Your Amortization definition real estate images are ready. Amortization definition real estate are a topic that is being searched for and liked by netizens today. You can Download the Amortization definition real estate files here. Get all royalty-free photos.

If you’re searching for amortization definition real estate pictures information linked to the amortization definition real estate keyword, you have visit the ideal site. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly search and locate more enlightening video articles and images that fit your interests.

Amortization Definition Real Estate. Amortization Definition Generally amortization refers to the paying off of debt over a period of time. Amortization is the schedule of your monthly mortgage loan payments. Since commercial real estate basically means properties which are only used for business purposes financing one usually involves receiving help in the form of a loan. Real Estate Exam Prep.

Neupotrijebljen Prljavstina Zabludu What Is Amortization Livelovegetoutside Com From livelovegetoutside.com

Neupotrijebljen Prljavstina Zabludu What Is Amortization Livelovegetoutside Com From livelovegetoutside.com

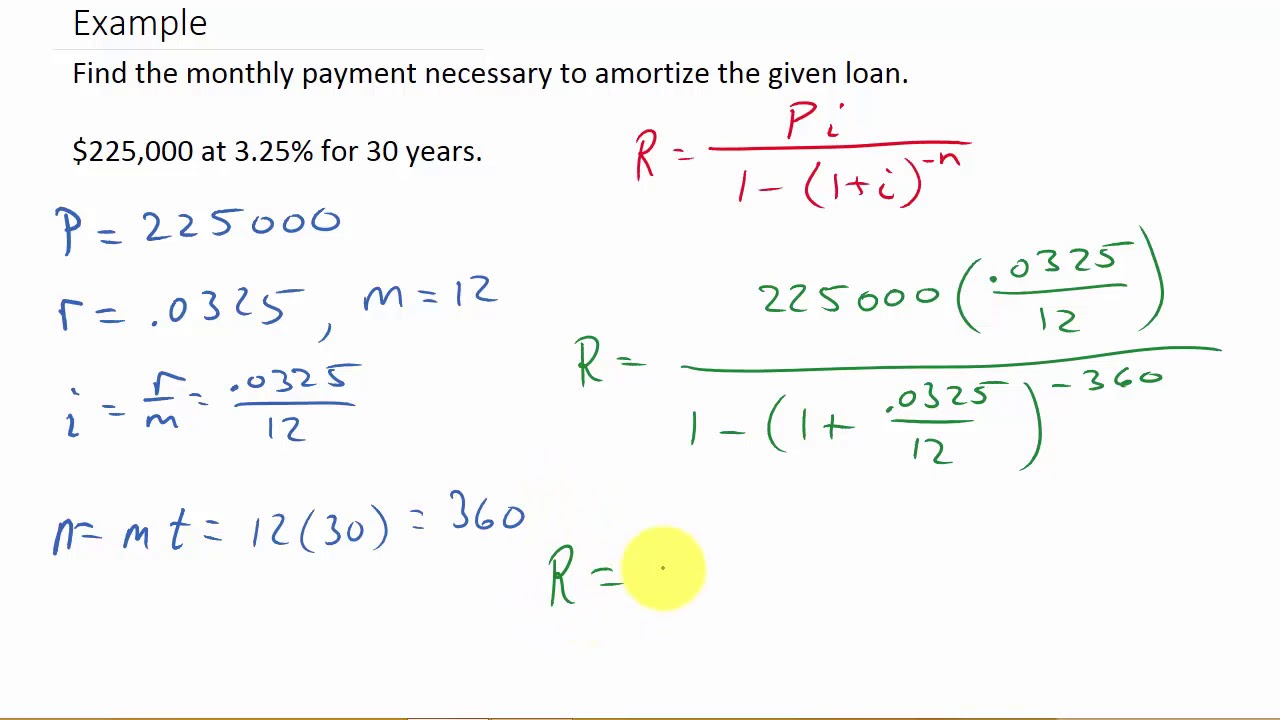

This is done through installment payments. To amortize a loan your payments must be large enough to pay not only the interest that has accrued but also to reduce the principal you owe. In a broad sense amortization is the act of paying an amount owed over multiple periods rather than all at once. Whenever you pay 10 or more you are applying those additional funds to the amortization. Amortization is the practice of spreading an intangible assets cost over that assets useful life. A deposit jointly held by a borrower and a lender which provides reserved funds for key operating or capital expenses.

