Your Accounting entries for real estate transactions images are ready in this website. Accounting entries for real estate transactions are a topic that is being searched for and liked by netizens now. You can Get the Accounting entries for real estate transactions files here. Find and Download all royalty-free photos and vectors.

If you’re looking for accounting entries for real estate transactions images information linked to the accounting entries for real estate transactions interest, you have pay a visit to the right blog. Our website always gives you suggestions for seeking the highest quality video and picture content, please kindly hunt and locate more informative video articles and images that match your interests.

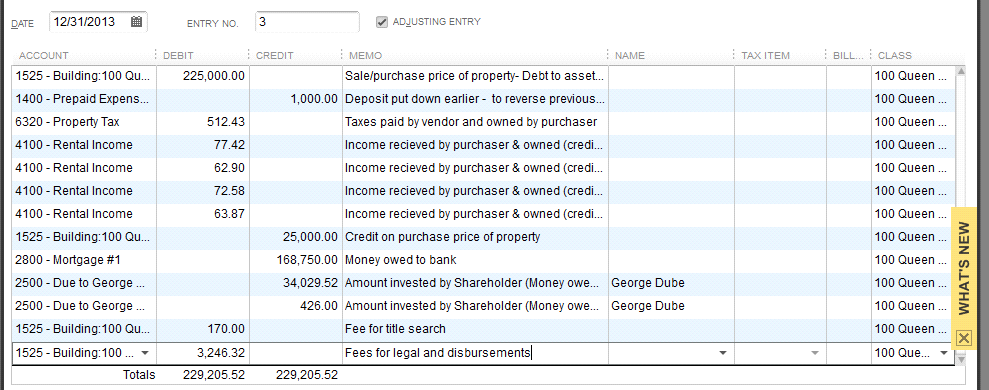

Accounting Entries For Real Estate Transactions. SOP 80 - 3 Accounting for Real Estate Acquisition Development and Construction Costs issued in 1980 In 1982 the Financial Accounting Standards Board FASB issued FASB Statement No. Record sale of your inventory of real estate. Contributions of Real Estate The ASU retains the current guidance in ASC 970 requiring an investor to generally record its contribution of real estate to a real estate joint venture at the. This is where I entered the earnest money check I wrote to the realtor.

T Chart Accounting Example Printables And Charts Throughout T Chart Accounting Example22396 Accounting Basics Accounting Balance Sheet From pinterest.com

T Chart Accounting Example Printables And Charts Throughout T Chart Accounting Example22396 Accounting Basics Accounting Balance Sheet From pinterest.com

Nevertheless diversity in practice has. Accounting for Real Estate Transactions Second Edition is an up-to-date comprehensive reference guide specifically written to help professionals understand and apply the accounting rules relating to real estate transactions. It will make it easier for you to figure out. Additionally we offer some brief insights on the. Setup your real estate ASSET and EQUITY Capital Investment accounts. This book provides financial professionals with a powerful tool to evaluate the accounting consequences of specific deals enabling them to structure transactions with the.

Houses 8 days ago 3.

ACCOUNTING ACCOUNTING —-EXAMPLEEXAMPLE App. SOP 80 - 3 Accounting for Real Estate Acquisition Development and Construction Costs issued in 1980 In 1982 the Financial Accounting Standards Board FASB issued FASB Statement No. Create an EQUITY account called Owner Capital Investment. A typical journal entry for a sales transaction in which you receive cash may look like this. When there is a selling of property the accounting professionals have to decide whether the record should be complete for sale. Contributions of Real Estate The ASU retains the current guidance in ASC 970 requiring an investor to generally record its contribution of real estate to a real estate joint venture at the.

Source: pinterest.com

Source: pinterest.com

Accounting for Real Estate Transactions 31 Real estate activities and transactions take diverse forms. Is applied to all transactions after the chosen earlier date yCovers all types of real estate transactions land plots with and without development development agreement building and without development development agreement building TDR etc. Id approach booking the entries this way but check in with your accountant to be sure. Total Saleable area 20000 Sq. Example 1 Revenue Sales Journal Entry.

