Your Allegany county real estate taxes images are available in this site. Allegany county real estate taxes are a topic that is being searched for and liked by netizens today. You can Find and Download the Allegany county real estate taxes files here. Download all royalty-free vectors.

If you’re searching for allegany county real estate taxes images information connected with to the allegany county real estate taxes topic, you have visit the ideal blog. Our site frequently provides you with hints for seeking the maximum quality video and picture content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Allegany County Real Estate Taxes. 7 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200. Please note the Parcel Id is the 8 digit account number on your bill. To properly view the tax maps and images. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Allegany County Md Recently Sold Homes Realtor Com From realtor.com

Allegany County Md Recently Sold Homes Realtor Com From realtor.com

Looking for information on properties in Allegheny County. As of April 27 Allegany County NY shows 13 tax liens. Allegheny County Treasurer Office. Counties cities towns villages school districts and special districts each raise money through the real property tax. The real estate taxes will recalculate based on the revised assessment and will estimate the tax savings. Please call for an appointment.

In the Owner field enter the last name followed by first name no comma as it appears on the tax bill or enter the street name with or without the street number omitting the suffix road street lane etc.

Delinquent Rental Vehicle Tax. You can pay for multiple properties in one transaction so have your parcel ID lotblock numbers handy. Tips to locate your information. Youll find property records real estate tax assessment information and everything you need to know about properties in Allegheny County on the. 269 673-6094 Email Us HOURS. Allegany County Property Records are real estate documents that contain information related to real property in Allegany County Maryland.

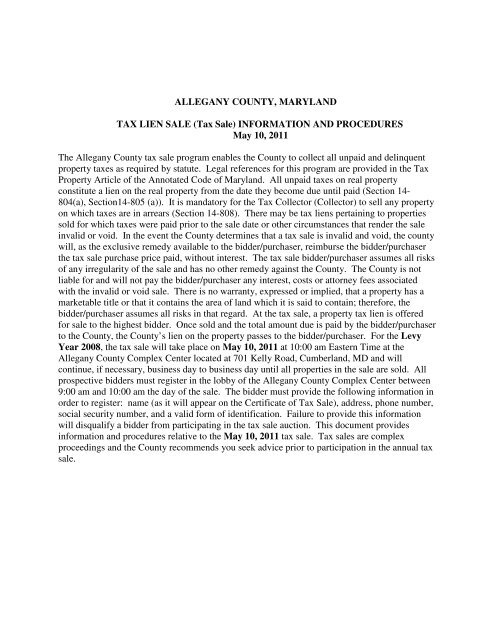

Source: yumpu.com

Source: yumpu.com

Please note the Parcel Id is the 8 digit account number on your bill. Allegheny County Pennsylvania Property Taxes. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. SEE Detailed property tax report for 410 Mchenry Valley Rd Allegany County NY. The median property tax in Allegany County Maryland is 1185 per year for a home worth the median value of 116800.

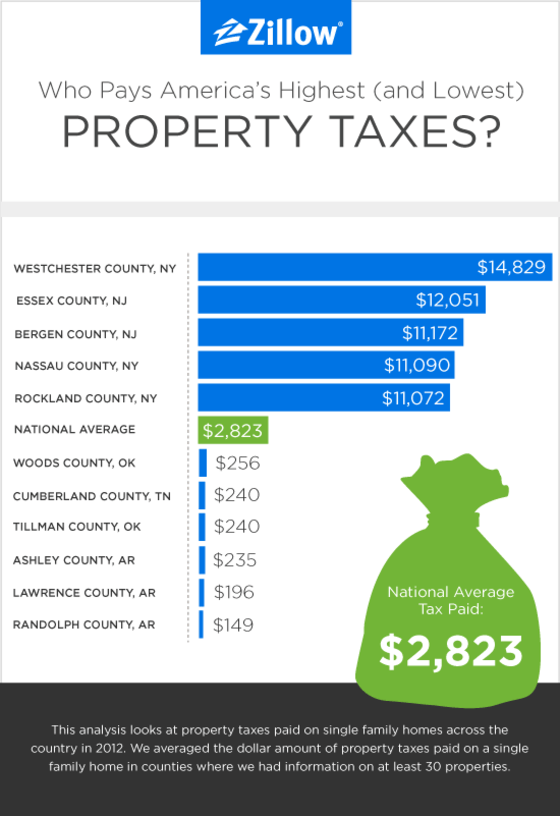

Source: zillow.com

Source: zillow.com

Allegan County Treasurer County Courthouse 113 Chestnut St. When a Allegany County NY tax lien is issued for unpaid past due balances Allegany County NY creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties. 800am - 500pm Monday -. Counties cities towns villages school districts and special districts each raise money through the real property tax. The Allegany County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

Source: realtor.com

Source: realtor.com

Allegheny County Treasurer Office. SEE Detailed property tax report for 410 Mchenry Valley Rd Allegany County NY. Box 259 Allegan MI 49010 Phone. Tax maps and images are rendered in many different formats. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Source: realtor.com

Source: realtor.com

Allegany County Property Records are real estate documents that contain information related to real property in Allegany County Maryland. Allegany County collects on average 101 of a propertys assessed fair market value as property tax. Allegany County offers online payment options for accounts receivable invoices and real estateproperty tax bills. Allegheny County Treasurer Office. Allegany County offers online payment options for real estate taxes.

