Your Affordable care act real estate transfer tax images are ready. Affordable care act real estate transfer tax are a topic that is being searched for and liked by netizens now. You can Get the Affordable care act real estate transfer tax files here. Download all free photos and vectors.

If you’re looking for affordable care act real estate transfer tax pictures information related to the affordable care act real estate transfer tax topic, you have pay a visit to the ideal blog. Our site always provides you with suggestions for downloading the highest quality video and picture content, please kindly hunt and find more informative video articles and graphics that fit your interests.

Affordable Care Act Real Estate Transfer Tax. May 3 2020 500 AM PDT. A provision of Obamacare health care legislation creates a 38 Medicare tax on real estate transactions. Taxpayers may opt out of this adjustment or they can choose to use their 2019 ATI rather than 2020 figures when determining maximum business interest deduction for 2020. Health Care and Education Reconciliation Act of 2010 PL.

Biden S Healthcare Agenda In 2021 Shoring Up The Affordable Care Act From forbes.com

Biden S Healthcare Agenda In 2021 Shoring Up The Affordable Care Act From forbes.com

The CARES Act has a hidden 135 billion tax break for real estate investors. Health Care and Education Reconciliation Act of 2010 PL. If your income is under 250000 for married couples filing jointly or 200000 for individual filers you are not subject to the ACA real estate tax. The ACA brought with it a 15 billion tax on individuals who take a deduction based on having high medical bills. For a real estate instrument paper or notice to be considered recorded in connection with a transfer of real property that is a residential dwelling to an owner - occupier must such documents be recorded concurrently with the document transferring a residential dwelling to an owner-occupier. The year 2013 brought a new income tax to estates and trusts.

Taxpayers may opt out of this adjustment or they can choose to use their 2019 ATI rather than 2020 figures when determining maximum business interest deduction for 2020.

A provision of Obamacare health care legislation creates a 38 Medicare tax on real estate transactions. Transfer taxes are calculated based on the sale price of your home and can range from 001 to over 4. The tax actually started on January 1 2013 as a direct new tax that was explicitly intended to help fund the now not-so-new Affordable Care Act. Starting in 2013 those with incomes over 200000 will have to pay a 38 tax on profit from. The CARES Act removed this limitation for 2018 2019 and 2020 tax years. For a real estate instrument paper or notice to be considered recorded in connection with a transfer of real property that is a residential dwelling to an owner - occupier must such documents be recorded concurrently with the document transferring a residential dwelling to an owner-occupier.

Source: forbes.com

Source: forbes.com

The tax actually started on January 1 2013 as a direct new tax that was explicitly intended to help fund the now not-so-new Affordable Care Act. The year 2013 brought a new income tax to estates and trusts. A new controversial tax embedded in the Affordable Care Act affects homeowners who sell their homes for a substantial profit. Market value of real estate is the price of real estate that is obtained or might be obtained on the. TAX BASE SUBJECT OF TAXATION Tax base is the market value of the real estate at the moment when the tax liability incurred.

Source: tcf.org

Source: tcf.org

Real Estate Sales Tax as Part of the Patient Protection and Affordable Care Act. The ACA brought with it a 15 billion tax on individuals who take a deduction based on having high medical bills. May 3 2020 500 AM PDT. Special provisions apply for partnerships. How much do real estate transfer taxes cost.

Source: pinterest.com

Source: pinterest.com

Not unless youre very wealthy. The ACA brought with it a 15 billion tax on individuals who take a deduction based on having high medical bills. Taxpayers subject to the EBL limitation on their 2018 income tax returns or 2019 if the return was already filed should consider amending to obtain income tax. Homeowners need to be aware of the new 38 percent net investment. And we assume that the claim that a 35 real estate transaction tax was added this year is an inaccurate reference to the health care laws 38 percent tax on the net investment income of.

Source: freopp.org

Source: freopp.org

A provision of Obamacare health care legislation creates a 38 Medicare tax on real estate transactions. Although those income thresholds are not indexed for inflation they still exempt nearly all Americans from this tax regardless of whether they sell a home. Exactly what your tax rate will be will depend on where you live. For a real estate instrument paper or notice to be considered recorded in connection with a transfer of real property that is a residential dwelling to an owner - occupier must such documents be recorded concurrently with the document transferring a residential dwelling to an owner-occupier. This reduced the tax benefit generated by large real estate losses as they were limited and any excess would be carried forward like a net operating loss NOL.

Source: forbes.com

Source: forbes.com

Health Care and Education Reconciliation Act of 2010 PL. The old threshold of deductible. A provision of Obamacare health care legislation creates a 38 Medicare tax on real estate transactions. There is a 38 tax on investment profits including real estate for profits of over 500000 or the sale of multiple estates. Transfer taxes are calculated based on the sale price of your home and can range from 001 to over 4.

