Your Allegheny county real estate tax assessment images are available in this site. Allegheny county real estate tax assessment are a topic that is being searched for and liked by netizens today. You can Download the Allegheny county real estate tax assessment files here. Download all free images.

If you’re searching for allegheny county real estate tax assessment pictures information connected with to the allegheny county real estate tax assessment interest, you have visit the ideal site. Our website always gives you suggestions for seeing the highest quality video and picture content, please kindly surf and find more enlightening video content and graphics that fit your interests.

Allegheny County Real Estate Tax Assessment. If you do not agree with your propertys tax assessment follow the Real Estate Property Assessment Appeals directions to file an appeal. Real Estate Home Allegheny County. Should you appeal your Allegheny County tax assessment. Find information regarding COVID-19.

Allegheny County Property Tax Assessment Search Lookup From anytimeestimate.com

Allegheny County Property Tax Assessment Search Lookup From anytimeestimate.com

Allegheny County 2021 Millage Rate. Houses 3 days ago Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County. They are a valuable tool for the real estate. They are maintained by various government offices in Allegheny County Pennsylvania State and at the Federal level. Real Estate Home Allegheny County. I developed this calculator to help me estimate the tax savings by appealing my Allegheny County tax assessment.

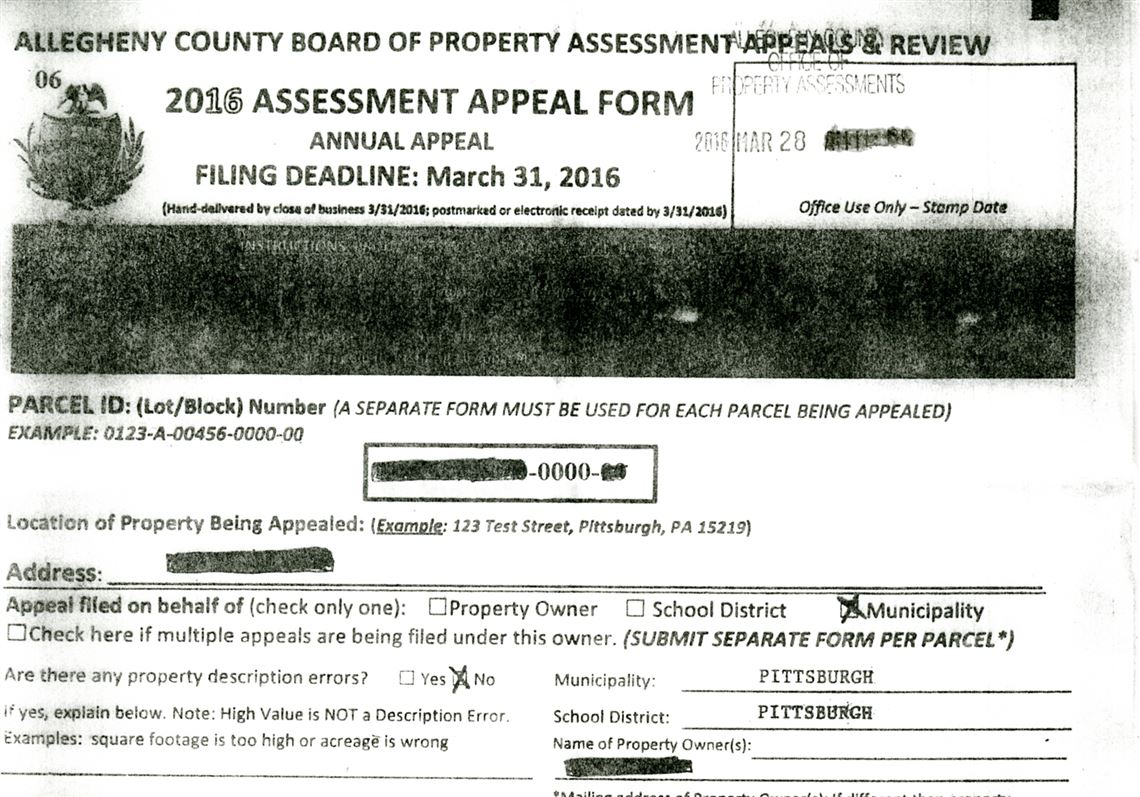

This year in 2021 thousands of Allegheny County property tax assessment appeals were filed by by both taxing entities and commercial and residential property owners.

