Your Arkansas real estate taxes due date images are ready in this website. Arkansas real estate taxes due date are a topic that is being searched for and liked by netizens now. You can Download the Arkansas real estate taxes due date files here. Get all royalty-free photos and vectors.

If you’re searching for arkansas real estate taxes due date images information connected with to the arkansas real estate taxes due date keyword, you have visit the ideal site. Our website always gives you hints for downloading the highest quality video and picture content, please kindly search and locate more informative video content and images that fit your interests.

Arkansas Real Estate Taxes Due Date. Otherwise check with locality. June 15 of the year taxes are due if notice of assessment is mailed on or after May 1 of the assessment year May 10. Assessment Notice Issue Date. Sign up for Gov2Go.

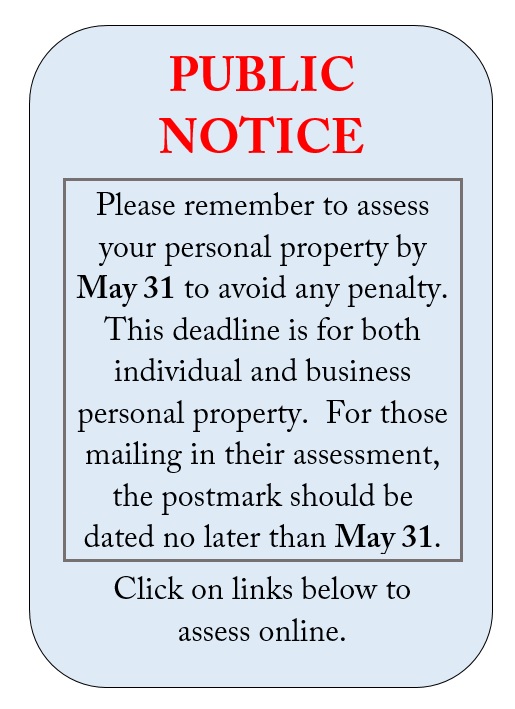

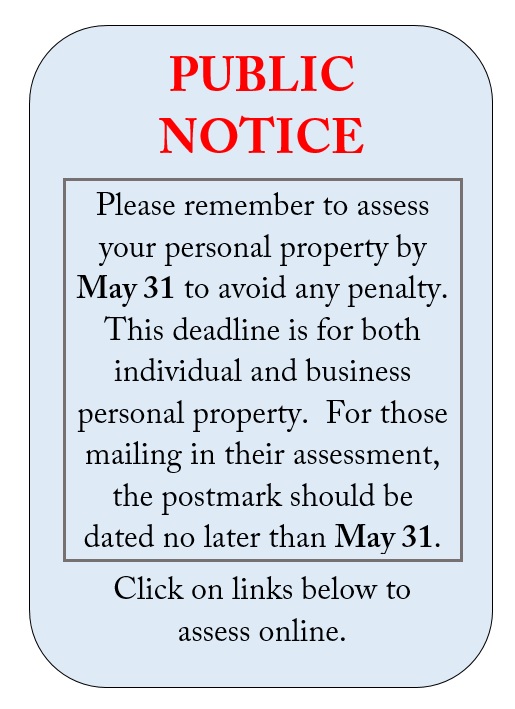

Assessor From faulknercounty.org

Assessor From faulknercounty.org

Real and Personal Property taxes less than 5000 are due in full by April 30th. Want to avoid paying a 10 late penalty. Taxpayers may pay their taxes in installments. Real Estate Date Events Notes. The entire years tax is due on or before April 30th. A 10 late assessment fee will be added to anyone assessing personal property after the May 31st deadline.

Use the link below to locate the correct website to pay your property taxes.

The Saline County tax books are open and personal and real estate taxes can be paid. By January 31 Furnish Forms 1099 and W-2. New purchases will have 30 days after purchase to assess without penalty A 10 penalty will be added to Personal Property and Real. File Form W-2 and ARW3. Sign up for Gov2Go. Due Dates Withholding Year End Payment Dates.

Interest and penalty will be charged on the entire principal balance. September 15 or November 30. On and after January 1 1991 taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from January 1 through May 31 ACA 26-26-1408. You may pay your property taxes each year starting in March and they are due by October 15th of every year. Real Property Information.

Source: propertytax.ark.org

Source: propertytax.ark.org

Otherwise check with locality. By January 31 Furnish Forms 1099 and W-2. Personal and Real Estate taxes are due March 1 through October 15 each year. Furnish each other payee a completed Form 1099. By Washington State law the postmark is considered the received date for interest calculations.