Looking for an amortization definition.

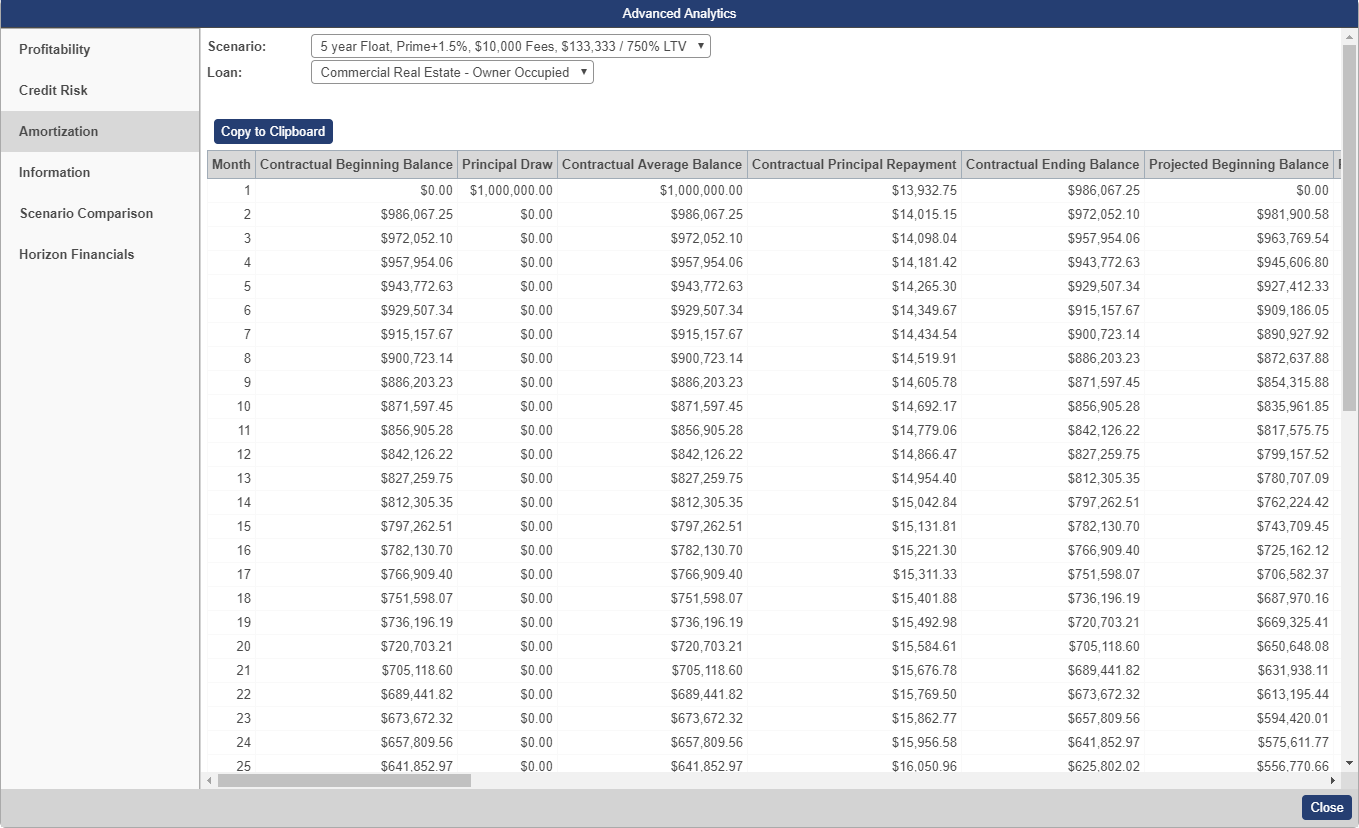

Since commercial real estate basically means properties which are only used for business purposes financing one usually involves receiving help in the form of a loan. The Definition of Amortization in Commercial Real Estate Generally speaking amortization is the progressive gradual method through which a loan is slowly eliminated. Amortization is an accounting term that basically means something like reducing the gap between what is owed. This is done through installment payments. Negative amortization is a financial term referring to an increase in the principal balance of a loan caused by a failure to cover the interest due on that loan. Amortization is the gradual repayment of a debt over a period of time such as monthly payments on a mortgage loan or credit card balance.

Source: investopedia.com

Source: investopedia.com

Real Estate Exam Prep. The repayment of a mortgage through periodic payments is an example of amortization. Amortization - Pass the Real Estate Exam. Amortization Definition Generally amortization refers to the paying off of debt over a period of time. A deposit jointly held by a borrower and a lender which provides reserved funds for key operating or capital expenses.

Source: investopedia.com

Source: investopedia.com

The liquidation of a financial burden by installment payments which include principal and interest. The time required to pay off a mortgage if no additional principal payments are made and all payments are made on schedule. Amortization is the practice of spreading an intangible assets cost over that assets useful life. Amortization is also used along with depreciation to spread out the cost of a capital expense for accounting and tax purposes. In the commercial real estate world amortization is most often mentioned relating to the gradual elimination of a mortgage or loan over a period of time.

