Your Arlington county real estate tax rate images are ready in this website. Arlington county real estate tax rate are a topic that is being searched for and liked by netizens now. You can Find and Download the Arlington county real estate tax rate files here. Download all royalty-free photos and vectors.

If you’re searching for arlington county real estate tax rate images information linked to the arlington county real estate tax rate keyword, you have pay a visit to the right blog. Our site always gives you hints for refferencing the highest quality video and image content, please kindly search and locate more informative video content and images that fit your interests.

Arlington County Real Estate Tax Rate. 2100 Clarendon Boulevard Suite 611. The tax rate will remain at 1026 including the sanitary district tax per 100 of assessed real estate value. Real Estate Taxes Payments. I makes or provides no warranties expressed or implied for the tax payment information herein including its accuracy completeness or reliability and ii assumes no liability or responsibility for the use misuse or interpretation of such information.

Graduated Real Estate Tax Reet For Snohomish County From barnettassociates.net

Graduated Real Estate Tax Reet For Snohomish County From barnettassociates.net

The Arlington County Board today citing increased assessments and increased revenues voted not to increase the real estate tax rate for Calendar Year 2021. The Board voted 5 to 0 to adopt the budget and 5 to 0 to set the real estate tax rate at 1006. Houses 4 days ago The median property tax in Arlington County Virginia is 4564 per year for a home worth the median value of 571700. The Board adopted an increase of two cents per 100 of assessed valuation in the property tax rate at that time with 15 cents devoted to Arlington Public Schools. The Board voted 4-0 to advertise a tax rate. 838 The property tax rate shown here is the rate per 1000 of home value.

5 days ago The median property tax also known as real estate tax in Arlington County is 456400 per year based on a median home value of 57170000 and a median effective property tax rate of 080 of property value.

Any personal property tax remaining unpaid in whole or in part sixty 60 days after the payment due date shall incur an additional penalty of fifteen 15 percent of the tax. Arlington County collects on average 08 of a propertys assessed fair market value as property tax. Arlington County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. 838 The property tax rate shown here is the rate per 1000 of home value. Any personal property tax remaining unpaid in whole or in part sixty 60 days after the payment due date shall incur an additional penalty of fifteen 15 percent of the tax. The late payment penalty for most taxes other than real estate taxes is.

Source: br.pinterest.com

Source: br.pinterest.com

All real property in Arlington is subject to taxation except that which is specifically exempt. The tax rate will remain at 1026 including the sanitary district tax per 100 of assessed real estate value. 2 1000 if the tax amount is between 1000 and 10000. Arlington County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Tax assessments are determined by the tax rate which is set by the Arlington County Board and the value of the property which is assessed by the Department of Real Estate.

Source: pinterest.com

Source: pinterest.com

The Board voted 4-0 to advertise a tax rate of 1013 per 100 of assessed value for Calendar Year 2020 1026 including stormwater. Houses 4 days ago The median property tax in Arlington County Virginia is 4564 per year for a home worth the median value of 571700. Real Estate Taxes Payments. The Treasurer of Arlington County the Treasurer makes every effort to provide the most current and accurate tax payment information possible however the Treasurer. The tax rate will remain at 1026 including the sanitary district tax per 100 of assessed real estate value.