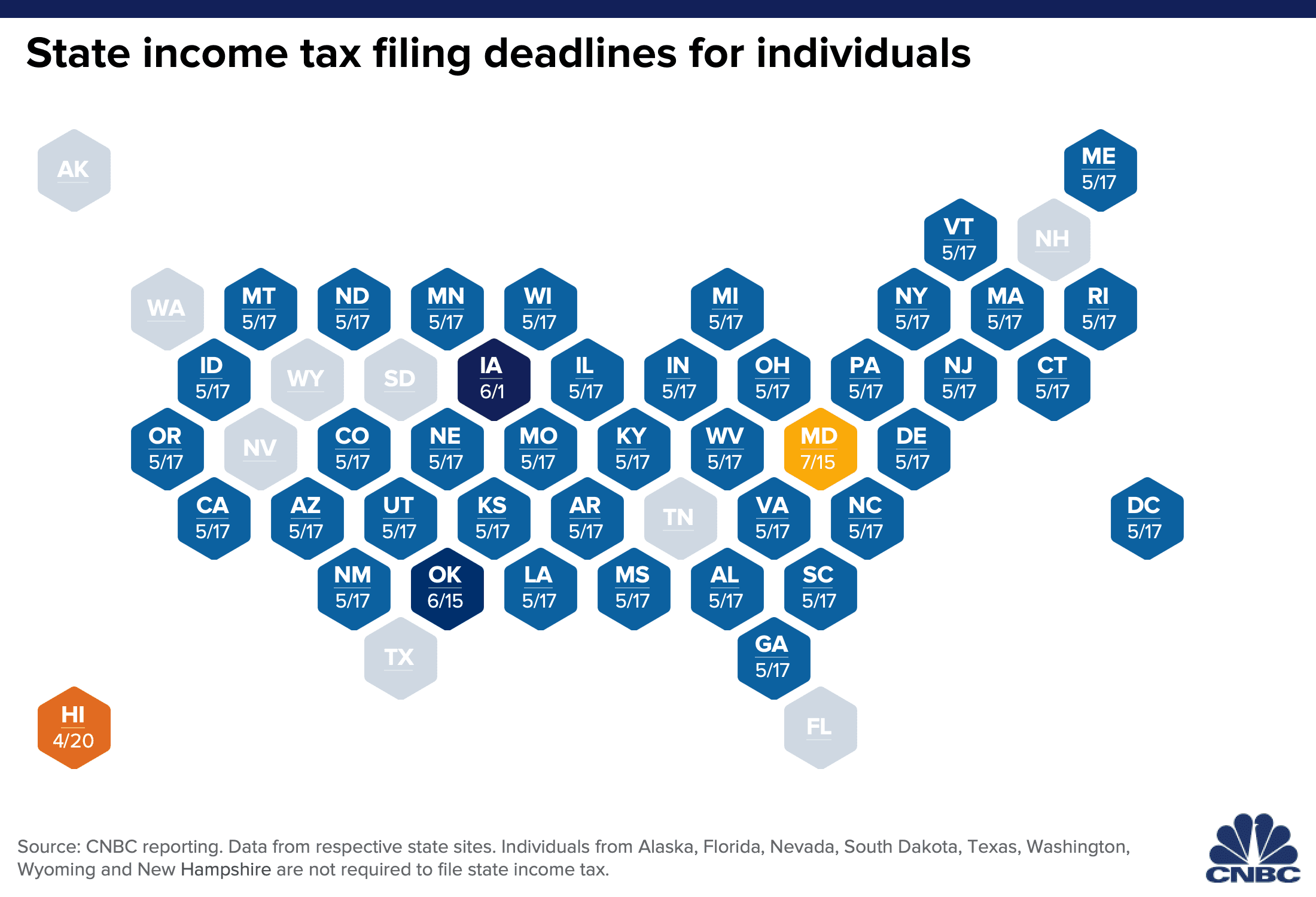

Source: cnbc.com

Source: cnbc.com

Mandatory Utility company installments are due by the 3rd Monday in April 2nd Monday in June and balance by October 15th. The statewide property tax deadline is October 15. Single Payment Due Delinquent Date October 10. File Copy 1- For State City or Local Tax Department of all paper Forms W-2 with Form ARW3 Transmittal of Wage and Tax Statements to the Arkansas Withholding. Use the link below to locate the correct website to pay your property taxes.

Source: propertytax.ark.org

Source: propertytax.ark.org

On and after January 1 1991 taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from January 1 through May 31 ACA 26-26-1408. Be sure to pay through your local county. Arkansas Personal Income Tax. Use the link below to locate the correct website to pay your property taxes. Furnish each employee a completed Form W-2 Wage and Tax Statement.

