Your Are foreign real estate taxes deductible images are available. Are foreign real estate taxes deductible are a topic that is being searched for and liked by netizens now. You can Download the Are foreign real estate taxes deductible files here. Download all free vectors.

If you’re searching for are foreign real estate taxes deductible pictures information related to the are foreign real estate taxes deductible interest, you have pay a visit to the ideal site. Our site frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly search and find more enlightening video articles and graphics that fit your interests.

Are Foreign Real Estate Taxes Deductible. However Treasury Regulations impose an additional requirement - they provide that real property taxes whether US. The Tax Cuts and Jobs Act limits the amount of property. The taxes paid on rental or commercial properties arent tax-deductible. You cant deduct more than 10000 per year 5000 if.

Steps To Take In Calculating Capital Gains For Selling Foreign Property From taxesforexpats.com

Steps To Take In Calculating Capital Gains For Selling Foreign Property From taxesforexpats.com

However in light of the changes implemented by the TCJA it appears in this authors opinion that the foreign real estate taxes can now be considered a qualified housing expense for purposes of the foreign housing exclusion because they are no longer allowable as a deduction under Sec. 164 but are a reasonable expense attributable to the housing. The good news is that you can deduct the amount of interest you pay on your tax returns. In 2017 and prior years foreign property taxes could be deducted. Foreign Real Estate Tax Deductions. First whether US persons living abroad having mortgage loans secured by their foreign residence can still deduct mortgage interest and second whether they can deduct foreign real property taxes paid.

First whether US persons living abroad having mortgage loans secured by their foreign residence can still deduct mortgage interest and second whether they can deduct foreign real property taxes paid.

The Tax Cuts and Jobs Act limits the amount of property. Taxes on foreign property tax reform has suspended this deduction for tax years 2018 through 2025 Other tidbits. The Internal Revenue Code is plain and simple on this issue - foreign real property taxes are deductible. Briefly yes mortgage interest is still deductible under the new rules but the deduction is more strictly curtailed. In 2017 and prior years foreign property taxes could be deducted. This is often the biggest write off youll get on your taxes.

Source: us-tax.org

Source: us-tax.org

However in light of the changes implemented by the TCJA it appears in this authors opinion that the foreign real estate taxes can now be considered a qualified housing expense for purposes of the foreign housing exclusion because they are no longer allowable as a deduction under Sec. Fees and taxes related to your foreign mortgage are deductible on your expat taxes regardless of your homes foreign location. If you itemize your deductions as an American living overseas you can deduct foreign real estate taxes imposed by you by a foreign country. In 2017 and prior years foreign property taxes could be deducted. Foreign Real Estate Tax Deductions.

Source: pinterest.com

Source: pinterest.com

The good news is that you can deduct the amount of interest you pay on your tax returns. Briefly yes mortgage interest is still deductible under the new rules but the deduction is more strictly curtailed. However Treasury Regulations impose an additional requirement - they provide that real property taxes whether US. In general the IRS considers deductible any state local and even foreign taxes on your real property. Mortgage interest paid on a second residence used personally is deductible as long as the mortgage satisfies the same requirements for deductible interest as on a primary residence.

Source: nycasas.com

Source: nycasas.com

The Internal Revenue Code is plain and simple on this issue - foreign real property taxes are deductible. In 2017 and prior years foreign property taxes could be deducted. However in light of the changes implemented by the TCJA it appears in this authors opinion that the foreign real estate taxes can now be considered a qualified housing expense for purposes of the foreign housing exclusion because they are no longer allowable as a deduction under Sec. Also if you pay taxes on properties that you dont own the taxes arent deductible. Lets look at the tax consequences of real estate transactions.

Source: taxesforexpats.com

Source: taxesforexpats.com

But limits apply and you have to itemize to take the deduction. In 2017 and prior years foreign property taxes could be deducted. If you itemize your deductions as an expat you can take deduction for foreign. A real estate sell may have deductible expenses taxable gains and possibly an exception for those gains. Briefly yes mortgage interest is still deductible under the new rules but the deduction is more strictly curtailed.