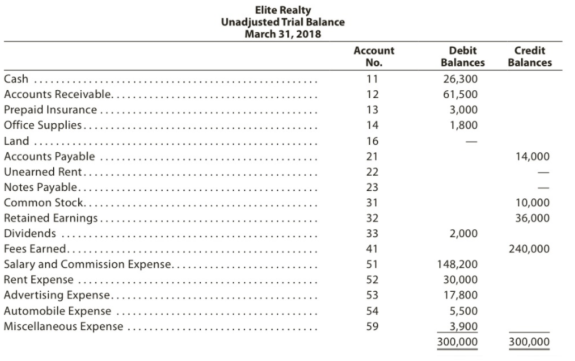

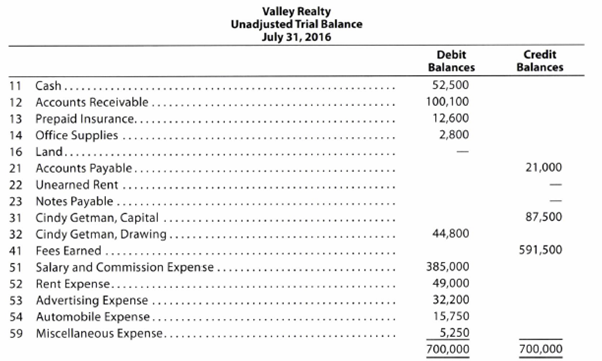

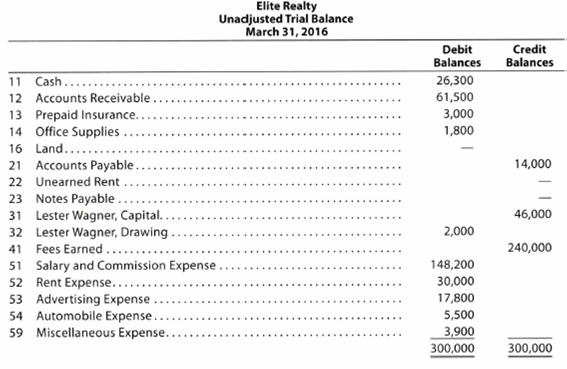

Source: bartleby.com

Source: bartleby.com

Area sold Area sold uptouptoupto3132016 31320163132016 5000 Sq. Here was the situation when I created my real estate company in QuickBooks. Accounting for Real Estate Transactions 31 Real estate activities and transactions take diverse forms. Contributions of Real Estate The ASU retains the current guidance in ASC 970 requiring an investor to generally record its contribution of real estate to a real estate joint venture at the. Accounting for Real Estate Transactions Second Edition is an up-to-date comprehensive reference guide specifically written to help professionals understand and apply the accounting rules relating to real estate transactions.

Source: pinterest.com

Source: pinterest.com

- I had not incorporated yet - I had not created my bank account yet. Id approach booking the entries this way but check in with your accountant to be sure. Record sale of your inventory of real estate. Example 1 Revenue Sales Journal Entry. Cash is considered an asset while revenue is part of your equity accounts.

Source: pinterest.com

Source: pinterest.com

Now in effect for public companies as well as looks ahead to highlight accounting rules that take effect in 2019 such as the new leasing requirements and other upcoming changes to existing US. GUIDANCE NOTE ON ACCOUNTING FOR REAL ESTATE TRANSACTIONS REVISED 2012 SIMPLIFIED 1 Applicability. I To the enterprises dealing in land building and or rights related thereto as sellers or developers. - I had not incorporated yet - I had not created my bank account yet. Additionally we offer some brief insights on the.

Source: pinterest.com

Source: pinterest.com

Since I didnt have a business checking account. Cash is considered an asset while revenue is part of your equity accounts. Total Saleable area 20000 Sq. DR Accounts Receivable 54000 and CR. The transaction above increases your cash account and increases your sales revenue account.

Source: pinterest.com

Source: pinterest.com

Contributions of Real Estate The ASU retains the current guidance in ASC 970 requiring an investor to generally record its contribution of real estate to a real estate joint venture at the. And also after-sales which method to use while recording profit. The real estate sector has always been a susceptible subject for all accounting professionals. Because both accounts are increasing revenue increases equity our golden equation A. Accounting for Real Estate Transactions Second Edition is an up-to-date comprehensive reference guide specifically written to help professionals understand and apply the accounting rules relating to real estate transactions.

Source: nl.pinterest.com

Source: nl.pinterest.com

While some are for sale of land developed or undeveloped others are for construction development or sale of units that are not complete at the time of entering into agreements for construction development or sale. Ftffttft Total Revenue receivable 3132016 on agreement to sell executed RRssRs. Since I didnt have a business checking account. An account is a location within an accounting system in which the debit and credit entries are recorded and this chapter presents the eight categories into which accounts in recording transactions are grouped. Because both accounts are increasing revenue increases equity our golden equation A.

Source: pinterest.com

Source: pinterest.com

The transaction above increases your cash account and increases your sales revenue account. I assume you treat your real estate as inventory if real estate is your business not as a sale of a capital asset of the business. Accounting for Real Estate Transactions 31 Real estate activities and transactions take diverse forms. Accounting for Real Estate Transactions Second Edition is an up-to-date comprehensive reference guide specifically written to help professionals understand and apply the accounting rules relating to real estate transactions. The list is not meant to be exhaustive.