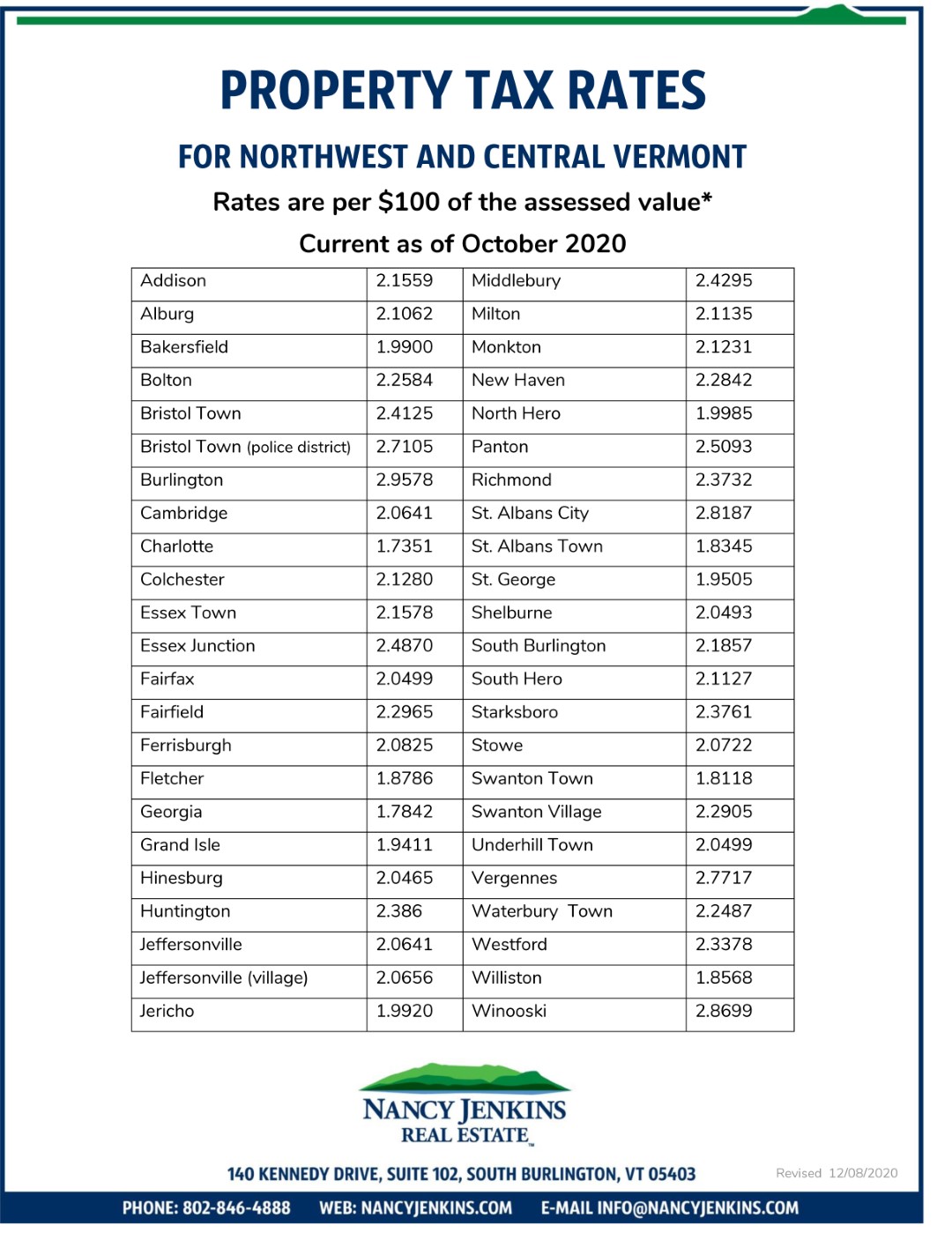

Source: nancyjenkins.com

Source: nancyjenkins.com

The Arlington County Board today adopted a 1276 billion balanced General Fund Budget for Fiscal Year 2019 that includes no increase in the real estate tax rate. The tax rate will remain at 1026 including the sanitary district tax per 100 of assessed real estate value. The Treasurer of Arlington County the Treasurer makes every effort to provide the most current and accurate tax payment information possible however the Treasurer. 5 days ago The median property tax also known as real estate tax in Arlington County is 456400 per year based on a median home value of 57170000 and a median effective property tax rate of 080 of property value. Houses Just Now All real property in Arlington is subject to taxation except that which is specifically exempt.

Source: pl.pinterest.com

Source: pl.pinterest.com

Treasurers Office 2100 Clarendon Boulevard Suite 201 Arlington VA 22201 703-228-4000 703-228-7436 fax TTY. The CY 2019 rate is 1026 number includes 0013 Sanitary District Tax per 100 of assessed value. The Arlington County Board today citing increased assessments and increased revenues voted not to increase the real estate tax rate for Calendar Year 2021. When real estate is sold responsibility for payment of taxes should be worked out during settlement. 2100 Clarendon Boulevard Suite 611.