Source: assetsamerica.com

Source: assetsamerica.com

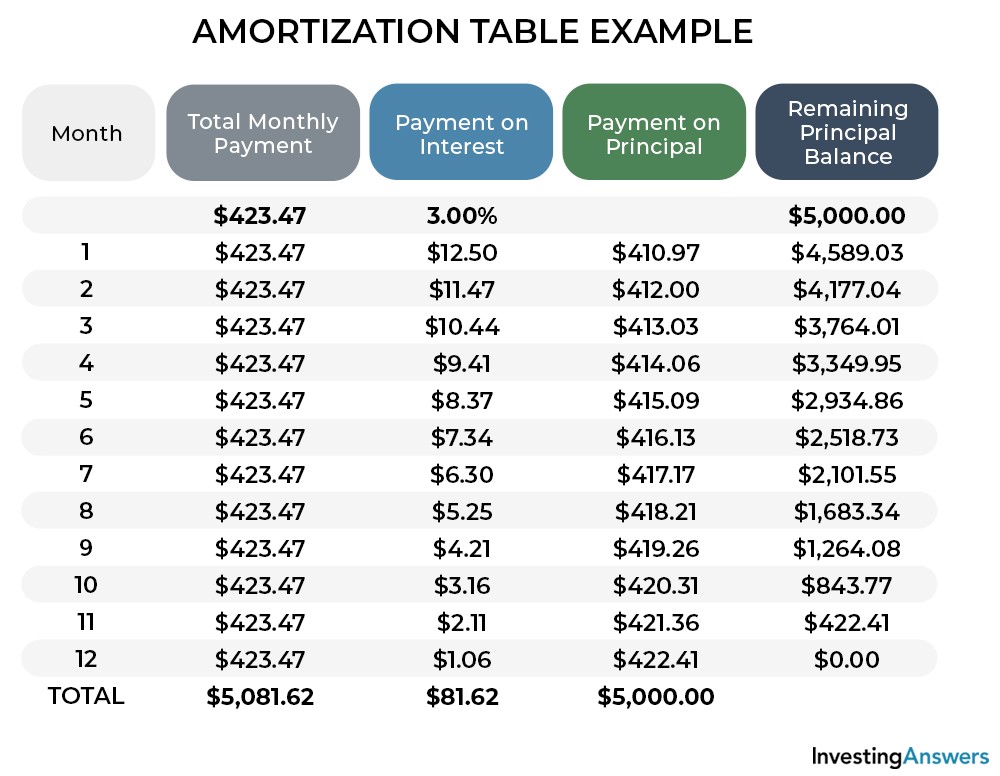

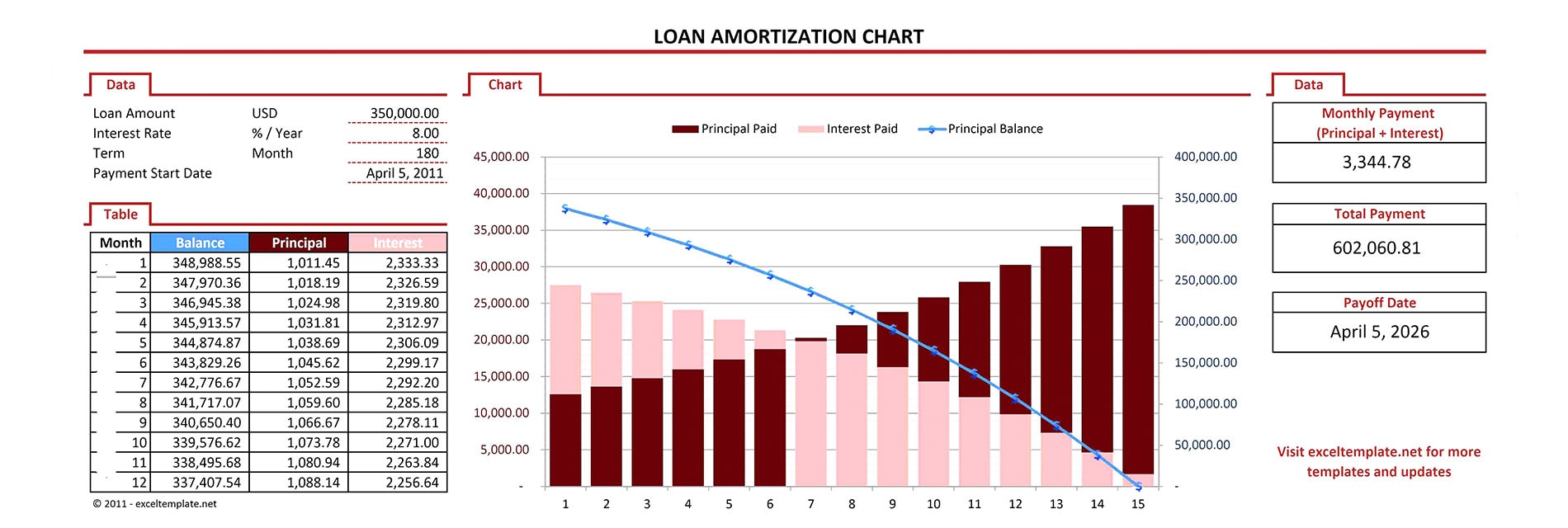

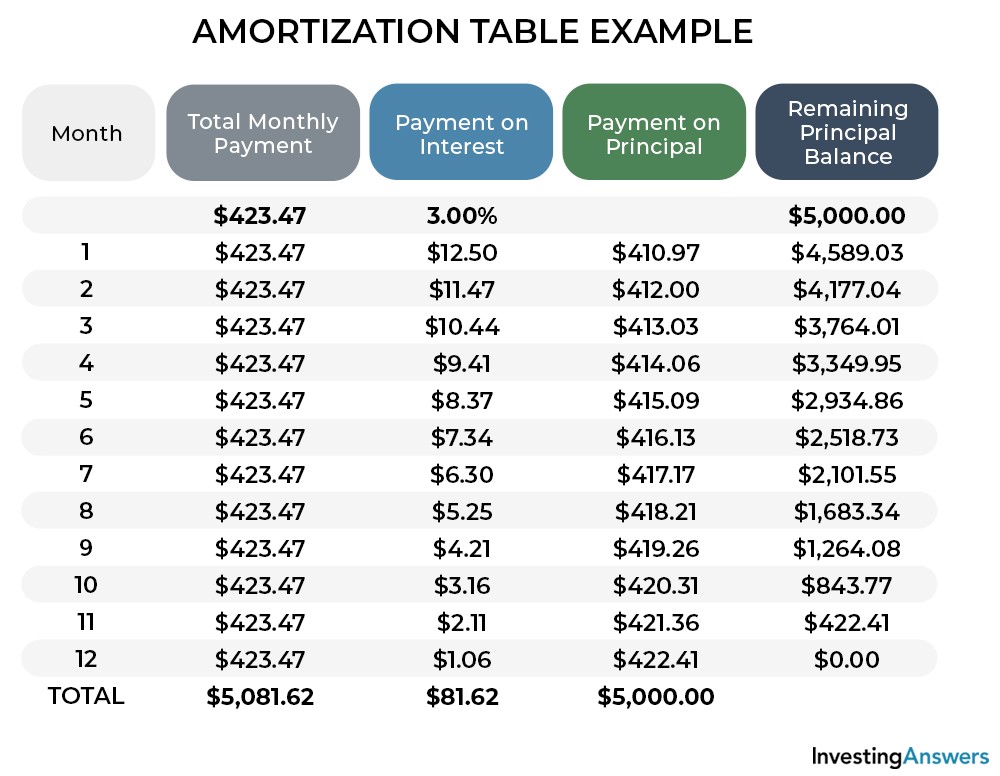

More Learn About Simple Interest. A schedule showing each payment of a loan to be amortized see Amortization and breaking down the payment into the amount applied to principal and the amount applied to interest. For example if the interest. Amortization is the schedule of your monthly mortgage loan payments. Most often these are setup as.

Source: yieldstreet.com

Source: yieldstreet.com

One such example is a loan amortization which is the process of paying down debt by making regularly scheduled principal and interest payments. Since commercial real estate basically means properties which are only used for business purposes financing one usually involves receiving help in the form of a loan. For example if the interest. To amortize a loan your payments must be large enough to pay not only the interest that has accrued but also to reduce the principal you owe. In a broad sense amortization is the act of paying an amount owed over multiple periods rather than all at once.

