Your Are real estate taxes deductible on federal income tax images are available in this site. Are real estate taxes deductible on federal income tax are a topic that is being searched for and liked by netizens now. You can Find and Download the Are real estate taxes deductible on federal income tax files here. Get all royalty-free photos.

If you’re searching for are real estate taxes deductible on federal income tax images information linked to the are real estate taxes deductible on federal income tax interest, you have visit the right blog. Our website always gives you hints for viewing the maximum quality video and picture content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Are Real Estate Taxes Deductible On Federal Income Tax. Interest paid on mortgages and stock margin accounts may be deducted as can real estate tax and state and local income tax. But limits apply and you have to. Federal law affords taxpayers the ability to deduct real estate taxes from federal income taxes. In order for a tax to be deductible for federal income tax purposes the tax must be a state local or foreign real estate taxes that are imposed equally on all property found within the jurisdiction.

Income Tax Deductions Under Chapter Vi For Ay 2020 21 Fy 2019 20 Sec 80c 80ccc Etc Tax Deductions Income Tax Income Tax Return From pinterest.com

Income Tax Deductions Under Chapter Vi For Ay 2020 21 Fy 2019 20 Sec 80c 80ccc Etc Tax Deductions Income Tax Income Tax Return From pinterest.com

On your federal tax returns assessed real estate or property taxes you pay to state and local government are tax deductible. One note of caution however is that taxes are not a deduction for Alternative Minimum Tax purposes. But limits apply and you have to. State and local income taxes are deductible when youre calculating your regular federal income tax but theyre not deductible when youre calculating the AMT. If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it. Deductible real estate taxes include any state local or foreign taxes that are.

Usually owners can deduct property taxes from their federal income.

So it appears that property taxes paid on real estate investment property would not be subject to the 10000 cap. Finance - Zacks Real estate commissions typically run 5 to 6 percent of the sale price on a. Are real estate taxes deductible. One note of caution however is that taxes are not a deduction for Alternative Minimum Tax purposes. But limits apply and you have to. Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property.

Source: pinterest.com

Source: pinterest.com

If you use the property as a second homenot as a rentalyou can deduct mortgage interest just as you would for a second home in the US. In order for a tax to be deductible for federal income tax purposes the tax must be a state local or foreign real estate taxes that are imposed equally on all property found within the jurisdiction. Depending on the situation including these additional tax deductions may not result in any less Federal Income Tax. Are real estate taxes deductible. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill.

Source: br.pinterest.com

Source: br.pinterest.com

One note of caution however is that taxes are not a deduction for Alternative Minimum Tax purposes. You can claim a deduction for real property taxes if the tax is uniformthe same rate is applied to all real property in the tax jurisdiction. Can I Deduct Realtors Commissions on My Income Tax Return. On your federal tax returns assessed real estate or property taxes you pay to state and local government are tax deductible. One note of caution however is that taxes are not a deduction for Alternative Minimum Tax purposes.

Source: nl.pinterest.com

Source: nl.pinterest.com

Federal law affords taxpayers the ability to deduct real estate taxes from federal income taxes. The IRS has slammed the door on paying estimated property taxes for the following year before years end. You can claim a deduction for real property taxes if the tax is uniformthe same rate is applied to all real property in the tax jurisdiction. The tax cant be paid in exchanged for any special service or privilege that only you would enjoy. Rules for the Property Tax Deduction.

Source: pinterest.com

Source: pinterest.com

Most state and local tax authorities calculate property taxes based on the value of the homes located within their areas and some agencies also tax personal property. One note of caution however is that taxes are not a deduction for Alternative Minimum Tax purposes. Usually owners can deduct property taxes from their federal income. All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income. The IRS has slammed the door on paying estimated property taxes for the following year before years end.

Source: pinterest.com

Source: pinterest.com

Real estate taxes also called property taxes for your main home vacation home or land are an allowable deduction if theyre based on the assessed value of the property and the property is for your own personal use. State and local property taxes are generally eligible to be deducted from the property owners federal income taxes. Are real estate taxes deductible. Real estate taxes also called property taxes for your main home vacation home or land are an allowable deduction if theyre based on the assessed value of the property and the property is for your own personal use. All rental income must be reported on your tax return and in general the associated expenses can be deducted from your rental income.

