Your Affordable care act real estate tax images are ready. Affordable care act real estate tax are a topic that is being searched for and liked by netizens today. You can Find and Download the Affordable care act real estate tax files here. Get all free photos.

If you’re looking for affordable care act real estate tax images information connected with to the affordable care act real estate tax interest, you have visit the right site. Our site frequently gives you hints for refferencing the maximum quality video and picture content, please kindly search and locate more informative video articles and images that fit your interests.

Affordable Care Act Real Estate Tax. Both of these changes effectively improve cash flow for real estate entities by allowing them to realize current losses and amend prior years returns to apply for tax refunds. Health Care and Education Reconciliation Act of 2010 PL. The CARES Act also offers a technical correction for fiscal year filers with an NOL in the 2017-2018 straddle year. ObamaCare increases taxes on unearned income by 38 and this can add additional taxes to the sales of some homes.

Healthcare U S House Of Representatives From kevinbrady.house.gov

Healthcare U S House Of Representatives From kevinbrady.house.gov

Health Care and Education Reconciliation Act of 2010 PL. Excise taxes from the Affordable Care Act raised 163 billion in fiscal year 2015. The Tax Cuts and Jobs Act passed in December 2017 included a permanent repeal of the individual mandate provision of the Affordable Care Act as of the 2019 tax. The Affordable Care Act includes the individual shared responsibility provision and the premium tax credit that may affect your tax return. The Act creates a nationwide insurance system and. The Affordable Care Act of 2010 imposed an additional potential tax on the sale of real estate but this tax impacts only high-income individuals who earn 200000 or 250000 for a couple.

It also doesnt usually apply to homes you have.

The Health Care and Education Reconciliation Act of 2010 HCA 2010 imposes an additional 38 income tax on individuals trusts and estates. The CARES Act also offers a technical correction for fiscal year filers with an NOL in the 2017-2018 straddle year. A middle-class taxpayer who happens to. Higher taxes on real estate investments. The Affordable Care Act includes the individual shared responsibility provision and the premium tax credit that may affect your tax return. Excise taxes from the Affordable Care Act raised 163 billion in fiscal year 2015.

Source: healthcarereform.procon.org

Source: healthcarereform.procon.org

38 tax on real estate transactions Under the new health care bill did you know that all real estate transactions are subject to a 38 Sales Tax. Annual excise taxes totaling 3 billion were levied on importers and manufacturers of prescription drugs. It also doesnt usually apply to homes you have. A middle-class taxpayer who happens to. This year marks the first time that certain taxpayers will receive new health-care related information forms that they can use to complete their tax return and then keep with their tax records.

Source: medicareresources.org

Source: medicareresources.org

This article originally said that the Affordable Care Act included a 09 percent Medicare tax increase The tax increase was 09 percentage points from 145 percent to 235. The 38 capital gains tax typically doesnt apply to your primary residence. Due to a drafting error the existing Tax Cuts and Jobs Act TCJA provision disallows NOL carrybacks made. The Patient Protection and Affordable Care Act PPAC also known as Obamacare is a United States federal statute passed in March of 2010. May 3 2020 500 AM PDT The CARES Act has a hidden 135 billion tax break for real estate investors.

