Your 750 hours real estate professional images are available. 750 hours real estate professional are a topic that is being searched for and liked by netizens now. You can Get the 750 hours real estate professional files here. Download all free images.

If you’re searching for 750 hours real estate professional images information linked to the 750 hours real estate professional keyword, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for seeing the maximum quality video and image content, please kindly surf and locate more enlightening video articles and images that match your interests.

750 Hours Real Estate Professional. Test and the 750-hours test for each property separately in order to qualify as a real estate professional with respect to that propertyand qualifying for one property wouldnt mean you qualify for any other property. You cannot count any personal services you provided while employed in real property trades or businesses unless you were a 5 owner of your employer. Your spouse will have to put in an enormous amount of work at least 750 hours to qualify as a real estate professional. Ive read the IRS pubs on this topic and I dont get this at all.

Real Estate Postcard Templates Cards Invites Print Templates Real Estate Postcards Postcard Template Real Estate Marketing Design From pinterest.com

Real Estate Postcard Templates Cards Invites Print Templates Real Estate Postcards Postcard Template Real Estate Marketing Design From pinterest.com

It is not only important to keep a log of the hours youve spent but also what exactly youve been doing during that time responding to tenants managing renovation meetings etc. Ive read the IRS pubs on this topic and I dont get this at all. But I dont see anything implies its 750 hours per property. You must have performed at least 750 hours of services in your real estate businesses or trades in which you materially participate. A taxpayer qualifies as a real estate professional if 1 more than one-half of the personal services the taxpayer performs in trades or businesses during the tax year are in real property trades or businesses in which the taxpayer materially participates and 2 hours spent providing personal services in real property trades or businesses in which the taxpayer materially participates total more than 750 during. Test and the 750-hours test for each property separately in order to qualify as a real estate professional with respect to that propertyand qualifying for one property wouldnt mean you qualify for any other property.

Real property trades or businesses include property development redevelopment construction reconstruction acquisition conversion rental operation management leasing or brokerage trade or business.

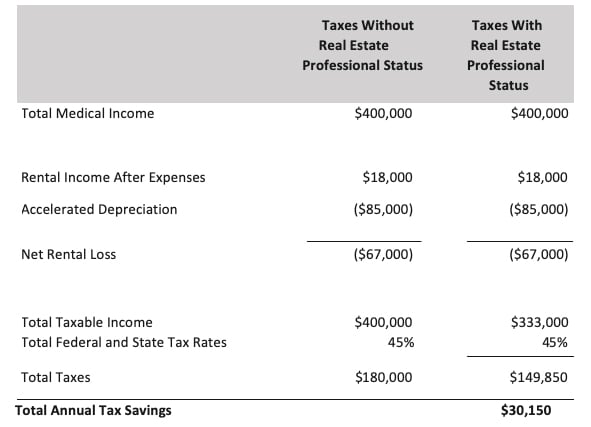

Real Estate Professional Qualification Material participation in each specific rental Material participation in separate Real Property Trade or business 50 rule 750 hours rule. If some investor accumulates more than 750 hours on real estate and they spend more than half their time on real estate they get two big benefits. Its 750 hours on real estate activities. Needless to say taxpayers with very time-intensive careers have difficulty meeting these criteria. Test and the 750-hours test for each property separately in order to qualify as a real estate professional with respect to that propertyand qualifying for one property wouldnt mean you qualify for any other property. A real estate professional must also materially participate in real estate activities for the two tests to be satisfied the activity has to be a real estate.

Source: financialresidency.com

Source: financialresidency.com

AND more hours than any other activity. If some investor accumulates more than 750 hours on real estate and they spend more than half their time on real estate they get two big benefits. You must have performed at least 750 hours of services in your real estate businesses or trades in which you materially participate. The taxpayer must spend more than 750 hours in real property trade or business activities in which the taxpayer materially participates. Needless to say taxpayers with very time-intensive careers have difficulty meeting these criteria.

Source: pinterest.com

Source: pinterest.com

1 You or your spouse must qualify by spending 750 hours or more per year in real estate activities plus you must spend more hours in real estate activities than any other trade or business and 2 You and your spouse together must meet the material participation rules. Ive read the IRS pubs on this topic and I dont get this at all. Make sure that your spouse has sufficient flexibility to fulfill this additional duty. The taxpayer performed more than 750 hours of services during the tax year in real property trades or businesses in which the taxpayer materially participated. 25 days ago 13 days ago A Real Estate Professional must have.