Source: forbes.com

Source: forbes.com

You may pay your property taxes each year starting in March and they are due by October 15th of every year. You may choose to pay half by April 30th and half by October 31st if applicable. Taxes are due by October 15th the following year. You may pay your property taxes each year starting in March and they are due by October 15th of every year. Many county collectors accept online property tax payments.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

Furnish each other payee a completed Form 1099. A 10 late assessment fee will be added to anyone assessing personal property after the May 31st deadline. Mandatory Utility company installments are due by the 3rd Monday in April 2nd Monday in June and balance by October 15th. September 15 or November 30. June 15 of the year taxes are due if notice of assessment is mailed on or after May 1 of the assessment year May 10.

Source: propertytax.ark.org

Source: propertytax.ark.org

Interest and penalty will be charged on the entire principal balance. Many county collectors accept online property tax payments. Taxes are due by October 15th the following year. On and after January 1 1991 taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from January 1 through May 31 ACA 26-26-1408. New purchases will have 30 days after purchase to assess without penalty A 10 penalty will be added to Personal Property and Real.

Source: faulknercounty.org

Source: faulknercounty.org

Find Your County Collector. Click the county of your choice on the map below or select it from the drop down to access its. Real Property Information. New purchases will have 30 days after purchase to assess without penalty A 10 penalty will be added to Personal Property and Real. Find Your County Collector.

Source: propertytax.ark.org

Source: propertytax.ark.org

You may choose to pay half by April 30th and half by October 31st if applicable. When a property owner fails to timely pay the assessed tax the property may become subject to sale by the State. Taxes become delinquent on October 16 The deadline for accepting online tax payments is Oct 15. Furnish each employee a completed Form W-2 Wage and Tax Statement. Find Your County Collector.

Source: propertytax.ark.org

Source: propertytax.ark.org

No penalty will be assessed for online payments made before the deadline. You may choose to pay half by April 30th and half by October 31st if applicable. Saline County TAXES are DUE OCTOBER 15 2020 Personal and Real Estate taxes are now payable and statements are in the process of being mailed out. When a property owner fails to timely pay the assessed tax the property may become subject to sale by the State. Taxes are due upon receipt and become delinquent after October 15th.

Source: caseescrow.com

Source: caseescrow.com

Many county collectors accept online property tax payments. Taxes become delinquent on October 16 The deadline for accepting online tax payments is Oct 15. The Saline County tax books are open and personal and real estate taxes can be paid. You may choose to pay half by April 30th and half by October 31st if applicable. Payments can be made by phone or online.

Source: listwithclever.com

Source: listwithclever.com

Property must be assessed between January 1st and May 31st each year. Find Your County Collector. Payments can be made by phone or online. By January 31 Furnish Forms 1099 and W-2. September 15 or November 30.

Source: propertytax.ark.org

Source: propertytax.ark.org

Otherwise check with locality. Sign up for Gov2Go. Taxpayers may pay their taxes in installments. Overview of Arkansas Property Tax Sales. By Washington State law the postmark is considered the received date for interest calculations.

Source: craigheadcounty.org

Source: craigheadcounty.org

Friday 12182020 was our last day to accept payments at Centennial branches. Be sure to pay through your local county. Any real estate tax payments filed with the Department of Revenue due between April 1 and June 1 are due June 1. In general the duty of the county assessor is to appraise and assess all real property between the first Monday in January and the first day of July ACA 26-26-1101. Assessment Notice Issue Date.

Source: bouldercounty.org

Source: bouldercounty.org

Be sure to pay before then to avoid late penalties. Sign up for Gov2Go. Taxes are due by October 15th the following year. Click the county of your choice on the map below or select it from the drop down to access its. Furnish each other payee a completed Form 1099.

Source: bouldercounty.org

Source: bouldercounty.org

Be sure to pay before then to avoid late penalties. File Form W-2 and ARW3. The Saline County tax books are open and personal and real estate taxes can be paid. 2019 Personal Property and Real Estate Taxes are now delinquent. Property must be assessed between January 1st and May 31st each year.

Source: co.carroll.ar.us

Source: co.carroll.ar.us

By January 31 Furnish Forms 1099 and W-2. Click the county of your choice on the map below or select it from the drop down to access its. You may choose to pay half by April 30th and half by October 31st if applicable. Real Estate Date Events Notes. Installment Payments are due by the 3rd Monday in April 3rd Monday in July and balance by October 15th.

Source: propertytax.ark.org

Source: propertytax.ark.org

Assessment Notice Issue Date. On and after January 1 1991 taxpayers shall annually assess their tangible personal property for ad valorem taxes during the period from January 1 through May 31 ACA 26-26-1408. Property must be assessed between January 1st and May 31st each year. Payments can be made by phone or online. Taxes are due by October 15th the following year.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title arkansas real estate taxes due date by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.