Your Adjusted cost base calculator real estate images are ready. Adjusted cost base calculator real estate are a topic that is being searched for and liked by netizens today. You can Find and Download the Adjusted cost base calculator real estate files here. Get all royalty-free photos and vectors.

If you’re searching for adjusted cost base calculator real estate pictures information related to the adjusted cost base calculator real estate topic, you have visit the right site. Our website always gives you hints for refferencing the maximum quality video and picture content, please kindly search and find more informative video content and graphics that fit your interests.

Adjusted Cost Base Calculator Real Estate. Calculate your real estate basis in the home by subtracting the basis of your land from the purchase price. 305000 129000 176000 basis. Cost basis is the original purchase price of real estate plus certain expenses and fees incurred by the buyer many of which are detailed in closing documents. When working out the reduced cost base for real estate you do not include.

Add the cost of major improvements. If we divide this total by the number of shares we arrive at the adjusted cost base per share. The adjusted cost base is calculated by adding in the price you paid to purchase all of your investments into a certain stock or mutual fund. For instance if 100 shares of XYZ Company were purchased at a price of 30 each then the ACB would be 3000. You bought your home for 305000. If you bought a building for 100000 and you paid 50000 to add an addition to it ie.

Adjusted Cost Base ACB or Cost Basis The adjusted cost base ACB includes the original purchase price and all costs related to the purchase of an item - ie those costs incurred before the itemasset is available for use.

305000 129000 176000 basis. The basic rules are the same for all assets but for real estate there are some additional rules for. If we divide this total by the number of shares we arrive at the adjusted cost base per share. Calculate your real estate basis in the home by subtracting the basis of your land from the purchase price. Cost basis is the original purchase price of real estate plus certain expenses and fees incurred by the buyer many of which are detailed in closing documents. You can increase your basis from there by adding the amount of money youve spent improving the asset as well as any amounts you might have paid for legal fees or the costs of sale.

305000 129000 176000 basis. Cost base to calculate a capital gain. To find the adjusted basis. Cost base adjustments for capital works deductions. So in case of property that you got as inheritance cost basis is the purchase price plus any improvement cost that your ancestor incurred.

Source: americancentury.com

Source: americancentury.com

Calculating the Adjusted Basis. A closed garage your ACB is 150000. Cost basis is the original purchase price of real estate plus certain expenses and fees incurred by the buyer many of which are detailed in closing documents. If we divide this total by the number of shares we arrive at the adjusted cost base per share. For What Assets Is ACB Tracked.

Source: novelinvestor.com

Source: novelinvestor.com

If you bought a building for 100000 and you paid 50000 to add an addition to it ie. Determine the adjusted basis of a property to calculate gain or loss on sale. Add the cost of major improvements. 305000 129000 176000 basis. Real estate investment calculator solving for adjusted basis given original basis capital additions sales cost cumulative real estate depreciation and cumulative capital improvements depreciation Adjusted Basis Calculator - Real Estate Investment Equations Formulas.

Source: milliondollarjourney.com

Source: milliondollarjourney.com

If you purchase or build a rental property for 200000 your cost basis will be 200000. If you paid 5000 for a realtor to sell it and 2000 in legal fees. 150000 5000 2000 157000. Whenever you acquire an asset such as a residential rental or investment real estate you have a cost basis associated with the acquisition. A closed garage your ACB is 150000.

Source: wikihow.com

Source: wikihow.com

Determine the adjusted basis of a property to calculate gain or loss on sale. Youll now want to add in any subsequent capital expenses to arrive at your adjusted cost basis. If you bought a building for 100000 and you paid 50000 to add an addition to it ie. To determine the capital gain on the sale of a property you subtract your adjusted cost base ACB from the net proceeds of the sale. So in case of property that you got as inheritance cost basis is the purchase price plus any improvement cost that your ancestor incurred.

Source: wowa.ca

Source: wowa.ca

Calculating the Adjusted Basis of Your Property to Account for Home Improvements Youll need to adjust the basis of your property for things you did after you bought the homeSo youd add the cost of additions or improvements to your basis. The basic rules are the same for all assets but for real estate there are some additional rules for. Cost basis is the original purchase price of real estate plus certain expenses and fees incurred by the buyer many of which are detailed in closing documents. Start with the original investment in the property. To calculate the adjusted basis you first have to know which expenses are eligible to be included in the calculation and if they adjust the basis up or down.