Source: pinterest.com

Source: pinterest.com

Your spouse must be willing to put in the work. 469c7 a real estate professional spends most of their time conducting real estate trades or businesses as compared to non-real estate activities the 50 percent test and puts in over 750 hours in real estate activities the 750-hour test. A real estate professional must also materially participate in real estate activities for the two tests to be satisfied the activity has to be a real estate. Your spouse must be willing to put in the work. You cannot count any personal services you provided while employed in real property trades or businesses unless you were a 5 owner of your employer.

Source: therealestatecpa.com

Source: therealestatecpa.com

A taxpayer qualifies as a real estate professional if 1 more than one-half of the personal services the taxpayer performs in trades or businesses during the tax year are in real property trades or businesses in which the taxpayer materially participates and 2 hours spent providing personal services in real property trades or businesses in which the taxpayer materially participates total more than 750 during. If some investor accumulates more than 750 hours on real estate and they spend more than half their time on real estate they get two big benefits. It is not only important to keep a log of the hours youve spent but also what exactly youve been doing during that time responding to tenants managing renovation meetings etc. Your spouse must be willing to put in the work. There are two parts to using the Real Estate Professional exception.

Source: pinterest.com

Source: pinterest.com

469c7 a real estate professional spends most of their time conducting real estate trades or businesses as compared to non-real estate activities the 50 percent test and puts in over 750 hours in real estate activities the 750-hour test. 25 days ago 13 days ago A Real Estate Professional must have. Its 750 hours on real estate activities. Test and the 750-hours test for each property separately in order to qualify as a real estate professional with respect to that propertyand qualifying for one property wouldnt mean you qualify for any other property. If some investor accumulates more than 750 hours on real estate and they spend more than half their time on real estate they get two big benefits.

Source: blueandco.com

Source: blueandco.com

A real estate professional must also materially participate in real estate activities for the two tests to be satisfied the activity has to be a real estate. So you would need 750 hours or more in each rental property activity to claim RE Pro status for all properties. Test and the 750-hours test for each property separately in order to qualify as a real estate professional with respect to that propertyand qualifying for one property wouldnt mean you qualify for any other property. 25 days ago 13 days ago A Real Estate Professional must have. If some investor accumulates more than 750 hours on real estate and they spend more than half their time on real estate they get two big benefits.

Source: pinterest.com

Source: pinterest.com

Minimum 750 hours per year of real estate activities AND More hours in real estate activities then any other activity. Minimum 750 hours per year of real estate activities AND More hours in real estate activities then any other activity. 25 days ago 13 days ago A Real Estate Professional must have. 469c7 a real estate professional spends most of their time conducting real estate trades or businesses as compared to non-real estate activities the 50 percent test and puts in over 750 hours in real estate activities the 750-hour test. As a rule people with full-time jobs outside of real estate cannot qualify.

Source: id.pinterest.com

Source: id.pinterest.com

In the case of a joint return these tests need only be satisfied by one of the spouses. If some investor accumulates more than 750 hours on real estate and they spend more than half their time on real estate they get two big benefits. To qualify you must spend 1 over 50 of your work time in a real estate business or businesses and 2 over 750 hours working in all your real estate businesses during the year. 25 days ago 13 days ago A Real Estate Professional must have. So you would need 750 hours or more in each rental property activity to claim RE Pro status for all properties.

Source: pinterest.com

Source: pinterest.com

Unfortunately thats where a lot of tax returns stop. Real property trades or businesses include property development redevelopment construction reconstruction acquisition conversion rental operation management leasing or brokerage trade or business. Your spouse must be willing to put in the work. If some investor accumulates more than 750 hours on real estate and they spend more than half their time on real estate they get two big benefits. As a rule people with full-time jobs outside of real estate cannot qualify.

Source: pinterest.com

Source: pinterest.com

AND more hours than any other activity. To qualify you must spend 1 over 50 of your work time in a real estate business or businesses and 2 over 750 hours working in all your real estate businesses during the year. You must have performed at least 750 hours of services in your real estate businesses or trades in which you materially participate. Minimum 750 hours per year of real estate activities AND More hours in real estate activities then any other activity. Similarly the time element of the real estate professional test provides that the taxpayer must perform more than 750 hours of services However the regulation providing more detail regarding the real estate professional test does not elaborate on what constitutes an hour of service.

