Your Adjusted cost basis calculator real estate images are available. Adjusted cost basis calculator real estate are a topic that is being searched for and liked by netizens now. You can Get the Adjusted cost basis calculator real estate files here. Find and Download all royalty-free photos and vectors.

If you’re searching for adjusted cost basis calculator real estate images information related to the adjusted cost basis calculator real estate keyword, you have pay a visit to the right site. Our website always provides you with suggestions for downloading the highest quality video and image content, please kindly surf and find more enlightening video content and graphics that match your interests.

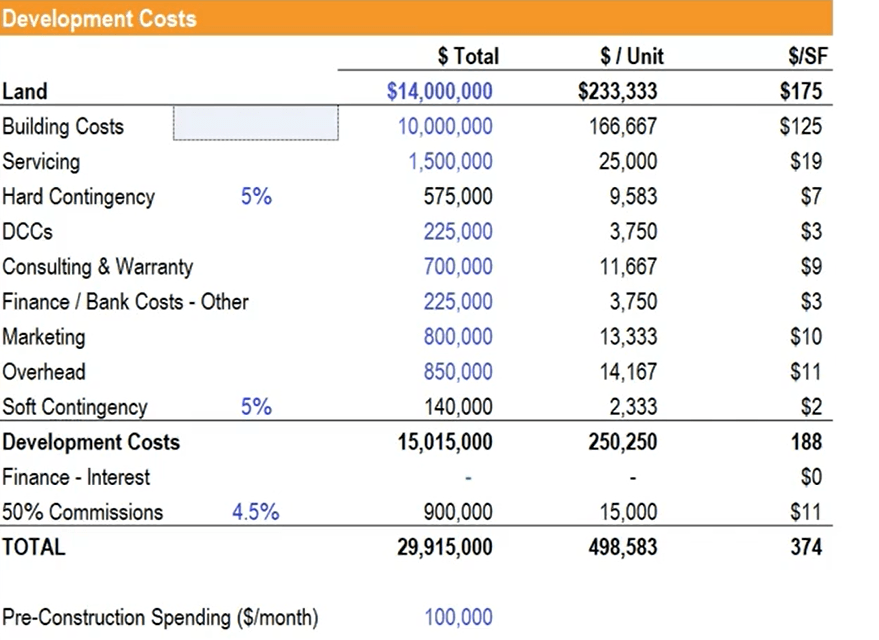

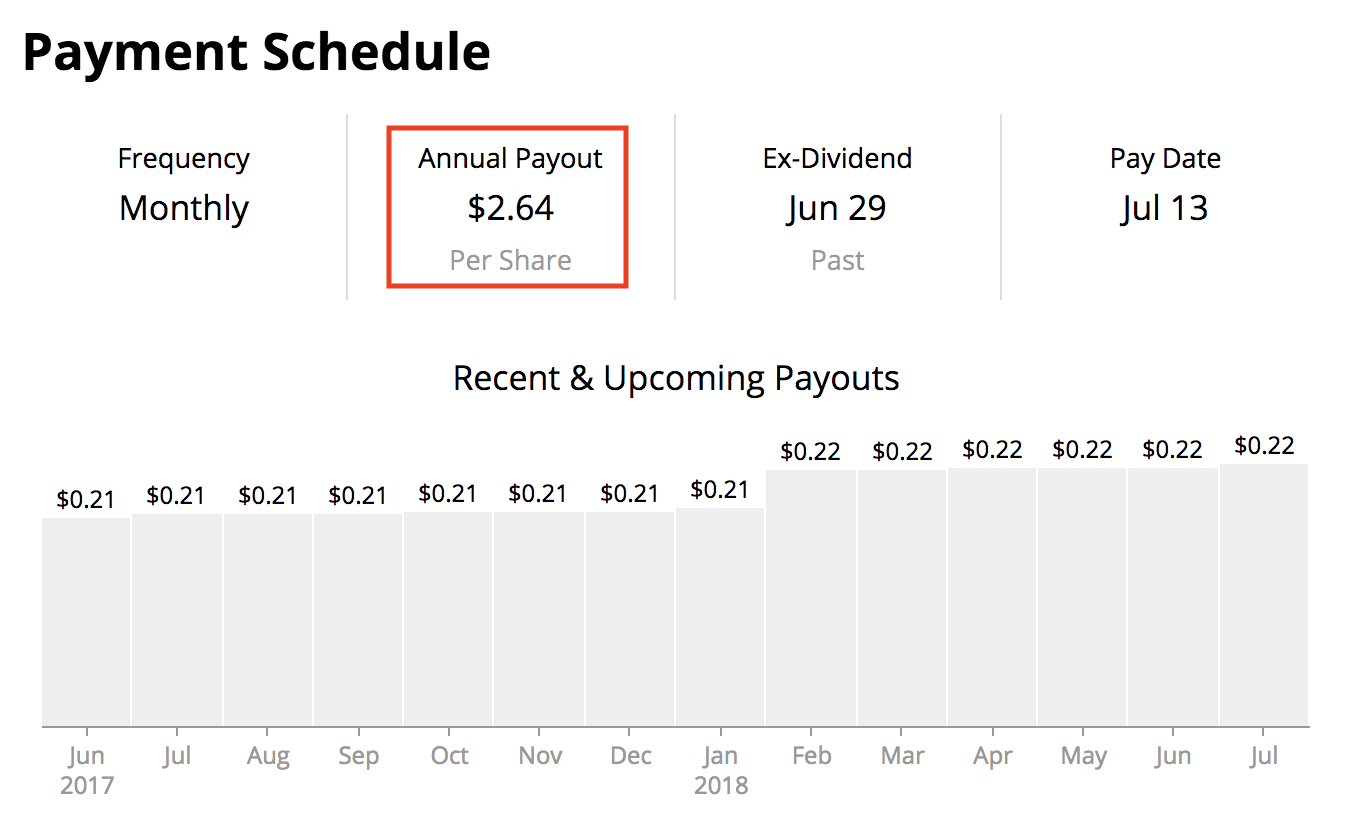

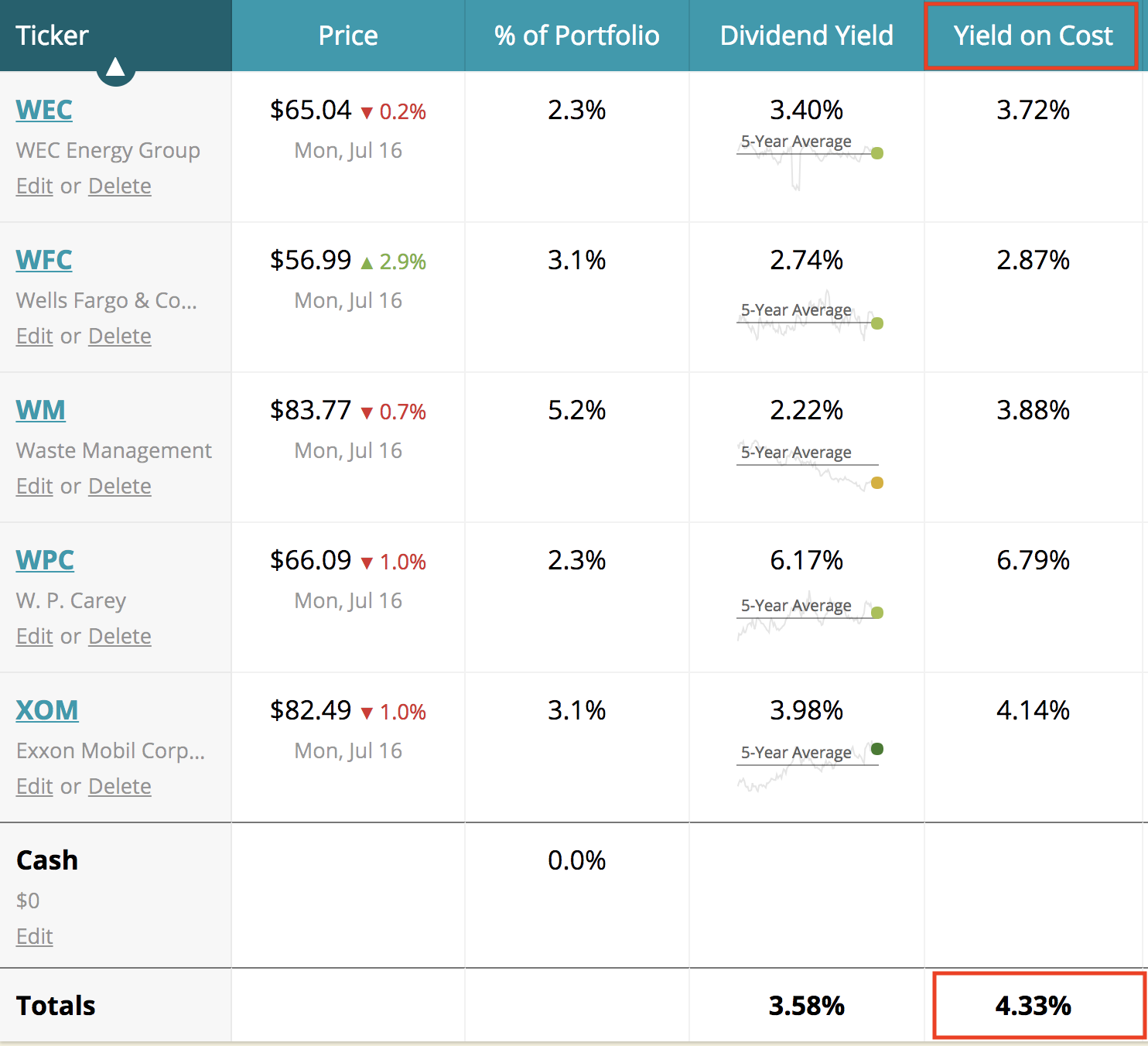

Adjusted Cost Basis Calculator Real Estate. Calculating the capital gain To determine the capital gain on the sale of a property you subtract your adjusted cost base ACB from the net proceeds of. It is the historical cost that you spent on your real estate. Calculate the cumulative depreciation on the property – this will reduce your adjusted basis. Reduced cost base to calculate a capital loss.