Real estate investment calculator solving for adjusted basis given original basis capital additions sales cost cumulative real estate depreciation and cumulative capital improvements depreciation Adjusted Basis Calculator - Real Estate Investment Equations Formulas. 305000 129000 176000 basis. Special rules can sometimes apply that will allow you to consider the cost of the capital property to be an amount other than its actual cost. To calculate the adjusted basis you first have to know which expenses are eligible to be included in the calculation and if they adjust the basis up or down. Cost basis is the original purchase price of real estate plus certain expenses and fees incurred by the buyer many of which are detailed in closing documents.

Source: mortgageblog.com

Source: mortgageblog.com

When working out the reduced cost base for real estate you do not include. To calculate the adjusted basis you first have to know which expenses are eligible to be included in the calculation and if they adjust the basis up or down. Youll now want to add in any subsequent capital expenses to arrive at your adjusted cost basis. If we look at a simple situation the purchase of stock for example the adjusted cost base is basically the purchase price per share multiplied by the number of shares plus any commission paid to acquire the shares. You renovated your kitchen add the cost to your homes basis.

Source: madanca.com

Source: madanca.com

Acquisition costs ie title-related transfer fees surveys. Special rules can sometimes apply that will allow you to consider the cost of the capital property to be an amount other than its actual cost. Calculate your real estate basis in the home by subtracting the basis of your land from the purchase price. Youll now want to add in any subsequent capital expenses to arrive at your adjusted cost basis. Real estate investment calculator solving for adjusted basis given original basis capital additions sales cost cumulative real estate depreciation and cumulative capital improvements depreciation Adjusted Basis Calculator - Real Estate Investment Equations Formulas.

Source: wikihow.com

Source: wikihow.com

Acquisition costs ie title-related transfer fees surveys. Adjusted Basis of Home with Improvements HR Block. 176000 70000 246000 basis. Acquisition costs ie title-related transfer fees surveys. Calculating Deductions to Cost Basis Cost basis can also be adjusted down by subtracting any capitalized costs directly correlated to the asset.

Source: bccpa.ca

Source: bccpa.ca

So in case of property that you got as inheritance cost basis is the purchase price plus any improvement cost that your ancestor incurred. To determine the capital gain on the sale of a property you subtract your adjusted cost base ACB from the net proceeds of the sale. Start with the original investment in the property. For instance if 100 shares of XYZ Company were purchased at a price of 30 each then the ACB would be 3000. A closed garage your ACB is 150000.

