Your Are florida real estate taxes paid in arrears images are ready in this website. Are florida real estate taxes paid in arrears are a topic that is being searched for and liked by netizens today. You can Get the Are florida real estate taxes paid in arrears files here. Download all royalty-free photos.

If you’re searching for are florida real estate taxes paid in arrears pictures information connected with to the are florida real estate taxes paid in arrears interest, you have pay a visit to the right site. Our website frequently provides you with hints for refferencing the highest quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

Are Florida Real Estate Taxes Paid In Arrears. Here is the right way. The local property appraisers office will usually be your best resource for this. Floridians like most everyone around the world pay taxes. Sarasota County property taxes are paid in arrears.

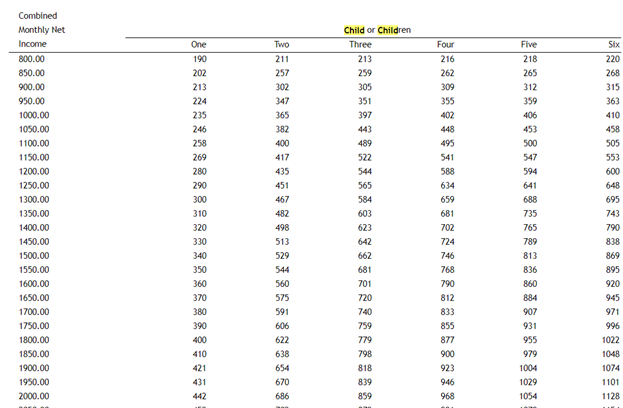

The Intersection Of F S 55 03 And Florida Family Law Statutory Interest Calculations For Past Due Support Payments The Florida Bar From floridabar.org

The Intersection Of F S 55 03 And Florida Family Law Statutory Interest Calculations For Past Due Support Payments The Florida Bar From floridabar.org

Ad Valorem Taxes are based on the value of real property and are collected in arrears on an annual basis beginning on or before November 1st for the tax year January through December. It is offered as a convenience by your lender so that you can avoid a large tax bill. Property taxes are paid in arrears here in Colorado. Therefore your lender is also paying from your account in arrears even though you dont see this payment. Taxable market value or just value resets to the last sales price the year following a sale and change of ownership. Short-term rentals have their own set of taxes which are normally shifted to.

In a real estate transaction that closes prior to the time when real estate taxes are paid for the year the Seller gives the Buyer a credit for taxes for the period of time when Seller owned the property.

We typically suggest budgeting 1 of the purchase price for taxes which are paid in arrears. The property tax portion is placed in an escrow account and is used to pay your property tax bill when it comes due. Property taxes are paid in arrears here in Colorado. That means that you pay your real estate taxes at the end of the year for the prior year. Here is the right way. Municipalities and counties levy property tax to raise money for local infrastructure as well as schools and other public services.

Source: recordinglaw.com

Source: recordinglaw.com

Taxable market value or just value resets to the last sales price the year following a sale and change of ownership. Ad valorem taxes are paid in arrears at the end of the year and are based on the Calendar Year from January 1December 31. Therefore your lender is also paying from your account in arrears even though you dont see this payment. Your lender may collect a property tax payment along with your regular mortgage payment. If closing is Monday 32120011 with the day of closing being charged to the Buyer the Seller is debited for 79 days and this becomes a credit to the Buyer.

The property tax portion is placed in an escrow account and is used to pay your property tax bill when it comes due. It is also important to note that real estate taxes in Florida are paid in arrears and you will have an opportunity to. Short-term rentals have their own set of taxes which are normally shifted to. Tax bill market values have no relation to real estate market values. We typically suggest budgeting 1 of the purchase price for taxes which are paid in arrears.

Source: pinterest.com

Source: pinterest.com

This can be difficult to say the least and there are many ways to deal with the issue. In Florida property taxes are paid in arrears. The buyer pays the seller 86150 for six months Oct 1 March 31 for assessments which the seller had paid in advance. Tax bills are sent out the first week of November each year. Taxes become delinquent on April 1st of each year at which time a 3 statutory interest is added to the total amount due.

