Your Are real estate commissions tax deductible in canada images are available. Are real estate commissions tax deductible in canada are a topic that is being searched for and liked by netizens today. You can Download the Are real estate commissions tax deductible in canada files here. Find and Download all free photos and vectors.

If you’re searching for are real estate commissions tax deductible in canada pictures information connected with to the are real estate commissions tax deductible in canada interest, you have come to the ideal site. Our website always provides you with hints for seeking the highest quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

Are Real Estate Commissions Tax Deductible In Canada. The maximum contribution limit for the tax year 2019 is CA26500. Assuming those commissions were 20000 at a 40 per cent marginal tax rate. With this strategy your RRSP portfolio will improve overtime. The first thing youll want to do is talk with your mortgage lender.

Is Real Estate Agent Cash Back Taxable In Us 1099 Misc Usa From am22tech.com

Is Real Estate Agent Cash Back Taxable In Us 1099 Misc Usa From am22tech.com

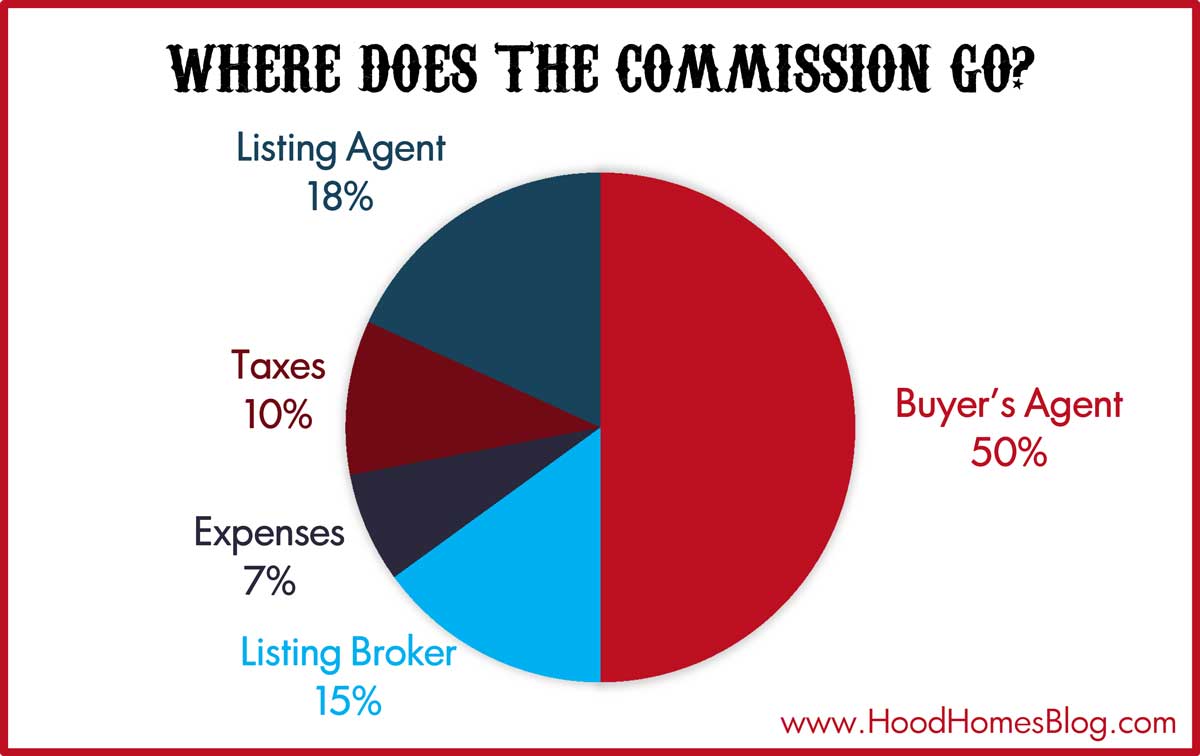

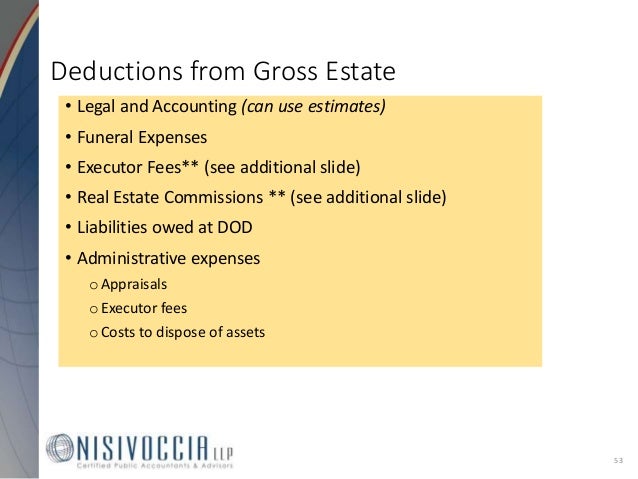

