Your Allegheny county pa real estate tax records images are available. Allegheny county pa real estate tax records are a topic that is being searched for and liked by netizens now. You can Get the Allegheny county pa real estate tax records files here. Download all free photos.

If you’re searching for allegheny county pa real estate tax records images information linked to the allegheny county pa real estate tax records interest, you have pay a visit to the ideal site. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

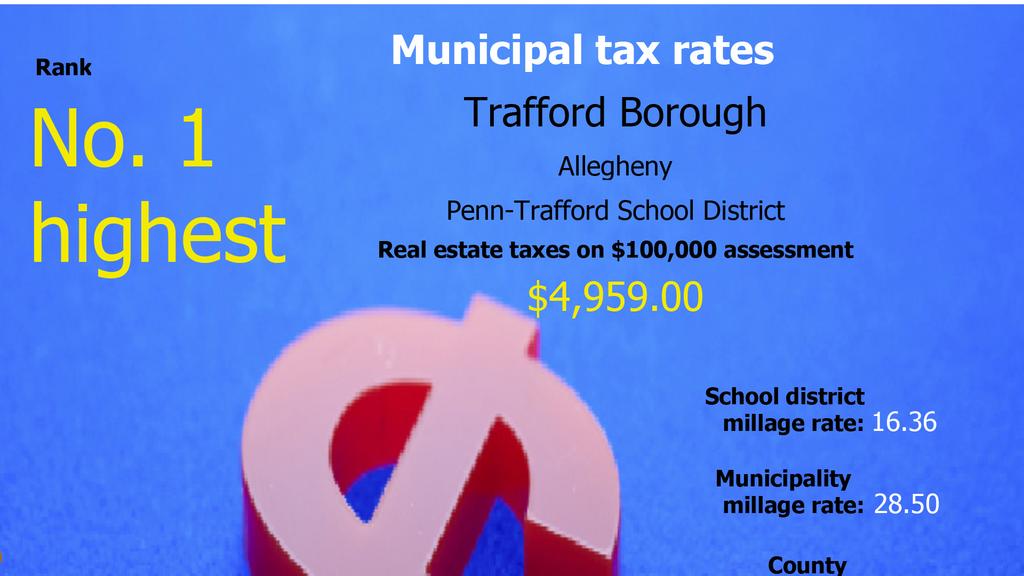

Allegheny County Pa Real Estate Tax Records. These range from rates of property taxation to local tax records and more. Delinquent Rental Vehicle Tax. Allegheny County collects on average 222 of a propertys assessed fair market value as property tax. The Allegheny Countys Department of Real Estate Office present the information on this web site as a service to the public.

How To Appeal Allegheny County Property Assessments From wikihow.com

How To Appeal Allegheny County Property Assessments From wikihow.com

Allegheny Township Tax Office Real Estate 1001 South Leechburg Hill Leechburg PA 15656 PhoneFax 724-845-3261 Email. You need to collect hotel tax. We are also responsible for administering and maintaining the Senior Citizen Tax Relief Program. The Department of Real Estate Office makes no warranty or guarantee concerning the accuracy or reliability of the content at this site or at other sites to which we link. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Metadata Field Value.

Allegheny County collects on average 222 of a propertys assessed fair market value as property tax.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The Department of Real Estate Office makes no warranty or guarantee concerning the accuracy or reliability of the content at this site or at other sites to which we link. Youll find property records real estate tax assessment information and everything you need to know about properties in Allegheny County on the county Real Estate Records and Property Assessments page. Houses Just Now The Allegheny County Department Of Real Estate located in Pittsburgh Pennsylvania is a centralized office where public records are recorded indexed and stored in Allegheny County PA. We have tried to ensure that the information contained in this electronic search system is accurate. Allegheny County Tax Liens Filings Satisfactions and Current Status Number of Resources.

Source: anytimeestimate.com

Source: anytimeestimate.com

Land Records - Search deeds block and lot maps and other real estate records. In-depth Allegheny County PA Property Tax Information. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the. Allegheny County Pennsylvania Property Taxes - 2021 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200. Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County.

Source: alleghenycounty.us

Source: alleghenycounty.us

In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. Considering renting out your home for the weekend. If you have a question about Allegheny Township taxes or taxation policies this is the office to contact regarding those questions. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a. Allegheny County Tax Liens Filings Satisfactions and Current Status Number of Resources.

If you have a question about Allegheny Township taxes or taxation policies this is the office to contact regarding those questions. Allegheny County Pennsylvania Property Taxes - 2021 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200. If you have a question about Allegheny Township taxes or taxation policies this is the office to contact regarding those questions. Land Records - Search deeds block and lot maps and other real estate records. Considering renting out your home for the weekend.

Source: wikihow.com

Source: wikihow.com

These records can include Allegheny County property tax assessments and assessment challenges appraisals and income taxes. Allegheny County Department Of Real Estate. Land Records - Search deeds block and lot maps and other real estate records. Youll find property records real estate tax assessment information and everything you need to know about properties in Allegheny County on the county Real Estate Records and Property Assessments page. Real Estate - Search property value and tax information.

Source: loc.gov

Source: loc.gov

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a. April 1 2021 1018 PM. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. The Department of Real Estate Office makes no warranty or guarantee concerning the accuracy or reliability of the content at this site or at other sites to which we link. The Allegheny Countys Department of Real Estate Office present the information on this web site as a service to the public.

Source: wikihow.com

Source: wikihow.com

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a. We maintain yearly records on over 550 thousand parcels. Allegheny County Department of Real Estate Allegheny County Office Building Room 101 542 Forbes Ave Pittsburgh PA 15219 Phone 412350-4226 Fax 412350-6877 Free Search Sex Offender Records. We have tried to ensure that the information contained in this electronic search system is accurate. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the.

