Your 38 real estate tax in obamacare bill images are available. 38 real estate tax in obamacare bill are a topic that is being searched for and liked by netizens today. You can Get the 38 real estate tax in obamacare bill files here. Find and Download all royalty-free vectors.

If you’re searching for 38 real estate tax in obamacare bill pictures information connected with to the 38 real estate tax in obamacare bill keyword, you have come to the right site. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

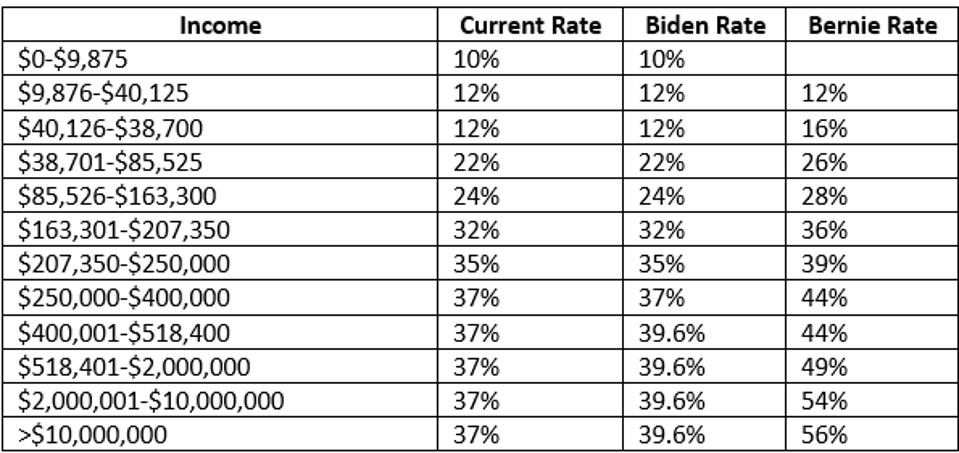

38 Real Estate Tax In Obamacare Bill. Say it aint so. Or perhaps this in your tweetstream. Obamacare Real Estate Tax The Obamacare 38 Real Estate Tax On January 1 2013 a new 38 percent tax on some investment income went into effect. 38 real estate tax in obamacare bill.

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends From simplysafedividends.com

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends From simplysafedividends.com

If Im making your eyes cross dont worry. 500000 for married couples filing jointly in profit on the sale of a. 38 tax on future real estate sales. Here are the facts. Or perhaps this in your tweetstream. This tax was passed by Congress in 2010 with the intent of generating an estimated 210 billion to help fund President Barack Obamas health care and Medicare overhaul plans.

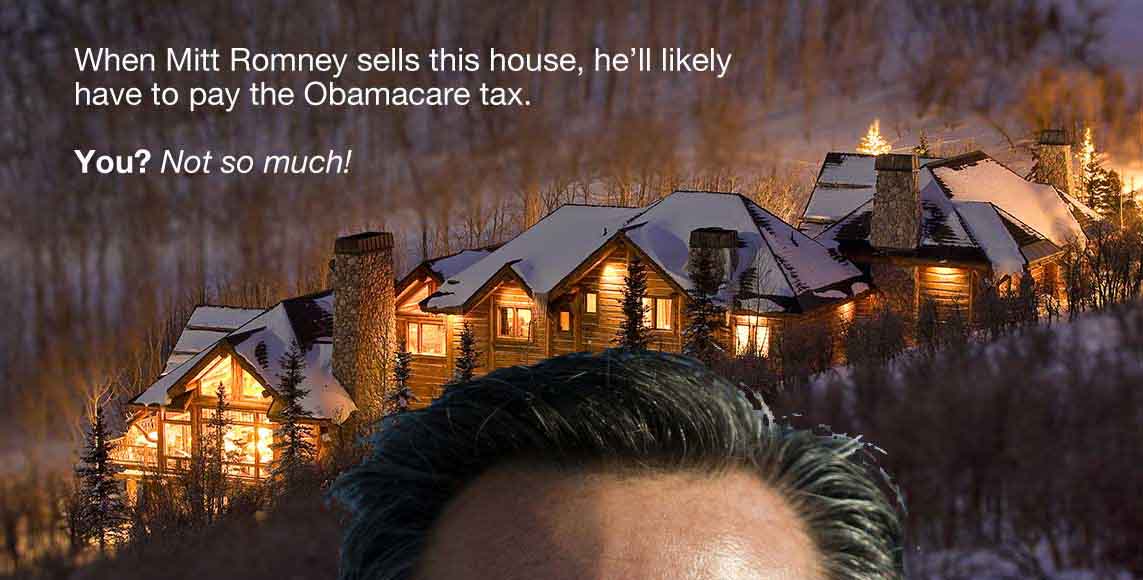

Ive heard that funding obamacare requires a huge tax on real estate transactions.