Source: tcf.org

Source: tcf.org

Special provisions apply for partnerships. There is a 38 tax on investment profits including real estate for profits of over 500000 or the sale of multiple estates. This reduced the tax benefit generated by large real estate losses as they were limited and any excess would be carried forward like a net operating loss NOL. Not unless youre very wealthy. The year 2013 brought a new income tax to estates and trusts.

Source: efile.com

Source: efile.com

If your income is under 250000 for married couples filing jointly or 200000 for individual filers you are not subject to the ACA real estate tax. Homeowners need to be aware of the new 38 percent net investment. The ACA brought with it a 15 billion tax on individuals who take a deduction based on having high medical bills. The old threshold of deductible. Here is how that works.

Source: forbes.com

Source: forbes.com

Although those income thresholds are not indexed for inflation they still exempt nearly all Americans from this tax regardless of whether they sell a home. H2648 189th 2015 - 2016. The year 2013 brought a new income tax to estates and trusts. Taxpayers may opt out of this adjustment or they can choose to use their 2019 ATI rather than 2020 figures when determining maximum business interest deduction for 2020. Homeowners need to be aware of the new 38 percent net investment.

Source: jdsupra.com

Source: jdsupra.com

The ACA brought with it a 15 billion tax on individuals who take a deduction based on having high medical bills. Exactly what your tax rate will be will depend on where you live. The tax actually started on January 1 2013 as a direct new tax that was explicitly intended to help fund the now not-so-new Affordable Care Act. Market value of real estate is the price of real estate that is obtained or might be obtained on the. A new controversial tax embedded in the Affordable Care Act affects homeowners who sell their homes for a substantial profit.

Source: tcf.org

Source: tcf.org

Real Estate Sales Tax as Part of the Patient Protection and Affordable Care Act. The CARES Act removed this limitation for 2018 2019 and 2020 tax years. State county and city transfer. A new controversial tax embedded in the Affordable Care Act affects homeowners who sell their homes for a substantial profit. Starting in 2013 those with incomes over 200000 will have to pay a 38 tax on profit from.

