Your 7 tax strategies every real estate agent should know images are ready. 7 tax strategies every real estate agent should know are a topic that is being searched for and liked by netizens now. You can Download the 7 tax strategies every real estate agent should know files here. Find and Download all free photos.

If you’re looking for 7 tax strategies every real estate agent should know images information connected with to the 7 tax strategies every real estate agent should know interest, you have come to the right blog. Our website always provides you with suggestions for seeing the maximum quality video and image content, please kindly search and locate more informative video content and graphics that match your interests.

7 Tax Strategies Every Real Estate Agent Should Know. A great way to find a tax professional like this is to network with experienced agents. Rental income is not subject to social security and Medicare taxes. For busy real estate agents who manage their own finances it can be hard to find time and energy to get expenses in order. This postponement applies to individual taxpayers including individuals who.

How To Use Pinterest In Real Estate Realtors Guide To Pinterest Selling Real Estate Real Estate Tips Real Estate Agent From de.pinterest.com

How To Use Pinterest In Real Estate Realtors Guide To Pinterest Selling Real Estate Real Estate Tips Real Estate Agent From de.pinterest.com

This postponement applies to individual taxpayers including individuals who. Total Assets Transferred Example 2. 11 Tax Deductions Every Real Estate Agent Should Know About. Chris is a former IRS agent with over 30 years of tax. Whether you run your real estate business full time or part time there are business tax shelters available to you. If you qualify for a home office you are even able to make repairs on your home and deduct the percentage that is used for your business.

Often their offer of marketing ad space space on the brokerage website and.

Are you overpaying on your taxes. I am currently working with a successful agent who netted 259197 after all the write-offs we come up with for him. 5 Strategies for Succeeding in a Low Inventory Market Straight from the Heyl Group. Tax-Saving Strategies for Real Estate Investors 1. If you drive 10000 miles or more per year for your real estate business its likely youll get the greatest tax benefit by taking the standard mileage deduction. However although buying real estate is something every investor should consider being a real estate professional ISNT for everyone.

Source: investfourmore.com

Source: investfourmore.com

Dont forget your mileage Many real estate agents leave money on the table when it comes to their mileage says Thomas J. Real estate agents are generally paid commissions on the sales of property and receive a 1099 at the end of the year. Over 75 of real estate agents report their income in the worst way possible. We asked real estate and tax professionals across the country for their very best tax tips. Your Complete Guide to the Real Estate Professional Tax.

Source: blog.graana.com

Source: blog.graana.com

Your Complete Guide to the Real Estate Professional Tax. Whether you run your real estate business full time or part time there are business tax shelters available to you. Choose the option that gives you the bigger deduction. What is Included in the Selling Price. The tax is in the amount of 153 and it is split 5050 between the employer and the employee.

Source: pinterest.com

Source: pinterest.com

Either way these costs can be deducted. Adding in Personal Property 3. Real estate coaching training and education costs. Marketing and advertising can be traditional or digital. If you qualify for a home office you are even able to make repairs on your home and deduct the percentage that is used for your business.

Source: pinterest.com

Source: pinterest.com

Often their offer of marketing ad space space on the brokerage website and. Office Supplies and Equipment. Home office expenses You have two options for this deductionregular or simplified. The best thing to do especially as a real estate agent is to have a certified tax professional especially one whos got experience with other real estate agent-clients look over your income and see what deductions you can make. Your accountant can help you determine the percentage of the expenses you can deduct but for a rough estimate divide the number of square feet of the home that you use for your real estate business by the total square footage of the home.

Source: de.pinterest.com

Source: de.pinterest.com

Either way these costs can be deducted. 20 Lead Generation Ideas for More Listings. Real estate agents are generally paid commissions on the sales of property and receive a 1099 at the end of the year. Marketing expenses Real estate agents rely on a strong marketing strategy to advertise their business. For busy real estate agents who manage their own finances it can be hard to find time and energy to get expenses in order.

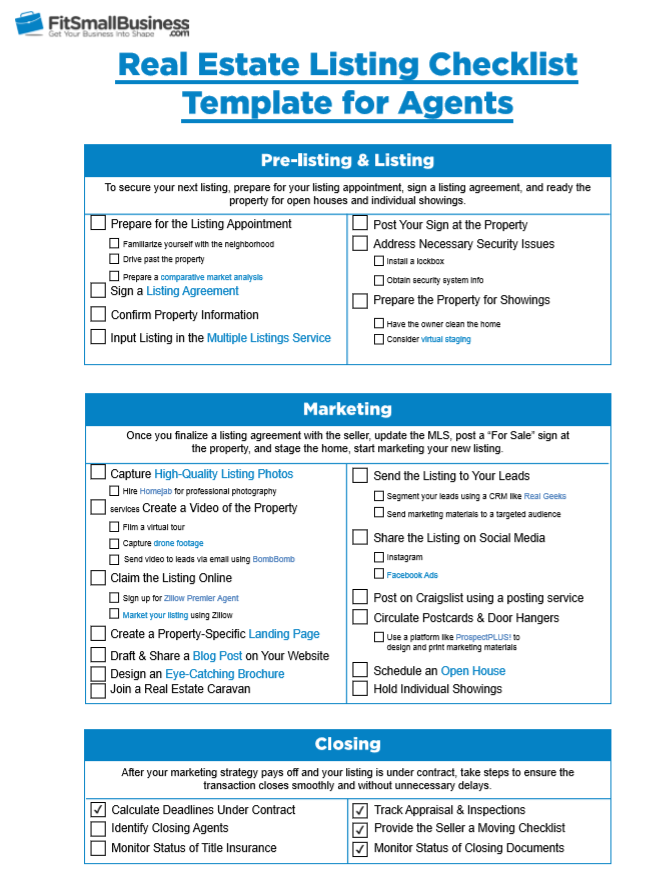

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

Over 75 of real estate agents report their income in the worst way possible. Depending on whether youre employed or self-employed you could be paying 765 to 153 toward this FICA tax on other income. A great way to find a tax professional like this is to network with experienced agents. The tax is in the amount of 153 and it is split 5050 between the employer and the employee. Website development and maintenance.

