Your 2020 real estate withholding tax statement images are ready in this website. 2020 real estate withholding tax statement are a topic that is being searched for and liked by netizens now. You can Download the 2020 real estate withholding tax statement files here. Download all royalty-free images.

If you’re looking for 2020 real estate withholding tax statement pictures information linked to the 2020 real estate withholding tax statement interest, you have visit the ideal site. Our website always gives you suggestions for seeking the maximum quality video and image content, please kindly hunt and locate more informative video content and graphics that match your interests.

2020 Real Estate Withholding Tax Statement. Form MW506R may not be filed after December 1 2020. There are no deductions for repairs and maintenance however. For tax purposes that 100000 would be taken away from the sale price of the home. So instead of paying capital gains on 350000 you would pay it on 250000.

Irs Form W4 How Many Allowances Should I Claim Irs Forms Income Tax Return Tax Payment From pinterest.com

Irs Form W4 How Many Allowances Should I Claim Irs Forms Income Tax Return Tax Payment From pinterest.com

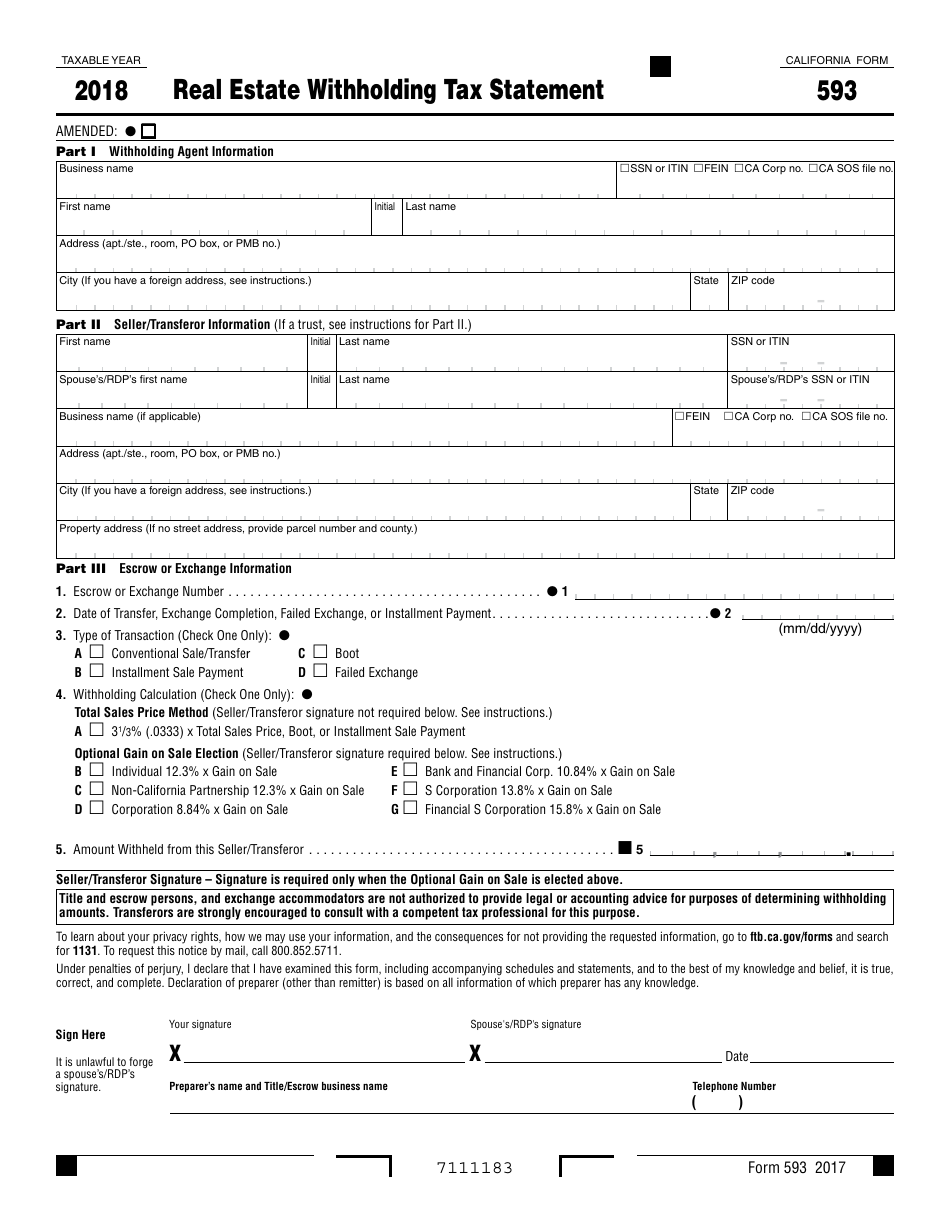

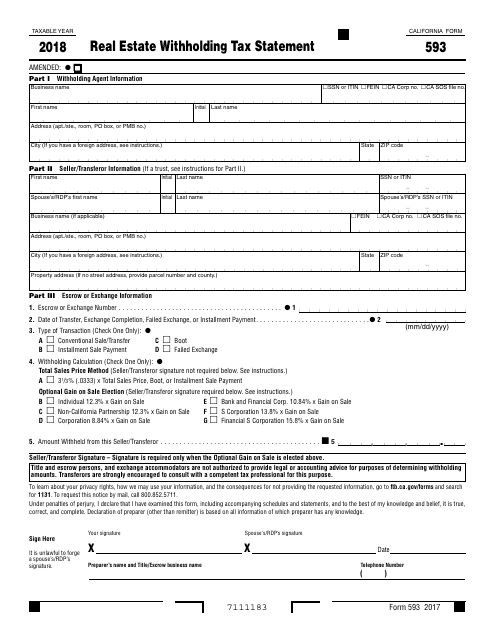

2020 Income Tax Booklet 2020 Vermont Income Tax Return Booklet. REAL ESTATE WITHHOLDING RETURN FOR TRANSFER OF REAL PROPERTY MAINE REVENUE SERVICES 99 1201401 FORM REW-1-1040 2020 TO BE COMPLETED BY THE BUYER OR OTHER TRANSFEREE REQUIRED TO WITHHOLD 1. Form MW506R may not be filed after December 1 2020. On January 1 2020 our new Form 593 Real Estate Withholding Statement went live. 2021 Property Tax Credit Calculator. Effective January 1 2020 the following real estate withholding forms and instructions have been consolidated into one new Form 593 Real Estate Withholding Statement.

This article is presented to address the important parts of the law and.

This means that we dont yet have the updated form for the current tax year. There are no deductions for repairs and maintenance however. For tax purposes that 100000 would be taken away from the sale price of the home. Please check this page regularly as we will post the updated form as soon as it is released by the California Franchise Tax Board. The tax for the year was 730 and was due and paid by the seller on August 15. Form 593 Real Estate Withholding.

