Your 38 percent tax on real estate sales images are available. 38 percent tax on real estate sales are a topic that is being searched for and liked by netizens today. You can Download the 38 percent tax on real estate sales files here. Get all free photos and vectors.

If you’re looking for 38 percent tax on real estate sales images information linked to the 38 percent tax on real estate sales interest, you have pay a visit to the ideal blog. Our website always gives you suggestions for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and images that fit your interests.

38 Percent Tax On Real Estate Sales. Long-term capital gains tax rates are based on your income. There is an internet message being passed around citing NAR as a source that says if you sell your house after 2012 you will pay a 38 sales tax on it and this provision is in the health care. Instead of being a sales tax on all real estate transactions the 38 percent tax is actually a tax on investment income for the wealthy. Rumor has been flying that beginning Jan.

5 Real Estate Tips For Summer S Period Real Estate Tips Real Estate Infographic Real Estate From pinterest.com

5 Real Estate Tips For Summer S Period Real Estate Tips Real Estate Infographic Real Estate From pinterest.com

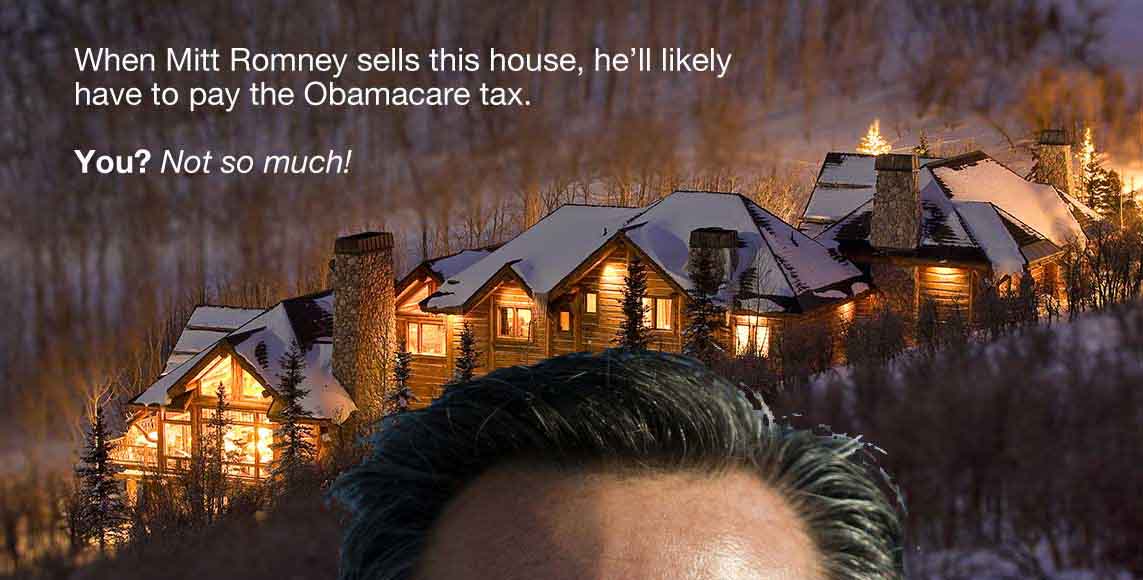

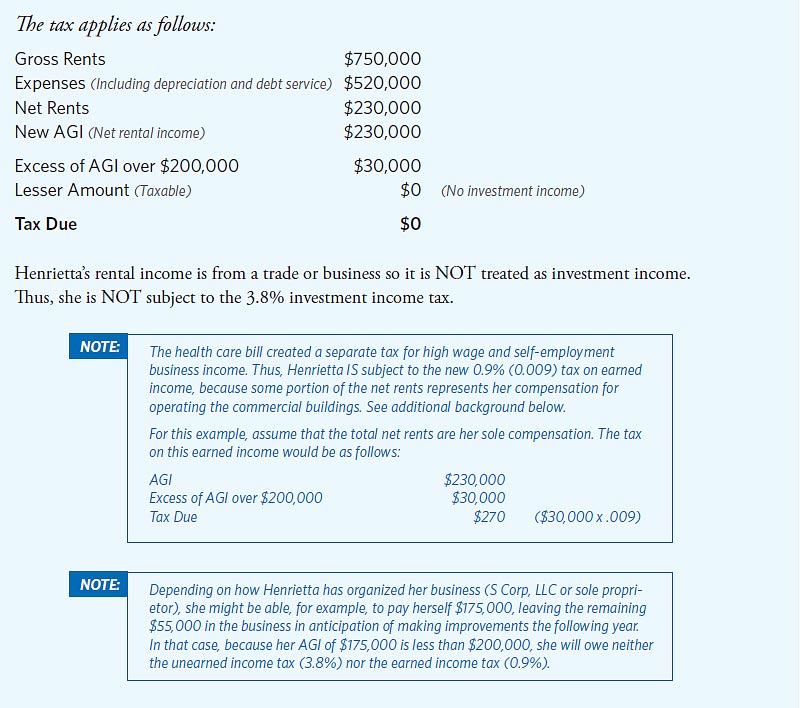

Instead of being a sales tax on all real estate transactions the 38 percent tax is actually a tax on investment income for the wealthy. However the house wouldnt be subject to the NIIT if its your primary residence and you. In the words of one blogger Obamacare will impose a 38 percent tax on all home sales and real estate transactions Umm no it wont. Apart from the capital gains tax you might have to pay the 38 percent NIIT Net Investment Income Tax. Colorado Real Estate Denver Housing Market Home Buying Home Selling Leave a comment By Robert Freedman Senior Editor REALTOR Magazine. The health care law imposes a new 38 percent tax on investment income but it only applies to couples who make more than 250000 or individuals who make more than 200000.

Imposes a 38 percent tax on home sales and other real estate transactions.

Yes the health law will impose a 38 percent tax on. Apart from the capital gains tax you might have to pay the 38 percent NIIT Net Investment Income Tax. Houses 3 days ago It says that a 38 percent tax applies to all real estate transactions as a sales tax. PolitiFact A 38 sales tax on real estate in the health. For individuals earning 200000 a year or more and married couples earning 250000 a year or more certain investment income above these income levels might be subject to the 38 percent tax on a portion of that income. In the words of one blogger Obamacare will impose a 38 percent tax on all home sales and real estate transactions Umm no it wont.

Source: fool.com

Source: fool.com

That is not the case. Sale of primary residence. Rumor has been flying that beginning Jan. Yes the health law will impose a 38 percent tax on. The 38 tax will apply to amounts exceeding the income threshold.

Source: amazon.com

Source: amazon.com