Source: anytimeestimate.com

Source: anytimeestimate.com

April 5 2016 340 PM. If you have a question about Allegheny Township taxes or taxation policies this is the office to contact regarding those questions. Allegheny County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Allegheny County Pennsylvania. Allegheny County property records for real estate brokers Residential brokers can inform their clients by presenting user-friendly property reports that include property characteristics recent sales property tax records and useful property maps. We are also responsible for administering and maintaining the Senior Citizen Tax Relief Program.

Source: alleghenycountytreasurer.us

Source: alleghenycountytreasurer.us

Considering renting out your home for the weekend. 2 days ago Allegheny County Property Records are real estate documents that contain information related to real property in Allegheny County Pennsylvania. These records can include Allegheny County property tax assessments and assessment challenges appraisals and income taxes. The Allegheny Countys Department of Real Estate Office present the information on this web site as a service to the public. These range from rates of property taxation to local tax records and more.

Source: sites.google.com

Source: sites.google.com

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. The Department of Real Estate Office makes no warranty or guarantee concerning the accuracy or reliability of the content at this site or at other sites to which we link. In-depth Allegheny County PA Property Tax Information. Allegheny County Pennsylvania Property Taxes - 2021 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200. Allegheny County Property Records are real estate documents that contain information related to real property in Allegheny County Pennsylvania.

Source: anytimeestimate.com

Source: anytimeestimate.com

Allegheny County collects on average 222 of a propertys assessed fair market value as property tax. Allegheny County Department of Real Estate Allegheny County Office Building Room 101 542 Forbes Ave Pittsburgh PA 15219 Phone 412350-4226 Fax 412350-6877 Free Search Sex Offender Records. You need to collect hotel tax. Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County. April 5 2016 340 PM.

Source: anytimeestimate.com

Source: anytimeestimate.com

The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. These records can include Allegheny County property tax assessments and assessment challenges appraisals and income taxes. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the. You need to collect hotel tax. Land Records - Search deeds block and lot maps and other real estate records.

Source: anytimeestimate.com

Source: anytimeestimate.com

Assessed Values by School District updated bi-weekly Assessed Values by Municipality updated bi-weekly. You can see all factors used to determine the tax bill and find more information on your property of interest by opening the. Allegheny County Pennsylvania Property Taxes - 2021 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200. Allegheny County collects on average 222 of a propertys assessed fair market value as property tax. Assessed Values by School District updated bi-weekly Assessed Values by Municipality updated bi-weekly.

Source: anytimeestimate.com

Source: anytimeestimate.com

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a. Alleghany is made up of approximately 16000 parcels of land and has 1000 business accounts and. Allegheny County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Allegheny County Pennsylvania. Allegheny Township Tax Office Real Estate 1001 South Leechburg Hill Leechburg PA 15656 PhoneFax 724-845-3261 Email. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually.

Source: anytimeestimate.com

Source: anytimeestimate.com

The Allegheny Countys Department of Real Estate Office present the information on this web site as a service to the public. Allegheny County collects on average 222 of a propertys assessed fair market value as property tax. Houses Just Now The Allegheny County Department Of Real Estate located in Pittsburgh Pennsylvania is a centralized office where public records are recorded indexed and stored in Allegheny County PA. Allegheny County Pennsylvania Property Taxes - 2021 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200. Allegheny County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Allegheny County Pennsylvania.

Source: alleghenycounty.us

Source: alleghenycounty.us

We are also responsible for administering and maintaining the Senior Citizen Tax Relief Program. Allegheny County Department of Real Estate Allegheny County Office Building Room 101 542 Forbes Ave Pittsburgh PA 15219 Phone 412350-4226 Fax 412350-6877 Free Search Sex Offender Records. In order to determine the tax bill your local tax assessors office takes into account the propertys assessed value the current assessment rate as well as any tax exemptions or abatements for that property. These range from rates of property taxation to local tax records and more. Allegheny Township Tax Office Real Estate 1001 South Leechburg Hill Leechburg PA 15656 PhoneFax 724-845-3261 Email.

Source: bizjournals.com

Source: bizjournals.com

Find Allegheny County property records deeds real estate tax assessment information and everything you need to know about properties in Allegheny County. These records can include Allegheny County property tax assessments and assessment challenges appraisals and income taxes. Allegheny County property records for real estate brokers Residential brokers can inform their clients by presenting user-friendly property reports that include property characteristics recent sales property tax records and useful property maps. Alleghany is made up of approximately 16000 parcels of land and has 1000 business accounts and. We maintain yearly records on over 550 thousand parcels.

Source: sites.google.com

Source: sites.google.com

Allegheny County Tax Liens Filings Satisfactions and Current Status Number of Resources. The Alleghany County Tax Office is responsible for the assessing listing and collection of tax for all real and personal property located within the County as of January 1st annually. Delinquent Rental Vehicle Tax. The Department of Real Estate Office makes no warranty or guarantee concerning the accuracy or reliability of the content at this site or at other sites to which we link. You need to collect hotel tax.

Source: wtae.com

Source: wtae.com

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a. You need to collect hotel tax. Allegheny County Pennsylvania Property Taxes - 2021 2 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200. If you have a question about Allegheny Township taxes or taxation policies this is the office to contact regarding those questions. Youll find property records real estate tax assessment information and everything you need to know about properties in Allegheny County on the county Real Estate Records and Property Assessments page.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title allegheny county pa real estate tax records by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.