If you are a seller buyer real estate escrow person REEP or qualified intermediary QI use this guide to help you complete Form 593 California Real Estate Withholding Statement and Form 593V Payment Voucher for Real Estate Withholding. As of January 1 2020 California real estate withholding changed. Find 2020 Real Estate Withholding Statement sold homes homes for sale real estate house for rent. This booklet includes forms and instructions for. Please check this page regularly as we will post the updated form as soon as it is released by the California Franchise Tax Board.

We now have one Form 593 Real Estate Withholding Statement which is filed with FTB after every real estate transaction. 2021 Property Tax Credit Calculator. IN-111 IN-112 IN-113 IN-116 HS-122 PR-141 HI-144. 2020 Real Estate Withholding Statement CALIFORNIA FORM 593 Part III Certifications which fully exempt the sale from withholding See instructions Determine whether you qualify for a full withholding exemption. For more details refer to the Form 593 instructions and FTB Publication 1016 Real Estate Withholding Guidelines.

Source: in.pinterest.com

Source: in.pinterest.com

So instead of paying capital gains on 350000 you would pay it on 250000. There are no deductions for repairs and maintenance however. On January 1 2020 our new Form 593 Real Estate Withholding Statement went live. For more details refer to the Form 593 instructions and FTB Publication 1016 Real Estate Withholding Guidelines. Be sure you choose the version for the current year.

Source: pinterest.com

Source: pinterest.com

A copy of the 2020 version of this form can be accessed at this link. Be sure you choose the version for the current year. Remit real estate withholding payments to the Franchise Tax Board FTB whether Forms 593 Real Estate Withholding Statement is submitted electronically or by mail. Use Form 593 Real Estate Withholding Tax Statement to report real estate withholding on sales closing in 2019 installment payments made in 2019 or exchanges that were completed or failed in 2019. Use a separate Form 593 to report the amount withheld from each sellertransferor.

Source: pinterest.com

Source: pinterest.com

If you are a seller buyer real estate escrow person REEP or qualified intermediary QI use this guide to help you complete Form 593 California Real Estate Withholding Statement and Form 593V Payment Voucher for Real Estate Withholding. 2020 Income Tax Booklet 2020 Vermont Income Tax Return Booklet. Use Form REW-1-1040 only for sellers who are individuals or sole proprietors. You owned your new home during the property tax year for 122 days September 1 to December 31 including your date of purchase. Form MW506R may not be filed after December 1 2020.

