Your 1031 exchange stocks to real estate images are available. 1031 exchange stocks to real estate are a topic that is being searched for and liked by netizens now. You can Download the 1031 exchange stocks to real estate files here. Get all royalty-free photos and vectors.

If you’re looking for 1031 exchange stocks to real estate images information connected with to the 1031 exchange stocks to real estate interest, you have pay a visit to the right site. Our website frequently gives you hints for seeing the maximum quality video and picture content, please kindly search and find more informative video articles and graphics that fit your interests.

1031 Exchange Stocks To Real Estate. Luckily a 1031 exchange commercial real estate transaction lets you avoid those taxes. The individual shares owned by the investors in the REIT are considered personal property not real property and in general will not qualify for tax deferral under IRC 1031. The exchange can only be utilized to defer taxes on the sale of an investment property and the money gained in the sale. Is There A 1031 Exchange For Stocks.

1031 Exchange Bestreich Realty Group From brg-cre.com

1031 Exchange Bestreich Realty Group From brg-cre.com

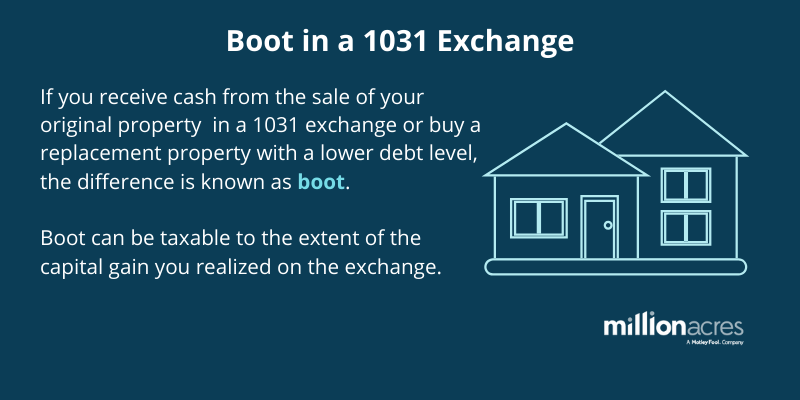

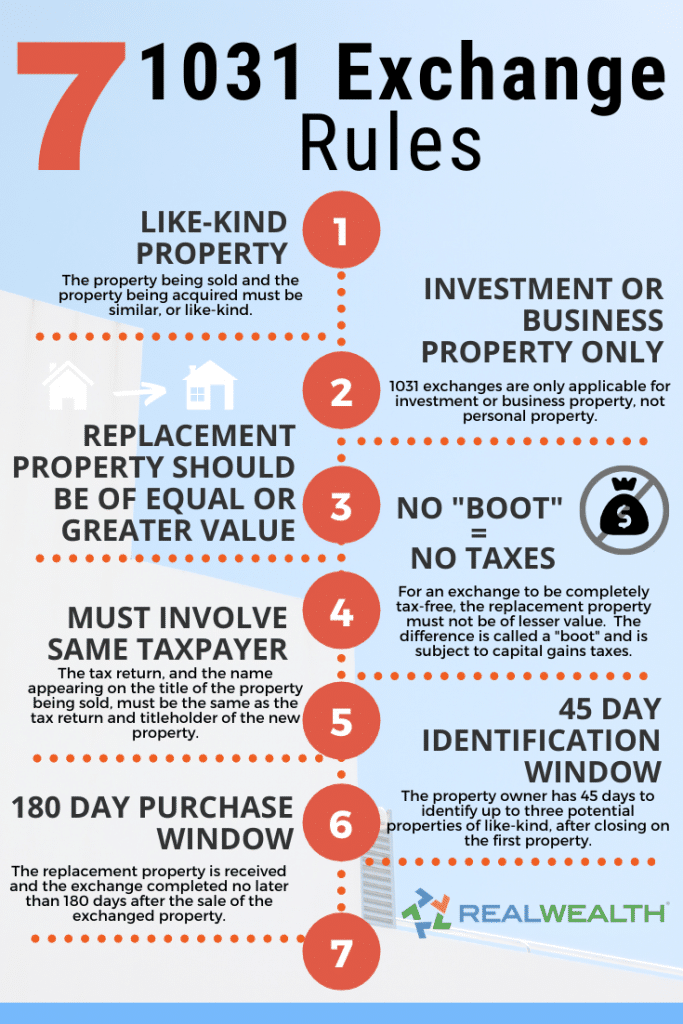

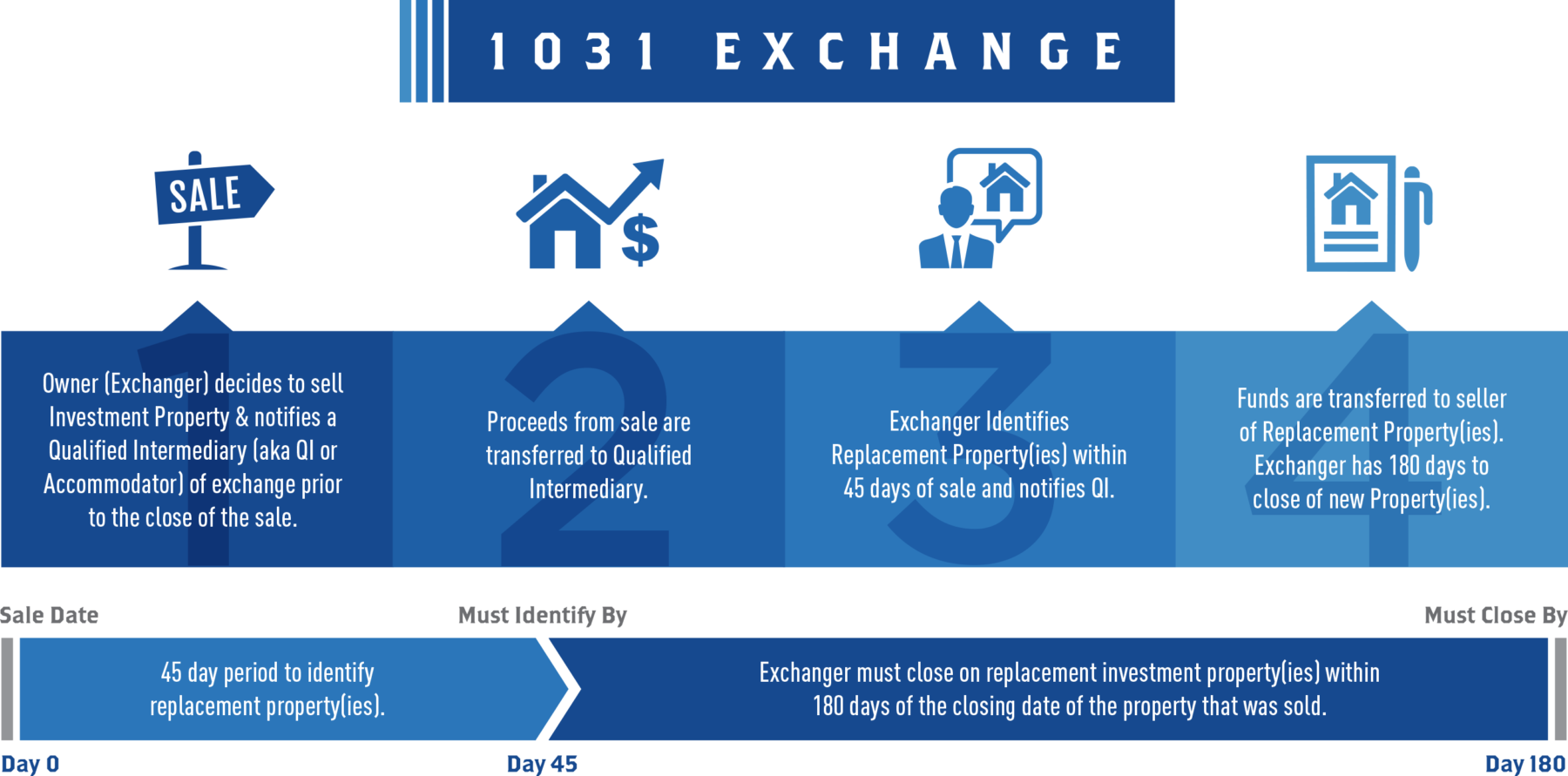

So paper such as stock bonds and notes are all excluded from 1031 treatment. A simple definition of 1031 exchange properties is the property being sold and the property being purchased under Section 1031 of the tax code. However the impact this time. What is a 1031 Exchange. Known as a like-kind or 1031 exchange the perk allows property investors to roll the proceeds of real estate sales into future purchases without paying capital gains taxes on profits. A 1031 exchange comes from Section 1031 of the US.