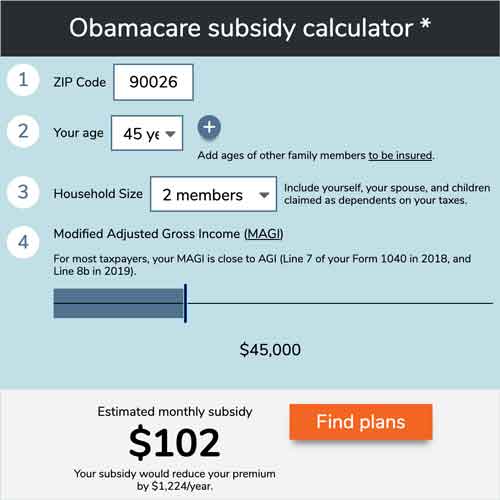

Source: healthinsurance.org

Source: healthinsurance.org

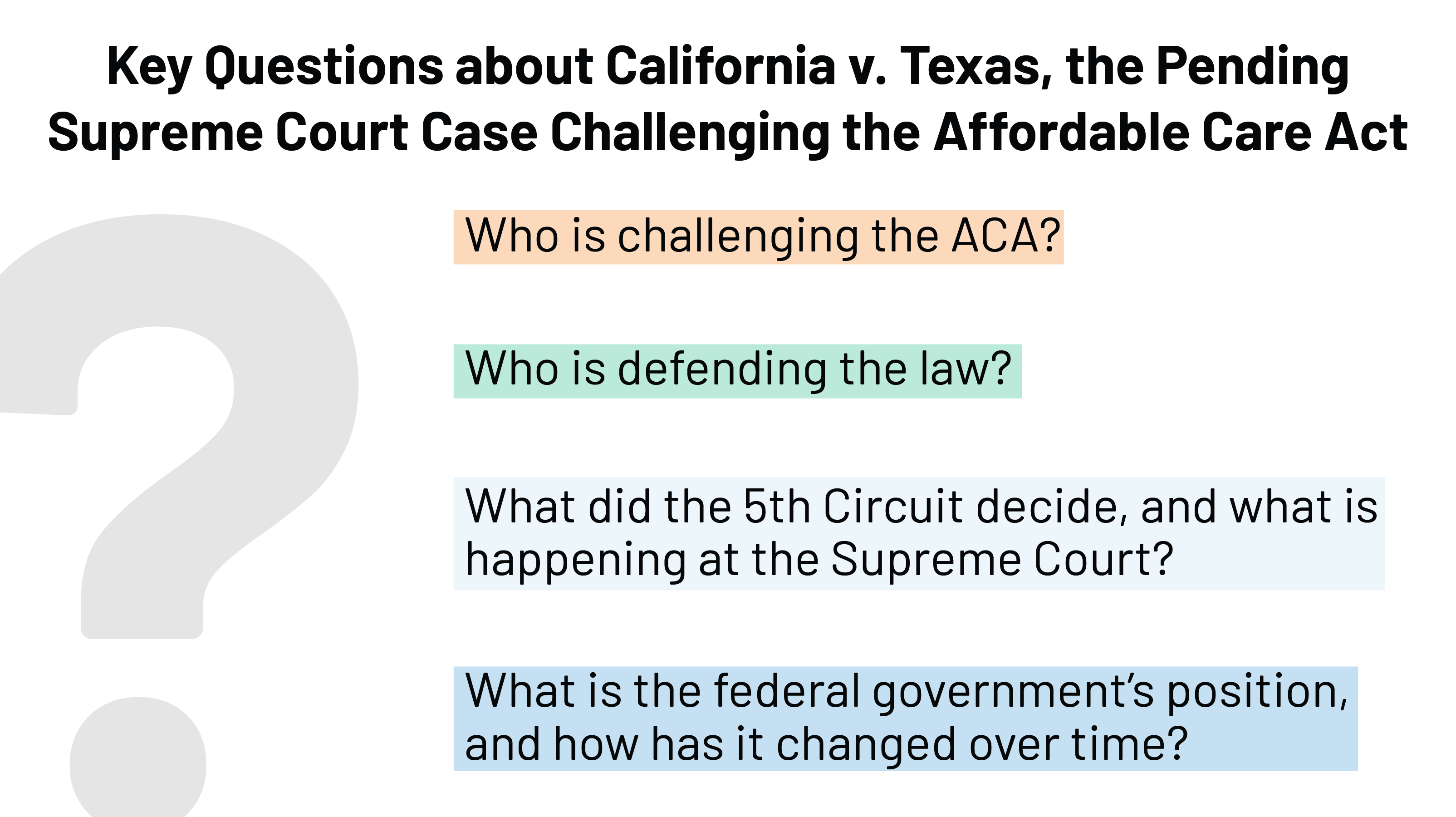

A great deal of concern exists about what some people are calling a real estate tax buried deep in the reams of paper that comprise the Patient Protection and Affordable Care Act. The 38 Medicare surtax would hit average middle-class investors in real estate. The Individual mandate tax was 695 per individual or 2085 per family at a minimum reaching as high. The Tax Cuts and Jobs Act passed in December 2017 included a permanent repeal of the individual mandate provision of the Affordable Care Act as of the 2019 tax. Section 1411 of the Internal Revenue Code enacted through the reconciliation process under which the act was passed quickly led to a slew.