Tax Abatements and Exemptions. Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County. Should you appeal your Allegheny County tax assessment. This year in 2021 thousands of Allegheny County property tax assessment appeals were filed by by both taxing entities and commercial and residential property owners. Use the property tax calculator to estimate the annual tax savings with a lower assessment. This reduction reduces the tax paid to Allegheny County.

Source: pinterest.com

Source: pinterest.com

Find information regarding COVID-19. Allegheny County 2021 Millage Rate. The real estate taxes. Act 50 Application Process. An application for Act 50 relief will also be considered a request for Act 1 relief The Property Tax Relief Act if.

Land Records - Search deeds block and lot maps and other real estate records. In short how much would I reduce my taxes by lowering my assessment. Should you appeal your Allegheny County tax assessment. A property owner or any taxing entity in Allegheny County has the right to appeal a property each and every calendar year. This year in 2021 thousands of Allegheny County property tax assessment appeals were filed by by both taxing entities and commercial and residential property owners.

Source: pinterest.com

Source: pinterest.com

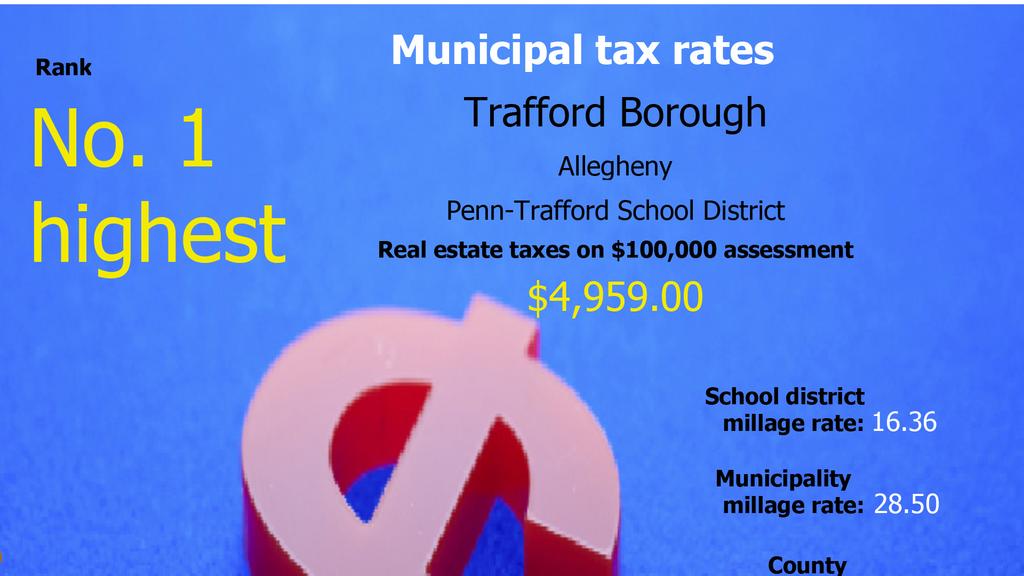

Allegheny County Property taxes are calculated by multiplying the county property assessment by the current millage rate for each specific taxing entity. Real Estate Home Allegheny County. Appealing the BPAAR Decision. Assessed Values by School District updated bi-weekly Assessed Values by Municipality updated bi-weekly. The Treasurer office does not set your propertys assessed value.

Source: anytimeestimate.com

Source: anytimeestimate.com

I developed this calculator to help me estimate the tax savings by appealing my Allegheny County tax assessment. Should you appeal your Allegheny County tax assessment. An application for Act 50 relief will also be considered a request for Act 1 relief The Property Tax Relief Act if. 473 mills or 473 per 10000 valuation. Real Estate - Search property value and tax information.

Source: anytimeestimate.com

Source: anytimeestimate.com

Find information regarding COVID-19. Allegheny County Property taxes are calculated by multiplying the county property assessment by the current millage rate for each specific taxing entity. Allegheny County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Houses 3 days ago Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County. Act 50 Application Process.

Source: alleghenycountytreasurer.us

Source: alleghenycountytreasurer.us

Simply lookup the current property assessment on the Allegheny County search page and enter the assessment values into the calculator. In short how much would I reduce my taxes by lowering my assessment. Tax Abatements and Exemptions. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. A property owner or any taxing entity in Allegheny County has the right to appeal a property each and every calendar year.

Source: century21core.com

Source: century21core.com

A property owner or any taxing entity in Allegheny County has the right to appeal a property each and every calendar year. Houses 3 days ago Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County. The Allegheny County tax. Allegheny County Tax Calculator. Hearing Day - What to Do.