Source: templateroller.com

Source: templateroller.com

Check all boxes that apply to the property being sold or transferred. Form 593 Real Estate Withholding. Be sure you choose the version for the current year. Homestead Declaration AND Property Tax Credit Claim. 2020 Income Tax Booklet 2020 Vermont Income Tax Return Booklet.

Source: templateroller.com

Source: templateroller.com

Form MW506R may be filed not less than 60 days after the date the tax withheld is paid to the Clerk of the Circuit Court. We last updated the Real Estate Withholding Tax Statement in February 2020 and the latest form we have available is for tax year 2019. 2020 Real Estate Withholding Statement CALIFORNIA FORM 593 Part III Certifications which fully exempt the sale from withholding See instructions Determine whether you qualify for a full withholding exemption. However you must attach paid invoices or receipts with cancelled checks for improvements. So technically youd pay absolutely nothing in capital gains tax on the sale of that home.

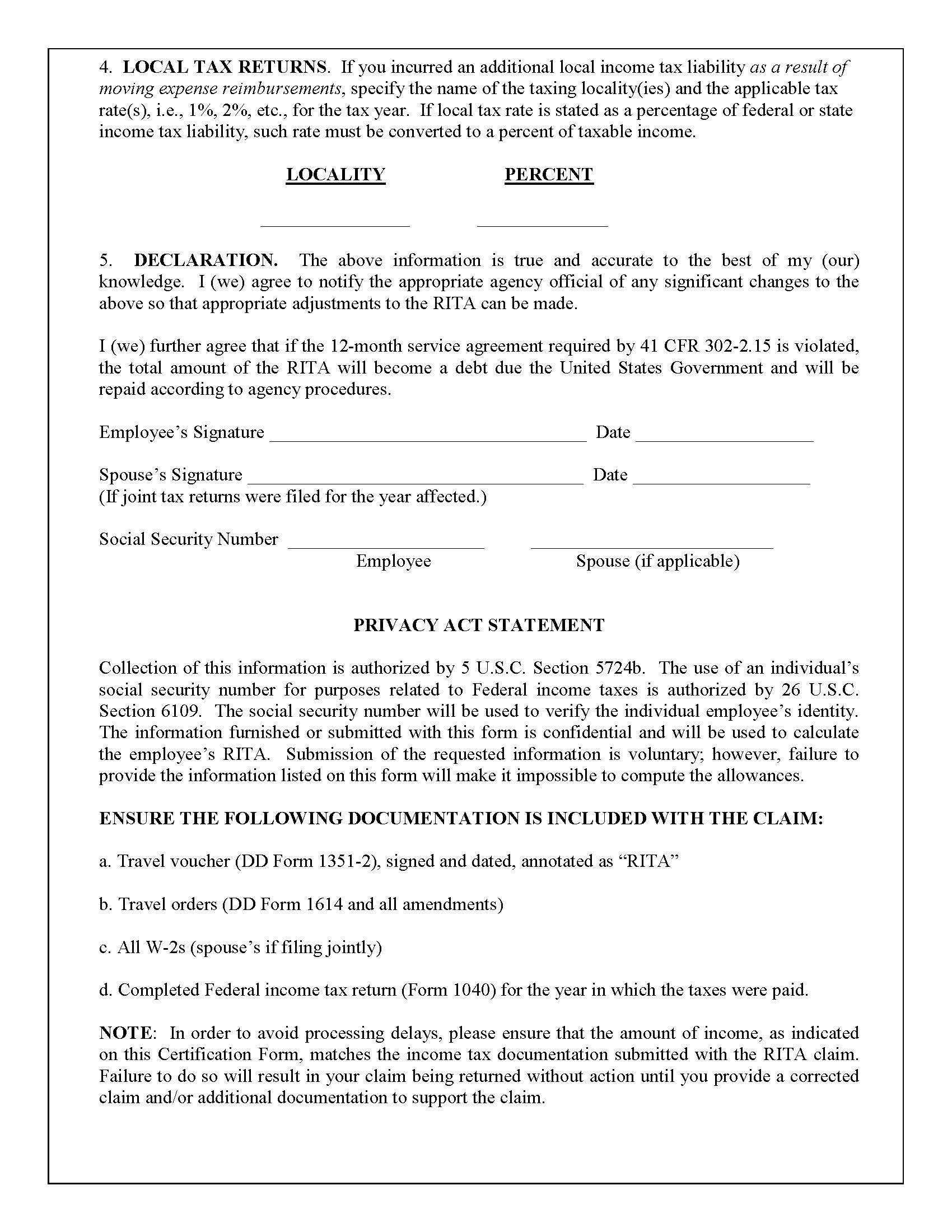

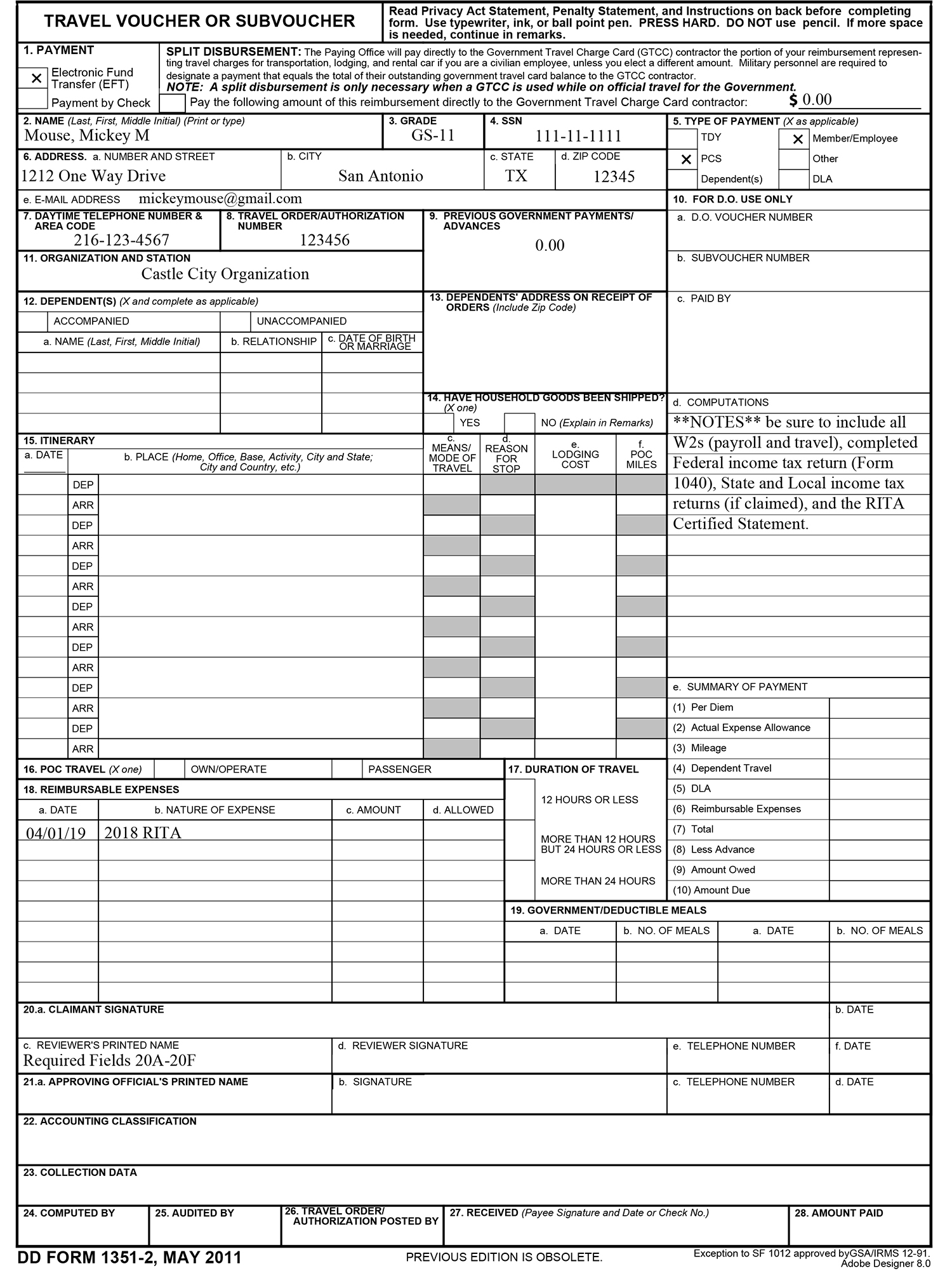

Source: dfas.mil

Source: dfas.mil

IN-111 IN-112 IN-113 IN-116 HS-122 PR-141 HI-144. The law did not change but the forms changed in 2020 combining the original 4 different forms 593C 593E 593I 593 into one 593 Real Estate Withholding Statement. Form used to apply for a refund of the amount of tax withheld on the 2020 sale or transfer of Maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferorsellers tax liability for the transaction. For more details refer to the Form 593 instructions and FTB Publication 1016 Real Estate Withholding Guidelines. Payment Voucher for Real Estate Withholding.