Source: civicfed.org

Source: civicfed.org

Arlington County collects on average 08 of a propertys assessed fair market value as property tax. 5 days ago The median property tax also known as real estate tax in Arlington County is 456400 per year based on a median home value of 57170000 and a median effective property tax rate of 080 of property value. I makes or provides no warranties expressed or implied for the tax payment information herein including its accuracy completeness or reliability and ii assumes no liability or responsibility for the use misuse or interpretation of such information. Department of Real Estate Assessments. The Board voted 4 to 0 to adopt the budget with no increase in the Calendar Year 2020 tax rate.

Source: ar.pinterest.com

Source: ar.pinterest.com

Tax assessments are determined by the tax rate which is set by the Arlington County Board and the value of the property which is assessed by the Department of Real Estate Assessments. The 725 percent rate includes the State 2 percent regional Transient Occupancy Tax the local County 5 percent Transient Occupancy Tax and a County 025 percent Transient Occupancy Tax to be used exclusively for travel and tourism promotion in Arlington County. The Board voted 4-0 to advertise a tax rate. The CY 2019 rate is 1026 number includes 0013 Sanitary District Tax per 100 of assessed value. Treasurers Office 2100 Clarendon Boulevard Suite 201 Arlington VA 22201 703-228-4000 703-228-7436 fax TTY.

Source: waller.com

Source: waller.com

The Arlington County Board today adopted a 1276 billion balanced General Fund Budget for Fiscal Year 2019 that includes no increase in the real estate tax rate. For example a tax rate of 0996 cents per 10000 would result in a real estate tax of 3984 on a property assessed at 400000. Tax Rates for Arlington VA. Document pick-up is available by appointment only. 838 The property tax rate shown here is the rate per 1000 of home value.

Source: pinterest.com

Source: pinterest.com

Any personal property tax remaining unpaid in whole or in part sixty 60 days after the payment due date shall incur an additional penalty of fifteen 15 percent of the tax. The Board adopted an increase of two cents per 100 of assessed valuation in the property tax rate at that time with 15 cents devoted to Arlington Public Schools. Arlington County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. 575 The total of all income taxes for an area including state county and local taxes. The Real Estate Assessments Office is operating but closed for in-person customer service.

Source: pinterest.com

Source: pinterest.com

The Board adopted an increase of two cents per 100 of assessed valuation in the property tax rate at that time with 15 cents devoted to Arlington Public Schools. 8 am-5 pm Mon-Fri. The Treasurer of Arlington County the Treasurer makes every effort to provide the most current and accurate tax payment information possible however the Treasurer. I makes or provides no warranties expressed or implied for the tax payment information herein including its accuracy completeness or reliability and ii assumes no liability or responsibility for the use misuse or interpretation of such information. 1 10 of the tax amount if the tax is greater than 10000.