Sale of primary residence. The 38 tax will apply to amounts exceeding the income threshold. At the last minute Democratic lawmakers decided on a new 38 percent tax on the net investment income of high-income persons. Instead of being a sales tax on all real estate transactions the 38 percent tax is actually a tax on investment income for the wealthy. This tax applies only to investment income also known as capital gains received on the sale of a home and many most taxpayers will be exempt from this tax.

Source: healthinsurance.org

Source: healthinsurance.org

Please note that real estate sales that are exempt from VAT based on the above threshold shall be subject to 3 percentage tax. Middle-income people must pay the full tax even if they are rich. In the words of one blogger Obamacare will impose a 38 percent tax on all home sales and real estate transactions Umm no it wont. Apart from the capital gains tax you might have to pay the 38 percent NIIT Net Investment Income Tax. But the claim that this would amount to a 15200 tax on the.

Source: pinterest.com

Source: pinterest.com

The 38 Tax Is Not a Real Estate Transfer Tax Posted. For capital gains over that 250000-per-person exemption just how much tax will Uncle Sam take out of your long-term real estate sale. The email seems intended to scare people particularly older Americans thinking of. 500000 for married couples filing jointly in profit on the sale of a primary residence is excluded from the tax. There is an internet message being passed around citing NAR as a source that says if you sell your house after 2012 you will pay a 38 sales tax on it and this provision is in the health care.

Source: theguardian.com

Source: theguardian.com

Colorado Real Estate Denver Housing Market Home Buying Home Selling Leave a comment By Robert Freedman Senior Editor REALTOR Magazine. Yes the health law will impose a 38 percent tax on. However the house wouldnt be subject to the NIIT if its your primary residence and you. The 250K500K exclusion on the sale of a principal residence will continue to apply. Colorado Real Estate Denver Housing Market Home Buying Home Selling Leave a comment By Robert Freedman Senior Editor REALTOR Magazine.

Source: oneilrealty.com

Source: oneilrealty.com

Houses 3 days ago It says that a 38 percent tax applies to all real estate transactions as a sales tax. Fred Smith Filed under. For individuals earning 200000 a year or more and married couples earning 250000 a year or more certain investment income above these income levels might be subject to the 38 percent tax on a portion of that income. Imposes a 38 percent tax on home sales and other real estate transactions. Instead of being a sales tax on all real estate transactions the 38 percent tax is actually a tax on investment income for the wealthy.

Source: gordcollins.com

Source: gordcollins.com

The first 250000 for an individual. In The 38 Tax Is not a Real Estate Transfer Tax Robert Freedman Senior Editor of Realtor Magazine says this. It applies only to the investment income of single. Imposes a 38 percent tax on home sales and other real estate transactions. Instead of being a sales tax on all real estate transactions the 38 percent tax is actually a tax on investment income for the wealthy.