Is real estate commission tax-deductible. These include real estate commission legal and advertising fees as well as mortgage penalty if you pay your mortgage off before it matures. Condominium fees are tax deductible in some rental situations. If you pay it to sell your house its not deductible although it is a part of the cost of selling your house. Some real estate commissions are tax-deductible and some arent. When the PRE Doesnt Apply Homes that you own exclusively for rental purposes at which you do not reside or use for business purposes dont qualify for the PRE.

Your investment will grow tax-free increasing the savings.

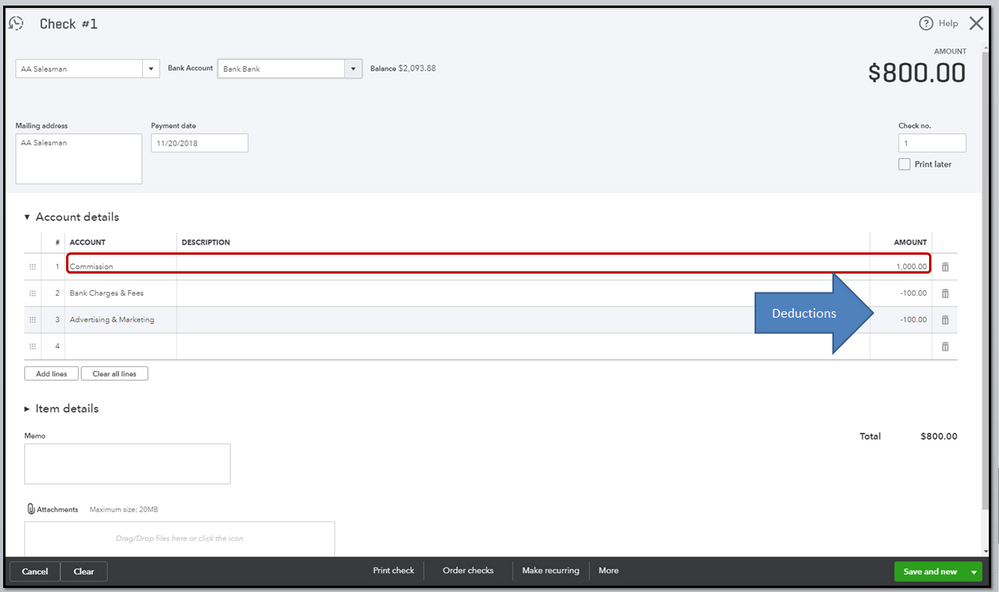

These include real estate commission legal and advertising fees as well as mortgage penalty if you pay your mortgage off before it matures. By adding your real estate commissions to the homes basis you reduce your total capital gain taxes from the sale of the property. Thats because real estate commissions which can run into five figures are included in the deduction she says. If youre buying and the seller insists you take care of the commissions you cant claim them as a tax deduction until you sell the house. At that point you treat them like closing costs and add. The HST is part of the cost of the property and the legal fees etc are included with the adjusted cost base.