Source: pinterest.com

Source: pinterest.com

HS-122W Vermont Homestead Declaration andor Property Tax Credit Withdrawal. Form 593 Real Estate Withholding. Form used to apply for a refund of the amount of tax withheld on the 2020 sale or transfer of Maryland real property interests by a nonresident individual or nonresident entity which is in excess of the transferorsellers tax liability for the transaction. You owned your new home during the property tax year for 122 days September 1 to December 31 including your date of purchase. Use Form 593-V Payment Voucher for Real Estate Withholding to.

Source: youtube.com

Source: youtube.com

The tax for the year was 730 and was due and paid by the seller on August 15. Form MW506R may not be filed after December 1 2020. This booklet includes forms and instructions for. So instead of paying capital gains on 350000 you would pay it on 250000. We last updated the Real Estate Withholding Tax Statement in February 2020 and the latest form we have available is for tax year 2019.

Source: pinterest.com

Source: pinterest.com

You owned your new home during the property tax year for 122 days September 1 to December 31 including your date of purchase. 2020 Instructions for Form 593-V. Use a separate Form 593 to report the amount withheld from each sellertransferor. The new form is a combination of the prior. For tax purposes that 100000 would be taken away from the sale price of the home.

Source: pinterest.com

Source: pinterest.com

A copy of the 2020 version of this form can be accessed at this link. Use Form 593-V Payment Voucher for Real Estate Withholding to. Statemdus original contract date of death appraisal or other proof of original purchase price or inherited value. Remit real estate withholding payments to the Franchise Tax Board FTB whether Forms 593 Real Estate Withholding Statement is submitted electronically or by mail. 2020 Real Estate Withholding Statement CALIFORNIA FORM 593 Part III Certifications which fully exempt the sale from withholding See instructions Determine whether you qualify for a full withholding exemption.

Source: dfas.mil

Source: dfas.mil

Use a separate Form 593 to report the amount withheld from each sellertransferor. Effective January 1 2020 the following real estate withholding forms and instructions have been consolidated into one new Form 593 Real Estate Withholding Statement. If you are a seller buyer real estate escrow person REEP or qualified intermediary QI use this guide to help you complete Form 593 California Real Estate Withholding Statement and Form 593V Payment Voucher for Real Estate Withholding. Statement property tax printout available at wwwdat. Form MW506R may be filed not less than 60 days after the date the tax withheld is paid to the Clerk of the Circuit Court.

Form MW506R may not be filed after December 1 2020. Use Form REW-1-1040 only for sellers who are individuals or sole proprietors. Remit real estate withholding payments to the Franchise Tax Board FTB whether Forms 593 Real Estate Withholding Statement is submitted electronically or by mail. Please check this page regularly as we will post the updated form as soon as it is released by the California Franchise Tax Board. Be sure you choose the version for the current year.

Source: pinterest.com

Source: pinterest.com

Be sure you choose the version for the current year. We now have one Form 593 Real Estate Withholding Statement which is filed with FTB after every real estate transaction. So instead of paying capital gains on 350000 you would pay it on 250000. Use the voucher below to remit payment by. This booklet includes forms and instructions for.

Source: in.pinterest.com

Source: in.pinterest.com

Homestead Declaration AND Property Tax Credit Claim. Use Form REW-1-1040 only for sellers who are individuals or sole proprietors. If the sellerstransferors are married or RDPs and they plan to file a joint return include both spousesRDPs. 2020 Income Tax Booklet 2020 Vermont Income Tax Return Booklet. Use a separate Form 593 to report the amount withheld from each sellertransferor.

Source: tehcpa.net

Source: tehcpa.net

IN-111 IN-112 IN-113 IN-116 HS-122 PR-141 HI-144. Form 593-C Real Estate Withholding Certificate. If the sellerstransferors are married or RDPs and they plan to file a joint return include both spousesRDPs. Use the voucher below to remit payment by. Homestead Declaration AND Property Tax Credit Claim.

Source: whitecase.com

Source: whitecase.com

Form 593-I Real Estate Withholding Installment Sale Acknowledgement. The law did not change but the forms changed in 2020 combining the original 4 different forms 593C 593E 593I 593 into one 593 Real Estate Withholding Statement. Statemdus original contract date of death appraisal or other proof of original purchase price or inherited value. Use the voucher below to remit payment by. Use Form REW-1-1040 only for sellers who are individuals or sole proprietors.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 2020 real estate withholding tax statement by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.