Tax code that allows you to reinvest the proceeds from a property sale paying no capital gains taxes on that money.

The short answer is. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. The end game for the taxpayerinvestor is to avoid having exchanges. A 1031 Exchange is an incredibly useful tool for many real estate investors. However the impact this time. What qualifies for a 1031 exchange.

Source: exchangeauthority.com

Source: exchangeauthority.com

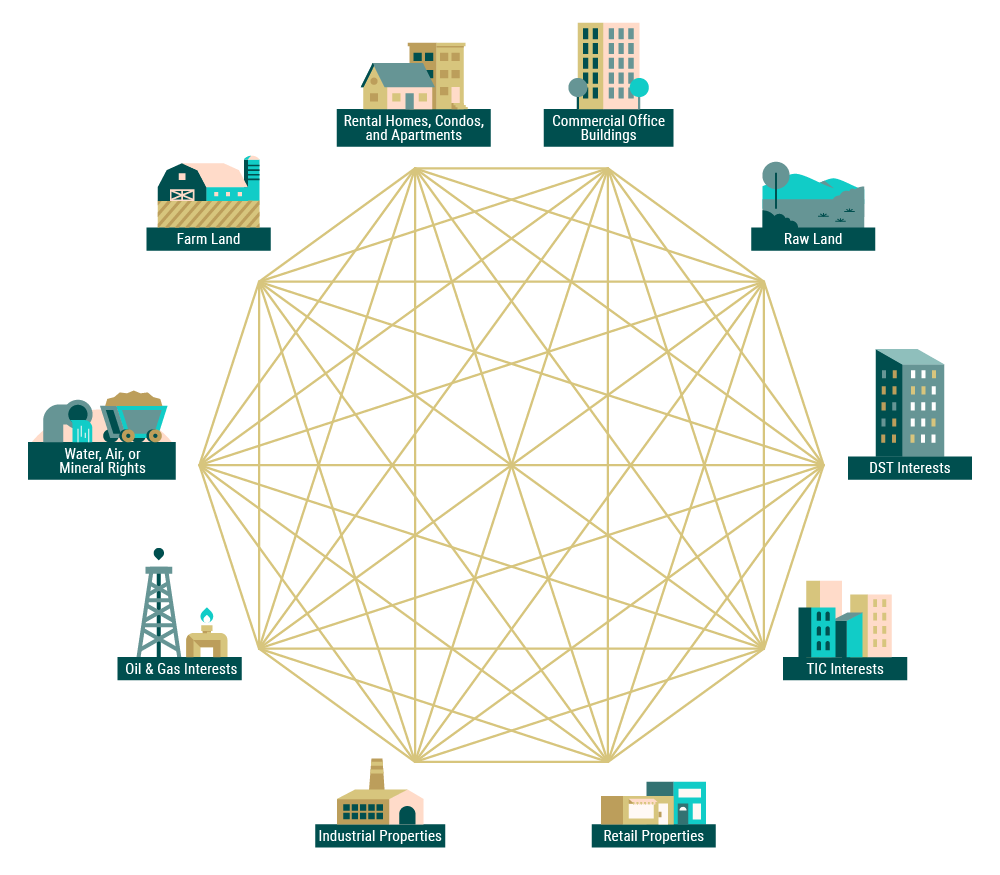

The reason is that for a property to be considered like-kind real property must be exchange for real property. A modification or outright elimination of IRC section 1031 could potentially create a real estate recession that mirrors the impact of the Tax Reform Act of 1986. What some investors like to do is acquire an interest in a portion of real. However the impact this time. What qualifies for a 1031 exchange.