Source: pinterest.com

Source: pinterest.com

If you buy a real estate investment or rental home the transfer taxes can be deducted as a work expense. Interest paid on mortgages and stock margin accounts may be deducted as can real estate tax and state and local income tax. Offsetting capital gains if real estate losses are passive income If the loss is considered to be from a source of passive income which is most common your loss may be used to offset any other capital gains that year. Can I Deduct Realtors Commissions on My Income Tax Return. So it appears that property taxes paid on real estate investment property would not be subject to the 10000 cap.

Source: fi.pinterest.com

Source: fi.pinterest.com

Deductible real estate taxes include any state local or foreign taxes that are. Federal law affords taxpayers the ability to deduct real estate taxes from federal income taxes. Real estate taxes also called property taxes for your main home vacation home or land are an allowable deduction if theyre based on the assessed value of the property and the property is for your own personal use. But limits apply and you have to. Are real estate taxes deductible.

Source: pinterest.com

Source: pinterest.com

State and local income taxes are deductible when youre calculating your regular federal income tax but theyre not deductible when youre calculating the AMT. Then up to 3000 may be deducted from ordinary income 1500 if you are married filing separately. Federal law affords taxpayers the ability to deduct real estate taxes from federal income taxes. Usually owners can deduct property taxes from their federal income. Taxes paid on investment property should be reported as Other Taxes on Line 6 of Schedule A Form 1040.

Source: hrblock.com

Source: hrblock.com

If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it. How to Deduct Interest and Taxes for a Decedent Estate or Trust When preparing a decedents final income tax Form 1040 or an estate or trusts Form 1041 you may deduct certain types of interest and taxes. If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it. And not only are the real estate taxes on your primary home deductible. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill.

Source: pinterest.com

Source: pinterest.com

How to Deduct Interest and Taxes for a Decedent Estate or Trust When preparing a decedents final income tax Form 1040 or an estate or trusts Form 1041 you may deduct certain types of interest and taxes. The revenues raised must benefit the community as a whole or the government. If you own rental real estate you should be aware of your federal tax responsibilities. There is no maximum cap on the amount of property tax that can be deducted. Depending on the situation including these additional tax deductions may not result in any less Federal Income Tax.

Source: cz.pinterest.com

Source: cz.pinterest.com

Deductible real estate taxes include any state local or foreign taxes that are. If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it. Offsetting capital gains if real estate losses are passive income If the loss is considered to be from a source of passive income which is most common your loss may be used to offset any other capital gains that year. If you use the property as a second homenot as a rentalyou can deduct mortgage interest just as you would for a second home in the US. Taxes paid on investment property should be reported as Other Taxes on Line 6 of Schedule A Form 1040.

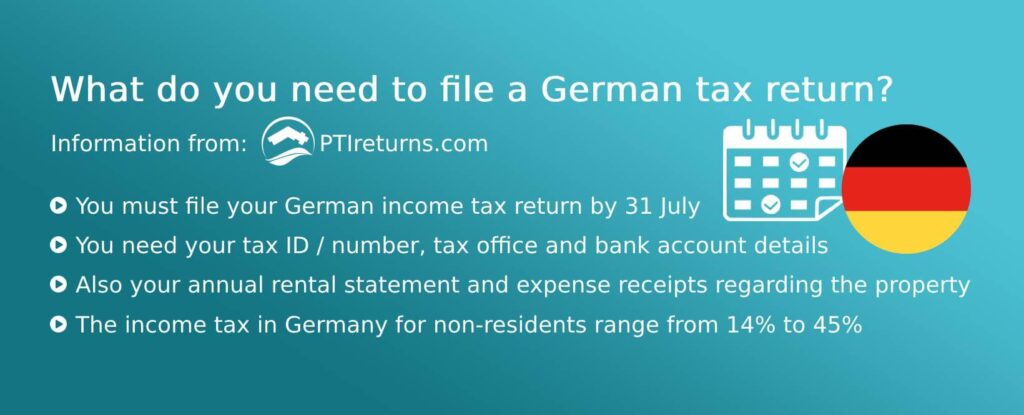

Source: ptireturns.com

Source: ptireturns.com

Can I Deduct Realtors Commissions on My Income Tax Return. If you are a cash basis taxpayer you report rental income on your return for the year you receive it regardless of when it. One note of caution however is that taxes are not a deduction for Alternative Minimum Tax purposes. And not only are the real estate taxes on your primary home deductible. In order for a tax to be deductible for federal income tax purposes the tax must be a state local or foreign real estate taxes that are imposed equally on all property found within the jurisdiction.

