Your 2018 federal real estate tax deduction images are ready in this website. 2018 federal real estate tax deduction are a topic that is being searched for and liked by netizens now. You can Find and Download the 2018 federal real estate tax deduction files here. Get all royalty-free vectors.

If you’re looking for 2018 federal real estate tax deduction images information linked to the 2018 federal real estate tax deduction interest, you have come to the right blog. Our site always provides you with suggestions for viewing the maximum quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

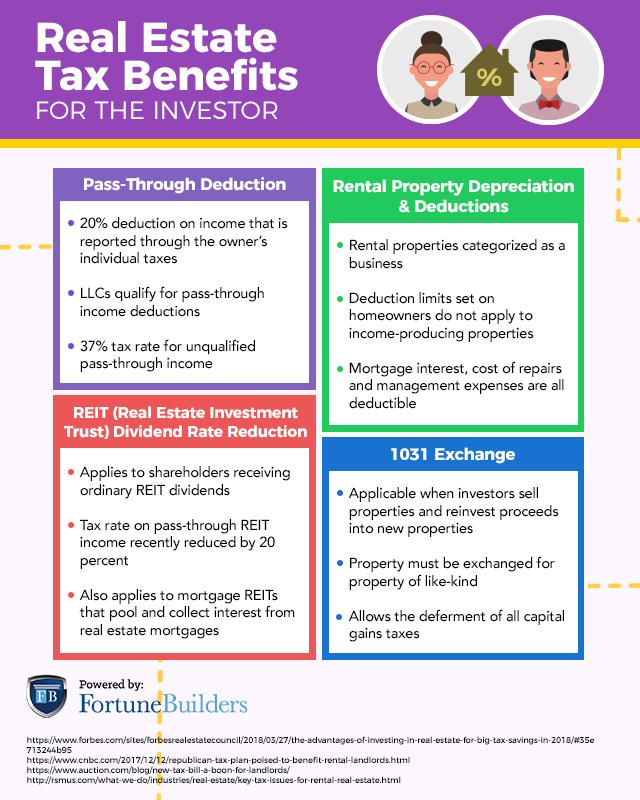

2018 Federal Real Estate Tax Deduction. Basically you will pay taxes on 80 of your net rental income instead of 100. Thats up one cent from 2017. This deduction began on Jan. The includible property may consist of cash and securities real estate insurance trusts annuities business interests and other assets.

How Does The Deduction For State And Local Taxes Work Tax Policy Center From taxpolicycenter.org

How Does The Deduction For State And Local Taxes Work Tax Policy Center From taxpolicycenter.org

The deduction is phased out if your income exceeds the 315000157500 limits. This discussion is intended to provide a road map for making the correct determinations and elections. Its now 24000 for married couples filing jointly and for qualified. Basically you will pay taxes on 80 of your net rental income instead of 100. Rules for the Property Tax Deduction You can claim a deduction for real property taxes if the tax is uniformthe same rate is applied to all real property in the tax jurisdiction. Once you have accounted for the Gross Estate certain deductions and in special circumstances reductions to value are allowed in arriving at your Taxable Estate These deductions may include mortgages and other debts estate administration expenses property.

Once you have accounted for the Gross Estate certain deductions and in special circumstances reductions to value are allowed in arriving at your Taxable Estate These deductions may include mortgages and other debts estate administration expenses property.