Source: fool.com

Source: fool.com

Using a 1031 exchange is an excellent tax strategy used to trade up to larger properties and increase the return on investment ROI from real estate. Again you can do a 1031 exchange into a REIT though the path between your property and REIT ownership is somewhat involved. So paper such as stock bonds and notes are all excluded from 1031 treatment. You cant exchange into it. It is only for business or investment property.

Source: 1031exchange.com

Source: 1031exchange.com

The short answer is. A 1031 Exchange is an incredibly useful tool for many real estate investors. But if you want to be a real estate investor there are other ways if your investment portfolio in the form of stocks and bonds is all you have at the moment to get started. Tax code that allows you to reinvest the proceeds from a property sale paying no capital gains taxes on that money. The individual shares owned by the investors in the REIT are considered personal property not real property and in general will not qualify for tax deferral under IRC 1031.

Source: realwealthnetwork.com

Source: realwealthnetwork.com

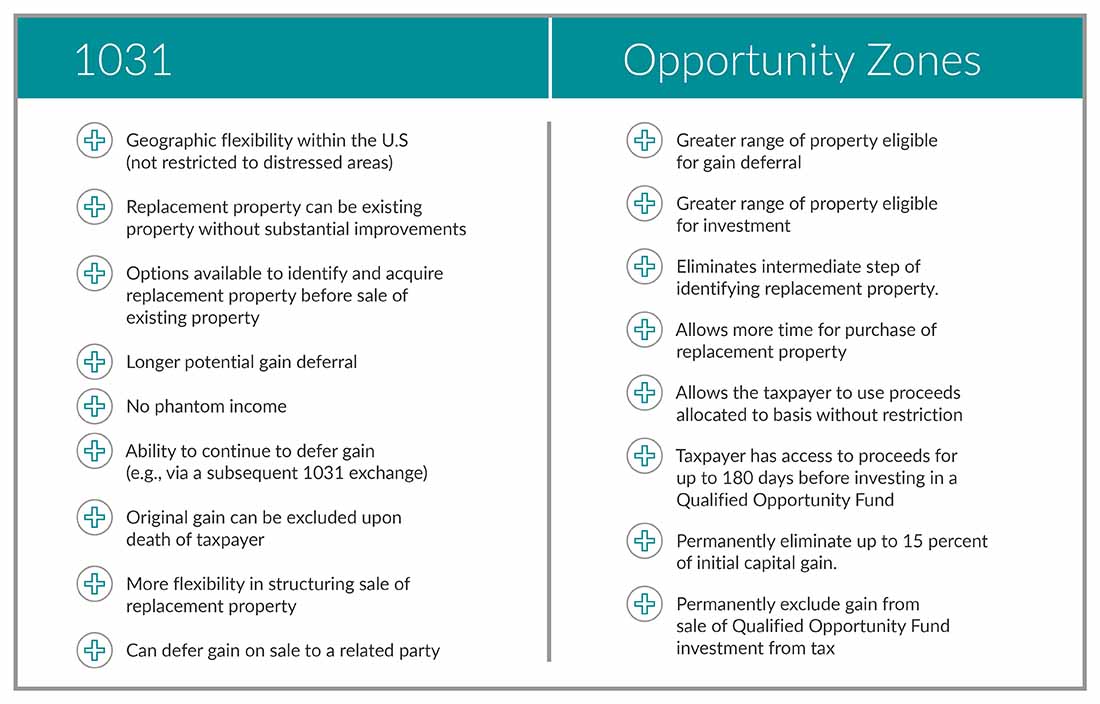

The end game for the taxpayerinvestor is to avoid having exchanges. The tax reform law that passed in December 2017 limited exchanges to only real estate. Why is this such a valuable opportunity. A 1031 exchange comes from Section 1031 of the US. Again you can do a 1031 exchange into a REIT though the path between your property and REIT ownership is somewhat involved.