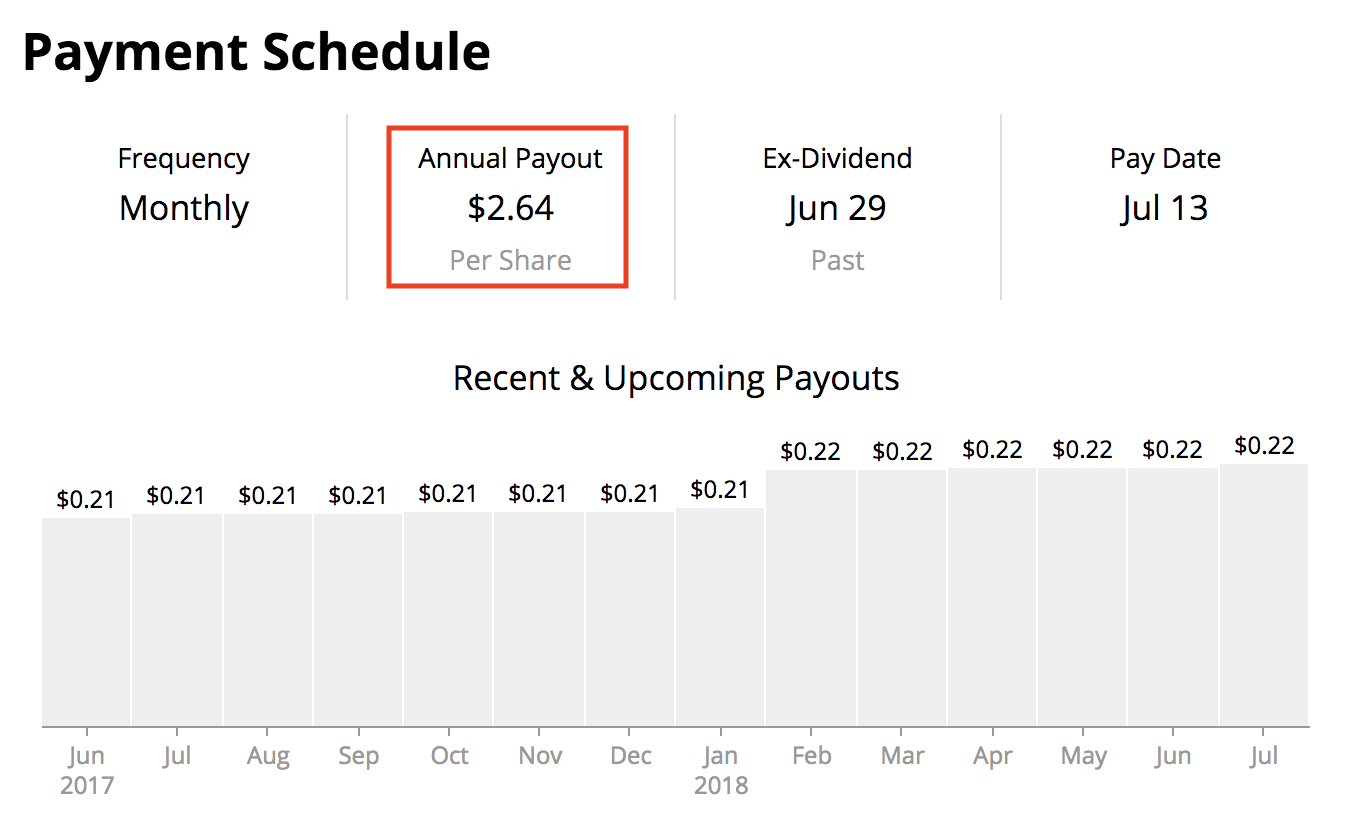

Source: simplysafedividends.com

Source: simplysafedividends.com

Therefore the purchase price title insurance costs settlement fees and property taxes owed by the. Cost base to calculate a capital gain. You can increase your basis from there by adding the amount of money youve spent improving the asset as well as any amounts you might have paid for legal fees or the costs of sale. The basic rules are the same for all assets but for real estate there are some additional rules for. If we look at a simple situation the purchase of stock for example the adjusted cost base is basically the purchase price per share multiplied by the number of shares plus any commission paid to acquire the shares.

Source: novelinvestor.com

Source: novelinvestor.com

Subtract the amount of allowable depreciation and casualty and theft losses. Calculate your real estate basis in the home by subtracting the basis of your land from the purchase price. You bought your home for 305000. For instance if 100 shares of XYZ Company were purchased at a price of 30 each then the ACB would be 3000. When you consider your ACB you also need to make sure that you are including any reinvested distributions as well as any commissions or fees incurred to purchase that stock or mutual fund.

Source: forbes.com

Source: forbes.com

You renovated your kitchen add the cost to your homes basis. So in case of property that you got as inheritance cost basis is the purchase price plus any improvement cost that your ancestor incurred. Therefore the purchase price title insurance costs settlement fees and property taxes owed by the. For financial instruments such as stocks the adjusted cost base is calculated as the number of shares multiplied by the share price at the time the shares were bought. Calculating the Adjusted Basis.

Source: wikihow.com

Source: wikihow.com

You renovated your kitchen add the cost to your homes basis. A closed garage your ACB is 150000. Cost base adjustments for capital works deductions. If you paid 5000 for a realtor to sell it and 2000 in legal fees. Subtract the amount of allowable depreciation and casualty and theft losses.

Source: darrowwealthmanagement.com

Source: darrowwealthmanagement.com

If we divide this total by the number of shares we arrive at the adjusted cost base per share. The adjusted cost base is calculated by adding in the price you paid to purchase all of your investments into a certain stock or mutual fund. 305000 129000 176000 basis. Calculating your adjusted basis in an asset begins with its original purchase price. When you consider your ACB you also need to make sure that you are including any reinvested distributions as well as any commissions or fees incurred to purchase that stock or mutual fund.

Source: wikihow.com

Source: wikihow.com

Whenever you acquire an asset such as a residential rental or investment real estate you have a cost basis associated with the acquisition. Youll now want to add in any subsequent capital expenses to arrive at your adjusted cost basis. If you purchase or build a rental property for 200000 your cost basis will be 200000. Therefore the purchase price title insurance costs settlement fees and property taxes owed by the. Calculating Deductions to Cost Basis Cost basis can also be adjusted down by subtracting any capitalized costs directly correlated to the asset.

Source: inside1031.com

Source: inside1031.com

So in case of property that you got as inheritance cost basis is the purchase price plus any improvement cost that your ancestor incurred. When you consider your ACB you also need to make sure that you are including any reinvested distributions as well as any commissions or fees incurred to purchase that stock or mutual fund. Whenever you acquire an asset such as a residential rental or investment real estate you have a cost basis associated with the acquisition. Below is a simple guide to help figure out the impact on the basis of various expenses. Determine the adjusted basis of a property to calculate gain or loss on sale.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title adjusted cost base calculator real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.