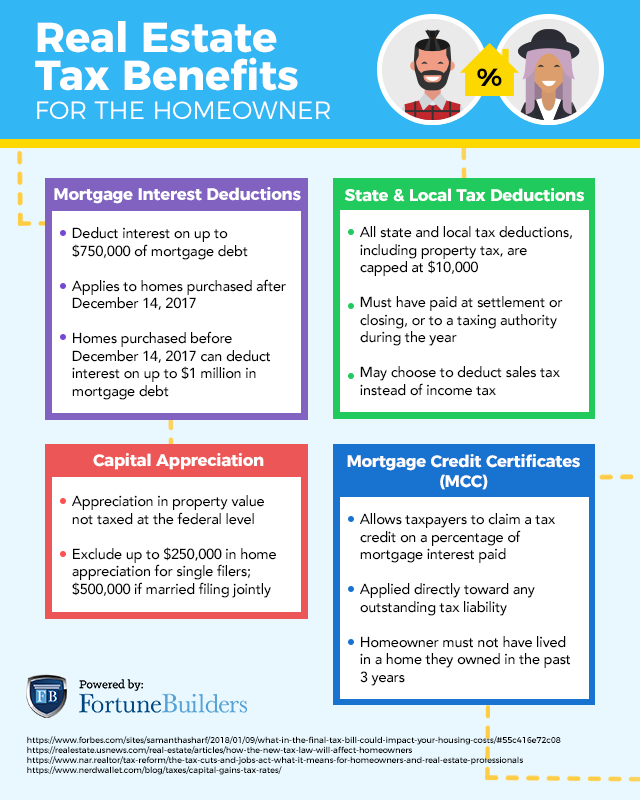

Real Estate Taxes Real Estate Tax Deductions Are Home Improvements Tax Deductible. For federal purposes your total itemized deduction for state and local taxes paid in 2020 is limited to a combined amount not to exceed 10000 5000 if married filing separate. Paid 6000 in real estate taxes. The 2018 tax law will allow homeowners to deduct property taxes and either income or sales taxes with a combined limit on these deductions being limited to no more than 10000. The tax deduction rules for residential landlords have changed dramatically from 2013 to 2018. For married couples filing jointly the deduction is 24800 in tax year 2020 and 25100 in tax year 2021.

Source: houselogic.com

Source: houselogic.com

For the International Revenue Services optional standard mileage rates for 2018 is 545 cents for every mile of business travel driven. You will be able to deduct 20 of your net rental income. Real Estate Taxes Real Estate Tax Deductions Are Home Improvements Tax Deductible. This can get complicated if you have employees or if your annual. The TCJA raised the standard deductions.

Source: fortunebuilders.com

Source: fortunebuilders.com

Rules for the Property Tax Deduction You can claim a deduction for real property taxes if the tax is uniformthe same rate is applied to all real property in the tax jurisdiction. In addition you can no longer deduct foreign taxes you paid on real estate. Even if you itemize the SALT deduction which includes property tax is now capped at 10000 5000 for couples filing separately. Beginning in 2018 the total amount of deductible state and local income taxes including property taxes is limited t 10000 per year. 12400 for single filers and.

The deduction is phased out if your income exceeds the 315000157500 limits. One way to claim mileage as a tax deduction is through a log of your miles. Although many itemized deductions have been suspended going into the 2018 tax year the standard deduction has increased. The TCJA raised the standard deductions. For the most part no theyre not tax-deductible.

Although many itemized deductions have been suspended going into the 2018 tax year the standard deduction has increased. That said you should still enter your property taxes in TurboTax. 12400 for single filers and. This can get complicated if you have employees or if your annual. This discussion is intended to provide a road map for making the correct determinations and elections.

Source: dfas.mil

Source: dfas.mil

The deduction is phased out if your income exceeds the 315000157500 limits. Real Estate Taxes Real Estate Tax Deductions Are Home Improvements Tax Deductible. Thats up one cent from 2017. Determining the character of expenditures. One way to claim mileage as a tax deduction is through a log of your miles.

Source: smartasset.com

Source: smartasset.com

12400 for single filers and. 1 2018 and is scheduled to last through Dec. For the most part no theyre not tax-deductible. Previously only 6500 was allowed as the standard deduction for individual filers. The deduction for state and local taxes including real estate taxes is limited to 10000 5000 if married filing separately.

Source: vox.com

Source: vox.com

This means taxpayers who live or own property in states with high property taxes may not be getting as big a deduction as they have in years past. Since the creation of the 2018 Tax Cuts Job Act each of the three entities is now entitled to a new pass-through tax deduction as long as the rental activity qualifies as a business for tax purposes. The deduction for state and local taxes including real estate taxes is limited to 10000 5000 if married filing separately. The TCJA raised the standard deductions. Thats up one cent from 2017.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

With the TCJA the. There are a few scenarios in which home. Landlords are now much more likely to be able to deduct most of their current expenditures. Beginning in 2018 the total amount of deductible state and local income taxes including property taxes is limited t 10000 per year. Even if you itemize the SALT deduction which includes property tax is now capped at 10000 5000 for couples filing separately.

Source: cpajournal.com

Source: cpajournal.com

The tax deduction rules for residential landlords have changed dramatically from 2013 to 2018. One way to claim mileage as a tax deduction is through a log of your miles. However with the TCJA the standard deduction has been higher since 2018. In addition you can no longer deduct foreign taxes you paid on real estate. For federal purposes your total itemized deduction for state and local taxes paid in 2020 is limited to a combined amount not to exceed 10000 5000 if married filing separate.