Source: brg-cre.com

Source: brg-cre.com

Traditionally a 1031 exchange is where one property is literally swapped for another property of like-kind. Is There A 1031 Exchange For Stocks. But if you want to be a real estate investor there are other ways if your investment portfolio in the form of stocks and bonds is all you have at the moment to get started. However this option provides. Traditionally a 1031 exchange is where one property is literally swapped for another property of like-kind.

Source: urbancatalyst.com

Source: urbancatalyst.com

The 1031 exchange is a tool used for deferring capital gains taxes ONLY for real estate. But if you want to be a real estate investor there are other ways if your investment portfolio in the form of stocks and bonds is all you have at the moment to get started. By and large IRS Section 1031 covers exchanges or swaps of a specific investable asset such as real estate for another. The tax reform law that passed in December 2017 limited exchanges to only real estate. However the impact this time.

Source: taxesforexpats.com

Source: taxesforexpats.com

It is only for business or investment property. But if you want to be a real estate investor there are other ways if your investment portfolio in the form of stocks and bonds is all you have at the moment to get started. Weve already identified that stocks and bonds cannot be directly exchanged for real estate and qualify for tax-deferral under section 1031. Again you can do a 1031 exchange into a REIT though the path between your property and REIT ownership is somewhat involved. Real Estate Investment Trusts REIT.

Source: midstreet.com

Source: midstreet.com

It is an exchange of two or more pieces of real estate under Section 1031 of the tax code. It is only for business or investment property. In real estate a 1031 exchange is a swap of one investment property for another that allows capital gains taxes to be deferred. You can do a 1031 exchange into a REIT if you follow a few steps Many real estate professionals will tell you that this is not possible because your rental house or office building is different from a REIT. Why is this such a valuable opportunity.

Source: propertycashin.com

Source: propertycashin.com

Luckily a 1031 exchange commercial real estate transaction lets you avoid those taxes. What qualifies for a 1031 exchange. Unfortunately when the Treasury regulations were written for the tax code relating to Section 1031 Congress excluded stocks bonds and other evidences of indebtedness. What some investors like to do is acquire an interest in a portion of real. However this option provides.

Source: 1031gateway.com

Source: 1031gateway.com

The end game for the taxpayerinvestor is to avoid having exchanges. Using a 1031 exchange is an excellent tax strategy used to trade up to larger properties and increase the return on investment ROI from real estate. It does not apply to personal property but it can apply. The individual shares owned by the investors in the REIT are considered personal property not real property and in general will not qualify for tax deferral under IRC 1031. Luckily a 1031 exchange commercial real estate transaction lets you avoid those taxes.