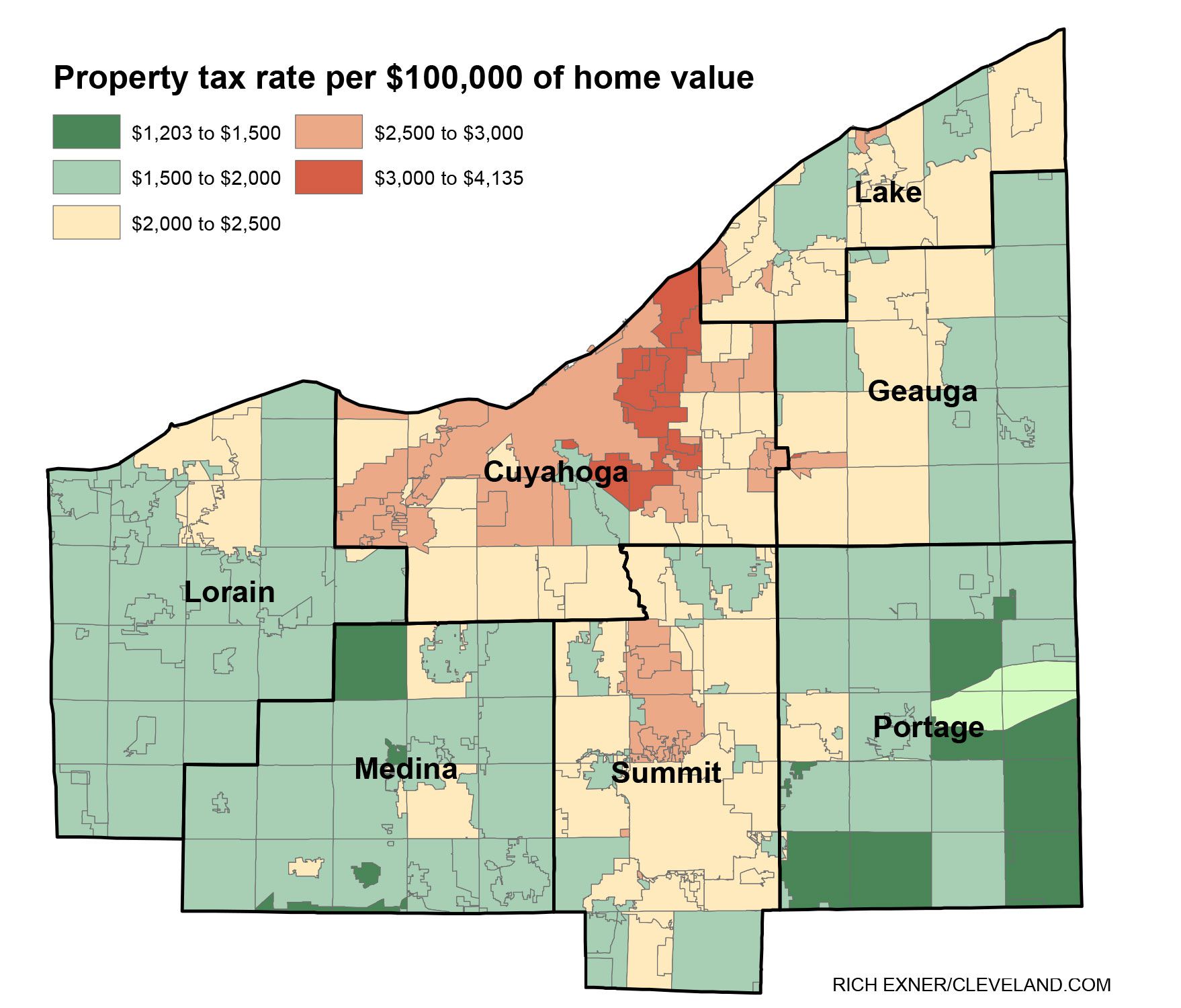

Source: cleveland.com

Source: cleveland.com

5 days ago The median property tax also known as real estate tax in Arlington County is 456400 per year based on a median home value of 57170000 and a median effective property tax rate of 080 of property value. If the tax rate is 1400 and the home value is 250000 the property tax. Arlington VA 22201 703-228-3033 703-228-7048 fax Email Department of Real Estate Assessment 2100 Clarendon Boulevard Suite 611 Arlington VA 22201 703-228-3920 Email Hours. The tax rate will remain at 1026 including the sanitary district tax per 100 of assessed real estate value. If youve sold the property referred to on the tax bill and another person has assumed responsibility for payment return the bill to the Treasurers Office 2100 Clarendon Blvd Suite 201 Arlington VA 22201 with any information you have about the new owner.

Source: wtop.com

Source: wtop.com

The Board voted 4-0 to advertise a tax rate. The Arlington County Board today adopted a 1276 billion balanced General Fund Budget for Fiscal Year 2019 that includes no increase in the real estate tax rate. The 725 percent rate includes the State 2 percent regional Transient Occupancy Tax the local County 5 percent Transient Occupancy Tax and a County 025 percent Transient Occupancy Tax to be used exclusively for travel and tourism promotion in Arlington County. All real property in Arlington is subject to taxation except that which is specifically exempt. Tax Rate x Assessment Tax.