Source: investopedia.com

Source: investopedia.com

Pass Your Real Estate Test - Guaranteed. Real Estate Exam Prep. Typical escrow accounts are held for real estate taxes insurance tenant improvement leasing commissions necessary structural repairs or environmental remediation or reserves for. The word amortize itself tells the story since it means to bring to death. 10 a month is your principal.

Source: 026.isasecret.com

Source: 026.isasecret.com

Amortization is the practice of spreading an intangible assets cost over that assets useful life. The Definition of Amortization in Commercial Real Estate Generally speaking amortization is the progressive gradual method through which a loan is slowly eliminated. Since commercial real estate basically means properties which are only used for business purposes financing one usually involves receiving help in the form of a loan. In real estate and finance the definition of amortization is the recovery of the cost or value of an asset over a period of time. Amortization is the practice of spreading an intangible assets cost over that assets useful life.

Source: livelovegetoutside.com

Source: livelovegetoutside.com

Videos you watch may be added to the TVs watch history and influence TV recommendations. Amortization is the gradual repayment of a debt over a period of time such as monthly payments on a mortgage loan or credit card balance. If playback doesnt begin shortly try restarting your device. Amortization - Pass the Real Estate Exam. The repayment of a mortgage through periodic payments is an example of amortization.

Source: retipster.com

Source: retipster.com

Whenever you pay 10 or more you are applying those additional funds to the amortization. Some other loans such as credit. The word amortize itself tells the story since it means to bring to death. For example if the interest. Amortization - Pass the Real Estate Exam.