Calculating Your Profit When Selling Your Rental Property Mortgage Blog From mortgageblog.com

Calculating Your Profit When Selling Your Rental Property Mortgage Blog From mortgageblog.com

Cost basis is the original purchase price of real estate plus certain expenses and fees incurred by the buyer many of which are detailed in closing documents. First its important to know that basis is the amount of your capital investment in a property and is used for tax purposes. The basic rules are the same for all assets but for real estate there are some additional rules for. To find the adjusted basis. Adjusted Cost Base. Cost basis is expressed in terms of a purchase price except for.

Most non-registered investments require an adjusted cost base calculation.

The capital costs usually have a long-lasting effect such as adding a deck attached to an existing house. Additionally you can usually include capital costs such as the cost of additions or improvements and legal fees as part of an assets ACB. Cost base to calculate a capital gain. Calculating the cost base for real estate. Cost basis is expressed in terms of a purchase price except for. Reduced cost base to calculate a capital loss.

Source: pinterest.com

Source: pinterest.com

305000 129000 176000 basis. When the asset is sold the capital gain is determined by subtracting the adjusted cost base from the sale price of the asset. Calculating Deductions to Cost Basis Cost basis can also be adjusted down by subtracting any capitalized costs directly correlated to the asset. Subtract the amount of allowable depreciation and casualty and theft losses. Real estate investment calculator solving for adjusted basis given original basis capital additions sales cost cumulative real estate depreciation and cumulative capital improvements depreciation Adjusted Basis Calculator - Real Estate Investment Equations Formulas.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Find Adjusted Cost Basis Real Estate sold homes homes for sale real estate house for rent. First its important to know that basis is the amount of your capital investment in a property and is used for tax purposes. Reduced cost base to calculate a capital loss. To find the adjusted basis. Calculate your real estate basis in the home by subtracting the basis of your land from the purchase price.