Source: ar.pinterest.com

Source: ar.pinterest.com

However Treasury Regulations impose an additional requirement - they provide that real property taxes whether US. Additionally local benefits taxes charged for repair maintenance or interest needed for. This rule applies to a personal residence or second property. In 2017 and prior years foreign property taxes could be deducted. The Tax Cuts and Jobs Act limits the amount of property.

Source: pinterest.com

Source: pinterest.com

If your property taxes are included in your monthly mortgage bill you can deduct them after your lender has paid the tax to the assessor on your behalf. Or foreign must be imposed for the general public welfare and not for local benefits. In general the IRS considers deductible any state local and even foreign taxes on your real property. You cant deduct more than 10000 per year 5000 if. However Treasury Regulations impose an additional requirement - they provide that real property taxes whether US.

Source: propertyturkey.com

Source: propertyturkey.com

A real estate sell may have deductible expenses taxable gains and possibly an exception for those gains. Also if you pay taxes on properties that you dont own the taxes arent deductible. Can I deduct the real estate tax I pay on my home overseas. Contact your lender to find out when they submit your property tax payments frequently this is done twice a year but it varies. The good news is that you can deduct the amount of interest you pay on your tax returns.

Source: es.pinterest.com

Source: es.pinterest.com

In 2017 and prior years foreign property taxes could be deducted. A real estate sell may have deductible expenses taxable gains and possibly an exception for those gains. Fees and taxes related to your foreign mortgage are deductible on your expat taxes regardless of your homes foreign location. The Internal Revenue Code is plain and simple on this issue - foreign real property taxes are deductible. Or foreign must be imposed for the general public welfare and not for local benefits.

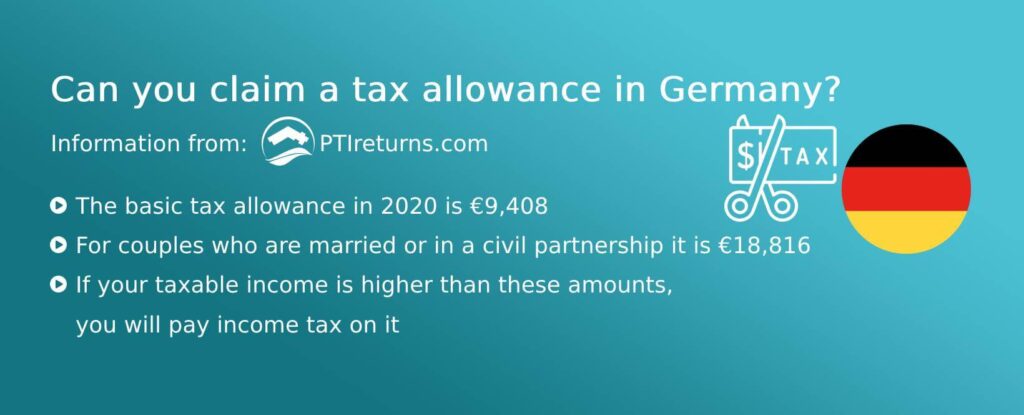

Source: ptireturns.com

Source: ptireturns.com

If you itemize your deductions as an American living overseas you can deduct foreign real estate taxes imposed by you by a foreign country. Or foreign must be imposed for the general public welfare and not for local benefits. 164 but are a reasonable expense attributable to the housing. The Internal Revenue Code is plain and simple on this issue - foreign real property taxes are deductible. If you itemize your deductions as an expat you can take deduction for foreign.

Source: pinterest.com

Source: pinterest.com

Fees and taxes related to your foreign mortgage are deductible on your expat taxes regardless of your homes foreign location. Also if you pay taxes on properties that you dont own the taxes arent deductible. First whether US persons living abroad having mortgage loans secured by their foreign residence can still deduct mortgage interest and second whether they can deduct foreign real property taxes paid. The information does need to be reported in Dollars US though making it essential to covert the US Dollarforeign currency amount before claiming the amount on your tax forms. Foreign Real Estate Tax Deductions.