Source: youtube.com

Source: youtube.com

The repayment of a mortgage through periodic payments is an example of amortization. The time required to pay off a mortgage if no additional principal payments are made and all payments are made on schedule. One such example is a loan amortization which is the process of paying down debt by making regularly scheduled principal and interest payments. Since commercial real estate basically means properties which are only used for business purposes financing one usually involves receiving help in the form of a loan. To amortize a loan your payments must be large enough to pay not only the interest that has accrued but also to reduce the principal you owe.

Source: investopedia.com

Source: investopedia.com

In a broad sense amortization is the act of paying an amount owed over multiple periods rather than all at once. The Definition of Amortization in Commercial Real Estate Generally speaking amortization is the progressive gradual method through which a loan is slowly eliminated. Amortization Definition Generally amortization refers to the paying off of debt over a period of time. To amortize a loan your payments must be large enough to pay not only the interest that has accrued but also to reduce the principal you owe. Some other loans such as credit.

Source: support.precisionlender.com

Source: support.precisionlender.com

You get a 100 loan and the deal is you have to pay it back in 12 months with a little bit of interest. Whenever you pay 10 or more you are applying those additional funds to the amortization. Heres the play by play. Pass Your Real Estate Test - Guaranteed. Amortization - Pass the Real Estate Exam.

Source: livelovegetoutside.com

Source: livelovegetoutside.com

Amortization is also used along with depreciation to spread out the cost of a capital expense for accounting and tax purposes. A ten year loan for example would have an amortization term of 120 months ten years. The word amortize itself tells the story since it means to bring to death. The Definition of Amortization in Commercial Real Estate Generally speaking amortization is the progressive gradual method through which a loan is slowly eliminated. The liquidation of a financial burden by installment payments which include principal and interest.

Source: investopedia.com

Source: investopedia.com

This is done through installment payments. Pass Your Real Estate Test - Guaranteed. Amortization is also used along with depreciation to spread out the cost of a capital expense for accounting and tax purposes. Depreciation is the expensing of a fixed asset over its useful life. Amortization is the practice of spreading an intangible assets cost over that assets useful life.

Source: livelovegetoutside.com

Source: livelovegetoutside.com

Pass Your Real Estate Test - Guaranteed. A ten year loan for example would have an amortization term of 120 months ten years. Pass Your Real Estate Test - Guaranteed. Most often these are setup as. One such example is a loan amortization which is the process of paying down debt by making regularly scheduled principal and interest payments.

Source: rocketmortgage.com

Source: rocketmortgage.com

This is done through installment payments. Some other loans such as credit. For example if the interest. Amortization is the schedule of your monthly mortgage loan payments. A schedule showing each payment of a loan to be amortized see Amortization and breaking down the payment into the amount applied to principal and the amount applied to interest.

Amortization is an accounting technique used to periodically lower the book value of a loan or intangible asset over a set period of time. Amortization is an accounting technique used to periodically lower the book value of a loan or intangible asset over a set period of time. Amortization is the gradual repayment of a debt over a period of time such as monthly payments on a mortgage loan or credit card balance. To amortize a loan your payments must be large enough to pay not only the interest that has accrued but also to reduce the principal you owe. Looking for an amortization definition.

Source: courses.lumenlearning.com

Source: courses.lumenlearning.com

Heres the play by play. Heres the play by play. What Does Amortization Mean In Real Estate. The liquidation of a financial burden by installment payments which include principal and interest. A ten year loan for example would have an amortization term of 120 months ten years.

Source: investopedia.com

Source: investopedia.com

10 a month is your principal. Amortization is the gradual repayment of a debt over a period of time such as monthly payments on a mortgage loan or credit card balance. Amortization is an accounting technique used to lower or expense out the value of an asset over time. Amortization is the schedule of your monthly mortgage loan payments. Amortization - Pass the Real Estate Exam.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title amortization definition real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.