Source: fi.pinterest.com

Source: fi.pinterest.com

Calculate your real estate basis in the home by subtracting the basis of your land from the purchase price. First its important to know that basis is the amount of your capital investment in a property and is used for tax purposes. Calculate the cumulative depreciation on the property – this will reduce your adjusted basis. Adjusted Basis or Adjusted Tax Basis refers to the original cost or other basis of property reduced by depreciation deductions and increased by capital expenditures. He then erects a retail facility for 600000 then depreciates the improvements for tax purposes at the rate of 15000 per year.

Source: mortgageblog.com

Source: mortgageblog.com

You can increase your basis from there by adding the amount of money youve spent improving the asset as well as any amounts you might have paid for legal fees or the costs of sale. Calculating the cost base for real estate. So in case of property that you got as inheritance cost basis is the purchase price plus any improvement cost that your ancestor incurred. The adjusted cost base ACB is usually the cost of a property plus any expenses to acquire it such as commissions and legal fees. The cost basis for real estate as defined by the tax law of the United States of America as the original cost of real estate adjusted for factors such as depreciation.

Source: simplysafedividends.com

Source: simplysafedividends.com

Your adjusted basis will be reduced by 100000 20000 depreciation per year multiplied by five years. Add the cost of major improvements. You can increase your basis from there by adding the amount of money youve spent improving the asset as well as any amounts you might have paid for legal fees or the costs of sale. Cost basis is the original purchase price of real estate plus certain expenses and fees incurred by the buyer many of which are detailed in closing documents. Cost basis is a tool used to calculate the profit made when you sell off your property.

Source: pinterest.com

Source: pinterest.com

Additionally you can usually include capital costs such as the cost of additions or improvements and legal fees as part of an assets ACB. This is assuming you elected to apply the entire cost basis addition to real estate and were not a surviving spouse. Calculate the cumulative depreciation on the property – this will reduce your adjusted basis. You bought your home for 305000. 305000 129000 176000 basis.

Source: pinterest.com

Source: pinterest.com

He then erects a retail facility for 600000 then depreciates the improvements for tax purposes at the rate of 15000 per year. So in case of property that you got as inheritance cost basis is the purchase price plus any improvement cost that your ancestor incurred. This is assuming you elected to apply the entire cost basis addition to real estate and were not a surviving spouse. If you made improvements to the home Ex. Cost basis is a tool used to calculate the profit made when you sell off your property.

Source: uk.pinterest.com

Source: uk.pinterest.com

To find the adjusted basis. Subtract the amount of allowable depreciation and casualty and theft losses. Your adjusted basis is generally your cost in acquiring your home plus the cost of any capital improvements you made less casualty loss amounts and other decreases. To find the adjusted basis. The cost basis for real estate as defined by the tax law of the United States of America as the original cost of real estate adjusted for factors such as depreciation.

Source: pinterest.com

Source: pinterest.com

This could include a rental property owned by an individual investor commercial real estate or the sale of securities such as stocks and bonds. 176000 70000. Cost basis is a tool used to calculate the profit made when you sell off your property. When the asset is sold the capital gain is determined by subtracting the adjusted cost base from the sale price of the asset. Brad buys a lot for 100000.

Source: investopedia.com

Source: investopedia.com

Calculating the cost base for real estate. If you made improvements to the home Ex. The ACB of an asset is the price you paid to acquire it. This could include a rental property owned by an individual investor commercial real estate or the sale of securities such as stocks and bonds. Calculating your adjusted basis in an asset begins with its original purchase price.

