Your 2018 real estate tax deduction limits images are ready. 2018 real estate tax deduction limits are a topic that is being searched for and liked by netizens today. You can Download the 2018 real estate tax deduction limits files here. Find and Download all royalty-free vectors.

If you’re looking for 2018 real estate tax deduction limits pictures information linked to the 2018 real estate tax deduction limits interest, you have pay a visit to the right site. Our website frequently gives you suggestions for refferencing the maximum quality video and image content, please kindly search and locate more enlightening video content and images that fit your interests.

2018 Real Estate Tax Deduction Limits. 162 other than the trade or business of performing services as an employee Regs. The IRS announced that the 2018 federal estate and gift tax limit is 11180000 based on inflation adjustments. A filing is required for estates with combined gross assets and prior taxable gifts exceeding 1500000 in 2004 - 2005. This would give you a total of 30000 in itemizable deductions.

Step By Step Guide From germantaxes.de

Step By Step Guide From germantaxes.de

This reduction occurs regardless of whether A is able to claim the state tax. In addition you can no longer deduct foreign taxes you paid on real estate. The TCJA limits the amount of property taxes you can claim. The press has more or less ignored these changes and focused instead on the new 10000 limitation on the SALT deduction He said prior to 2018 you could deduct 100 percent of your real estate tax on one or more homes plus 100 percent of your New Jersey state income tax. The SALT limitation caps that deduction to a maximum of 10000. 199A deduction if they meet the definition of a trade or business under Sec.

Since this exceeds your standard deduction you could deduct your real estate taxes.

Previously only 6500 was allowed as the standard deduction for. For federal purposes your total itemized deduction for state and local taxes paid in 2020 is limited to a combined amount not to exceed 10000 5000 if married filing separate. The notice also states that rental real estate businesses that do not meet the safe-harbor requirements may still qualify for the Sec. It places a 10000 cap on state local and property taxes collectively beginning in 2018. This ceiling applies to income taxes you pay at the state and possibly local level as well as property taxes. The IRS also issued two Revenue Procedures that affect interest deductibility and real estate.

Source: germantaxes.de

Source: germantaxes.de

This reduction occurs regardless of whether A is able to claim the state tax. Thats up one cent from 2017. One way to claim mileage as a tax deduction is through a log of your miles. The Winners and Losers in the Tax Overhaul Bill US. On November 26 2018 the IRS issued Rev.

Source: relakhs.com

Source: relakhs.com

A filing is required for estates with combined gross assets and prior taxable gifts exceeding 1500000 in 2004 - 2005. 2000000 in 2006 - 2008. Specifically excluded from the safe harbor are residences used by the taxpayer during the year and real estate. 2018-59 providing a safe harbor allowing taxpayers to treat certain infrastructure projects as real property trades or businesses solely for purposes of qualifying as an electing real property trade or business under Section 163j7B. 162 other than the trade or business of performing services as an employee Regs.

Source: hrblock.com

Source: hrblock.com

In addition foreign real estate taxes not related to a trade or business are not. Thats up one cent from 2017. This ceiling applies to income taxes you pay at the state and possibly local level as well as property taxes. Specifically excluded from the safe harbor are residences used by the taxpayer during the year and real estate. All these taxes fall under the same umbrella.

Source: relakhs.com

Source: relakhs.com

Specifically excluded from the safe harbor are residences used by the taxpayer during the year and real estate. In addition foreign real estate taxes not related to a trade or business are not. 199A deduction if they meet the definition of a trade or business under Sec. Starting in 2018 until the end of 2025 taxpayers can deduct only 10000 of these combined taxes. Since this exceeds your standard deduction you could deduct your real estate taxes.

Source: germantaxes.de

Source: germantaxes.de

This reduction occurs regardless of whether A is able to claim the state tax. June 4 2019 951 PM The 10000 itemized deduction limit which is the total of property state sales or income taxes does not apply to rental properties. The IRS announced that the 2018 federal estate and gift tax limit is 11180000 based on inflation adjustments. There is no limit on claiming property taxes on rental properties. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require the filing of an estate tax return.

Source: germantaxes.de

Source: germantaxes.de

The IRS also issued two Revenue Procedures that affect interest deductibility and real estate. The Winners and Losers in the Tax Overhaul Bill US. In addition foreign real estate taxes not related to a trade or business are not. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require the filing of an estate tax return. The notice also states that rental real estate businesses that do not meet the safe-harbor requirements may still qualify for the Sec.