Source: moneysense.ca

Source: moneysense.ca

With real estate prices in Canada and more specifically Vancouver and Toronto through the roof clients on both the buy and sell side frequently ask their Realtor for a break on their commission - to either help with closing costs possible renovations or to reduce their mortgage balance after closing. These commission rebates are 100 deductible to the agent. Cost of selling your old home including advertising notary or legal fees real estate commission and mortgage penalty when the mortgage is paid off before maturity. With this strategy your RRSP portfolio will improve overtime. The maximum contribution limit for the tax year 2019 is CA26500.

Source: researchgate.net

Source: researchgate.net

Can you deduct legal fees and realtor commission from capital gain of a vacant land sale. If youre buying and the seller insists you take care of the commissions you cant claim them as a tax deduction until you sell the house. Thats because real estate commissions which can run into five figures are included in the deduction she says. Is real estate commission tax-deductible. At that point you treat them like closing costs and add.

Source: diginerds.biz

Source: diginerds.biz

Can you deduct legal fees and realtor commission from capital gain of a vacant land sale. Selling a Revenue Property in Vancouver BC Capital Gains Tax and Deducting Real Estate Commissions in Canada So youve decided to sell an investment condo or other revenue property in Vancouver. With this strategy your RRSP portfolio will improve overtime. They are a necessary expense to remain licensed and to trade in real estate. Instead the income generated from the partnership is reported on the individuals tax return.

Source: slideshare.net

Source: slideshare.net

Are Condo Fees Tax Deductible for Rental Property in Canada. Can you deduct legal fees and realtor commission from capital gain of a vacant land sale. You cannot deduct these costs during a period when the old home was rented. The maximum contribution limit for the tax year 2019 is CA26500. Your investment will grow tax-free increasing the savings.

Source: mileiq.com

Source: mileiq.com

Instead the income generated from the partnership is reported on the individuals tax return. Section 121 The IRS provides an additional deduction against capital gains from the sale of a primary residence through the Section 121 exclusion. You cannot deduct these costs during a period when the old home was rented. They are a necessary expense to remain licensed and to trade in real estate. The maximum contribution limit for the tax year 2019 is CA26500.

Source: am22tech.com

Source: am22tech.com

Can you deduct legal fees and realtor commission from capital gain of a vacant land sale. For the Adjusted Cost Base ACB of the property you are going to show 3294686. Commission Rebates - With real estate prices rising in Canada customers who are either buying or selling regularly ask their agent for a break on their commission so as to aid in closing costs likely renovations or to decrease their mortgage balance after closing. With this strategy your RRSP portfolio will improve overtime. Commission Rebates are 100 deductible to the Real Estate Agent.

Source: realestatelicensehq.ca

Source: realestatelicensehq.ca

They are a necessary expense to remain licensed and to trade in real estate. Instead the income generated from the partnership is reported on the individuals tax return. They are a necessary expense to remain licensed and to trade in real estate. Assuming those commissions were 20000 at a 40 per cent marginal tax rate. If you paid commissions to a real estate agent when selling your rental property include them as outlays and expenses on Schedule 3 Capital Gains or Losses when you report the disposition of your property.

Source: researchgate.net

Source: researchgate.net

If your tenant pays the condominium fees you cannot deduct them during that time period. Cost of selling your old home including advertising notary or legal fees real estate commission and mortgage penalty when the mortgage is paid off before maturity. By adding your real estate commissions to the homes basis you reduce your total capital gain taxes from the sale of the property. Is real estate commission tax-deductible. With this strategy your RRSP portfolio will improve overtime.

Source: fivewalls.com

Source: fivewalls.com

These include board dues dues to other governing bodies registration fees and insurance. For the Adjusted Cost Base ACB of the property you are going to show 3294686. When the PRE Doesnt Apply Homes that you own exclusively for rental purposes at which you do not reside or use for business purposes dont qualify for the PRE. The maximum contribution limit for the tax year 2019 is CA26500. These include real estate commission legal and advertising fees as well as mortgage penalty if you pay your mortgage off before it matures.