Source: pinterest.com

Source: pinterest.com

The 2018 tax law will allow homeowners to deduct property taxes and either income or sales taxes with a combined limit on these deductions being limited to no more than 10000. That means an individual can leave 56 million to heirs and pay no federal estate or. Once you have accounted for the Gross Estate certain deductions and in special circumstances reductions to value are allowed in arriving at your Taxable Estate These deductions may include mortgages and other debts estate administration expenses property. The tax deduction rules for residential landlords have changed dramatically from 2013 to 2018. Although many itemized deductions have been suspended going into the 2018 tax year the standard deduction has increased.

Source: cpajournal.com

Source: cpajournal.com

The deduction for state and local taxes including real estate taxes is limited to 10000 5000 if married filing separately. Rules for the Property Tax Deduction You can claim a deduction for real property taxes if the tax is uniformthe same rate is applied to all real property in the tax jurisdiction. This would give you a total of 30000 in itemizable deductions. The tax deduction rules for residential landlords have changed dramatically from 2013 to 2018. Once you have accounted for the Gross Estate certain deductions and in special circumstances reductions to value are allowed in arriving at your Taxable Estate These deductions may include mortgages and other debts estate administration expenses property.

Source: dfas.mil

Source: dfas.mil

For married couples filing jointly the deduction is 24800 in tax year 2020 and 25100 in tax year 2021. For 2018 the estate and gift tax exemption is 56 million per individual up from 549 million in 2017. For single filers the deduction is 12400 in. Rules for the Property Tax Deduction You can claim a deduction for real property taxes if the tax is uniformthe same rate is applied to all real property in the tax jurisdiction. This discussion is intended to provide a road map for making the correct determinations and elections.

Source: houselogic.com

Source: houselogic.com

The tax deduction rules for residential landlords have changed dramatically from 2013 to 2018. Landlords are now much more likely to be able to deduct most of their current expenditures. The deduction is phased out if your income exceeds the 315000157500 limits. The includible property may consist of cash and securities real estate insurance trusts annuities business interests and other assets. This means taxpayers who live or own property in states with high property taxes may not be getting as big a deduction as they have in years past.

Source: pinterest.com

Source: pinterest.com

The deduction for state and local taxes including real estate taxes is limited to 10000 5000 if married filing separately. Determining the character of expenditures. The includible property may consist of cash and securities real estate insurance trusts annuities business interests and other assets. Non-deductible real property charges Certain items on your real estate property tax bill may look like taxes but are actually miscellaneous charges that are not deductible. With the TCJA the.

Source: fortunebuilders.com

Source: fortunebuilders.com

One way to claim mileage as a tax deduction is through a log of your miles. There are a few scenarios in which home. Once you have accounted for the Gross Estate certain deductions and in special circumstances reductions to value are allowed in arriving at your Taxable Estate These deductions may include mortgages and other debts estate administration expenses property. 12400 for single filers and. That said you should still enter your property taxes in TurboTax.

That means an individual can leave 56 million to heirs and pay no federal estate or. For single filers the deduction is 12400 in. This discussion is intended to provide a road map for making the correct determinations and elections. For the most part no theyre not tax-deductible. That means an individual can leave 56 million to heirs and pay no federal estate or.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

For the International Revenue Services optional standard mileage rates for 2018 is 545 cents for every mile of business travel driven. The rules changed somewhat with the passage of the Tax Cuts and Jobs Act TCJA in 2018 but the property tax deduction is still available. The deduction is phased out if your income exceeds the 315000157500 limits. Since this exceeds your standard deduction you. Determining the character of expenditures.

Source: taxpolicycenter.org

Source: taxpolicycenter.org

Real Estate Taxes Real Estate Tax Deductions Are Home Improvements Tax Deductible. Although many itemized deductions have been suspended going into the 2018 tax year the standard deduction has increased. Since the creation of the 2018 Tax Cuts Job Act each of the three entities is now entitled to a new pass-through tax deduction as long as the rental activity qualifies as a business for tax purposes. Basically you will pay taxes on 80 of your net rental income instead of 100. It disappears entirely for marrieds filing jointly whose income exceeds 415000 and for singles whose income exceeds 207500.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 2018 federal real estate tax deduction by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.