Source: engagedinvestor.ca

Source: engagedinvestor.ca

While some are for sale of land developed or undeveloped others are for construction development or sale of units that are not complete at the time of entering into agreements for construction development or sale. The transaction above increases your cash account and increases your sales revenue account. While some are for sale of land developed or undeveloped others are for construction development or sale of units that are not complete at the time of entering into agreements for construction development or sale. The list is not meant to be exhaustive. While some are for sale of land developed or undeveloped others are for construction development or sale of units that are not complete at the time of entering into agreements for construction development or sale.

Source: bartleby.com

Source: bartleby.com

A typical journal entry for a sales transaction in which you receive cash may look like this. Now in effect for public companies as well as looks ahead to highlight accounting rules that take effect in 2019 such as the new leasing requirements and other upcoming changes to existing US. Additionally we offer some brief insights on the. When sales are made on credit journal entry for accounts receivable is debited and sales account. Setup your real estate ASSET and EQUITY Capital Investment accounts.

Source: pinterest.com

Source: pinterest.com

Ii To all projects where revenue is being recognized for the first time on or after 01042012. Houses 8 days ago 3. Because both accounts are increasing revenue increases equity our golden equation A. When sales are made on credit journal entry for accounts receivable is debited and sales account. Ftffttft Total Revenue receivable 3132016 on agreement to sell executed RRssRs.

Source: pinterest.com

Source: pinterest.com

An account is a location within an accounting system in which the debit and credit entries are recorded and this chapter presents the eight categories into which accounts in recording transactions are grouped. Accounting for Real Estate Transactions 31 Real estate activities and transactions take diverse forms. Record sale of your inventory of real estate. Total Saleable area 20000 Sq. The list is not meant to be exhaustive.

Source: pinterest.com

Source: pinterest.com

Accounting for Real Estate Transactions 31 Real estate activities and transactions take diverse forms. Those are assets liabilities owners equity revenues expenses gains and extraordinary items. - I had not incorporated yet - I had not created my bank account yet. ACCOUNTING ACCOUNTING —-EXAMPLEEXAMPLE App. Passing the journal entries is very much required as they allow the business organization to sort their transactions into manageable data.

Source: pinterest.com

Source: pinterest.com

I assume you treat your real estate as inventory if real estate is your business not as a sale of a capital asset of the business. I To the enterprises dealing in land building and or rights related thereto as sellers or developers. It will make it easier for you to figure out. When sales are made on credit journal entry for accounts receivable is debited and sales account. Total Saleable area 20000 Sq.

Source: bartleby.com

Source: bartleby.com

Ftffttft Total Revenue receivable 3132016 on agreement to sell executed RRssRs. It will make it easier for you to figure out. Setup your real estate ASSET and EQUITY Capital Investment accounts. Those are assets liabilities owners equity revenues expenses gains and extraordinary items. Ftffttft Total Revenue receivable 3132016 on agreement to sell executed RRssRs.

Source: pinterest.com

Source: pinterest.com

The transaction above increases your cash account and increases your sales revenue account. Create an EQUITY account called Owner Capital Investment. Passing the journal entries is very much required as they allow the business organization to sort their transactions into manageable data. While some are for sale of land developed or undeveloped others are for construction development or sale of units that are not complete at the time of entering into agreements for construction development or sale. Ftffttft Total Revenue receivable 3132016 on agreement to sell executed RRssRs.

Source: pinterest.com

Source: pinterest.com

Discount of 50 of the annual rental over the next 18 months 50 x CU1 million CU500000 for 15 years therefore 15 x CU500000 CU750000 Entity B should recognise revenue of CU875000 each year over the lease term CU1000000 x 8 CU75000010. Record sale of your inventory of real estate. Additionally we offer some brief insights on the. - I had not incorporated yet - I had not created my bank account yet. This is where I entered the earnest money check I wrote to the realtor.

Source: pinterest.com

Source: pinterest.com

67 Accounting for Costs and Initial Operations of Real Estate Projects extracting the accounting principles provided by these AICPA pro-nouncements. Nevertheless diversity in practice has. Discount of 50 of the annual rental over the next 18 months 50 x CU1 million CU500000 for 15 years therefore 15 x CU500000 CU750000 Entity B should recognise revenue of CU875000 each year over the lease term CU1000000 x 8 CU75000010. Cash is considered an asset while revenue is part of your equity accounts. And also after-sales which method to use while recording profit.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title accounting entries for real estate transactions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.