Source: blog.graana.com

Source: blog.graana.com

Your Complete Guide to the Real Estate Professional Tax. If you are a lower mileage driver or have especially high car payments the actual cost method may yield a higher deduction. The tax is in the amount of 153 and it is split 5050 between the employer and the employee. 11 Tax Deductions Every Real Estate Agent Should Know About. If you drive 10000 miles or more per year for your real estate business its likely youll get the greatest tax benefit by taking the standard mileage deduction.

Source: pinterest.com

Source: pinterest.com

Sales and open house signs and flyers. Whether you run your real estate business full time or part time there are business tax shelters available to you. Business cards and mailers. This weeks topic for our Keyrenter community of client real estate investors and real estate agents in on tax strategy. Total Assets Transferred Example 2.

Source: fi.pinterest.com

Source: fi.pinterest.com

Here are some of the most common real estate agent and broker deductions. Luckily the Internal Revenue Service recently announced an extension to file for the 2020 tax year stating. Often their offer of marketing ad space space on the brokerage website and. After all as an independent contractor you essentially are your own business and therefore can deduct some expenses as business expenses. Tax-Saving Strategies for Real Estate Investors 1.

Source: investopedia.com

Source: investopedia.com

Youre probably familiar with IRAs and Roth IRAs as a tax-deferred way to invest for retirement. Allocating Purchase Price among Properties Purchased 4. Over 75 of real estate agents report their income in the worst way possible. Here are some of the most common real estate agent and broker deductions. This classification only helps WHEN you have multiple rental properties and you make more than 150000 a year in Adjusted Gross Income.

Source: investfourmore.com

Source: investfourmore.com

Allocating Purchase Price among Properties Purchased 4. Choose the option that gives you the bigger deduction. In this fast-paced tax savings webinar Chris Bird shares his four most important tax strategies for real estate professionals. Ill give you an example. 20 Lead Generation Ideas for More Listings.

Source: pinterest.com

Source: pinterest.com

Choose the option that gives you the bigger deduction. Most self-employed real estate professionals forego valuable deductions out of uncertainty or fear of filing incorrectly and triggering an IRS audit. Sales and open house signs and flyers. Your accountant can help you determine the percentage of the expenses you can deduct but for a rough estimate divide the number of square feet of the home that you use for your real estate business by the total square footage of the home. Youre probably familiar with IRAs and Roth IRAs as a tax-deferred way to invest for retirement.

Source: fool.com

Source: fool.com

Either way these costs can be deducted. Home office expenses You have two options for this deductionregular or simplified. 5 Choices of Operational. Dont feel like this should be the first priority in tax planning when it comes to real estate. However although buying real estate is something every investor should consider being a real estate professional ISNT for everyone.

Source: br.pinterest.com

Source: br.pinterest.com

I am currently working with a successful agent who netted 259197 after all the write-offs we come up with for him. In this fast-paced tax savings webinar Chris Bird shares his four most important tax strategies for real estate professionals. Like most real estate agents he was reporting his income for tax purposes in the worst way possible. Luckily the Internal Revenue Service recently announced an extension to file for the 2020 tax year stating. We asked real estate and tax professionals across the country for their very best tax tips.

Source: pinterest.com

Source: pinterest.com

Where many new agents make a mistake is in selecting a brokerage based only on money issues. Your Complete Guide to the Real Estate Professional Tax. Own Properties in a Self-Directed IRA. However although buying real estate is something every investor should consider being a real estate professional ISNT for everyone. Real estate agents are generally paid commissions on the sales of property and receive a 1099 at the end of the year.

Source: pinterest.com

Source: pinterest.com

Adding in Personal Property 3. Your Complete Guide to the Real Estate Professional Tax. Real estate licensing and renewal fees. According to CPA Mark Kohler in 7 Tax Strategies Every Real Estate Agent Should Know an S corporation can reduce your self-employment tax by allowing you to. The best thing to do especially as a real estate agent is to have a certified tax professional especially one whos got experience with other real estate agent-clients look over your income and see what deductions you can make.

Source: pinterest.com

Source: pinterest.com

This postponement applies to individual taxpayers including individuals who. What Every Agent Should Know Course Outline Continued a. Money Money Money. Own Properties in a Self-Directed IRA. Your Complete Guide to the Real Estate Professional Tax.

Source: pinterest.com

Source: pinterest.com

FREE Archived Webinar. This classification only helps WHEN you have multiple rental properties and you make more than 150000 a year in Adjusted Gross Income. Office Supplies and Equipment. What you may not know is that you can set up your own self-directed IRA and use it to invest in real estate tax-free. In this fast-paced tax savings webinar Chris Bird shares his four most important tax strategies for real estate professionals.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 7 tax strategies every real estate agent should know by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.