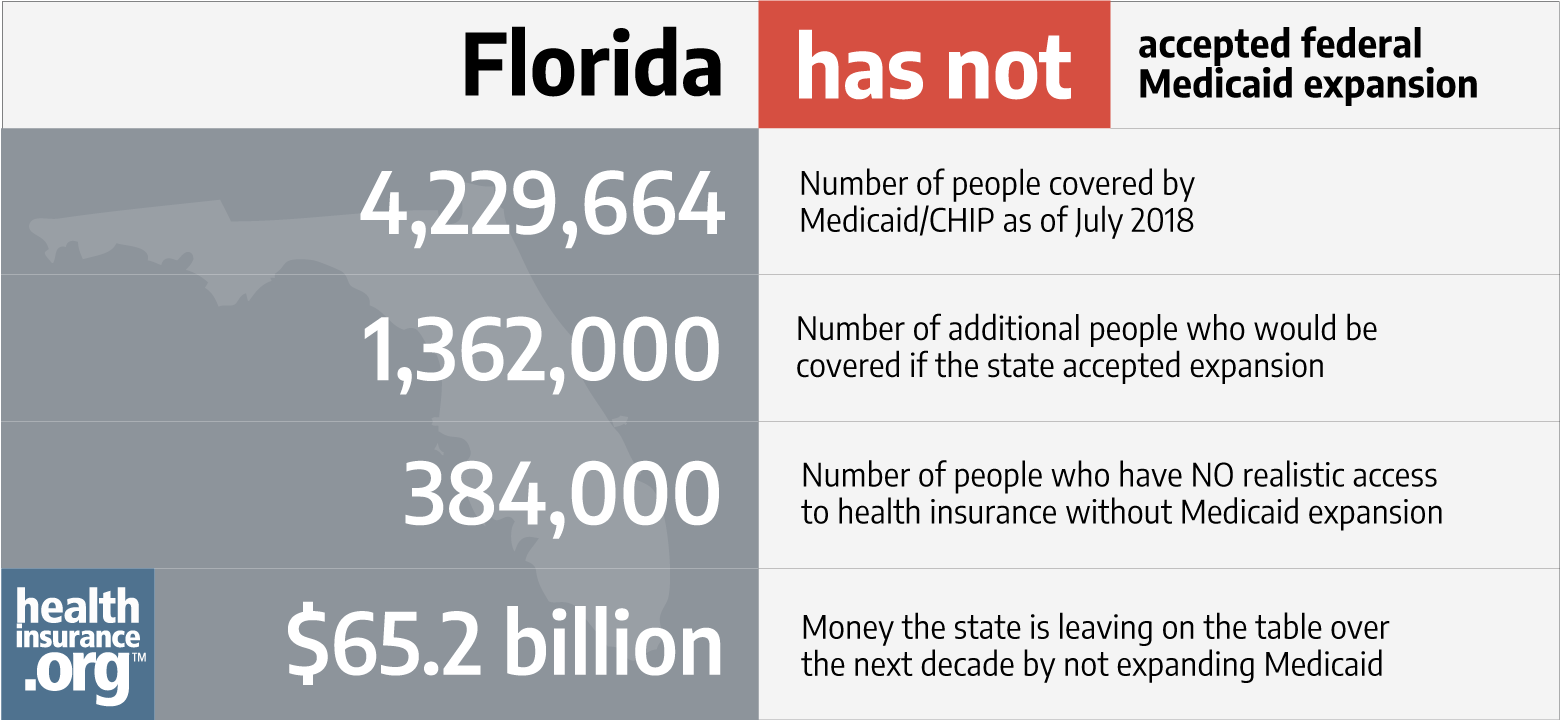

Source: healthinsurance.org

Source: healthinsurance.org

Although the tax is similar between individuals on the. The CARES Act has a hidden 135 billion tax break for real estate investors. It doesnt apply to many people but it WILL apply to some people that have profit from the sale of their homes. Health Care and Education Reconciliation Act of 2010 PL. An Act relative to property tax exemptions for rental properties in the town of Truro restricted as affordable housing.

Source: en.wikipedia.org

Source: en.wikipedia.org

State county and city transfer. Here is how that works. Real Estate Sales Tax as Part of the Patient Protection and Affordable Care Act. When you sell a home estate you can deduct most of that income and wont owe the 38 tax unless you make over 500000 in profit. Congress needs to repeal the provision writes.

Source: healthinsurance.org

Source: healthinsurance.org

Taxpayers subject to the EBL limitation on their 2018 income tax returns or 2019 if the return was already filed should consider amending to obtain income tax. Real Estate Sales Tax as Part of the Patient Protection and Affordable Care Act. Starting in 2013 those with incomes over 200000 will have to pay a 38 tax on profit from. REAL ESTATE TRANSFER TAX ACT TAXPAYER A person who acquires real estate in the Republic of Croatia when such acquisition is exempt from value added tax VAT. The CARES Act has a hidden 135 billion tax break for real estate investors.

Source: tcf.org

Source: tcf.org

The year 2013 brought a new income tax to estates and trusts. Taxpayers subject to the EBL limitation on their 2018 income tax returns or 2019 if the return was already filed should consider amending to obtain income tax. H3300 189th 2015 - 2016 An Act authorizing the town of Provincetown to impose a 05 real estate transfer fee. An Act relative to property tax exemptions for rental properties in the town of Truro restricted as affordable housing. The tax actually started on January 1 2013 as a direct new tax that was explicitly intended to help fund the now not-so-new Affordable Care Act.

Health Care and Education Reconciliation Act of 2010 PL. Posted on August 27 2012 by dlukins I met with a very nice couple today who asked me if it was true that Obamacare legislation included a 38 real estate sales tax on all transactions. Taxpayers may opt out of this adjustment or they can choose to use their 2019 ATI rather than 2020 figures when determining maximum business interest deduction for 2020. A provision of Obamacare health care legislation creates a 38 Medicare tax on real estate transactions. The year 2013 brought a new income tax to estates and trusts.

Source: financialsamurai.com

Source: financialsamurai.com

It doesnt apply to many people but it WILL apply to some people that have profit from the sale of their homes. For a real estate instrument paper or notice to be considered recorded in connection with a transfer of real property that is a residential dwelling to an owner - occupier must such documents be recorded concurrently with the document transferring a residential dwelling to an owner-occupier. Under the CARES Act the 30 limit on ATI is increased to 50 for tax years beginning in 2019 and 2020. Taxpayers may opt out of this adjustment or they can choose to use their 2019 ATI rather than 2020 figures when determining maximum business interest deduction for 2020. The tax actually started on January 1 2013 as a direct new tax that was explicitly intended to help fund the now not-so-new Affordable Care Act.

Source: forbes.com

Source: forbes.com

The Health Care and Education Reconciliation Act of 2010 HCA 2010 imposes an additional 38 income tax on individuals trusts and estates. State county and city transfer. The exemptions include real property transactions subject to a documentary transfer tax or on any real estate instrument paper or notice recorded in connection with a transfer of real property emphasis added that is a residential dwelling to an owner-occupier One issue the county recorders are still struggling with is what is or is not a transfer of real property under the code. TAX BASE SUBJECT OF TAXATION Tax base is the market value of the real estate at the moment when the tax liability incurred. Market value of real estate is the price of real estate that is obtained or might be obtained on the.

Source: jdsupra.com

Source: jdsupra.com

May 3 2020 500 AM PDT. A new controversial tax embedded in the Affordable Care Act affects homeowners who sell their homes for a substantial profit. The Health Care and Education Reconciliation Act of 2010 HCA 2010 imposes an additional 38 income tax on individuals trusts and estates. Health Care and Education Reconciliation Act of 2010 PL. Homeowners need to be aware of the new 38 percent net investment.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title affordable care act real estate transfer tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.