Source: pinterest.com

Source: pinterest.com

The IRS has slammed the door on paying estimated property taxes for the following year before years end. Taxes paid on investment property should be reported as Other Taxes on Line 6 of Schedule A Form 1040. Deductible real estate taxes include any state local or foreign taxes that are. The tax cant be paid in exchanged for any special service or privilege that only you would enjoy. Then up to 3000 may be deducted from ordinary income 1500 if you are married filing separately.

Source: in.pinterest.com

Source: in.pinterest.com

There is no maximum cap on the amount of property tax that can be deducted. Are real estate taxes deductible. So it appears that property taxes paid on real estate investment property would not be subject to the 10000 cap. Then up to 3000 may be deducted from ordinary income 1500 if you are married filing separately. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill.

Source: pinterest.com

Source: pinterest.com

Interest paid on mortgages and stock margin accounts may be deducted as can real estate tax and state and local income tax. If you use the property as a second homenot as a rentalyou can deduct mortgage interest just as you would for a second home in the US. For 2019 you can deduct the interest you pay on the first. You can deduct your real estate taxes on your federal income tax return. How to Deduct Interest and Taxes for a Decedent Estate or Trust When preparing a decedents final income tax Form 1040 or an estate or trusts Form 1041 you may deduct certain types of interest and taxes.

Source: pinterest.com

Source: pinterest.com

Interest paid on mortgages and stock margin accounts may be deducted as can real estate tax and state and local income tax. How to Deduct Interest and Taxes for a Decedent Estate or Trust When preparing a decedents final income tax Form 1040 or an estate or trusts Form 1041 you may deduct certain types of interest and taxes. Federal law affords taxpayers the ability to deduct real estate taxes from federal income taxes. On your federal tax returns assessed real estate or property taxes you pay to state and local government are tax deductible. Offsetting capital gains if real estate losses are passive income If the loss is considered to be from a source of passive income which is most common your loss may be used to offset any other capital gains that year.

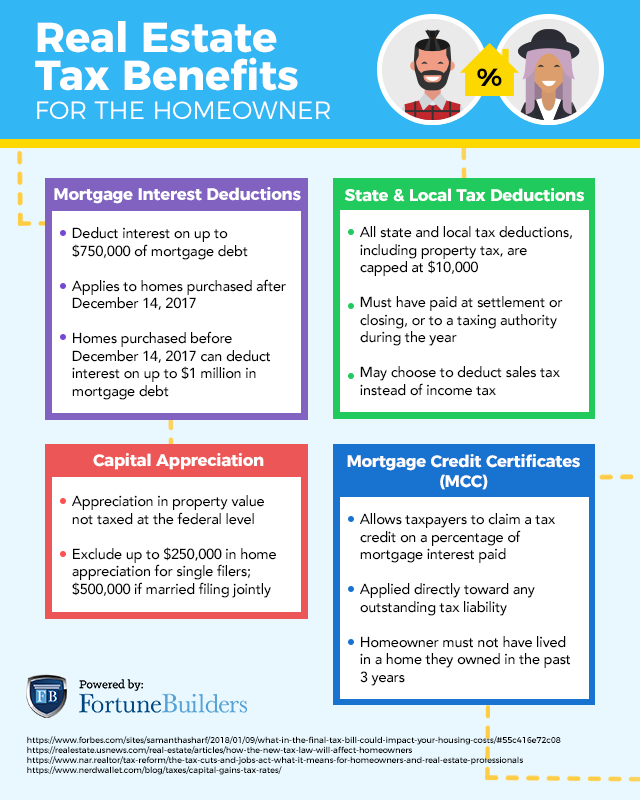

Source: fortunebuilders.com

Source: fortunebuilders.com

And not only are the real estate taxes on your primary home deductible. On your federal tax returns assessed real estate or property taxes you pay to state and local government are tax deductible. You can deduct your real estate taxes on your federal income tax return. The revenues raised must benefit the community as a whole or the government. The Internal Revenue Service IRS allows property holders to deduct their property tax payments from their tax return.

Source: pinterest.com

Source: pinterest.com

If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill. If you pay taxes on your personal property and owned real estate they may be deductible from your federal income tax bill. Usually owners can deduct property taxes from their federal income. How to Deduct Interest and Taxes for a Decedent Estate or Trust When preparing a decedents final income tax Form 1040 or an estate or trusts Form 1041 you may deduct certain types of interest and taxes. In order for a tax to be deductible for federal income tax purposes the tax must be a state local or foreign real estate taxes that are imposed equally on all property found within the jurisdiction.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title are real estate taxes deductible on federal income tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.