Source: zillow.com

Source: zillow.com

To properly view the tax maps and images. Allegheny County collects on average 222 of a propertys assessed fair market value as property tax. Tax maps and images are rendered in many different formats. SEE Detailed property tax report for 410 Mchenry Valley Rd Allegany County NY. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually.

Source: realtor.com

Source: realtor.com

We maintain yearly records on. SEE Detailed property tax report for 410 Mchenry Valley Rd Allegany County NY. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. Allegany County with the cooperation of SDG provides access to RPS data tax maps and photographic images of properties. Our work in the Real Estate department involves preparing and collecting county taxes while serving the taxpayers in a professional and courteous manner.

Source: realtor.com

Source: realtor.com

You can download Form RP-5217-PDF at wwwtaxnygov. Counties cities towns villages school districts and special districts each raise money through the real property tax. Allegheny County Pennsylvania Property Taxes. Allegany County Property Records are real estate documents that contain information related to real property in Allegany County Maryland. Senior Citizen Tax Relief.

Source: realtor.com

Source: realtor.com

Looking for information on properties in Allegheny County. We maintain yearly records on. Box 259 Allegan MI 49010 Phone. The real estate taxes will recalculate based on the revised assessment and will estimate the tax savings. Counties cities towns villages school districts and special districts each raise money through the real property tax.

Source: zillow.com

Source: zillow.com

Please call for an appointment. 800am - 500pm Monday -. The Allegheny County Treasurer collects more than 250 million in county real estate taxes annually. 7 days ago The median property tax in Allegheny County Pennsylvania is 2553 per year for a home worth the median value of 115200. Allegheny County collects on average 222 of a propertys assessed fair market value as property tax.

Source: zillow.com

Source: zillow.com

Please call 585-268-9289 to set up an appointment they. These records can include Allegany County property tax assessments and assessment challenges appraisals and income taxes. Allegany County offers online payment options for real estate taxes. Allegheny County Pennsylvania Property Taxes. The Allegany County Clerks Office and the Office of Real Property will begin accepting the Online Generated Real Property Transfer Report starting June 1st 2013.

Source: nbcnews.com

Source: nbcnews.com

Allegany County Property Records are real estate documents that contain information related to real property in Allegany County Maryland. The Allegany County Clerks Office and the Office of Real Property will begin accepting the Online Generated Real Property Transfer Report starting June 1st 2013. Counties cities towns villages school districts and special districts each raise money through the real property tax. Allegany County Property Records are real estate documents that contain information related to real property in Allegany County Maryland. 800am - 500pm Monday -.

Source: realtor.com

Source: realtor.com

When a Allegany County NY tax lien is issued for unpaid past due balances Allegany County NY creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties. As of April 27 Allegany County NY shows 13 tax liens. Tax maps and images are rendered in many different formats. We will no longer accept the old style RP-5217 after December 31 2013. As part of the effort to slow the spread of the COVID- virus along with the decisions recently made pertaining to the safety of Allegany County residents and surrounding counties the services we provide in the Treasurers office have been modified as follows.

Source: zillow.com

Source: zillow.com

The real estate taxes will recalculate based on the revised assessment and will estimate the tax savings. Box 259 Allegan MI 49010 Phone. Tips to locate your information. Allegany County offers online payment options for accounts receivable invoices and real estateproperty tax bills. To properly view the tax maps and images.

Source: kevindcampbell.ca

Source: kevindcampbell.ca

Maryland is ranked 1191st of the 3143 counties in the United States in order of the median amount of property taxes collected. Delinquent Rental Vehicle Tax. 269 673-6094 Email Us HOURS. We will no longer accept the old style RP-5217 after December 31 2013. As of April 27 Allegany County NY shows 13 tax liens.

Source: alleganyco.com

Source: alleganyco.com

The Allegany County Clerks Office and the Office of Real Property will begin accepting the Online Generated Real Property Transfer Report starting June 1st 2013. In New York State the real property tax is a tax based on the value of real property. Allegany County offers online payment options for accounts receivable invoices and real estateproperty tax bills. Our work in the Real Estate department involves preparing and collecting county taxes while serving the taxpayers in a professional and courteous manner. 269 673-6094 Email Us HOURS.

Source: realtor.com

Source: realtor.com

269 673-6094 Email Us HOURS. Looking for information on properties in Allegheny County. We maintain yearly records on. Tips to locate your information. In New York State the real property tax is a tax based on the value of real property.

Source: whilbr.org

Source: whilbr.org

Allegheny County Treasurer Office. Image Mate Online is Allegany Countys commitment to provide the public with easy access to real property information. When a Allegany County NY tax lien is issued for unpaid past due balances Allegany County NY creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties. As of April 27 Allegany County NY shows 13 tax liens. Allegany County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Allegany County Maryland.

Source: realtor.com

Source: realtor.com

Obtaining deeds of bargain and sale deeds of correction and lists of heirs wills and other records from the Clerk of the Circuit Court allows us to complete the transfer of ownership of property. You can pay for multiple properties in one transaction so have your parcel ID lotblock numbers handy. Allegany County with the cooperation of SDG provides access to RPS data tax maps and photographic images of properties. Please call 585-268-9289 to set up an appointment they. The real estate taxes will recalculate based on the revised assessment and will estimate the tax savings.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title allegany county real estate taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.