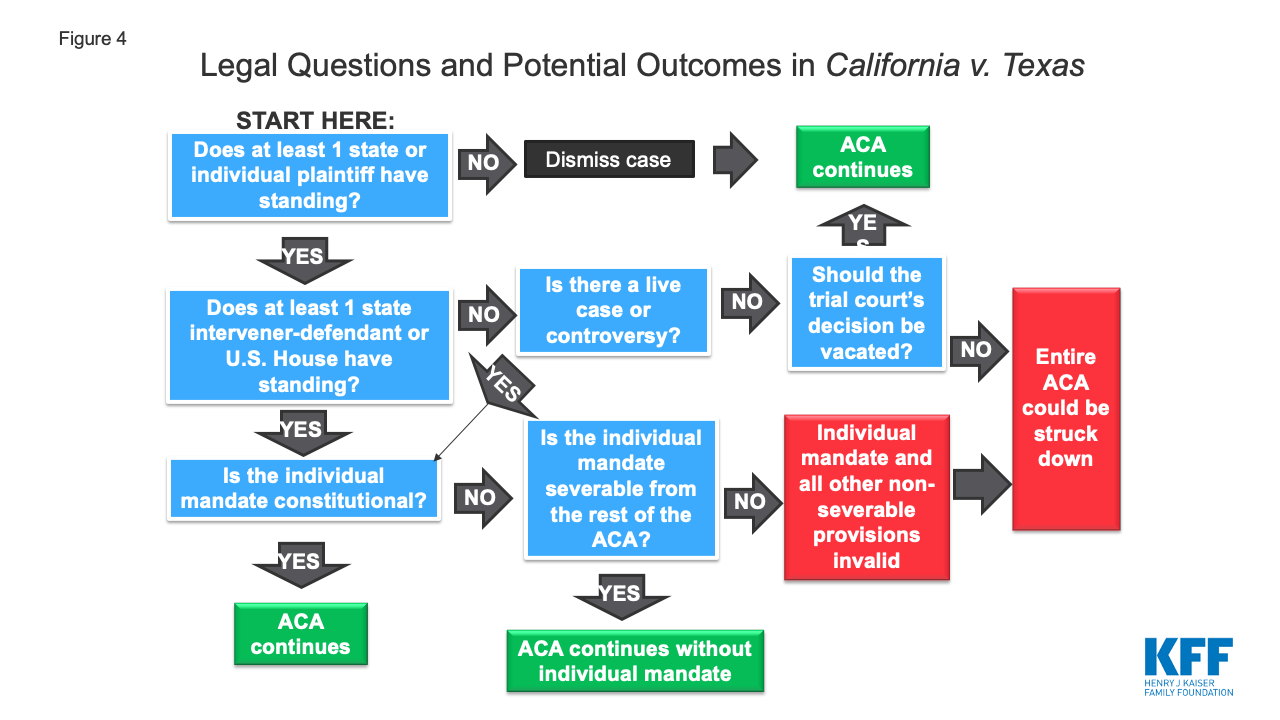

Source: kff.org

Source: kff.org

The Health Care and Education Reconciliation Act of 2010 HCA 2010 imposes an additional 38 income tax on individuals trusts and estates. Homeowners need to be aware of the new 38 percent net investment. Excise taxes from the Affordable Care Act raised 163 billion in fiscal year 2015. Both of these changes effectively improve cash flow for real estate entities by allowing them to realize current losses and amend prior years returns to apply for tax refunds. May 3 2020 500 AM PDT The CARES Act has a hidden 135 billion tax break for real estate investors.