Source: pinterest.com

Source: pinterest.com

Or foreign must be imposed for the general public welfare and not for local benefits. Briefly yes mortgage interest is still deductible under the new rules but the deduction is more strictly curtailed. The good news is that you can deduct the amount of interest you pay on your tax returns. Additionally local benefits taxes charged for repair maintenance or interest needed for. Also if you pay taxes on properties that you dont own the taxes arent deductible.

Source: pinterest.com

Source: pinterest.com

This rule applies to a personal residence or second property. A real estate sell may have deductible expenses taxable gains and possibly an exception for those gains. Foreign Real Estate Tax Deductions. If you itemize your deductions as an expat you can take deduction for foreign. This is often the biggest write off youll get on your taxes.

Source: taxesforexpats.com

Source: taxesforexpats.com

Lets look at the tax consequences of real estate transactions. Briefly yes mortgage interest is still deductible under the new rules but the deduction is more strictly curtailed. This is often the biggest write off youll get on your taxes. Contact your lender to find out when they submit your property tax payments frequently this is done twice a year but it varies. You cant deduct more than 10000 per year 5000 if.

Source: myexpattaxes.com

Source: myexpattaxes.com

Can I deduct foreign income taxes I paid overseas. Unfortunately you cannot take deduction for personal property taxes unless these taxes are incurred in a trade or business or in the production of income. However in light of the changes implemented by the TCJA it appears in this authors opinion that the foreign real estate taxes can now be considered a qualified housing expense for purposes of the foreign housing exclusion because they are no longer allowable as a deduction under Sec. Or foreign must be imposed for the general public welfare and not for local benefits. First whether US persons living abroad having mortgage loans secured by their foreign residence can still deduct mortgage interest and second whether they can deduct foreign real property taxes paid.

Source: ecovis.com

Source: ecovis.com

Fees and taxes related to your foreign mortgage are deductible on your expat taxes regardless of your homes foreign location. Briefly yes mortgage interest is still deductible under the new rules but the deduction is more strictly curtailed. Contact your lender to find out when they submit your property tax payments frequently this is done twice a year but it varies. Foreign property real estate taxes arent deductible in tax year 2018 through 2025 due to the Tax Cuts and Jobs Act. If your property taxes are included in your monthly mortgage bill you can deduct them after your lender has paid the tax to the assessor on your behalf.

Source: br.pinterest.com

Source: br.pinterest.com

If your property taxes are included in your monthly mortgage bill you can deduct them after your lender has paid the tax to the assessor on your behalf. Foreign Real Estate Tax Deductions. This is often the biggest write off youll get on your taxes. The good news is that you can deduct the amount of interest you pay on your tax returns. Lets look at the tax consequences of real estate transactions.

Source: ro.pinterest.com

Source: ro.pinterest.com

The information does need to be reported in Dollars US though making it essential to covert the US Dollarforeign currency amount before claiming the amount on your tax forms. The Internal Revenue Code is plain and simple on this issue - foreign real property taxes are deductible. If you itemize your deductions as an expat you can take deduction for foreign. Unfortunately you cannot take deduction for personal property taxes unless these taxes are incurred in a trade or business or in the production of income. The taxes paid on rental or commercial properties arent tax-deductible.

Source: taxesforexpats.com

Source: taxesforexpats.com

In 2017 and prior years foreign property taxes could be deducted. A real estate sell may have deductible expenses taxable gains and possibly an exception for those gains. The Tax Cuts and Jobs Act limits the amount of property. Foreign property real estate taxes arent deductible on tax year 2018 through 2025 returns due to the Tax Cuts and Jobs Act. If you itemize your deductions as an expat you can take deduction for foreign.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title are foreign real estate taxes deductible by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.