Source: simplysafedividends.com

Source: simplysafedividends.com

305000 129000 176000 basis. This could include a rental property owned by an individual investor commercial real estate or the sale of securities such as stocks and bonds. Special rules can sometimes apply that will allow you to consider the cost of the capital property to be an amount other than its actual cost. Real estate investment calculator solving for adjusted basis given original basis capital additions sales cost cumulative real estate depreciation and cumulative capital improvements depreciation Adjusted Basis Calculator - Real Estate Investment Equations Formulas. Calculating the Adjusted Basis of Your Property to Account for Home Improvements Youll need to adjust the basis of your property for things you did after you bought the homeSo youd add the cost of additions or improvements to your basis.

Source: pinterest.com

Source: pinterest.com

Calculating the Adjusted Basis of Your Property to Account for Home Improvements Youll need to adjust the basis of your property for things you did after you bought the homeSo youd add the cost of additions or improvements to your basis. For more information on basis and adjusted basis refer to Publication 523 Selling Your Home. Brad buys a lot for 100000. Calculating your adjusted basis in an asset begins with its original purchase price. Calculating Deductions to Cost Basis Cost basis can also be adjusted down by subtracting any capitalized costs directly correlated to the asset.

Source: investopedia.com

Source: investopedia.com

The cost basis for real estate as defined by the tax law of the United States of America as the original cost of real estate adjusted for factors such as depreciation. For more information on basis and adjusted basis refer to Publication 523 Selling Your Home. Cost basis is expressed in terms of a purchase price except for. First its important to know that basis is the amount of your capital investment in a property and is used for tax purposes. Reduced cost base to calculate a capital loss.

Source: pinterest.com

Source: pinterest.com

If you made improvements to the home Ex. The adjusted cost base ACB is usually the cost of a property plus any expenses to acquire it such as commissions and legal fees. Calculating the Adjusted Basis of Your Property to Account for Home Improvements Youll need to adjust the basis of your property for things you did after you bought the homeSo youd add the cost of additions or improvements to your basis. You can increase your basis from there by adding the amount of money youve spent improving the asset as well as any amounts you might have paid for legal fees or the costs of sale. Adjusted Basis or Adjusted Tax Basis refers to the original cost or other basis of property reduced by depreciation deductions and increased by capital expenditures.

Source: pinterest.com

Source: pinterest.com

Calculating Cost Basis For Real Estate. Calculate your real estate basis in the home by subtracting the basis of your land from the purchase price. Calculating Deductions to Cost Basis Cost basis can also be adjusted down by subtracting any capitalized costs directly correlated to the asset. Calculating the capital gain To determine the capital gain on the sale of a property you subtract your adjusted cost base ACB from the net proceeds of. Cost base to calculate a capital gain.

Source: pinterest.com

Source: pinterest.com

Cost basis is expressed in terms of a purchase price except for. So in case of property that you got as inheritance cost basis is the purchase price plus any improvement cost that your ancestor incurred. Suppose you held the property for five years and took depreciation of 20000 every year. To calculate a capital gain or loss you need to know the assets. Calculating Deductions to Cost Basis Cost basis can also be adjusted down by subtracting any capitalized costs directly correlated to the asset.

Source: breakingintowallstreet.com

Source: breakingintowallstreet.com

Calculating Deductions to Cost Basis Cost basis can also be adjusted down by subtracting any capitalized costs directly correlated to the asset. This is assuming you elected to apply the entire cost basis addition to real estate and were not a surviving spouse. Calculating your adjusted basis in an asset begins with its original purchase price. The capital costs usually have a long-lasting effect such as adding a deck attached to an existing house. Suppose you held the property for five years and took depreciation of 20000 every year.

Source: de.pinterest.com

Source: de.pinterest.com

Additionally you can usually include capital costs such as the cost of additions or improvements and legal fees as part of an assets ACB. This is assuming you elected to apply the entire cost basis addition to real estate and were not a surviving spouse. Calculating the cost base for real estate. For more information on basis and adjusted basis refer to Publication 523 Selling Your Home. 176000 70000.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title adjusted cost basis calculator real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.