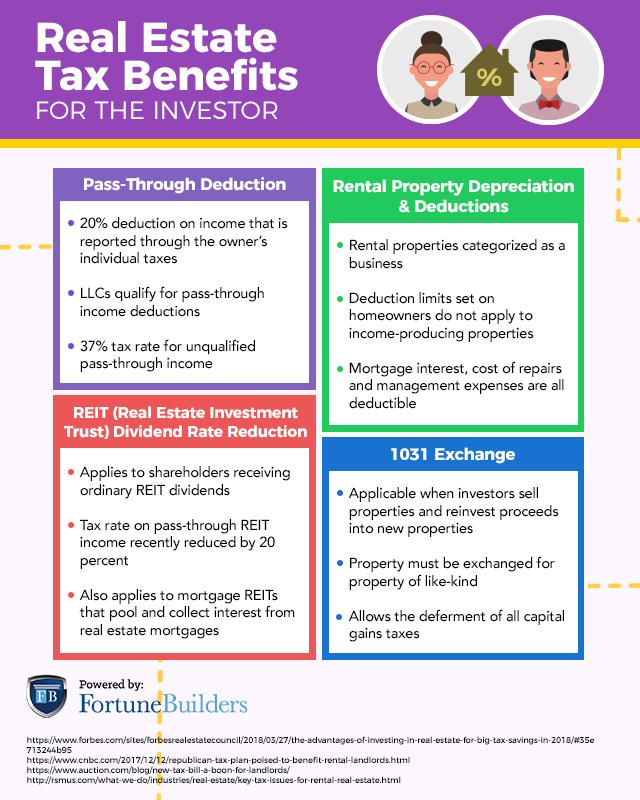

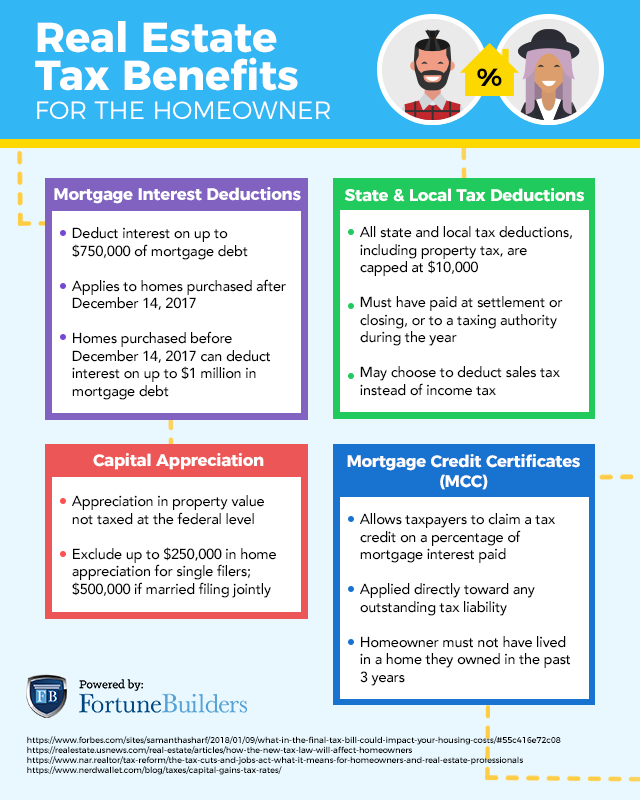

Source: fortunebuilders.com

Source: fortunebuilders.com

2018 tax rates schedules and contribution limits Tax on capital gains and qualified dividends Income Single MarriedFiling jointlyQualifying Widower Tax rate 038600 077200 0 38601425800 77201479000 15 Over 425800 Over 479000 20 Additional 38 federal net investment income NII tax applies to individuals on the lesser of NII or modified AGI in excess of. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require the filing of an estate tax return. April 2018 Update. On November 26 2018 the IRS issued Rev. On December 21 2018 the.

Source: relakhs.com

Source: relakhs.com

The IRS announced that the 2018 federal estate and gift tax limit is 11180000 based on inflation adjustments. It places a 10000 cap on state local and property taxes collectively beginning in 2018. In addition foreign real estate taxes not related to a trade or business are not. This would give you a total of 30000 in itemizable deductions. 2018 tax rates schedules and contribution limits Tax on capital gains and qualified dividends Income Single MarriedFiling jointlyQualifying Widower Tax rate 038600 077200 0 38601425800 77201479000 15 Over 425800 Over 479000 20 Additional 38 federal net investment income NII tax applies to individuals on the lesser of NII or modified AGI in excess of.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

The notice also states that rental real estate businesses that do not meet the safe-harbor requirements may still qualify for the Sec. In addition foreign real estate taxes not related to a trade or business are not. On December 21 2018 the. This reduction occurs regardless of whether A is able to claim the state tax. 2018-59 providing a safe harbor allowing taxpayers to treat certain infrastructure projects as real property trades or businesses solely for purposes of qualifying as an electing real property trade or business under Section 163j7B.