Source: in.pinterest.com

Source: in.pinterest.com

Tax rates in Arlington are expressed in dollars per one hundred dollars of assessed value. The Board voted 4 to 0 to adopt the budget with no increase in the Calendar Year 2020 tax rate. The Real Estate Assessments Office is operating but closed for in-person customer service. Contact your settlement attorney with any questions regarding who is responsible for paying taxes. Arlington County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Source: pinterest.com

Source: pinterest.com

The CY 2019 rate is 1026 number includes 0013 Sanitary District Tax per 100 of assessed value. Houses Just Now All real property in Arlington is subject to taxation except that which is specifically exempt. Fiscal Year 2019 Budget Close out. Arlington has an online financial transparency tool that makes it easier to see and understand how the County spends and receives money. 8 am-5 pm Mon-Fri.

Source: budget.arlingtonva.us

Source: budget.arlingtonva.us

The tax rate will remain at 1026 including the sanitary district tax per 100 of assessed real estate value. The Board adopted an increase of two cents per 100 of assessed valuation in the property tax rate at that time with 15 cents devoted to Arlington Public Schools. The increase raised the Calendar Year 2019 tax rate to 1026 including the sanitary district tax per 100 of assessed value. 2100 Clarendon Boulevard Suite 611. Tax assessments are determined by the tax rate which is set by the Arlington County Board and the value of the property which is assessed by the Department of Real Estate Assessments.

Source: barnettassociates.net

Source: barnettassociates.net

The Real Estate Assessments Office is operating but closed for in-person customer service. 8 am-5 pm Mon-Fri. The increase raised the Calendar Year 2019 tax rate to 1026 including the sanitary district tax per 100 of assessed value. Any personal property tax remaining unpaid in whole or in part sixty 60 days after the payment due date shall incur an additional penalty of fifteen 15 percent of the tax. The Board voted 5 to 0 to adopt the budget and 5 to 0 to set the real estate tax rate at 1006.

Source: wtop.com

Source: wtop.com

The Board adopted an increase of two cents per 100 of assessed valuation in the property tax rate at that time with 15 cents devoted to Arlington Public Schools. Federal income taxes are not included Property Tax Rate. Real Estate Taxes Payments. Contact your settlement attorney with any questions regarding who is responsible for paying taxes. If youve sold the property referred to on the tax bill and another person has assumed responsibility for payment return the bill to the Treasurers Office 2100 Clarendon Blvd Suite 201 Arlington VA 22201 with any information you have about the new owner.

Source: civicfed.org

Source: civicfed.org

Arlington County collects on average 08 of a propertys assessed fair market value as property tax. 1 10 of the tax amount if the tax is greater than 10000. The Arlington County Board citing increased assessments and increased revenues voted not to increase the real estate tax rate for Calendar Year 2021. Arlington VA 22201 703-228-3033 703-228-7048 fax Email Department of Real Estate Assessment 2100 Clarendon Boulevard Suite 611 Arlington VA 22201 703-228-3920 Email Hours. 8 am-5 pm Mon-Fri.

Source: smartsettlements.com

Source: smartsettlements.com

The Treasurer of Arlington County the Treasurer makes every effort to provide the most current and accurate tax payment information possible however the Treasurer. Treasurers Office 2100 Clarendon Boulevard Suite 201 Arlington VA 22201 703-228-4000 703-228-7436 fax TTY. The Arlington County Board today adopted a 1276 billion balanced General Fund Budget for Fiscal Year 2019 that includes no increase in the real estate tax rate. Houses Just Now All real property in Arlington is subject to taxation except that which is specifically exempt. If youve sold the property referred to on the tax bill and another person has assumed responsibility for payment return the bill to the Treasurers Office 2100 Clarendon Blvd Suite 201 Arlington VA 22201 with any information you have about the new owner.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title arlington county real estate tax rate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.