The tax is 38 on net investment income which includes. To be hit by the 38 percent capital gains tax you first have to be a married couple making more than 250000 in adjusted gross income or 200000 if you are single. This tax was passed by Congress in 2010 with the intent of generating an estimated 210 billion to help fund President Barack Obamas health care and Medicare overhaul plans. New 38 tax on real estate sales starting 2013. If you are winning big on one holding you may have losses you can realize on other holdings to help minimize your tax bill. It probably will not affect you the real estate investor.

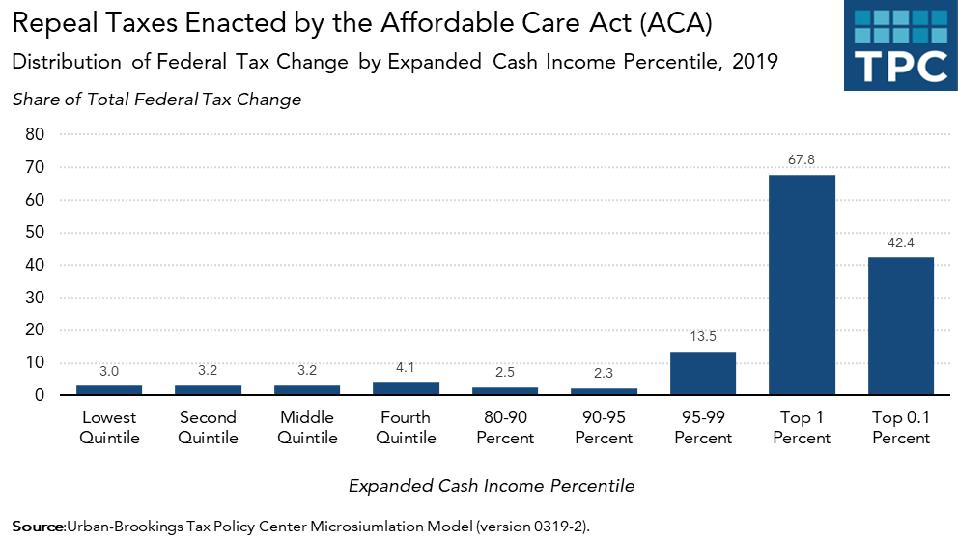

Source: taxpolicycenter.org

Source: taxpolicycenter.org

It probably will not affect you the real estate investor. The new tax will apply to taxpayers whose adjusted gross income is 200000 or more single or 250000 or more married. Not unless youre very wealthy. Obamacare Real Estate Tax The Obamacare 38 Real Estate Tax On January 1 2013 a new 38 percent tax on some investment income went into effect. 38 tax on future real estate sales.

Source: epmonthly.com

Source: epmonthly.com

Starting in 2013 the health care bill does impose a 38 Medicare tax on high-income taxpayers who exceed a total. Will There really be a Sales Tax on Real Estate. By admin on September 29th 2010. The new tax is not indexed to inflation so more people will fall under it each year. It just AINT so.

Source: internationalinvestment.net

Source: internationalinvestment.net

Here are the facts. Theres much noise about this new 38 Medicare tax but most of this noise is just that noise. Here are the facts. Say it aint so. Or perhaps this in your tweetstream.

Source: slideshare.net

Source: slideshare.net

If Im making your eyes cross dont worry. Or perhaps this in your tweetstream. Effective January 1 2013 there is a new 38 tax. The tax is 38 on net investment income which includes. At the last minute Democratic lawmakers decided on a new 38 percent tax.

Source: 1040abroad.com

Source: 1040abroad.com

The new tax will apply to taxpayers whose adjusted gross income is 200000 or more single or 250000 or more married. It probably will not affect you the real estate investor. Taxes A 38 Tax on Real Estate Sales. The first 250000 for an individual. Or perhaps this in your tweetstream.

38 real estate tax in obamacare bill. By admin on September 29th 2010. Yes the health law will impose a 38 percent tax on. 38 tax on future real estate sales. Have you seen these Google headlines.

Source: cpadonovan.com

Source: cpadonovan.com

Dear real estate adviser. ObamaCare imposes a 38 percent annual tax on investment income of individuals making 200000 or more and on families making 250000 or more. To be hit by the 38 percent capital gains tax you first have to be a married couple making more than 250000 in adjusted gross income or 200000 if you are single. At the last minute Democratic lawmakers decided on a new 38 percent tax. For people who do have incomes that exceed those amounts the ACAs Medicare surtax is 38 percent of capital gains profit on real estate transactions.