Source: pinterest.com

Source: pinterest.com

The Tax Cuts and Jobs Act passed in December 2017 included a permanent repeal of the individual mandate provision of the Affordable Care Act as of the 2019 tax. Higher taxes on real estate investments. Section 1411 of the Internal Revenue Code enacted through the reconciliation process under which the act was passed quickly led to a slew. The CARES Act also offers a technical correction for fiscal year filers with an NOL in the 2017-2018 straddle year. 113 billion came from an excise tax placed directly on health insurers based on their market share.

Source: ehealthinsurance.com

Source: ehealthinsurance.com

Cynthia Petitjean ESQ CPA sits down with us on the Market Minute to discuss how the new tax on capital gains will effect real estate. Excise taxes from the Affordable Care Act raised 163 billion in fiscal year 2015. 113 billion came from an excise tax placed directly on health insurers based on their market share. A new controversial tax embedded in the Affordable Care Act affects homeowners who sell their homes for a substantial profit. Due to a drafting error the existing Tax Cuts and Jobs Act TCJA provision disallows NOL carrybacks made.

Source: investopedia.com

Source: investopedia.com

The law also ended the individual mandate a provision of the Affordable Care Act ACA or Obamacare that provided tax penalties for individuals who did not obtain health insurance coverage in. Homeowners need to be aware of the new 38 percent net investment. A middle-class taxpayer who happens to. Annual excise taxes totaling 3 billion were levied on importers and manufacturers of prescription drugs. The CARES Act also offers a technical correction for fiscal year filers with an NOL in the 2017-2018 straddle year.

Source: forbes.com

Source: forbes.com

The Affordable Care Act of 2010 imposed an additional potential tax on the sale of real estate but this tax impacts only high-income individuals who earn 200000 or 250000 for a couple. Homeowners need to be aware of the new 38 percent net investment. Health Care and Education Reconciliation Act of 2010 PL. 113 billion came from an excise tax placed directly on health insurers based on their market share. ObamaCare increases taxes on unearned income by 38 and this can add additional taxes to the sales of some homes.

Source: ehealthinsurance.com

Source: ehealthinsurance.com

A great deal of concern exists about what some people are calling a real estate tax buried deep in the reams of paper that comprise the Patient Protection and Affordable Care Act. For people who do have incomes that exceed those amounts the ACAs Medicare surtax is 38 percent of capital gains profit on real estate transactions. Although the tax is similar between individuals on the. 113 billion came from an excise tax placed directly on health insurers based on their market share. May 3 2020 500 AM PDT The CARES Act has a hidden 135 billion tax break for real estate investors.

Source: pinterest.com

Source: pinterest.com

The Affordable Care Act includes the individual shared responsibility provision and the premium tax credit that may affect your tax return. Homeowners need to be aware of the new 38 percent net investment. The Affordable Care Act includes the individual shared responsibility provision and the premium tax credit that may affect your tax return. The Act creates a nationwide insurance system and. The first 250000 for an individual.