Source: pinterest.com

Source: pinterest.com

The email seems intended to scare people particularly older Americans thinking of. The first 250000 or 500000 for a married couple in gains. But the claim that this would amount to a 15200 tax on the. The first 250000 for an individual. Accordingly the new 38 tax will NOT apply to this excluded amount of the gain.

Source: in.pinterest.com

Source: in.pinterest.com

There is an internet message being passed around citing NAR as a source that says if you sell your house after 2012 you will pay a 38 sales tax on it and this provision is in the health care. For capital gains over that 250000-per-person exemption just how much tax will Uncle Sam take out of your long-term real estate sale. The 250K500K exclusion on the sale of a principal residence will continue to apply. August 30 2012 Author. The 38 tax will apply to amounts exceeding the income threshold.

Source: fool.com

Source: fool.com

1 2013 a new 38 percent sales tax will be imposed on real estate sales transactions. Fred Smith Filed under. Rumor has been flying that beginning Jan. However if the seller is a VAT-registered person the sale of his ordinary asset shall be subject to VAT even if the sales made are within the prescribed threshold. For capital gains over that 250000-per-person exemption just how much tax will Uncle Sam take out of your long-term real estate sale.

Source: ar.pinterest.com

Source: ar.pinterest.com

The first 250000 or 500000 for a married couple in gains. Beginning in 2013 some homeowners will owe 38 percent of the investment value of the sale value of their home when they sell it as part of the funding system for the health care overhaul. Instead of being a sales tax on all real estate transactions the 38 percent tax is actually a tax on investment income for the wealthy. In The 38 Tax Is not a Real Estate Transfer Tax Robert Freedman Senior Editor of Realtor Magazine says this. Please note that real estate sales that are exempt from VAT based on the above threshold shall be subject to 3 percentage tax.

Source: realtor.com

Source: realtor.com

Heres how the tax works. The health care law imposes a new 38 percent tax on investment income but it only applies to couples who make more than 250000 or individuals who make more than 200000. Rumor has been flying that beginning Jan. Long-term capital gains tax rates are based on your income. In addition to the rates listed in the table higher-income taxpayers may also have to pay an additional 38 net investment income tax.

Source: pinterest.com

Source: pinterest.com

Beginning in 2013 some homeowners will owe 38 percent of the investment value of the sale value of their home when they sell it as part of the funding system for the health care overhaul. But the claim that this would amount to a 15200 tax on the. Yes the health law will impose a 38 percent tax on. There is an internet message being passed around citing NAR as a source that says if you sell your house after 2012 you will pay a 38 sales tax on it and this provision is in the health care. In the words of one blogger Obamacare will impose a 38 percent tax on all home sales and real estate transactions Umm no it wont.

Source: pinterest.com

Source: pinterest.com

The email seems intended to scare people particularly older Americans thinking of. The 38 tax will apply to amounts exceeding the income threshold. In the words of one blogger Obamacare will impose a 38 percent tax on all home sales and real estate transactions Umm no it wont. This tax applies only to investment income also known as capital gains received on the sale of a home and many most taxpayers will be exempt from this tax. August 30 2012 Author.

For people who do have incomes that exceed those amounts the ACAs Medicare surtax is 38 percent of capital gains profit on real estate transactions. Beginning in 2013 some homeowners will owe 38 percent of the investment value of the sale value of their home when they sell it as part of the funding system for the health care overhaul. But the claim that this would amount to a 15200 tax on the. The first 250000 or 500000 for a married couple in gains. Accordingly the new 38 tax will NOT apply to this excluded amount of the gain.

Source: listwithclever.com

Source: listwithclever.com

Heres how the tax works. For capital gains over that 250000-per-person exemption just how much tax will Uncle Sam take out of your long-term real estate sale. But the claim that this would amount to a 15200 tax on the. In The 38 Tax Is not a Real Estate Transfer Tax Robert Freedman Senior Editor of Realtor Magazine says this. Accordingly the new 38 tax will NOT apply to this excluded amount of the gain.

Source: pinterest.com

Source: pinterest.com

Middle-income people must pay the full tax even if they are rich. Please note that real estate sales that are exempt from VAT based on the above threshold shall be subject to 3 percentage tax. In addition to the rates listed in the table higher-income taxpayers may also have to pay an additional 38 net investment income tax. There is an internet message being passed around citing NAR as a source that says if you sell your house after 2012 you will pay a 38 sales tax on it and this provision is in the health care. Shortly after the federal government enacted sweeping healthcare reform earlier this year there was considerable concern.

Source: homesforlife.ca

Source: homesforlife.ca

Shortly after the federal government enacted sweeping healthcare reform earlier this year there was considerable concern. The 250K500K exclusion on the sale of a principal residence will continue to apply. The health care law imposes a new 38 percent tax on investment income but it only applies to couples who make more than 250000 or individuals who make more than 200000. That is not the case. Sale of primary residence.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 38 percent tax on real estate sales by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.