Real Estate Home Allegheny County. I developed this calculator to help me estimate the tax savings by appealing my Allegheny County tax assessment. Houses 3 days ago Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County. Many property owners also filed 2021 tax appeals challenging. If you do not agree with your propertys tax assessment follow the Real Estate Property Assessment Appeals directions to file an appeal.

Source: pinterest.com

Source: pinterest.com

Allegheny County Tax Calculator. This reduction reduces the tax paid to Allegheny County. Land Records - Search deeds block and lot maps and other real estate records. Real Estate Home Allegheny County. Assessed Values by School District updated bi-weekly Assessed Values by Municipality updated bi-weekly.

Source: bizjournals.com

Source: bizjournals.com

Choose the Allegheny County Municipality and enter the new or estimated assessment number in the New Total Value box and click calculate. Appealing the BPAAR Decision. The Treasurer office does not set your propertys assessed value. The calculator should also be useful for real estate agents to update the property taxes. The real estate taxes.

Source: post-gazette.com

Source: post-gazette.com

Assessed Values by School District updated bi-weekly Assessed Values by Municipality updated bi-weekly. Use the property tax calculator to estimate the annual tax savings with a lower assessment. The taxing entities mainly the school districts filed property tax appeals against recent home buyers whose sale price was higher than their current property assessment. Act 50 Application Process. Find information regarding COVID-19.

Source: pinterest.com

Source: pinterest.com

This reduction reduces the tax paid to Allegheny County. This year in 2021 thousands of Allegheny County property tax assessment appeals were filed by by both taxing entities and commercial and residential property owners. 473 mills or 473 per 10000 valuation. Real Estate Home Allegheny County. I developed this calculator to help me estimate the tax savings by appealing my Allegheny County tax assessment.

Source: in.pinterest.com

Source: in.pinterest.com

Choose the Allegheny County Municipality and enter the new or estimated assessment number in the New Total Value box and click calculate. This year in 2021 thousands of Allegheny County property tax assessment appeals were filed by by both taxing entities and commercial and residential property owners. Real Estate Home Allegheny County. Allegheny County Property taxes are calculated by multiplying the county property assessment by the current millage rate for each specific taxing entity. Allegheny County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections.

Source: pinterest.com

Source: pinterest.com

Each school district and local taxing entity municipalityborough or township. Choose the Allegheny County Municipality and enter the new or estimated assessment number in the New Total Value box and click calculate. County property owners with primary residences here are eligible to have the property assessment value of their home reduced by 18000 for county tax purposes only. Allegheny County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Appealing the BPAAR Decision.

Source: anytimeestimate.com

Source: anytimeestimate.com

The county millage rate for 2020 is 473. If you live in Allegheny County and the county has assessed the value of your property in a way you think is unfair or unrepresentative of its fair market value you have the option of appealing this property assessment. An application for Act 50 relief will also be considered a request for Act 1 relief The Property Tax Relief Act if. The county millage rate for 2020 is 473. Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County.

Source: pinterest.com

Source: pinterest.com

Tax Abatements and Exemptions. Allegheny County Tax Calculator. Real Estate Home Allegheny County. This year in 2021 thousands of Allegheny County property tax assessment appeals were filed by by both taxing entities and commercial and residential property owners. I developed this calculator to help me estimate the tax savings by appealing my Allegheny County tax assessment.

Source: anytimeestimate.com

Source: anytimeestimate.com

Choose the Allegheny County Municipality and enter the new or estimated assessment number in the New Total Value box and click calculate. Allegheny County Property taxes are calculated by multiplying the county property assessment by the current millage rate for each specific taxing entity. In short how much would I reduce my taxes by lowering my assessment. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Choose the Allegheny County Municipality and enter the new or estimated assessment number in the New Total Value box and click calculate.

Source: pinterest.com

Source: pinterest.com

Act 50 Application Process. County property owners with primary residences here are eligible to have the property assessment value of their home reduced by 18000 for county tax purposes only. A property owner or any taxing entity in Allegheny County has the right to appeal a property each and every calendar year. If you do not agree with your propertys tax assessment follow the Real Estate Property Assessment Appeals directions to file an appeal. Allegheny County Property Records are real estate documents that contain information related to real property in Allegheny County Pennsylvania.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title allegheny county real estate tax assessment by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.