Source: caseescrow.com

Source: caseescrow.com

The municipality doesnt receive your tax payment early when you use this method. Therefore when a closing takes place between January and the first week in November the amount of the current years property taxes are unknown. Here is the right way. The Real Estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. Tax bills are sent out the first week of November each year.

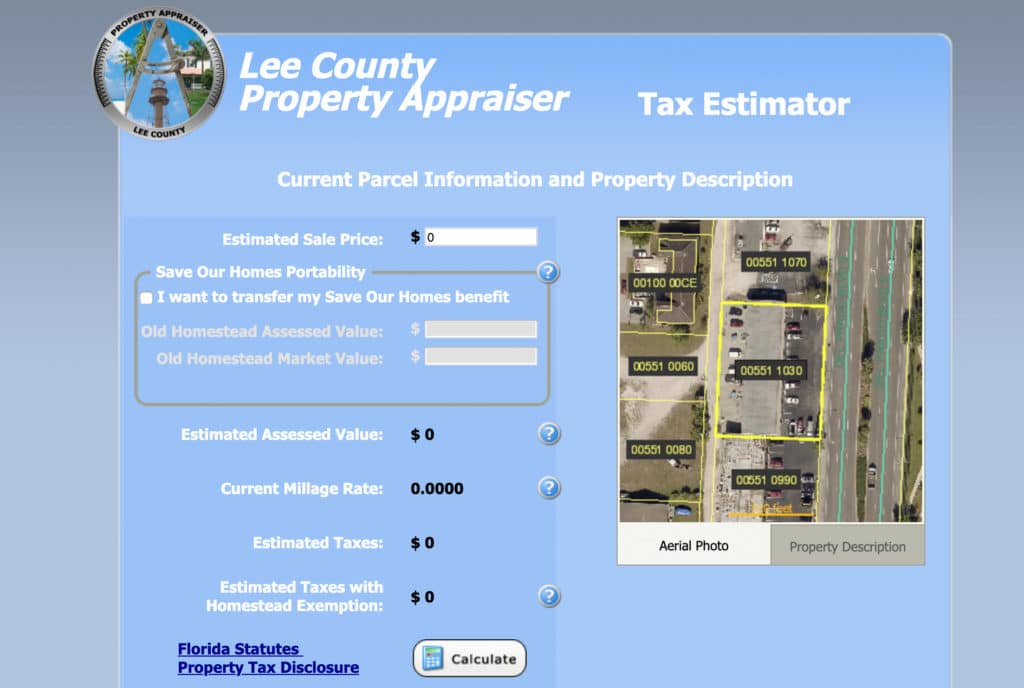

We typically suggest budgeting 1 of the purchase price for taxes which are paid in arrears. The tax is paid in arrears which means the homeowner pays for. You can also use the Lee County Property Appraiser website to get detailed information on the property you are purchasing including parcel details such as square-footage past sales and tax information and appraisal details. In Florida real estate taxes are paid in arrears. Since the taxes are in arrears you owe the total annual taxes due for the previous year but rather than pay it in one lump sum you have the option to pay 50 percent in May and the remaining 50 percent in.