Source: pinterest.com

Source: pinterest.com

2018-59 providing a safe harbor allowing taxpayers to treat certain infrastructure projects as real property trades or businesses solely for purposes of qualifying as an electing real property trade or business under Section 163j7B. 2018-59 providing a safe harbor allowing taxpayers to treat certain infrastructure projects as real property trades or businesses solely for purposes of qualifying as an electing real property trade or business under Section 163j7B. See line 8d in the Instructions for Schedule A Form 1040 and complete the Mortgage Insurance Premiums Deduction Worksheet to. Starting in 2018 until the end of 2025 taxpayers can deduct only 10000 of these combined taxes. Specifically excluded from the safe harbor are residences used by the taxpayer during the year and real estate.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

In addition foreign real estate taxes not related to a trade or business are not. It places a 10000 cap on state local and property taxes collectively beginning in 2018. 162 other than the trade or business of performing services as an employee Regs. In addition you can no longer deduct foreign taxes you paid on real estate. The IRS announced that the 2018 federal estate and gift tax limit is 11180000 based on inflation adjustments.

The press has more or less ignored these changes and focused instead on the new 10000 limitation on the SALT deduction He said prior to 2018 you could deduct 100 percent of your real estate tax on one or more homes plus 100 percent of your New Jersey state income tax. View solution in original post. The IRS announced that the 2018 federal estate and gift tax limit is 11180000 based on inflation adjustments. Taxpayers can deduct their 2018 state and local property taxes on their 2017 returns if they pay those tax bills before the end of the year –. The 2018 tax law will allow homeowners to deduct property taxes and either income or sales taxes with a combined limit on these deductions being limited to no more than 10000.

Source: stessa.com

Source: stessa.com

The 2018 tax law will allow homeowners to deduct property taxes and either income or sales taxes with a combined limit on these deductions being limited to no more than 10000. Thats up one cent from 2017. 199A deduction if they meet the definition of a trade or business under Sec. This ceiling applies to income taxes you pay at the state and possibly local level as well as property taxes. The SALT limitation caps that deduction to a maximum of 10000.

Source: germantaxes.de

Source: germantaxes.de

2018-59 providing a safe harbor allowing taxpayers to treat certain infrastructure projects as real property trades or businesses solely for purposes of qualifying as an electing real property trade or business under Section 163j7B. It places a 10000 cap on state local and property taxes collectively beginning in 2018. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly held property do not require the filing of an estate tax return. If your adjusted gross income on Form 1040 or 1040-SR line 11 is more than 100000 50000 if your filing status is married filing separately the amount of your mortgage insurance premiums that are otherwise deductible is reduced and may be eliminated. The IRS announced that the 2018 federal estate and gift tax limit is 11180000 based on inflation adjustments.

Source: cpajournal.com

Source: cpajournal.com

If your adjusted gross income on Form 1040 or 1040-SR line 11 is more than 100000 50000 if your filing status is married filing separately the amount of your mortgage insurance premiums that are otherwise deductible is reduced and may be eliminated. The IRS announced that the 2018 federal estate and gift tax limit is 11180000 based on inflation adjustments. April 2018 Update. See line 8d in the Instructions for Schedule A Form 1040 and complete the Mortgage Insurance Premiums Deduction Worksheet to. A filing is required for estates with combined gross assets and prior taxable gifts exceeding 1500000 in 2004 - 2005.

Source: fortunebuilders.com

Source: fortunebuilders.com

The SALT limitation caps that deduction to a maximum of 10000. There is no limit on claiming property taxes on rental properties. The press has more or less ignored these changes and focused instead on the new 10000 limitation on the SALT deduction He said prior to 2018 you could deduct 100 percent of your real estate tax on one or more homes plus 100 percent of your New Jersey state income tax. Under paragraph h 3 i of this section As charitable contribution deduction is reduced by 700 70 x 1000. June 4 2019 951 PM The 10000 itemized deduction limit which is the total of property state sales or income taxes does not apply to rental properties.

Source: crowdstreet.com

Source: crowdstreet.com

Taxpayers can deduct their 2018 state and local property taxes on their 2017 returns if they pay those tax bills before the end of the year –. Starting in 2018 until the end of 2025 taxpayers can deduct only 10000 of these combined taxes. The Winners and Losers in the Tax Overhaul Bill US. On November 26 2018 the IRS issued Rev. Thats up one cent from 2017.

Source: mwcpa.com

Source: mwcpa.com

Paid 6000 in real estate taxes. Specifically excluded from the safe harbor are residences used by the taxpayer during the year and real estate. However with the TCJA the standard deduction has been higher since 2018. 199A deduction if they meet the definition of a trade or business under Sec. This would give you a total of 30000 in itemizable deductions.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 2018 real estate tax deduction limits by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.