Source: pinterest.com

Source: pinterest.com

To be a real estate professional a taxpayer must provide more than one-half of his or her total personal services in real property trades or businesses in which he or she materially participates and perform more than 750 hours of services during the tax year in real property trades or businesses. Unfortunately thats where a lot of tax returns stop. To qualify you must spend 1 over 50 of your work time in a real estate business or businesses and 2 over 750 hours working in all your real estate businesses during the year. The taxpayer must also show that the time they spend materially participating in real property businesses and rentals exceeds 750 hours during the year. There are two parts to using the Real Estate Professional exception.

Source: biggerpockets.com

Source: biggerpockets.com

Real Estate Professional Qualification Material participation in each specific rental Material participation in separate Real Property Trade or business 50 rule 750 hours rule. It is not only important to keep a log of the hours youve spent but also what exactly youve been doing during that time responding to tenants managing renovation meetings etc. So you would need 750 hours or more in each rental property activity to claim RE Pro status for all properties. Needless to say taxpayers with very time-intensive careers have difficulty meeting these criteria. To be a real estate professional a taxpayer must provide more than one-half of his or her total personal services in real property trades or businesses in which he or she materially participates and perform more than 750 hours of services during the tax year in real property trades or businesses.

Source: therealestatecpa.com

Source: therealestatecpa.com

You must have performed at least 750 hours of services in your real estate businesses or trades in which you materially participate. It is not only important to keep a log of the hours youve spent but also what exactly youve been doing during that time responding to tenants managing renovation meetings etc. 25 days ago 13 days ago A Real Estate Professional must have. So you would need 750 hours or more in each rental property activity to claim RE Pro status for all properties. The taxpayer performed more than 750 hours of services during the tax year in real property trades or businesses in which the taxpayer materially participated.

Source: nl.pinterest.com

Source: nl.pinterest.com

So you would need 750 hours or more in each rental property activity to claim RE Pro status for all properties. 25 days ago 13 days ago A Real Estate Professional must have. Make sure that your spouse has sufficient flexibility to fulfill this additional duty. You cannot count any personal services you provided while employed in real property trades or businesses unless you were a 5 owner of your employer. Your spouse will have to put in an enormous amount of work at least 750 hours to qualify as a real estate professional.

Source: pinterest.com

Source: pinterest.com

Real Estate Professional Qualification Material participation in each specific rental Material participation in separate Real Property Trade or business 50 rule 750 hours rule. The taxpayer must also show that the time they spend materially participating in real property businesses and rentals exceeds 750 hours during the year. 25 days ago 13 days ago A Real Estate Professional must have. Your spouse must be willing to put in the work. Unfortunately thats where a lot of tax returns stop.

Source: co.pinterest.com

Source: co.pinterest.com

Your spouse will have to put in an enormous amount of work at least 750 hours to qualify as a real estate professional. Thus if you dont make the election qualifying as a real estate professional. Real Estate Professional Qualification Material participation in each specific rental Material participation in separate Real Property Trade or business 50 rule 750 hours rule. As a rule people with full-time jobs outside of real estate cannot qualify. But I dont see anything implies its 750 hours per property.

Source: pinterest.com

Source: pinterest.com

Real Estate Professional Qualification Material participation in each specific rental Material participation in separate Real Property Trade or business 50 rule 750 hours rule. Make sure that your spouse has sufficient flexibility to fulfill this additional duty. Real Estate Professional Qualification Material participation in each specific rental Material participation in separate Real Property Trade or business 50 rule 750 hours rule. If some investor accumulates more than 750 hours on real estate and they spend more than half their time on real estate they get two big benefits. 469c7 a real estate professional spends most of their time conducting real estate trades or businesses as compared to non-real estate activities the 50 percent test and puts in over 750 hours in real estate activities the 750-hour test.

Source: biggerpockets.com

Source: biggerpockets.com

You must have performed at least 750 hours of services in your real estate businesses or trades in which you materially participate. The IRS counts each rental property as a separate real estate activity. As a rule people with full-time jobs outside of real estate cannot qualify. The taxpayer performed more than 750 hours of services during the tax year in real property trades or businesses in which the taxpayer materially participated. There are two parts to using the Real Estate Professional exception.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 750 hours real estate professional by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.