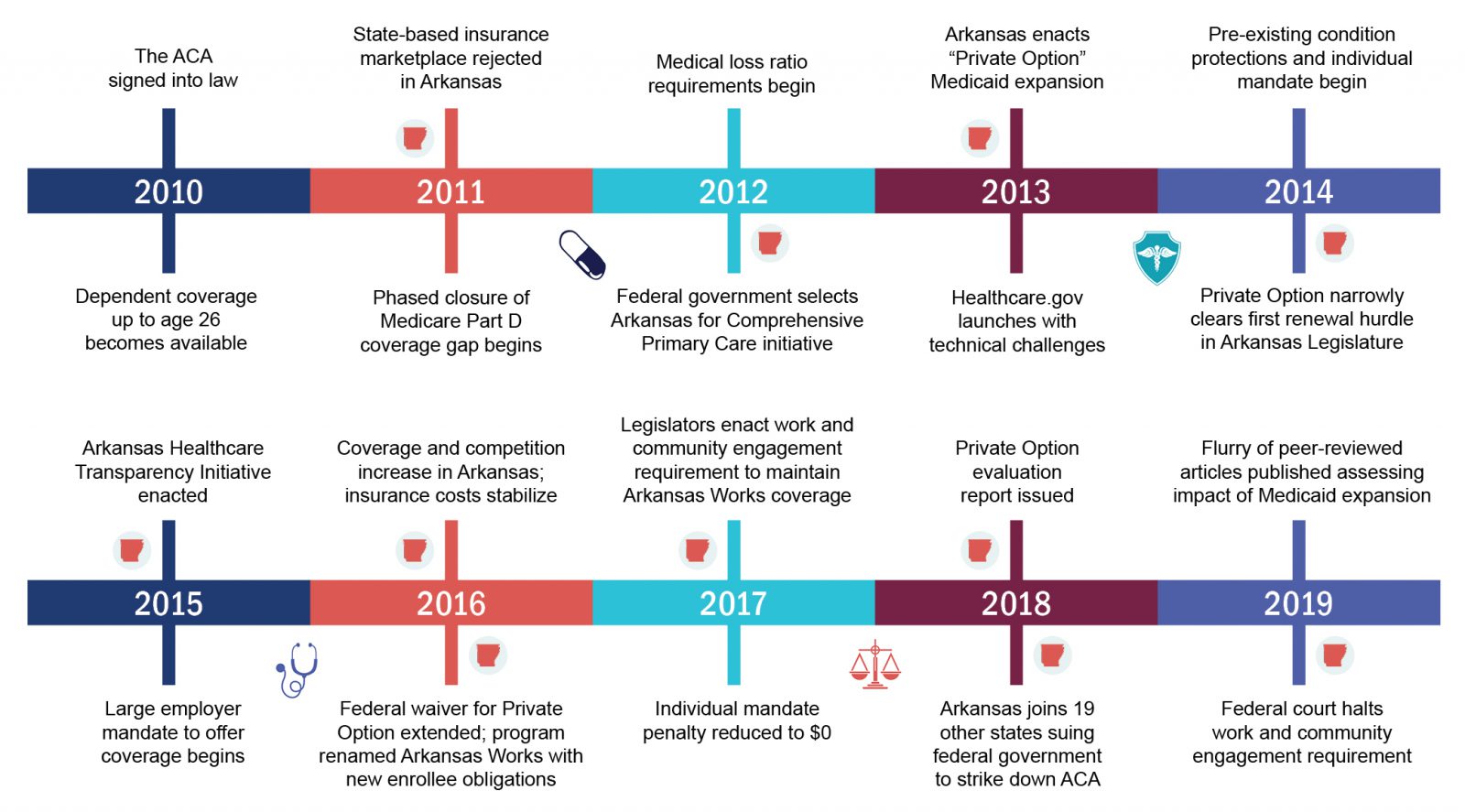

Source: achi.net

Source: achi.net

Health Care and Education Reconciliation Act of 2010 PL. The Health Care and Education Reconciliation Act of 2010 HCA 2010 imposes an additional 38 income tax on individuals trusts and estates. However many limitations apply so this wont affect most sellers. The Act creates a nationwide insurance system and. Excise taxes from the Affordable Care Act raised 163 billion in fiscal year 2015.