Source: realestatetaxtips.ca

Source: realestatetaxtips.ca

Selling a Revenue Property in Vancouver BC Capital Gains Tax and Deducting Real Estate Commissions in Canada So youve decided to sell an investment condo or other revenue property in Vancouver. If you move 40 kilometres away to be closer to your school or office you may claim a reasonable amount of tax rebates from your moving expenses. The first thing youll want to do is talk with your mortgage lender. Condominium fees are tax deductible in some rental situations. Cost of selling your old home including advertising notary or legal fees real estate commission and mortgage penalty when the mortgage is paid off before maturity.

Some real estate commissions are tax-deductible and some arent. They can be taken as deductions when they impact what you would otherwise make in rental income. These include board dues dues to other governing bodies registration fees and insurance. Commission Rebates - With real estate prices rising in Canada customers who are either buying or selling regularly ask their agent for a break on their commission so as to aid in closing costs likely renovations or to decrease their mortgage balance after closing. If youre buying and the seller insists you take care of the commissions you cant claim them as a tax deduction until you sell the house.

Source: thinkaccounting.ca

Source: thinkaccounting.ca

They can be taken as deductions when they impact what you would otherwise make in rental income. Your investment will grow tax-free increasing the savings. Fees for licensing are tax deductible. These include real estate commission legal and advertising fees as well as mortgage penalty if you pay your mortgage off before it matures. You cannot deduct these costs during a period when the old home was rented.

You can also deduct amounts paid or payable to agents for collecting rents or finding new tenants. Your investment will grow tax-free increasing the savings. Can you deduct legal fees and realtor commission from capital gain of a vacant land sale. With this strategy your RRSP portfolio will improve overtime. The HST is part of the cost of the property and the legal fees etc are included with the adjusted cost base.

Source: researchgate.net

Source: researchgate.net

These are separate from any fees you pay to you brokerage for commissions earned. The first thing youll want to do is talk with your mortgage lender. With this strategy your RRSP portfolio will improve overtime. Cost of selling your old home including advertising notary or legal fees real estate commission and mortgage penalty when the mortgage is paid off before maturity. Selling a Revenue Property in Vancouver BC Capital Gains Tax and Deducting Real Estate Commissions in Canada So youve decided to sell an investment condo or other revenue property in Vancouver.

Source: iclg.com

Source: iclg.com

These include board dues dues to other governing bodies registration fees and insurance. Condominium fees are tax deductible in some rental situations. These include board dues dues to other governing bodies registration fees and insurance. Can you deduct legal fees and realtor commission from capital gain of a vacant land sale. In the sale of a property that qualifies for the PRE any capital gain or loss is exempt from income tax claim or deduction.

Source: mikestewart.ca

Source: mikestewart.ca

Can you deduct legal fees and realtor commission from capital gain of a vacant land sale. Your investment will grow tax-free increasing the savings. With real estate prices in Canada and more specifically Vancouver and Toronto through the roof clients on both the buy and sell side frequently ask their Realtor for a break on their commission - to either help with closing costs possible renovations or to reduce their mortgage balance after closing. For the Adjusted Cost Base ACB of the property you are going to show 3294686. These include board dues dues to other governing bodies registration fees and insurance.

Source: fivewalls.com

Source: fivewalls.com

These include real estate commission legal and advertising fees as well as mortgage penalty if you pay your mortgage off before it matures. If you paid commissions to a real estate agent when selling your rental property include them as outlays and expenses on Schedule 3 Capital Gains or Losses when you report the disposition of your property. Condominium fees are tax deductible in some rental situations. Your investment will grow tax-free increasing the savings. Is real estate commission tax-deductible.

Source: reco.on.ca

Source: reco.on.ca

If you move 40 kilometres away to be closer to your school or office you may claim a reasonable amount of tax rebates from your moving expenses. They can be taken as deductions when they impact what you would otherwise make in rental income. Section 121 The IRS provides an additional deduction against capital gains from the sale of a primary residence through the Section 121 exclusion. Cost of selling your old home including advertising notary or legal fees real estate commission and mortgage penalty when the mortgage is paid off before maturity. In the sale of a property that qualifies for the PRE any capital gain or loss is exempt from income tax claim or deduction.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title are real estate commissions tax deductible in canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.