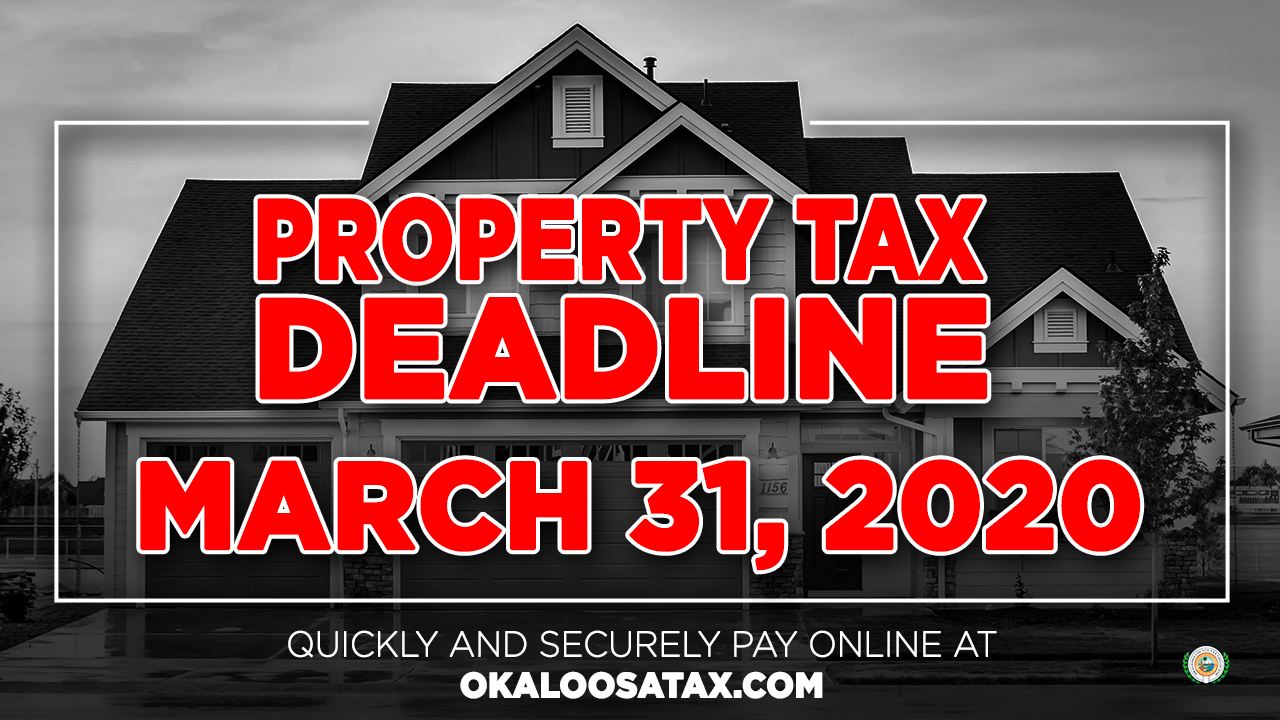

Source: okaloosatax.com

Source: okaloosatax.com

Short-term rentals have their own set of taxes which are normally shifted to. In a real estate transaction that closes prior to the time when real estate taxes are paid for the year the Seller gives the Buyer a credit for taxes for the period of time when Seller owned the property. It is also important to note that real estate taxes in Florida are paid in arrears and you will have an opportunity to. This can be difficult to say the least and there are many ways to deal with the issue. Therefore your lender is also paying from your account in arrears even though you dont see this payment.

Source: formydivorce.com

Source: formydivorce.com

Tax bill market values have no relation to real estate market values. The local property appraisers office will usually be your best resource for this. We typically suggest budgeting 1 of the purchase price for taxes which are paid in arrears. Real estate taxes are paid in arrears – they are partially paid on taxes accrued in the past and partially paid on taxes that accrue after the payment date. Florida does have a property tax on all properties you own and if you are renting or selling that property you may be required to pay federal taxes on any profit made.

Source: palmcoastgov.com

Source: palmcoastgov.com

You can also use the Lee County Property Appraiser website to get detailed information on the property you are purchasing including parcel details such as square-footage past sales and tax information and appraisal details. Ad valorem taxes are paid in arrears at the end of the year and are based on the Calendar Year from January 1December 31. The Real Estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. Your lender may collect a property tax payment along with your regular mortgage payment. Prorations going forward are usually based on the most recent mill levy times the most recent assessed valuation.

Source: pinterest.com

Source: pinterest.com

Ad valorem taxes are paid in arrears at the end of the year and are based on the Calendar Year from January 1December 31. The gross amount is due by March 31 st Next the real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. Sarasota County property taxes are paid in arrears. The tax roll is certified by the Property Appraiser in October. If closing is Monday 32120011 with the day of closing being charged to the Buyer the Seller is debited for 79 days and this becomes a credit to the Buyer.

Source: sanibelrealestateguide.com

Source: sanibelrealestateguide.com

Ad Valorem Taxes are based on the value of real property and are collected in arrears on an annual basis beginning on or before November 1st for the tax year January through December. Since the taxes are in arrears you owe the total annual taxes due for the previous year but rather than pay it in one lump sum you have the option to pay 50 percent in May and the remaining 50 percent in. It is offered as a convenience by your lender so that you can avoid a large tax bill. Tax bills are sent out the first week of November each year. Floridians like most everyone around the world pay taxes.