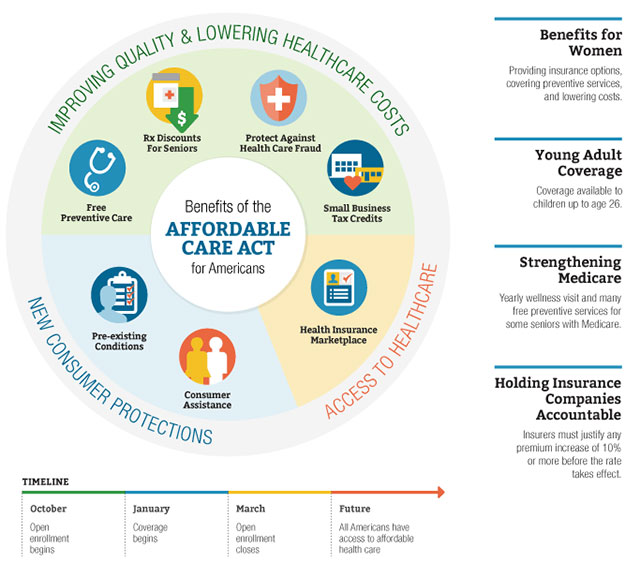

Source: obamacarefacts.com

Source: obamacarefacts.com

May 3 2020 500 AM PDT The CARES Act has a hidden 135 billion tax break for real estate investors. The first 250000 for an individual. However many limitations apply so this wont affect most sellers. A middle-class taxpayer who happens to. Both of these changes effectively improve cash flow for real estate entities by allowing them to realize current losses and amend prior years returns to apply for tax refunds.

Source: en.wikipedia.org

Source: en.wikipedia.org

500000 for married couples filing jointly in profit on the sale of a primary residence is excluded from the tax. Higher taxes on real estate investments. ObamaCare increases taxes on unearned income by 38 and this can add additional taxes to the sales of some homes. It also doesnt usually apply to homes you have. This year marks the first time that certain taxpayers will receive new health-care related information forms that they can use to complete their tax return and then keep with their tax records.

Source: kff.org

Source: kff.org

The Patient Protection and Affordable Care Act PPAC also known as Obamacare is a United States federal statute passed in March of 2010. 113 billion came from an excise tax placed directly on health insurers based on their market share. A middle-class taxpayer who happens to. The 38 capital gains tax typically doesnt apply to your primary residence. May 3 2020 500 AM PDT The CARES Act has a hidden 135 billion tax break for real estate investors.

Source: kff.org

Source: kff.org

This article originally said that the Affordable Care Act included a 09 percent Medicare tax increase The tax increase was 09 percentage points from 145 percent to 235. The first 250000 for an individual. Homeowners need to be aware of the new 38 percent net investment. The CARES Act also offers a technical correction for fiscal year filers with an NOL in the 2017-2018 straddle year. The Tax Cuts and Jobs Act passed in December 2017 included a permanent repeal of the individual mandate provision of the Affordable Care Act as of the 2019 tax.

Source: obamacarefacts.com

Source: obamacarefacts.com

Health Care and Education Reconciliation Act of 2010 PL. ObamaCare Home Sales Tax ObamaCare Real Estate Tax Increase. Higher taxes on real estate investments. A great deal of concern exists about what some people are calling a real estate tax buried deep in the reams of paper that comprise the Patient Protection and Affordable Care Act. The Individual mandate tax was 695 per individual or 2085 per family at a minimum reaching as high.

Source: kevinbrady.house.gov

Source: kevinbrady.house.gov

The Tax Cuts and Jobs Act passed in December 2017 included a permanent repeal of the individual mandate provision of the Affordable Care Act as of the 2019 tax. Section 1411 of the Internal Revenue Code enacted through the reconciliation process under which the act was passed quickly led to a slew. 113 billion came from an excise tax placed directly on health insurers based on their market share. The Affordable Care Act includes the individual shared responsibility provision and the premium tax credit that may affect your tax return. Due to a drafting error the existing Tax Cuts and Jobs Act TCJA provision disallows NOL carrybacks made.

Source: healthinsurance.org

Source: healthinsurance.org

The law also ended the individual mandate a provision of the Affordable Care Act ACA or Obamacare that provided tax penalties for individuals who did not obtain health insurance coverage in. It also doesnt usually apply to homes you have. A new controversial tax embedded in the Affordable Care Act affects homeowners who sell their homes for a substantial profit. The first 250000 for an individual. A middle-class taxpayer who happens to.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title affordable care act real estate tax by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.