Now there is one provision of the act that has been a source of confusion. Indeed buried deep in the Obamacare was an extra 38 Medicare tax starting from January 2013. According to the IRS the 38 Obamacare tax on net investment income applies to unincorporated taxpayers basically individuals estates and certain trusts who. Will There really be a Sales Tax on Real Estate. The tax is 38 on net investment income which includes.

Source: krscpas.com

Source: krscpas.com

At the last minute Democratic lawmakers decided on a new 38 percent tax. It is extra work but it can make a huge difference on net investor returns. To be hit by the 38 percent capital gains tax you first have to be a married couple making more than 250000 in adjusted gross income or 200000 if you are single. Seniors on fixed incomes and people with IRAs and 401k plans will be hit particularly hard. If you are winning big on one holding you may have losses you can realize on other holdings to help minimize your tax bill.

Source: yumpu.com

Source: yumpu.com

Indeed buried deep in the Obamacare was an extra 38 Medicare tax starting from January 2013. Or perhaps this in your tweetstream. Starting in 2013 the health care bill does impose a 38 Medicare tax on high-income taxpayers who exceed a total. Rumor of 38 Real Estate Sales Tax Imbedded in ObamaCare is Mostly False Snopes debunks an often-forwarded emails claim of an upcoming sales tax on all real estate transactions. 38 tax on future real estate sales.

Source: businesstoday.in

Source: businesstoday.in

It is not a sales tax on all real estate transactions. New 38 tax on real estate sales starting 2013. The 38 Obamacare surtax is also levied on net investment income. Not unless youre very wealthy. The new tax will apply to taxpayers whose adjusted gross income is 200000 or more single or 250000 or more married.

Source: politico.com

Source: politico.com

Seniors on fixed incomes and people with IRAs and 401k plans will be hit particularly hard. Effective January 1 2013 there is a new 38 tax. Say it aint so. For people who do have incomes that exceed those amounts the ACAs Medicare surtax is 38 percent of capital gains profit on real estate transactions. Indeed buried deep in the Obamacare was an extra 38 Medicare tax starting from January 2013.

Source: simplysafedividends.com

Source: simplysafedividends.com

38 tax on future real estate sales. Not unless youre very wealthy. By admin on September 29th 2010. 38 tax on future real estate sales. For people who do have incomes that exceed those amounts the ACAs Medicare surtax is 38 percent of capital gains profit on real estate transactions.

Source: forbes.com

Source: forbes.com

In the words of one blogger Obamacare will impose a 38 percent tax on all home sales and real estate transactions Umm no it wont. At the last minute Democratic lawmakers decided on a new 38 percent tax. Will There really be a Sales Tax on Real Estate. However much of the information circulating on the Internet is grossly inaccurate the tax is not a transfer tax and it will not be imposed on all real estate transactions. Seniors on fixed incomes and people with IRAs and 401k plans will be hit particularly hard.

Source: healthinsurance.org

Source: healthinsurance.org

Effective January 1 2013 there is a new 38 tax. Senate votes to repeal device tax that helps fund obamacare. The capital gain on the home. Or perhaps this in your tweetstream. It is not a sales tax on all real estate transactions.

Source: simplysafedividends.com

Source: simplysafedividends.com

Step 1 Your need high income. By admin on September 29th 2010. Obamacare Real Estate Tax The Obamacare 38 Real Estate Tax On January 1 2013 a new 38 percent tax on some investment income went into effect. Theres much noise about this new 38 Medicare tax but most of this noise is just that noise. The first 250000 for an individual.

Source: forbes.com

Source: forbes.com

Ive heard that funding obamacare requires a huge tax on real estate transactions. The new tax is not indexed to inflation so more people will fall under it each year. However much of the information circulating on the Internet is grossly inaccurate the tax is not a transfer tax and it will not be imposed on all real estate transactions. 500000 for married couples filing jointly in profit on the sale of a. The capital gain on the home.

Source: en.wikipedia.org

Source: en.wikipedia.org

Dear real estate adviser. Starting in 2013 not only will you pay the closing costs and real estate fee when you sell your house but now you will pay a 38 Sales Tax. Not unless youre very wealthy. ObamaCare imposes a 38 percent annual tax on investment income of individuals making 200000 or more and on families making 250000 or more. In the words of one blogger Obamacare will impose a 38 percent tax on all home sales and real estate transactions Umm no it wont.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 38 real estate tax in obamacare bill by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.