That means that you pay your real estate taxes at the end of the year for the prior year. The municipality doesnt receive your tax payment early when you use this method. Municipalities and counties levy property tax to raise money for local infrastructure as well as schools and other public services. Its important to get a whole tax picture view before deciding on an area. Since the taxes are in arrears you owe the total annual taxes due for the previous year but rather than pay it in one lump sum you have the option to pay 50 percent in May and the remaining 50 percent in.

Source: pbctax.com

Source: pbctax.com

Because property taxes are paid in arrears meaning that we pay this year for owning the property last year the buyer and seller have to figure out how to deal with the real estate taxes for the period during which the seller has owned the real estate but for which taxes have not yet been paid. Here is the right way. The tax roll is certified by the Property Appraiser in October. If closing is Monday 32120011 with the day of closing being charged to the Buyer the Seller is debited for 79 days and this becomes a credit to the Buyer. This can be difficult to say the least and there are many ways to deal with the issue.

Source: streamlineflorida.com

Source: streamlineflorida.com

Prorations going forward are usually based on the most recent mill levy times the most recent assessed valuation. The property tax portion is placed in an escrow account and is used to pay your property tax bill when it comes due. This can be difficult to say the least and there are many ways to deal with the issue. Property taxes are paid in arrears here in Colorado. Because property taxes are paid in arrears meaning that we pay this year for owning the property last year the buyer and seller have to figure out how to deal with the real estate taxes for the period during which the seller has owned the real estate but for which taxes have not yet been paid.

Source: floridabar.org

Source: floridabar.org

Florida is one of a few states that does not have state income tax making the state a popular place to retire. PROPERTY TAXES FOR SARASOTA FL HOME BUYERS. The buyer pays the seller 86150 for six months Oct 1 March 31 for assessments which the seller had paid in advance. Taxes become delinquent on April 1st of each year at which time a 3 statutory interest is added to the total amount due. Its important to get a whole tax picture view before deciding on an area.

Source: clackamas.us

Source: clackamas.us

Any changes to the tax roll name address location assessed value must be processed through the Lake County Property Appraisers Office 352 253-2150. Florida does have a property tax on all properties you own and if you are renting or selling that property you may be required to pay federal taxes on any profit made. Sarasota County property taxes are paid in arrears. Therefore your lender is also paying from your account in arrears even though you dont see this payment. It is offered as a convenience by your lender so that you can avoid a large tax bill.

Source: stpetelawgroup.com

Source: stpetelawgroup.com

You can also use the Lee County Property Appraiser website to get detailed information on the property you are purchasing including parcel details such as square-footage past sales and tax information and appraisal details. In Florida property taxes are paid in arrears. PROPERTY TAXES FOR SARASOTA FL HOME BUYERS. The municipality doesnt receive your tax payment early when you use this method. If closing is Monday 32120011 with the day of closing being charged to the Buyer the Seller is debited for 79 days and this becomes a credit to the Buyer.

Source: berlinpatten.com

Source: berlinpatten.com

Tax bill market values have no relation to real estate market values. The municipality doesnt receive your tax payment early when you use this method. Because property taxes are paid in arrears meaning that we pay this year for owning the property last year the buyer and seller have to figure out how to deal with the real estate taxes for the period during which the seller has owned the real estate but for which taxes have not yet been paid. Real estate taxes are paid in arrears – they are partially paid on taxes accrued in the past and partially paid on taxes that accrue after the payment date. The Real Estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments.

Source: floridalegaladvice.com

Source: floridalegaladvice.com

Tax bill market values have no relation to real estate market values. Florida does have a property tax on all properties you own and if you are renting or selling that property you may be required to pay federal taxes on any profit made. The gross amount is due by March 31 st Next the real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. Your lender may collect a property tax payment along with your regular mortgage payment. Therefore when a closing takes place between January and the first week in November the amount of the current years property taxes are unknown.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title are florida real estate taxes paid in arrears by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.