Source: thebasispoint.com

Source: thebasispoint.com

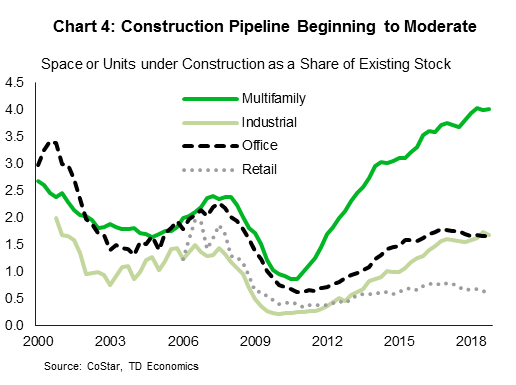

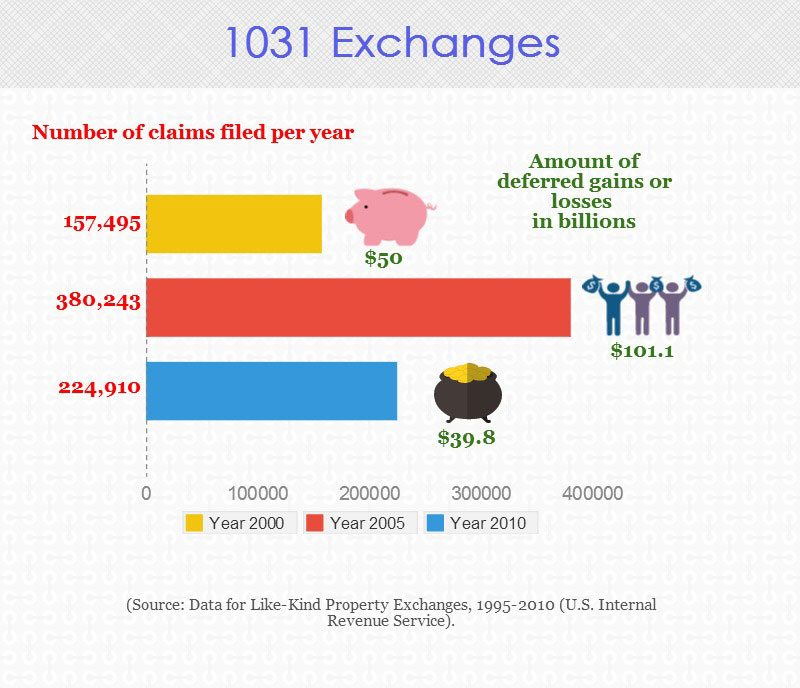

However the impact this time. Why is this such a valuable opportunity. Keep reading to learn about a 1031 exchange and how it can help you. Indeed 1031 exchanges account for 6 of all commercial real estate sales volume and cost the government 2 billion to 4 billion in lost tax revenue per year according to a study by the. By and large IRS Section 1031 covers exchanges or swaps of a specific investable asset such as real estate for another.

Source: investorjunkie.com

Source: investorjunkie.com

What qualifies for a 1031 exchange. It is only for business or investment property. Is There A 1031 Exchange For Stocks. The tax reform law that passed in December 2017 limited exchanges to only real estate. However this option provides.

Source: trianglerealtyllc.com

Source: trianglerealtyllc.com

A simple definition of 1031 exchange properties is the property being sold and the property being purchased under Section 1031 of the tax code. Real Estate Investment Trusts REIT. In the simplest case youre swapping one property for another. Why is this such a valuable opportunity. The term which gets its name from IRS code Section 1031 is bandied.

Source: plantemoran.com

Source: plantemoran.com

The exchange can only be utilized to defer taxes on the sale of an investment property and the money gained in the sale. In the simplest case youre swapping one property for another. A 1031 exchange named after Section 1031 of the tax code can defer capital gains taxes on a sale of investment property by reinvesting in similar property. Is There A 1031 Exchange For Stocks. The term which gets its name from IRS code Section 1031 is bandied.

Source: midstreet.com

Source: midstreet.com

A 1031 Exchange is an incredibly useful tool for many real estate investors. A 1031 Exchange is an incredibly useful tool for many real estate investors. Real estate is often considered the safest investment because the real estate market itself has been on a reliably upward trend. A 1031 exchange comes from Section 1031 of the US. What qualifies for a 1031 exchange.

Source: freemangroupoflbi.com

Source: freemangroupoflbi.com

A modification or outright elimination of IRC section 1031 could potentially create a real estate recession that mirrors the impact of the Tax Reform Act of 1986. Using a 1031 exchange is an excellent tax strategy used to trade up to larger properties and increase the return on investment ROI from real estate. However the impact this time. Real Estate Investment Trusts REIT. In a delayed exchange you need a middleman known as a Qualified Intermediary who holds onto the cash from the sale of your property.

Source: coakleyrealty.com

Source: coakleyrealty.com

Why is this such a valuable opportunity. What qualifies for a 1031 exchange. Internal Revenue Code IRC. You cant exchange into it. The short answer is.

Source: barry4homes.net

Source: barry4homes.net

A modification or outright elimination of IRC section 1031 could potentially create a real estate recession that mirrors the impact of the Tax Reform Act of 1986. The individual shares owned by the investors in the REIT are considered personal property not real property and in general will not qualify for tax deferral under IRC 1031. However the impact this time. The term which gets its name from IRS code Section 1031 is bandied. Indeed 1031 exchanges account for 6 of all commercial real estate sales volume and cost the government 2 billion to 4 billion in lost tax revenue per year according to a study by the.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title 1031 exchange stocks to real estate by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.