund managers one troubling aspect of Form ADV had been the calculation of assets under management in item 5F. For each private fund calculate assets under management AUM by adding together the market value and where market value is not available the fair value on a gross basis of all assets of such private fund regardless of their nature including assets that are not securities plus uncalled commitments. In real estate does assets under management just mean the amount of investor capital that a firm has. Assets under management definitions and methods differ by company. How certain institutions define or calculate their AUM can differ slightly.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title assets under management calculation real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.